Gold From a Failed Breakout to a Failed Breakdown

Commodities / Gold & Silver 2020 Apr 01, 2020 - 11:45 AM GMTBy: Jordan_Roy_Byrne

The historic action of the precious metals sector over the past few weeks has continued.

The strong recovery in GDX, GDXJ, and Silver has potentially invalidated the technical breakdown that occurred during the crash. It appears to be a failed breakdown.

Furthermore, Gold was looking vulnerable on the weekly, and monthly chart yet was able to slingshot back to $1700/oz. It is currently up $88/oz or 5.6% this month, while the S&P 500 is down 14%.

The market provides and conveys information day to day and week by week. Still, monthly charts will smooth out the volatility, and that is especially important during periods of extreme volatility.

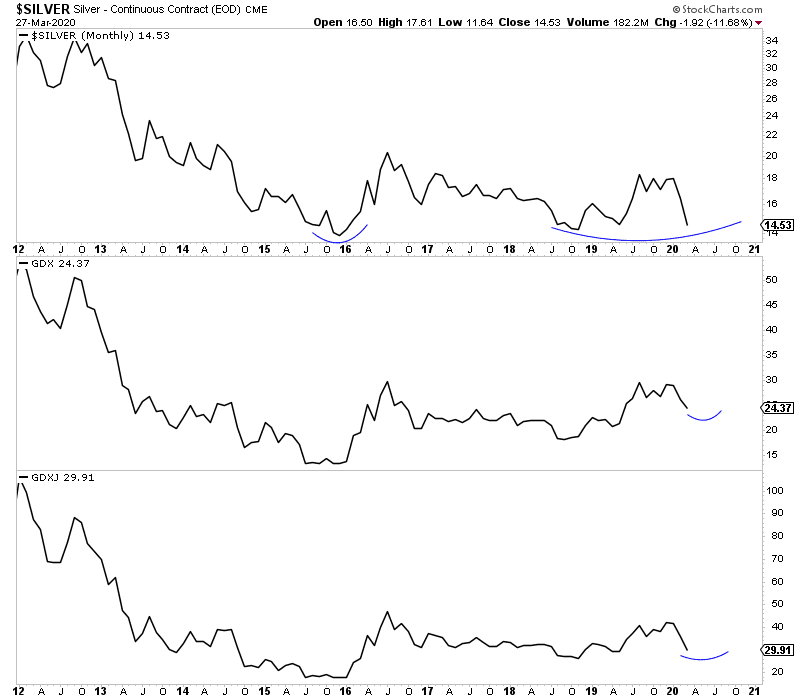

We plot the monthly line charts for Silver, GDX, and GDXJ below.

There are two trading days left in March, but note how these charts look entirely different from just a week ago.

Silver has not broken down to a new low nor have the miners (GDX, GDXJ), which are merely correcting.

Silver, GDX, GDXJ Monthly Lines

If precious metals markets can maintain current levels into April, then that is a reason for optimism.

Another reason for optimism is that the recent rebounds in GDX and GDXJ are similar to the rebounds from the major low in late October 2008.

In closing price terms, GDX rebounded 39% in 8 days. That is slightly less than its 47% rebound in 6 trading days from the October 2008 low.

However, when using absolute low and highs, GDX just rebounded 63% in 8 days. That exceeds its 57% rebound in 9 days from the October 2008 low.

The parent index of GDXJ (information and chart here) rebounded 51% in 8 days (in closing price terms) from its late October 2008 low. GDXJ just rallied 52% in 7 days!

After back to back sharp moves and high volatility, markets may consolidate as volatility subsides.

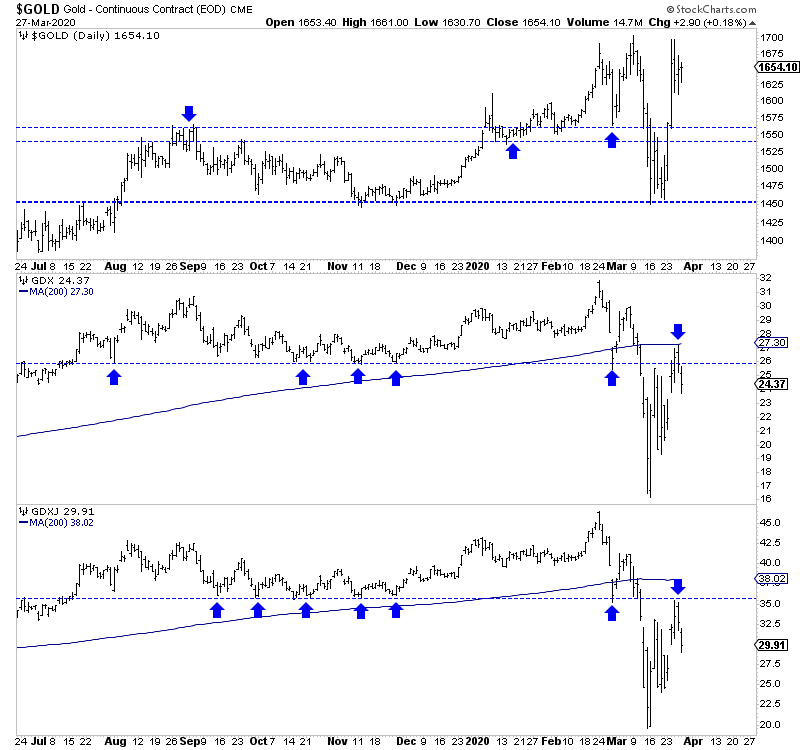

Should Gold, which closed last week at $1654, hold above $1540 to $1560, then it could be deemed a bullish consolidation.

GDX and GDXJ just rallied back to stiff resistance, and they could retreat more if Gold stays below $1700 for a little while.

Gold, GDX, GDXJ Daily Bars

Note that precious metals markets followed the late October 2008 bottom with five to six weeks of backing and filling before pushing higher in an impulsive fashion.

Gold faces resistance at $1700, and its net speculative position remains above 300K contracts. GDX and GDXJ face stiff resistance around $26-$27 and $35-$36, respectively. It could take the market a few weeks or longer to work through that supply.

I am looking to put more cash to work if individual, quality juniors correct more and get somewhat close to recent lows.

The crash has delivered short-term pain and anxiety, but it is leading to some incredible values that could turn into 5 and 10 baggers over the next 12 to 18 months.

To learn the stocks we own and intend to buy during the next correction that have 3x to 5x potential, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.