Coronavirus Dow Stocks Bear Market Into End April 2020 Trend Forecast

Stock-Markets / Stock Markets 2020 Mar 31, 2020 - 09:36 AM GMTBy: Nadeem_Walayat

My full stock market analysis follows that was first made available to Patrons who support my work - Coronavirus Dow Stocks Bear Market - March and April 2020 Trend Forecast

Whilst my latest analysis in this series was posted yesterday (30th March) - US and UK Coronavirus Trend Trajectories vs Bear Market and AI Stocks Sector

Before you read this analysis, ask yourselves is it worth $3 for advance warning of one of the greatest AI stocks sector buying opportunities of our time? https://www.patreon.com/Nadeem_Walayat.

Coronavirus Dow Stocks Bear Market Into End April 2020 Trend Forecast

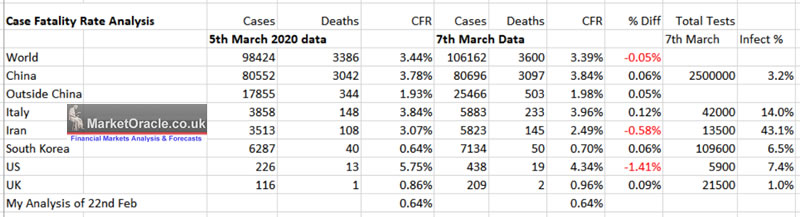

This analysis continues from part 1 (How Deadly is the Coronavirus - Case Fatality Rate (CFR) Analysis) that seeks to conclude in a probable trend forecast for the unfolding Coronavirus stocks bear market that has caught most market participants by surprise, one where the formulaic mainstream financial press see's a bottom in EVERY BOUNCE! Well the Dow's latest plunge Friday makes a mockery of such expectations of barely a few trading days ago! For as I try and point out from time to time that technical analysis on it's own is NOT enough! Which is why I try and keep my antenna's focused on any outside market influencing factors that could drive stock prices at some point in the future where we have the usual drivers such as population growth, climate change, governments printing money that resulted in driving the Dow from a 1930's low of 40 to the recent high of 29,600. Without money printing there would be no exponential stocks bull market as the indices rotate in new rising corps and eject old dieing corps. Likewise, way back in January when most were shrugging their shoulders to "corona what?" my antenna was focused on what was taking place in Hubei China that was sending alarm bell rings despite art the time the Dow was was busy making a series of new all time highs.

Whilst monitoring the unfolding pandemic in China, I was increasingly struck by the fact that our governments in the West were just NOT ACTING as I though they should be. I am no virologist or scientist, but if I could see the unfolding catastrophic consequences of the Coronavirus then why have our governments been sat on their lazy asses for at least the past 6 weeks and basically done nothing!

They have been shockingly negligent! And my assumptions of early February that the West would do a far better job at containing the Coronavirus than China have all gone up in smoke! INEPT! INCOMPETENT, as it appeared the likes of the CDC and the Public Health England were doing their utmost to BRING the VIRUS into densely populated areas that risked the virus out breaks! I am no conspiracy theorist but various Governments actions were at the very least negligent and at worst CRIMINAL! YOU DON'T FLY IN INFECTED PEOPLE AND THEN DISTRIBUTE THEM ACROSS THE COUNTRY!

YOU DON'T ALLOW AIR TRAVEL FROM REGIONS WITH OUT OF CONTROL OUTBREAKS!

THEY DID NOTHING! Even now as of writing the US has yet to actually begin mass testing for the coronavirus which given it's lethal nature, not because of the 1% to 3% death rate but the fact that infected people can be asymptomatic for as long as 2 weeks! Which means quietly spreading viral particles all whilst the likes of the CDC are sleep to the wheel, unable to even pick up the phone and place an order for coronavirus tests! And only doing so a week ago!

China looks like it has gained a grip on it's pandemic by crippling it's economy even if the figures for the numbers infected are likely still being under reported for political reasons, which obviously the general population do not trust.

Unfortunately, the West has very badly dropped the ball by NEVER ACTING PROACTIVELY to prevent OUTBREAKS, instead the imbeciles continued to let infected Chinese nationals and others fly into our virus free nations spreading their viral particles that have now sparked outbreaks across Europe and the US. Which translated into my unfolding analysis that increasingly warned that this Coronavirus stocks bear market is nowhere near bottom! Where outbreaks outside of Asia such as in the UK and US are only just beginning whilst incompetence continues to rule! For instance the US is still waiting on delivery of 1.2 million tests that the CDC promises will be sent out this week!

This is a recipe for disaster that COULD HAVE BEEN PREVENTED! What we are about to witness in the West was NOT INEVITABLE!

The current tally of 216 infected in the UK and 438 in the US (7th March) is likely under reporting the actual number of infected in both nations by several orders of magnitude as the price paid for gross incompetence bordering on criminal and it does not help having an idiot in the White House!

If I had to put a number on how many are infected in the UK and US right now given the percentage who are testing positive, and taking into account abysmal lack of testing than likely right now then the UK has at least 1000 infected people many which will become ill and get tested and make their way into the official data over the coming week, so this week expect the UK to soon pass 1000 infected people as they ramp up testing because 21,500 tests to date whilst a lot better than the US, is still not enough to contain this virus.

Whilst for the US, with less than 6000 tests to date of which 7.4% have tested positive implies a huge pool of infected people, a number that I can only guess at being at least 4000, most of whom will start showing symptoms over the coming week whilst continuing to infect 3 to 4 others, as was the warning out of South Korea. So a week from now if the US actually starts rolling out tests in significant numbers then the US infected tally could easily increase ten fold to at 4000 during this coming week.

Thus the implied infections trend trajectory for the US is currently running at about three times worse than my forecast as people are not being tested in enough numbers which they should start being done during the coming week, given that the CDC has promised to deliver at least 1 million test kits to the states during the week. Whilst it is too early to speculate on the CFR for the UK and US as the decline from 5.75% (5th March) to 4.34% (7th March) for the US illustrates.

The lack of US testing means that there is a massive hidden unrecorded pool of infected people that continues to quietly expand EVERY DAY until they finally start to fall ill and end up in A&E and go on to infect medical staff. And from what I see the US is still largely in a state of denial with political campaign rally's continuing as though the virus does not exist. So pert haps the US will only truly start to act when the body bags start piling up in their hundreds.

Thus the number of infected looks set to EXPLODE higher, far beyond today's tally of 450 infected and 19 deaths. My forecast is for 13,000 infected by the end of March, that number now could easily double because without knowing who is infected then there are no quarantine and containment measures in place. I will look at updating my forecasts into the End of April for the UK and US at the end of next week.

Stock Market Trend Implications

Is the Stock Market discounting the Coronavirus yet?

Well what will be effect on the stock market when we see start to see the numbers of infected virtually doubling every couple of days over the coming week, especially as unlike China the US is not going to hide the numbers of infected.

The markets look at the numbers, they want to see the number of infected stabilising and then DECREASING on a daily basis, and NOT DOUBLING every couple of days!

Therefore this implies we are going to continue to experience a bearish trend trajectory for at least March and likely April, despite Fed panic actions, as it now looks like my estimate of 13,000 US infected by the end of March gave way too much credence to US healthcare and CDC competency, instead both have proven to be seriously lacking i.e. closer in performance to that of Iran than South Korea!

So once more NO the stock market is NOT discounting the Coronavirus yet which means we are likely to see a series of new lows in the stock market as the US is not handling the pandemic in a competent manner which means to expect far higher number of infected and deaths as I have been warning for some weeks.

4th March - Coronavirus Parabolic Pandemic, Bitcoin Price Trend Forecast

So is the stock market discounting what is to come? NO, NOWHERE NEAR! Whilst I will cover the prospects for the stock market in my next analysis as the focus of this analysis is the prospects for the Bitcoin price. However, I do not see any signs for an imminent end to the Coronavirus bear market, instead it looks like it could run on for several months, i.e. it's increasingly looking like it could be May before we see the bottom!

Coronavirus Global Recession 2020

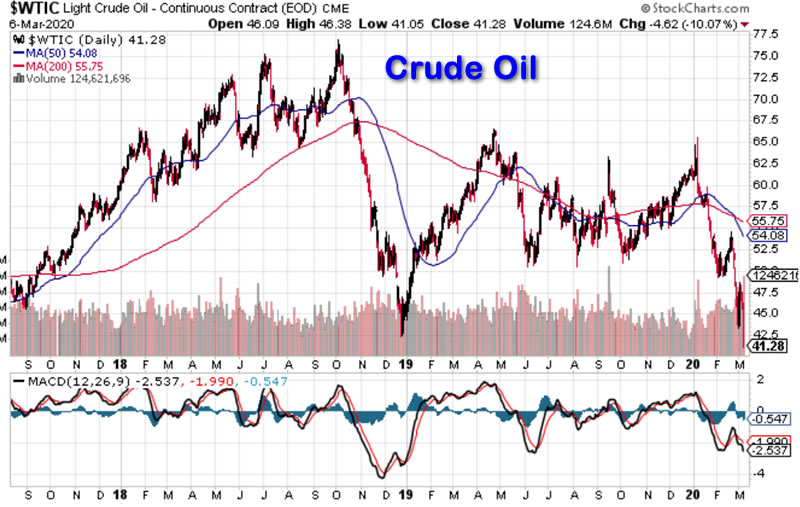

It increasingly looks likely that ALL western nations are heading for an imminent SHARP economic slowdown as consumers change behaviour and supply chains are curtailed. China started the ball rolling for Q1 which will likely continue in Q2 and Q3, with western nations joining China level of economic contraction in Q2. So it's going to be a short sharp economic drop, the signs for which are obvious when we look at what's happened to the crude oil price.

(Charts courtesy of stockcharts.com)

Whilst it is beyond the scope of this article to analyse and forecast the Crude oil price, nevertheless to me it looks like it's going to go a lower than the recent low of $41.

On the plus side we should see a sharp economic rebound maybe starting Q4 as China starts to get production going again towards normal and consumers have adapted to the coronavirus crisis and start to see sunlit uplands that the promise of vaccine in 2021 promises.

So a short sharp economic contraction for 2020 for at least 2 quarters and maybe 3 followed by a sharp V shaped recovery into 2021.

In terms of the stock market trend then whilst the stock market has fallen by about 15% were still only at the very beginnings of this economic contraction with much corporate pain to come over the coming months.

DJIA Stock Market Technical Trend Analysis

Short-term Trend Analysis

The bubble that was the Dow's early year bull run has well and truly burst with the Dow literally crashing to a low of 24,700, and if it wasn't for the Coronavirus than the Dow would still have fallen to trade down to a low of about 27,500. Instead we have gone beyond that which technical analysis can determine, hence my continuing heavy focus on the Coronavirus trend which on the 27th of February concluded in expectations for the Dow to fairly quickly trade down to about 25,500 that it soon sliced through during it's multi day crash.

(Charts courtesy of stockcharts.com)

The short-term chart analysis -

1. The Dow made a double top as I suspected it could early February.

2. MACD is very oversold so implies limited downside but given thousand point plus moves per day is pretty much meaningless.

3. The trend is most definitely DOWN i.e. supports are not offering any support. So we have NOT seen the low yet!

Long-term Trend Analysis

The Dow has breached significant support at 27,500 hence triggering this bear market that initially targeted 25,500 (achieved). The coronavirus has ensured that it's going to be very tough to see Dow trade near 30k again in 2020.

TREND ANALYSIS - The Dow is in crash mode, slicing through support levels as investors panic sell whenever stocks bounce off their lows. Again to emphasis that the Dow has broken to the downside so rallies should be seen as being corrective at least for the time being.

RESISTANCE : Resistance is at the bear market trigger of 27,500.

SUPPORT : Is at the first target for this bear market of 25,500. Though given how easily it broke last time then it's not going to act as much of a support next time either. Then we have 24,600 which did manage to halt the sell off, and below that 23,300 and then 21,700.

TRENDLINES - A rising trend line off the recent low offers WEAK support at 25,000. Though I doubt it will hold any selling.

The overall trend picture is bearish i.e. we are likely to see new lows for this bear market. Anywhere from 22k to 24k.

MACD - MACD is extremely oversold. Which implies downside is limited. However we are literally in uncharted territory.

ELLIOTT WAVES

My elliott wave count continues to prove remarkably accurate as illustrated by the last update of 9th Feb suggesting a downtrend after a bounce to new highs towards a mid March low.

So the Feb high was definitely a major 5th wave peak which now implies to expect a major ABC pattern to play out over the coming weeks and months. Where at present we are in Wave A decline to be followed by a B wave bounce and then a further C wave decline that normally should trade below the A low. Though note A-B-C is an idealised pattern as what actually tends to transpire won't usually be as clearly defined as an ABC i.e. Waves B and C could resemble a trading range, so highly subjective in where the Wave B peak is and the Wave C trough is which is what tends to catch most analysts out as they take EWT too literally, when at best it's a vague guide for what could come and not to get too carried away in making wave patterns fit price action, at best it tends to give a rough sketch of what is possible.

Central Banks Money Printing

To counter the Coronavirus shock to the financial and economic system we have the worlds central banks cutting interests and opening the liquidity taps which both acts to limit the downside and ensures that at some point there is going to be a sharp rebound in stock prices as the markets start to discount a post Coronavirus world.

Formulating a Stock Market Trend Forecast

The stock markets are ill, febrile, unable to quantify the viral risk hence why technical levels don't tend to work well at the moment resulting in the wild swings up and down that we witnessed last week. The market is literally infected with Coronavirus which breeds fear of the unknown where it is my task to try and quantify so as to arrive at a probable trend forecast. Where the Coronavirus trend trajectory states that the market is in for a couple of months of pain, but markets tend to move a lot faster than viral particles! Which implies that the markets will bottom BEFORE we witness the worst of the Coronavirus crisis headlines. Which I am sure will confuse many investors who will be expecting fresh lows in stead the market will likely be rising in the wake of bad news of increasing rate of infections, which is what you will be reading in the largely clueless financial press in a month or so's time, puzzlement as to why stocks are shrugging off bad coronavirus news.

So the stock market IS going to make new lows, but the time for this sell off will be compressed i.e. the market will bottom before the Coronavirus situation starts to improve, probably by several weeks before hand. Though don't expect a return to the raging stocks bull market any time soon, at best after the current panic phase the stock market will enter a volatile trading range as it attempts to ride out coronavirus bad news.

How low can the Dow go ?

20% off it's all time equals 23860.

25% off its all time high equals 22,200.

Somewhere in that range is where we are likely to see the Dow bottom, with the middle of this range being around 23,000. Though the market does not care too much about technical levels at the moment, so spikes even flash crashes lower are possible.

At least this time round the technical picture more accurately matches my Coronavirus trend analysis which was not the case early February.

Dow Stock Market Forecast Conclusion

Therefore my forecast conclusion is for the Dow to be targeting a VERY VOLATILE MOVE lower to between 22,500 and 23,00, with a risk of spikes or even flash crashes lower, that it could achieve any where from a matter of days to a couple of weeks, but definitely before the end of March.

After which I expect the Dow to enter into a volatile trading range as bargain hunting rally's give way to selling in the wake of more Coronavirus infection bad news as the markets basically attempt to ride out the worst of the Coronavirus storm as illustrated by my trend forecast graph.

The bottom line is that the Stock market IS heading lower but that it will bottom WELL BEFORE we hear the worst of the Coronavirus Infections numbers in the news. Whilst the risks to the forecasts are to the downside, i.e. FLASH CRASH uncertainty.

Investing in AI to Kill the Coronavirus

Vaccines to the coronavirus are likely to materialise in record time, 12 to 18 months. I know it doesn;t sound like fast but apparently it can usually take decades to develop and test a new vaccine before it can be mass produced for humans. In which respect AI is playing a crucial role in the deployment of a vaccine. Not only that but deployed machine learning systems will be able far more quickly develop vaccine responses during future outbreaks which could make waits such as for this pandemic a thing of the past.

This just acts to reinforce the primacy of the AI mega-trend and why every stock market panic sell off should be viewed as a buying opportunely as we trundle along to the inevitable point when some corporations start to merge AI algorithms with Quantum computers. So folks not only is the AI trend exponential there's also going to come a point when we see explosive change. Machine intelligence running on an Quantum Computer. When is that going to happen? I can guess at 2035? But it's just a guess, could be later or earlier. Anyway these two computing mega-trends are destined to converge and then explode!

That for instance could churn out a vaccine within minutes of having sampled viral RNA.

What this translates into is support for AI stocks and that biotech and pharma stocks that have out performed the rest of the market.

AI Stocks Q1 Buying Levels Current State.

And now for the primary reason why we should look forward to this Coronavirus bear market because it gives us an opportunity to pick up AI mega-trend stocks at a deep discount to where they were trading a few weeks ago, with many of the stocks hitting their Q1 buying levels. So those who followed my analysis of keeping the AI Buying stocks list at hand will have been able to pick up Top AI stocks such as Apple at its Q1 buying level of 255, though you would have to have either used market orders or been very nimble footed as the stock spiked lower before rebounding sharply from $255.

What about Numero Uno, Google?

Google has triggered it's Buying level of $1280 TWICE, retreating all the way from dizzy heights of $1525 to $1255 and currently standing at $1295.

Remember these buying levels have been in force since the 1st of January 2020 of what I deemed were probable prices the AI stocks could trade down to during Q1.

Which given this analysis we should now see most of the AI stocks significantly break their buying levels by a good % at some point. But as Apple illustrates volatility is EXTREMELY high, and there are so many individual corporate dynamics at work that we won't be aware of until after the fact such as when Apple iphone production will be back to normal levels?

So there is little point in trying to determine new buying levels for individual stocks as stock prices react to virus fundamentals rather than technical levels.

So what am I doing?

I am scaling into purchasing AI stocks as and when they break their Q1 buying levels, with many having traded down to the levels and then bounced. Though this forecasts suggests that they are not done to the downside yet so several more bites at the AI cherry.

Again remember that I consider this Coronavirus stocks bear market to be TEMPORARY, especially for top AI stocks such as Google!

KIlling the Coronavirus!

Here's something you may not have heard of or paid much attention to in the past. UV Light KILLS Bacteria and Viruses! Specifically UV-C in the 200 to 280 nm wavelength range.

So I thought I would give one a shot by buying a lamp off Amazon. Apparently you leave it switched on in a room for 30 minutes or so and it kills 99.9% of the bacteria and viruses by UV radiation and o-zone. Though you don't want to be in the room whilst the lamp is on or have pets and plants in it's vicinity!

Though it is being shipped from China so it remains to be be seen if I get what I paid for given domestic demand for killing coronavirus over there. I'll especially inspect to make sure the lamp actually is UV-C as stated and not A or B.

Also before you rush out and buy a UV Lamp make sure to do your own research on how to use it safely.

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Your analyst getting ready to kill some COVID-19.

By Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.