US Stock Market Upswing Meets Employment Data

Stock-Markets / Stock Markets 2020 Mar 27, 2020 - 06:31 PM GMTBy: Arkadiusz_Sieron

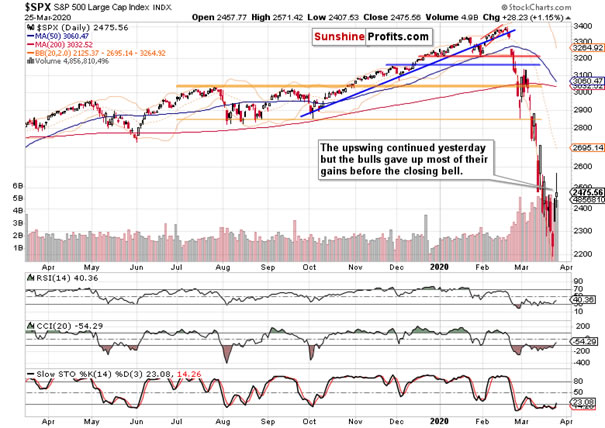

The much-anticipated upswing continuation came yesterday, and the bulls certainly fought hard to keep up the upside momentum. To what degree have they been successful with most of the intraday gains evaporating before the closing bell?

The intraday volatility is high and offers many opportunities to profit on both long and short positions. And that’s certainly what we did earlier this week, cashing in a 168-point gain on Friday-opened short position, and two more profitably closed positions (both were long trades) yesterday for an 82- and 52-point profit respectively. In total, that’s 302-point gain this week so far!

But going into the employment data later today, how does the technical outlook look like right now?

Fundamentally, we can expect rather disappointing figures, but the real question is how much of a disappointment vs. expectations of a disappointment, it would be. And most importantly, how will the market balance out its reaction with the stimulus effect hopes.

Let’s start our analysis with the daily chart examination (chart courtesy of http://stockcharts.com).

Stocks opened on a strong note yesterday, yet didn’t close in a show of strength. While the futures tumbled in the final 15 minutes of the regular trading session, and extended losses thereafter, they seem to have rebounded from the low 2410s – for now.

These were our yesterday’s observations regarding the daily indicators’ posture:

(…) solidly in bearish territory, they’re increasingly curling higher, thus supporting another leg up.

While the above remains true, the rally and its path higher so far doesn’t seem to be proportionate to the monetary and fiscal stimulus thrown at the coronavirus fallout. And as more and more parts of the US grind to a temporary economic halt, bearing directly on the US consumer, industry and services, we can expect the sellers to return forcefully. As the death toll and the associated economic impact coupled with the sense of alarm unfortunately grow over the coming days and weeks, we better brace ourselved for the renewal of the downtrend in stocks.

Remember, this is a health crises affecting the works of the real economy, not a monetary or fiscal crisis. Therefore, we can reasonably expect the fiscal and monetary tools to play out their magic only when the situation on the ground stabilizes first, or when the market stops reacting to them. That would be similar to the early March 2009 bottom when bad news kept pouring in for weeks longer, yet stocks marched higher already.

Has the time come to jump back in on the short side? Arguably, not yet – certainly not from the risk-reward perspective. Careful monitoring of both the technical and fundamental situation would allow us to identify such an opportune moment. And in general, that goes for both the long and short trades. In these exceptional times, capital preservation is the call of the day as we’re in it for the long run. Therefore, we’re keeping our powder dry at this moment, and will let our subscribers know once a promising setup (long or short) presents itself.

The above though didn’t prevent us from cashing yet another quick gain earlier today! On top of all the above recapitulation, we went in for a 38-point profit a while ago, bringing this week’s total to 340-points gained so far!

Summing up, while the bears have the upper hand, the potential for a temporary upswing to resume, is still there. While a little underwhelming so far, this Fed and stimulus-triggered move might live on. It has the benefit of short-term doubt, but the upswing is kind of racing against the time, which is not really on its side. Considering the risk-reward perspective, we’re not entering into any new trades after the recent profitable string of respectable gains. As always, we'll let our subscribers know of the next worthwhile trade opportunity. That's where the heavy lifting for their benefit is done, that's where the value is.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Stock Trading Alerts to also benefit from the trading action we describe – the moment it happens. The full analysis includes more details about our current positions and levels to watch before deciding to open any new ones or where to close existing ones. Check more of our free articles on our website – just drop by and have a look. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock & Oil Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

Monica Kingsley is a trader and financial markets analyst. Apart from diving into the charts on a daily basis, she is very much into economics, marketing and writing as well. Naturally, she has found home at Sunshine Profits - a leading company that has been publishing quality analysis for more than a decade. Sunshine Profits has been founded by Przemyslaw Radomski, CFA - a renowned precious metals investor and analyst.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.