Gold Miners: Dismissing the inflation Bugs

Commodities / Gold and Silver Stocks 2020 Mar 16, 2020 - 03:59 PM GMTBy: Gary_Tanashian

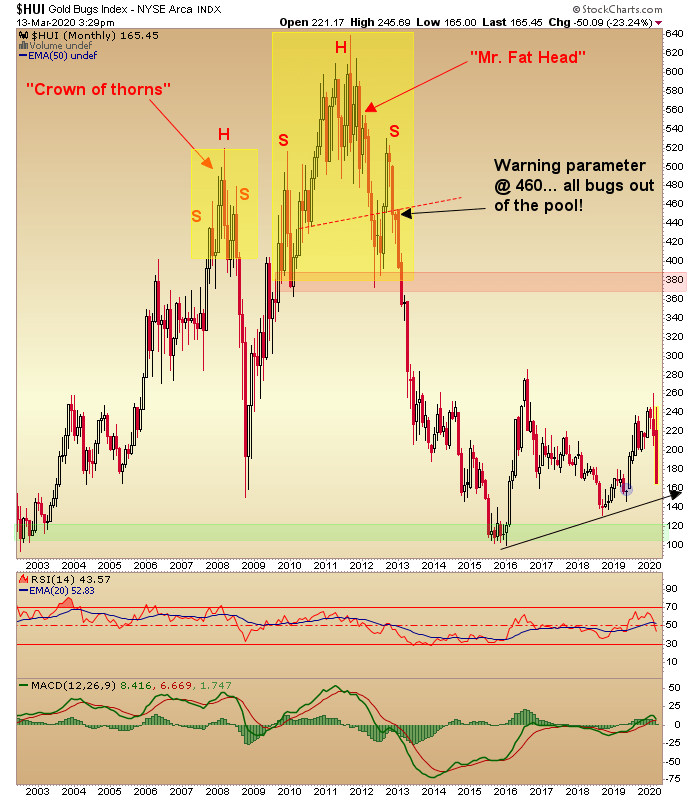

Below is a monthly chart of HUI telling some stories of the past.

- The 2003 to 2008 bull rally ended with Huey’s “crown of thorns” as I used to call it back then. An H&S that formed at the end of a great inflationary phase in the markets.

- The great crash of 2008 (Armageddon ’08) was completely deserved because as I’ve belabored for so many years now, you don’t buy gold stocks in any heavy and/or long-term way during cyclical inflationary touts as gold barely keeps up with mining cost commodities and other assets/markets. The crash of Q4 ’08 cleaned out the inflation bugs and it did so with great cruelty and relentlessness. Only when every last bug who’d come aboard for the wrong reasons was exterminated did the bloodshed finally end.

- So who turned and burned first out of the ’08 (deflationary) bottom? Gold and then the miners, that’s who. They led the whole raft of commodities and stocks, which finally bottomed in March of 2009. Then another massive inflation trade ensued, before blowing out in Q1 of 2011. Then? What I called “Mr. Fat Head” formed as the first drop found support at 375, the sector rammed upward on a QE tout, then failed, taking out 460 on the downside and we proclaimed that was that. Welcome to the bear market.

- Then years of a bear crash and grind took HUI down to Mr. Fat Head’s measured target, which was around 100.

See you after the chart for more thoughts.

Last year as NFTRH subscribers know, I had a downside projection for HUI of a gap fill and support test at 170 to 180 coming off the summer rally. That did not come about as the ensuing inflation/reflation trade of Q4 2019 lifted all boats, Huey’s included. I had to announce I was wrong about that target. And I make no claim to be right about it now because I had for all intents and purposes, shelved it. Well sir, wrong again.

And I am happy to be wrong because as noted in NFTRH all these months (years, actually) I never was nearly loaded with gold stocks. Since Q4 2008 I have hoped for another ‘slingshot’ opportunity like that. While that trade was wildly successful it came at the expense of weeks of pain as I bought the crash enthusiastically at HUI 250, only to end up buying again – while figuratively sucking my thumb – at 150, the ultimate bottom. This time I am more patient.

The end of an inflation trade pressures gold stocks because inflation bugs buy during inflationary touts and sell during climactic deflationary phases. But a funny thing happens during the latter. The fundamentals improve. These are beyond the scope of this article but we have kept a close watch on the improvement as the fundamentals pull back to end the week but are not nearly broken (with the stock prices and gold bug spirits).

COVID-19 hysteria helped put a dangerous hype bid in gold (along with an even more dangerous one in Treasury bonds) and we noted that as a vulnerability along with the Commitments of Traders (likely much improved after gold’s correction this week although you will not notice much in this week’s data, as of 3/10/20). You can bet it’s better now. Silver by the way is likely very close to repaired as it was much improved even before the majority of this week’s horror show. Consider it repaired now, for all intents and purposes. It’s not a timer, but it is also no longer a risk indicator.

But I digress. The story of gold stocks is one of fundamental improvement amid counter-cyclical economic activity and deflationary pressure. History (along with the HUI chart above) states clearly that as the fundamentals improve, the gold stocks get sold down. It’s just the way it works and you can’t fight City Hall (or an inflation-centric gold bug bent of puking). Also involved are forced liquidations and various other hangers on who will be exhausted when they are exhausted and not any sooner.

I am looking forward to this opportunity, especially in gold stocks but also possibly in broad stocks (big time gorillas like MSFT, AMZN and GOOGL are now in the portfolios thanks to this correction). We’ll see on that, however. Today was likely just massive short covering. The gold stocks will seek out a bottom as will the stock market after these violent drops and bounces play out and firm support is found (for reference here is the latest post showing some unfinished business for the S&P 500).

I do think that history, from the deflationary phases of 2001 and 2008 and to a minor extent 2016 that saw gold miner bottoms, to the inflationary phases of 2003-2008, 2010-2011 and to a minor extent 2016 that saw gold miner tops is a good guide in the current situation. You buy the deflationary washouts and sell (or avoid buying as a longer-term holder) the inflationary touts. Now it’s all about patience and timing.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2020 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.