Coronavirus China Infection Statistics Analysis, Probability Forecasts 1/2 Million Infected

Politics / Pandemic Feb 21, 2020 - 06:23 PM GMTBy: Nadeem_Walayat

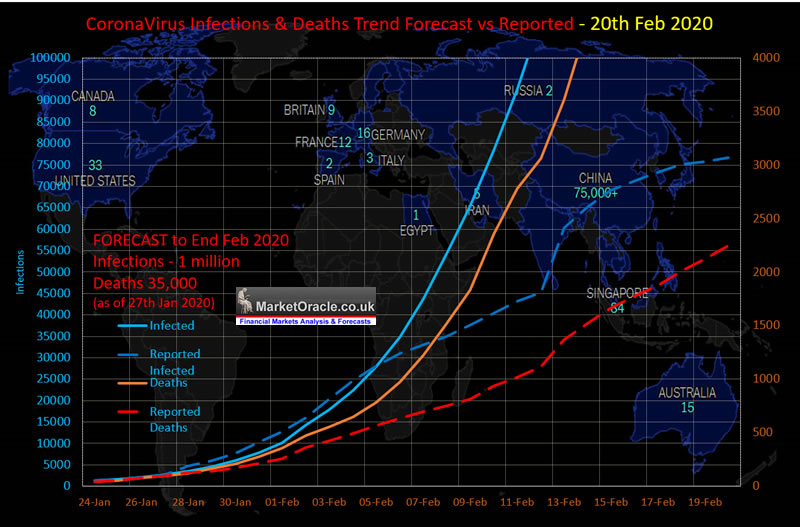

We in the West are in still the CALM before the Coronavirus STORM stage, both in terms of infections and in terms of economic impact as we witness China's economy effectively grind to a halt, a harbinger of what to expect to come that the financial markets are STILL NOT discounting! For China's Coronavirus statistics grossly under report the number of infections by several multiples that this analysis will attempt to determine the true magnitude of China's outbreak which even the Chinese CDC now admits that their statistics are under reporting by significant degree the actual number of infected. Which has not just been my consistent view since the Coronavirus story first broke a month ago, but many scientists around the world have questioned China's data as measured across several metrics such as the unrealistic day to day change in infection numbers that for want of a better word were unnatural.

Basically China cannot test all suspected cases for the virus, instead only those who make into hospital tend to get tested, and thus excluding all those who either don't turn up to hospital i.e. told to self quarantine at home or are turned away from hospitals because there is no capacity to deal with more people clogging up the corridors, that and the tendency to brush bad news under the carpet then be reasonable for passing it up the command chain.

Furthermore the chinese CDC has stated that the Coronavirus IS airborne spread by aerosol rather than just being spread by droplets. The difference being that droplet spread is within close contact of a few meters, which is what we are still being told in the West, i.e. we will be fine if we stay over a metre away from infected people, whilst aerosol spread means transmission is by smaller particles of virus over vast distances, which is apparent given what we have witnessed take place on the Diamond Princess cruse ship over the past 2 weeks, where just 1 infected passenger catching the virus in hong kong has gone to infect over 700 fellow passengers as the virus likely spread through the ships ventilation system, and the fact that the Chinese have been spraying disinfectant into the air in Wuhan in attempts to kill airborne virus particles.

So to what probable degree are China's coronavirus infection numbers being under reported. My consistent view has been that the actual number is likely at least twice the official data, and possibly as high as ten times official statistics. However reading the mainstream press where estimates tend to vary from X4 to X20 the reported number .

That means that current chinese tally of approximately 75,500 infected could range from 300,000 to as high as 1.5 million. So where on this wide spectrum is that which is most probable, which is important to know to determine how widely the Coronavirus will spread across the world over the coming weeks and months.

Will CoronaVirus Pandemic Trigger a Stocks Bear Market 2020?

The rest of this analysis that concludes in a detailed trend forecast for the Dow stocks index has first been made available to Patrons who support my work (Will CoronaVirus Pandemic Trigger a Stocks Bear Market 2020?).

- Stock Market Deviation from Overall Outlook for 2020

- QE4EVER

- As Goes January So Goes the Year

- Short-term Trend Analysis

- Long-term Trend Analysis

- ELLIOTT WAVES

- Formulating a Stock Market Trend Forecast

- Dow Stock Market Forecast Conclusion

- TRADING THE DOW

- Will Trump Win US Presidential Election 2020?

Recent analysis includes :

- Will CoronaVirus Pandemic Trigger a Stocks Bear Market 2020?

- Silver Price Trend Forecast 2020

- Gold Price Trend Forecast 2020

- British Pound GBP Trend Forecast 2020

- AI Stocks 2019 Review and Buying Levels Q1 2020

- Stock Market Trend Forecast Outlook for 2020

Scheduled Analysis Includes:

- UK Housing market series

- Machine Intelligence Investing stocks sub sector analysis

- Bitcoin trend forecast

- Euro Dollar Futures

- EUR/RUB

- US House Prices trend forecast update

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.