Is The Coronavirus bullish for Stocks?

Stock-Markets / Stock Markets 2020 Feb 08, 2020 - 04:18 PM GMTBy: Chris_Vermeulen

Earnings volatility has certainly been big. Tesla pushed the markets much higher early this week and the US stock markets have continued the upward momentum after the State Of The Union address and the acquittal of President Trump on Wednesday. Still, we continue to believe this rally may be a “fake-out” rally with respect to the fallout from the Wuhan virus. Certainly, foreign investors are continuing to pour capital into the US stock market as the strength of the US Dollar and the strong US economy is drawing investment from all areas of the globe.

We believe the scope of this parabolic rally in the US stock market should actually concern skilled traders. Markets just don’t go straight up for very long. The last time this happened was in the 1970s and 1980s. Very minor volatility during that time prompted a big move higher in the US stock market that set up the eventual DOT COM collapse.

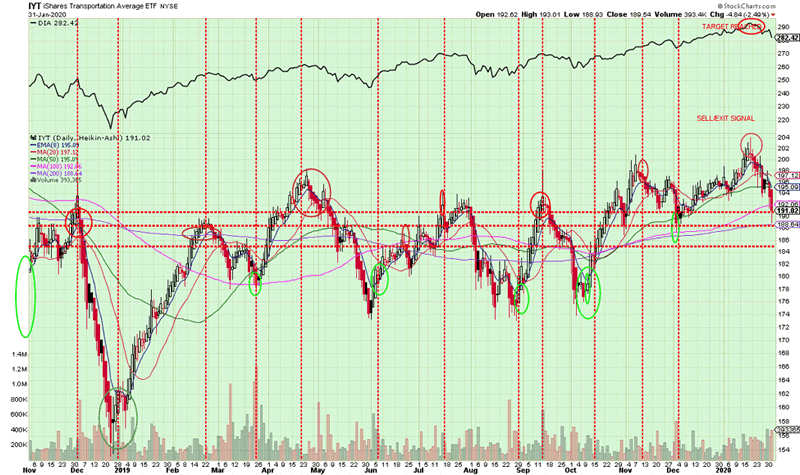

Oil, Shipping, Transportation, Consumer, Manufacturing, and Retail will all take a hit because of the Wuhan virus. We’ve, personally, received notices from certain suppliers that factory closures in China will greatly delay the fulfillment of orders. Our opinion is that nations may have to close all or a majority of their cities, ports, and activities in Asia for at least 90+ days in order to allow this virus event to peak and subside. We don’t see any other way to contain this other than to shut down entire cities and nations.

The US Fed and Central Banks are doing everything possible to continue the economic growth and stability of global economics. Yet, the reality may suddenly set in that without risking a global virus contagion, nations may be forced to actually shut down all non-essential activities for well over 90+ days (possibly even longer). If you could stop and consider what it would be like for half of the world, and many of the major manufacturing and supply hubs, to shut down for more than 3 to 6 months while a deadly virus is spreading.

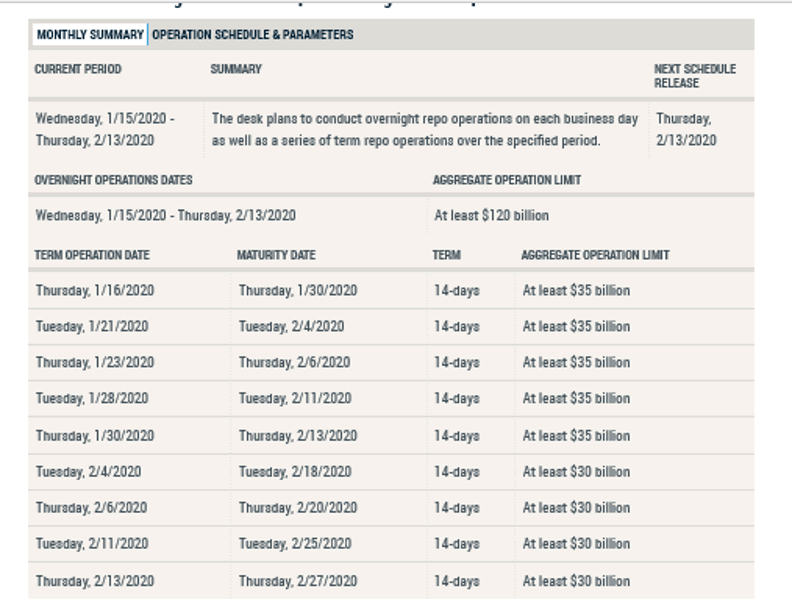

Repo lending continues to show that liquidity is a problem. We believe this problem could get much worse. Skilled traders need to be prepared for a sudden and potentially violent change in the direction of the global stock markets.

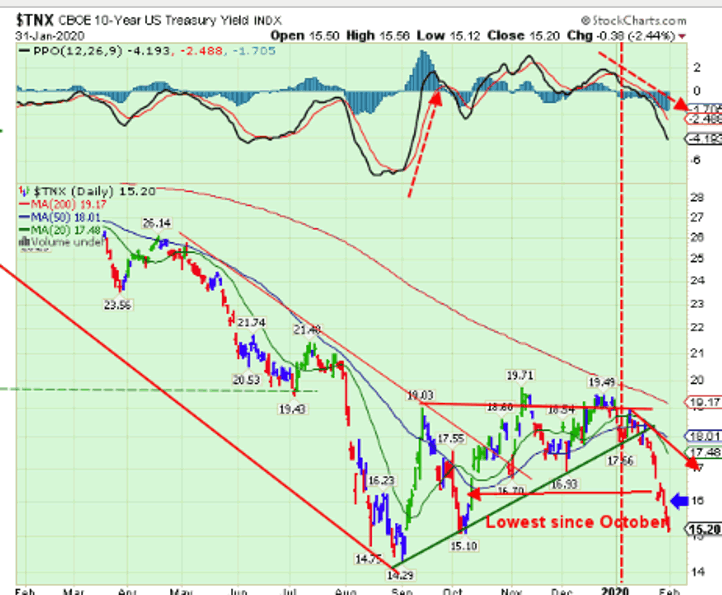

$TNX – 10 Year US Treasure Yield Daily Chart

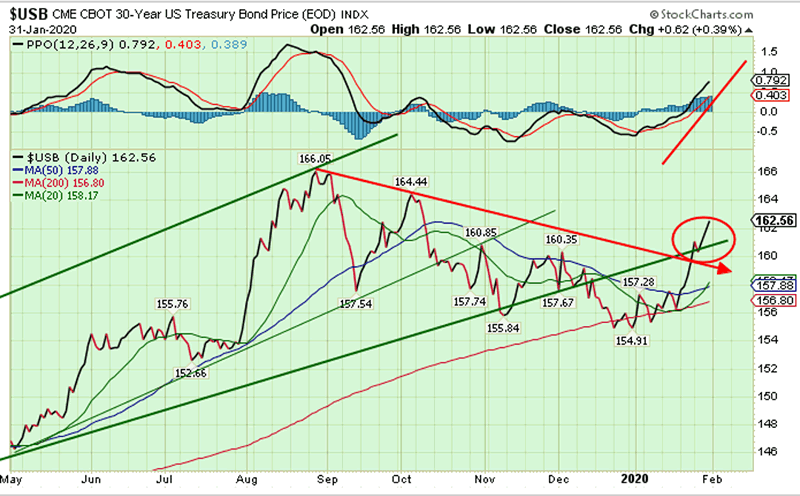

30 Year Treasury Bond Price – Daily Chart

There is now a solid wall of inversions in all the treasury notes and bills. The 10-year yield is inverted with 6-month and shorter durations. The 30-year long bond dipped below 2.0% for the third time and is just 6 basis points from a record low.

Prepare to capitalize on this “crowd behavior” in the near future. Right now, the US stock market is pushing higher as Q4 earnings drive future expectations. Yet, be prepared for the reality of the situation going forward.

This Wuhan virus may present a very real “black swan” event. At the moment, the US stock market appears to want to rally as earnings and economic data continues to impress investors. Overall, the real risk to the markets is a broader global economic contagion related to the Wuhan virus and the potential it may have on foreign and regional economies.

Next week is going to be critical for many things I feel. Virus contagion growth, factory closures, Oil breakdown follow through, equities breakout follow through, and the precious metals pending move.

We locked more gains this week with one of our positions as we rebalance our portfolio holdings for these new big trends to emerge. If you want to know where the markets are moving each day and follow my trades then join my ETF Trading Newsletter.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.