British Pound Fundamental Analysis and US Dollar Trend Analysis

Currencies / British Pound Feb 05, 2020 - 05:54 PM GMTBy: Nadeem_Walayat

This is part 2 of my British Pound Analysis that concludes in a detailed trend forecast for 2020

- British Pound 2019 Review (Part1)

- Political Implications

- Fundamentals

- US Dollar Index

- GBP Long-term analysis

- GBP Trend Analysis

- Elliott Wave Theory

- GBP 2020 Forecast Conclusion

However the whole of analysis was first made available to Patrons who support my work: British Pound GBP Trend Forecast 2020

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Political Implications

Despite continuing mainstream press talking heads obsession with Brexit, basically you can put the TV on mute whenever anyone talks about BrExit because the uncertainty is OVER, Britain is heading for a relatively mild Brexit which the EU will be in full agreement with.

That and given the fact the Tories are now in power for the next 10 years, means politics is no longer a factor in the equation so should result in relative sterling strength against the US Dollar, especially given that the Dollar faces increased uncertainty in the countdown to the November Presidential election.

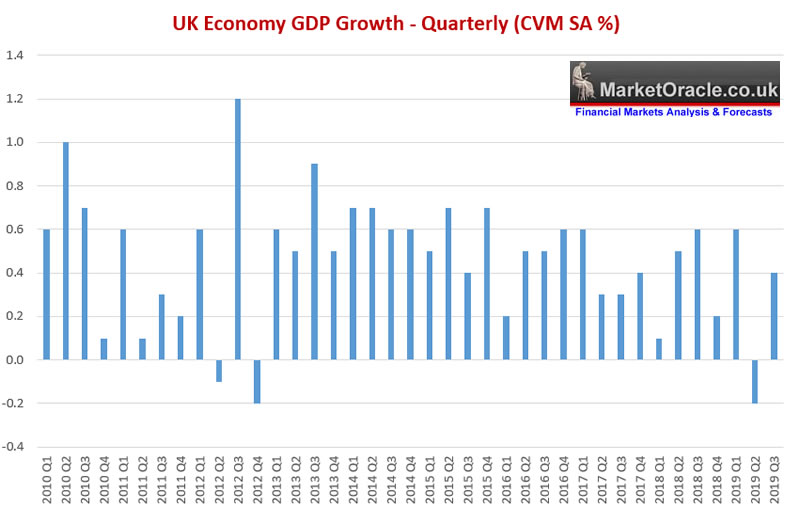

Fundamentals - GDP

Extreme Brexit uncertainty of Mid 2019 that saw negative quarterly GDP of -0.2% had already started to dissipate during Q3 with it's 0.4% rebound. and I can image a similar result for Q4 when it's published.

Whilst 2020 should see a similar trend for 0.4% per quarter GDP with the Bank of England signaling they are standing by to print money should the UK economy falter post 31st of January. So the UK looks set to achieve at least 1.6% GDP for 2020. Whilst typical economic forecasts range are for just 1% growth (BCC 1%, PWC 1%, BoE 1%).

So it looks like the consensus has failed to properly allow for a Boris bounce, which means there is plenty of room for upside surprise in GDP data to be published during to 2020. Which should strengthen sterling as it reduces the risks of interest rate cuts. Despite the Bank of England's recent announcement that it is prepared to cut rates to boost growth.

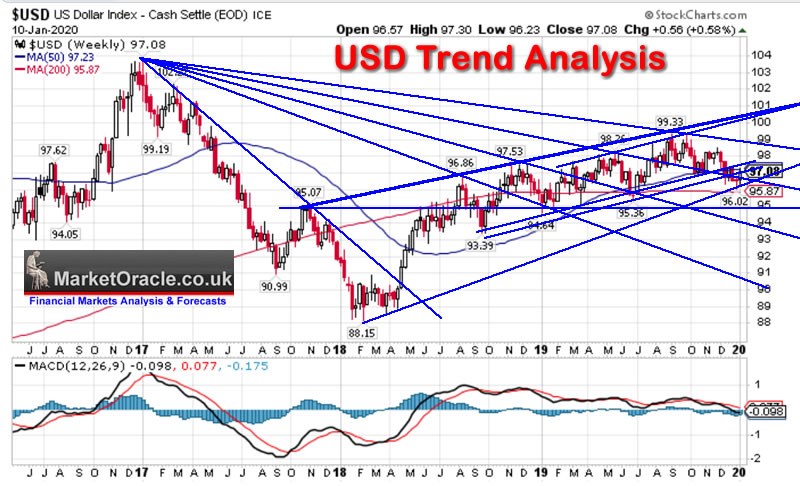

US Dollar Index Trend Analysis

A quick technical take on the US Dollar:

1. The US dollars bull market appears to have topped out at 100. So a change in trend is under way of sorts.

2. The dollar has breached significant trend line support which suggests that another run at USD 100 is unlikely anytime soon.

3. There is heavy support under the dollar from 93 to 96.

The overall picture is of the dollar trending sideways during 2020 in the range of about 98.5 to 93.5. So with the USD trading at 97 there is some room for USD downside so somewhat supportive of GBP relative strength by about 3 to 4 cents.

British Pound GBP Trend Forecast 2020

The rest of this analysis has first been made available to Patrons who support my work: British Pound GBP Trend Forecast 2020

- Political Implications

- Fundamentals

- US Dollar Index

- GBP Long-term analysis

- GBP Trend Analysis

- Elliott Wave Theory

- GBP 2020 Forecast Conclusion

Recent analysis includes :

- Silver Price Trend Forecast 2020

- Gold Price Trend Forecast 2020

- British Pound GBP Trend Forecast 2020

- AI Stocks 2019 Review and Buying Levels Q1 2020

- Stock Market Trend Forecast Outlook for 2020

Whilst my next soon to be completed analysis will be a detailed trend forecast for the Stock Market.

Scheduled Analysis Includes:

- UK Housing market series

- Machine Intelligence Investing stocks sub sector analysis

- Bitcoin trend forecast

- Euro Dollar Futures

- EUR/RUB

- US House Prices trend forecast update

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.