Stock Market Correction Continues

Stock-Markets / Stock Markets 2020 Feb 03, 2020 - 01:55 PM GMTBy: Andre_Gratian

Current Position of the Market

SPX: Long-term trend – There are no signs that the bull market is over.

Intermediate trend – Limited correction underway.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Daily market analysis of the short-term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please go to www.marketurningpoints.com and request a trial.

Market Review

Point & Figure Overview of SPX

Long-term trend: The bull market which started in 03/09 shows no sign of having run its course. A rough count taken on the long-term Point & Figure chart gives us a potential target to as high as 4080. P&F does not predict time, only price. (no change)

Intermediate trend: Current topping pattern suggests minimum correction to 3260. Maximum to 3090. The minimum target has been surpassed. 3155-3160 is now likely.

Important Cycles

In February, three important cycles are scheduled to make their lows: the 2-yr cycle, the 20-wk cycle, and the 80-day cycle.

Market Analysis (Charts courtesy of QCharts)

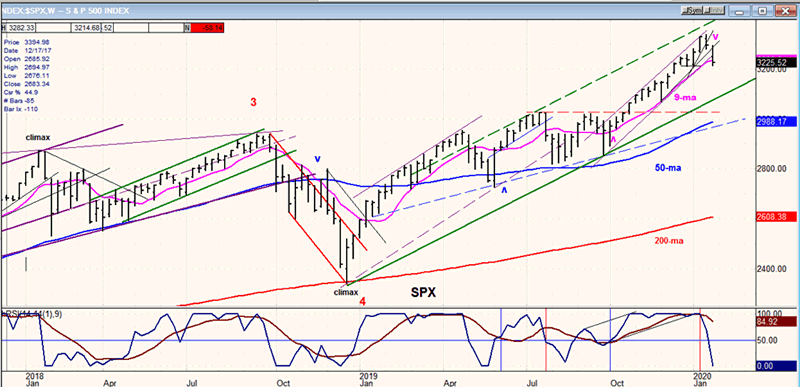

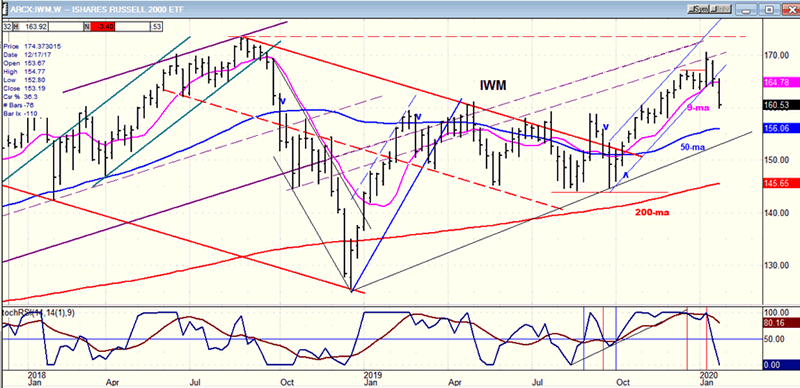

SPX-IWM weekly charts

The weekly (intermediate) trend line has been broken in both charts, suggesting that a correction of intermediate nature is underway. It is unlikely that the pull-back will last beyond the last week of this month, and it should end much sooner. Price projections are available in the P&F section.

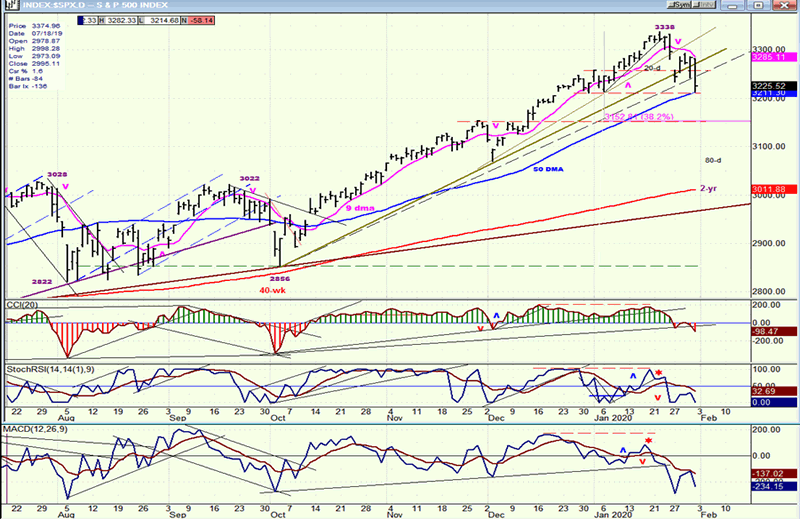

SPX daily chart

The bottoming cycles mentioned above finally gained control of prices after the index had risen to 3338. Since then, prices have fallen to Friday’s low of 3215, or 123 points, and could continue their declines for at least another 50 points into the middle of next week as the 80-day cycle makes its low. The unknown quantity is the 2-yr cycle whose low cannot be timed precisely because of its magnitude. If it extends beyond Thursday, then we can see prices reaching the maximum projection of 3145. The 20wk cycle which is due late in the month should not be a significant factor if the 2-yr has made its low before then, but it could provide a pause in the new uptrend. After all the cycles have bottomed, we can expect the market to resume its long-term uptrend until it is ready for the next correction.

The oscillators at the bottom of the chart gave us some advance notice that the market was ready to turn down by showing some negative divergence. Now that they are in full sell mode, they will most likely warn us of the next reversal to the upside by showing positive divergence ahead of the turn.

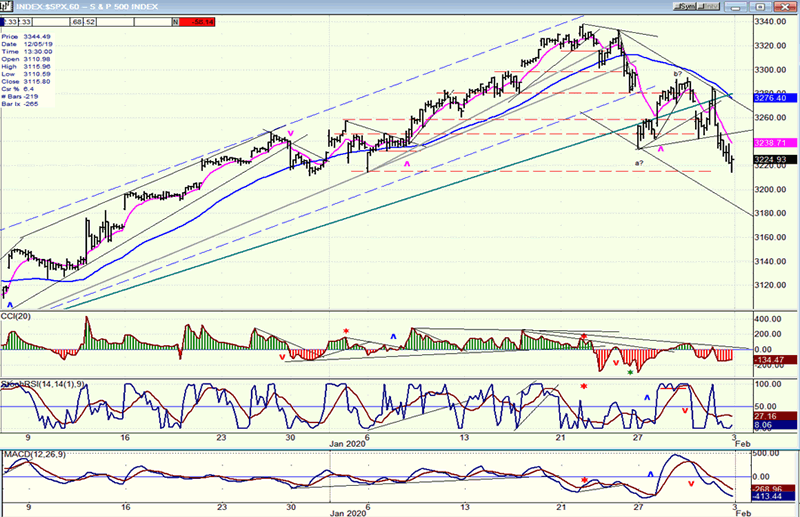

SPX hourly chart

The hourly chart is best suited to display the short-term market swings. There were few notable ones in the move from 2856 to 3338, with each minor correction limited in time and scope. In the next up-phase (whose extent has not yet been determined) the pull-backs generated by minor cycles could be more significant. But we will have to wait until we approach mid-year before we get another correction of the current magnitude, and possibly larger.

The CCI is showing some minor deceleration, but this is not likely to lead to a reversal until the 80-day cycle has made its low.

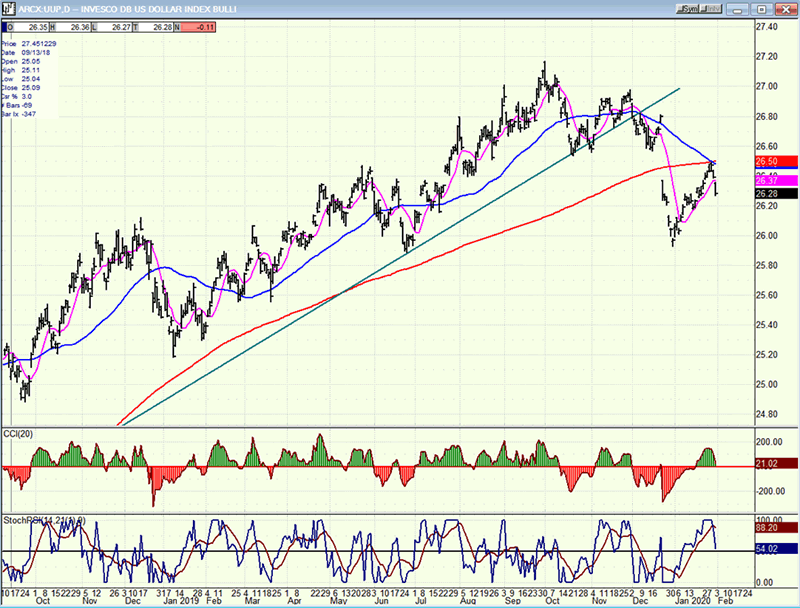

UUP (dollar ETF) daily

I am reverting to showing UUP now that enough time has passed since the dividend gap was created. By now, the indicators should should no longer be distorted. The green trend line originated in January 2018; and since it was decisively broken, it should signal a reversal of intermediate nature. This means that a correction back down to 25.00-25.50 can be expected.

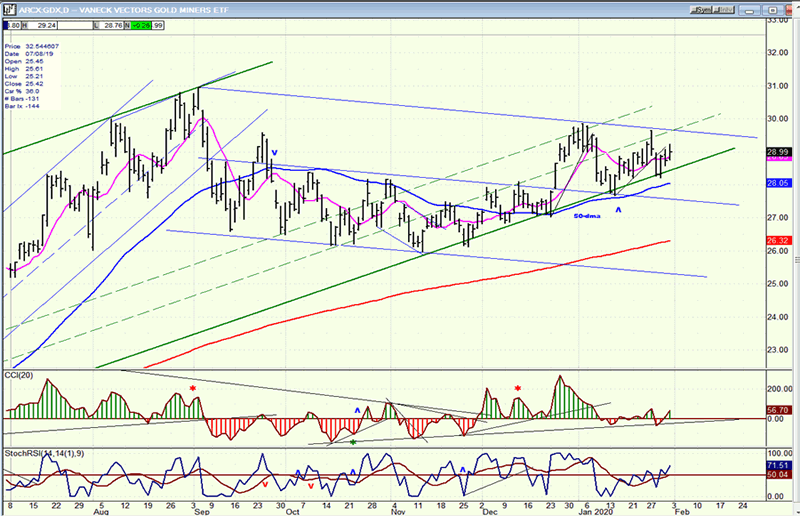

GDX (Gold miners ETF) daily

Since last November, GDX has been bouncing off its green trend/channel line. This is not a sign of real strength; and until the price can push beyond the blue downtrend line with more aggression than it currently displays, the index is risking additional consolidation/correction outside of the trend line.

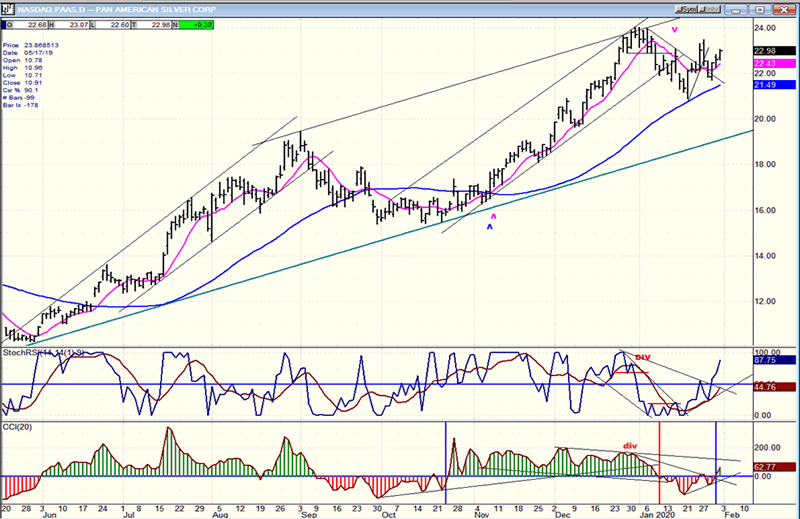

PASS (Pan American Silver Corp.) daily

Although the indicators have given buy signals, I am not convinced that PAAS is ready to extend its uptrend until it has consolidated for a bit longer. This could change if UUP extends its correction right away; and it would also affect GDX positively.

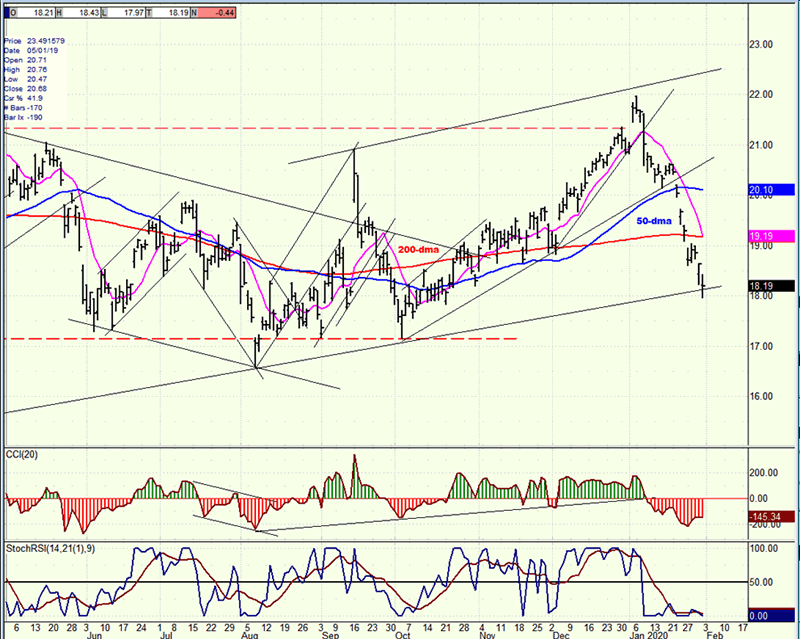

BNO (U.S. Brent oil fund) daily

BNO has matched the weakness in the market as it continued to correct along with it. It is possible that it could extend

its decline for another point or so before it finds good support. BNO will be ready to reverse when the market cycles have made their lows.

Summary

The correction continues as anticipated and its end may come as early as this week if the two-year cycle makes its low in conjunction with the 80-day cycle. Potential price targets are given above.

Andre

FREE TRIAL SUBSCRIPTON

For a FREE 4-week trial, send an email to anvi1962@cableone.net, or go to www.marketurningpoints.com and click on "subscribe". There, you will also find subscription options, payment plans, weekly newsletters, and general information. By clicking on "Free Newsletter" you can get a preview of the latest newsletter which is normally posted on Sunday afternoon (unless it happens to be a 3-day weekend, in which case it could be posted on Monday).

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.