Coronavirus Infections Spread vs Forecast - 30th Jan 2020 Pandemic Update

Politics / Pandemic Jan 30, 2020 - 03:28 PM GMTBy: Nadeem_Walayat

The Coronavirus continues it's exponential spread across China, this despite Chinese state propaganda peddling a line of measures taken especially earlier in the month having limited the spread of the virus that is not being born out by data released that on a daily basis shows the spread is exponential to across the whole of China and likely neighbouring nations.

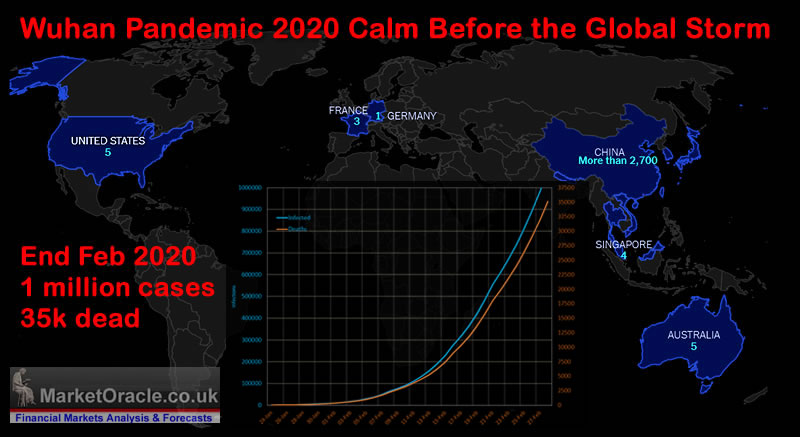

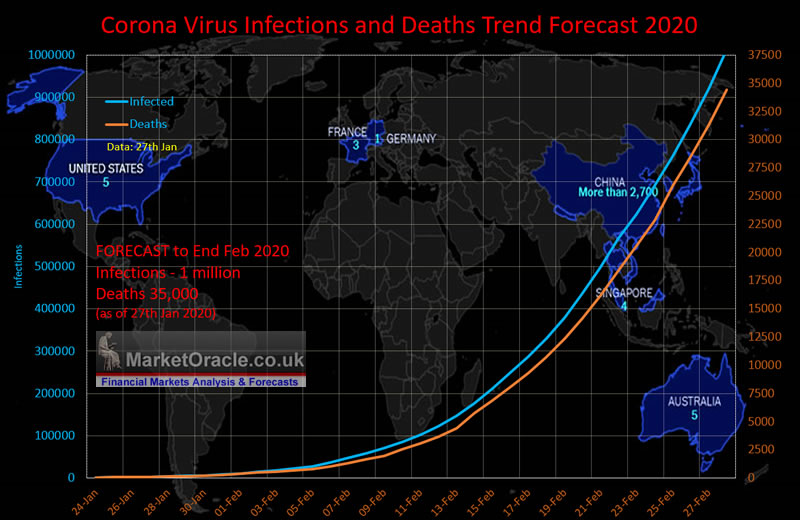

My analysis and concluding forecast of 28th January based on data up until the 27th of January utilised trend analysis to forecast that the Coronavirus could infect over 1 million people by the end of February 2020, which given the apparent fatality rate of 3.5% at the time converted into an death toll of at least 35,000. Which if it transpired would be far worse than the 2002-2003 SARS pandemic that infected 8,098 over 8 months resulting in 774 deaths, and this the Coronavirus would have significant economic and market consequences.

Youtube Video version : https://youtu.be/c1rXvXMD3jc

And here is a closer look at the trend forecast graph.

As the graph illustrates the trend trajectory forecast infections to only really start taking off globally mid February when the number of infections are expected to exceed 100,000 and deaths 2,500. So we are still some 12 days away from when the Coronavirus pandemic really starts to take off. Which means that the world has a short window of opportunity to act to limit the spread of the virus.

Unfortunately the worlds governments are doing the exact opposite, where even at this stage are actively flying home potentially infected nationals, with a flight of some 200 British nationals being brought to the UK tomorrow. No matter what the government states, the British government just as the Chinese government before it will NOT be able to contain infections from such flights as it only takes 1 person to start an epidemic in the UK.

Instead it would have been far better to isolate suspected infections rather than to transport to infection free areas!. Thus I am afraid the actions of most Governments will contribute to the spread of the virus and thus the forecast trend trajectory remains very highly probable.

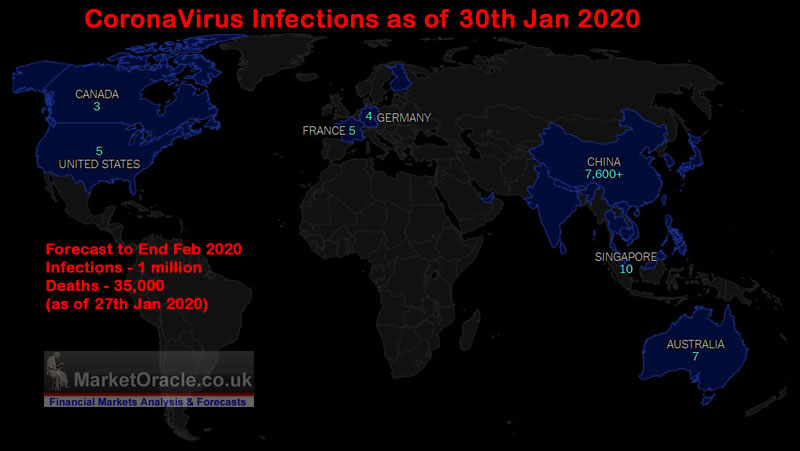

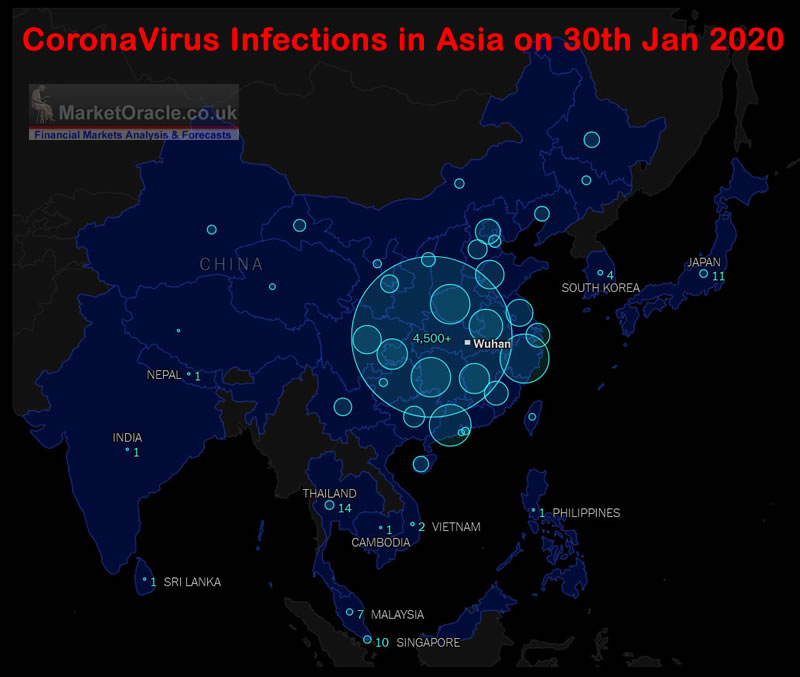

Infections Map 30th Jan 2020 Update

The world map illustrates the spread of the virus as of today (30th Jan 2020), where infections now total 7,700.

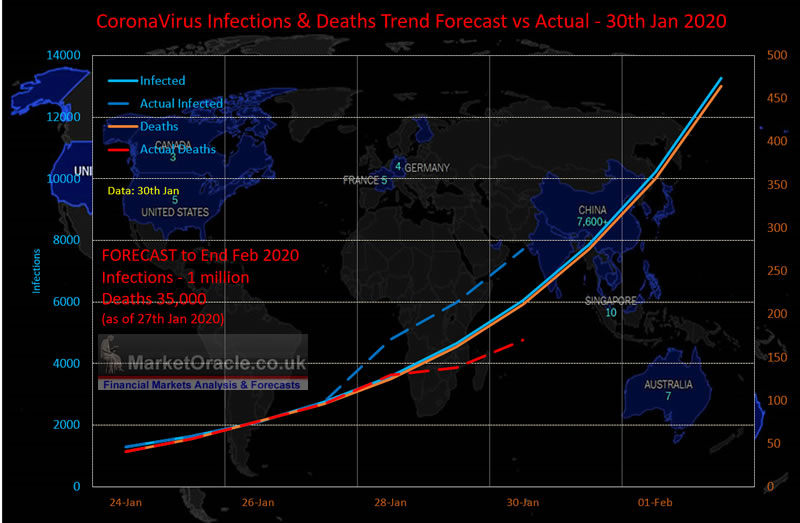

Is the virus Spreading Faster than Forecast Or Not?

The forecast for the number of infections and deaths by 30th of January 2020 vs actual:

| Infections | Deaths | |

| Forecast - 30th Jan | 6041 | 211 |

| Actual - 30th Jan | 7700 | 170 |

| % Change | 127% | 80% |

Were this trend to continue into the end of February 2020 then the number of infected would increase to 1.27 million, whilst the number of deaths would fall to 28,000. So the latest data implies a wider spread but a lower mortality rate.

However, these are still the very early days of the spread of the Coronavirus, especially given that there are large susceptible populations groups with poor healthcare infrastructure such as India that announced it's first infection today. Also that a vaccine is still a good 4 months away. far too late to have any impact on this pandemic.

Meanwhile this is what China and asia's infections map currently looks like, a harbinger of what to expect when the virus travels into uninfected populations.

Contrary to all of the measures taken by the Chinese to limit it's spread the virus has now spread to the whole of China which means it cannot be contained and is only a matter of time before it goes global at roughly the same rate of spread.

Silver Price Trend Forecast 2020

We can all dream about SIlver outpacing Gold. However the truth about Silver is that it tends to under perform during precious metals bull markets, and only really coming alive in the bull markets final stages when it tends to spike. So Silver for 2019 did what Silver tends to do which is to under perform against Gold. Though in reality maybe investors tend to set their hopes too high, as a gain of 15% for the year is still pretty good going against Gold up 19%.

My latest Silver price trend analysis that concludes in a detailed trend forecast for 2020 has first been made available to Patrons who support my work (Silver Price Trend Forecast 2020).

- Silver Price Trend 2019

- Silver Investing Strategy

- Gold Price Trend Forecast Implications for Silver

- Gold / Silver Ratio

- Long-term Trend Analysis

- Trend Analysis

- MACD

- Elliott Waves

- Formulating a Trend Forecast

- Silver Price Trend Forecast 2020

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Recent analysis includes :

- Gold Price Trend Forecast 2020

- British Pound GBP Trend Forecast 2020

- AI Stocks 2019 Review and Buying Levels Q1 2020

- Stock Market Trend Forecast Outlook for 2020

Scheduled Analysis Includes:

- Stock Market Multi Month Trend Forecast 2020

- UK Housing market series

- Machine Intelligence Investing stocks sub sector analysis

- Bitcoin trend forecast

- Euro Dollar Futures

- EUR/RUB

- US House Prices trend forecast update

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.