The Wuhan Wipeout – Could It Happen?

Politics / Pandemic Jan 26, 2020 - 05:37 PM GMTBy: Chris_Vermeulen

News is traveling fast about the Corona Virus that originated in Wuhan, China. Two new confirmed cases in the US, one in Europe and hundreds in China. As we learn more about this potential pandemic outbreak, we are learning that China did very little to contain this problem from the start. Now, quarantining two cities and trying to control the potential outbreak, may become a futile effort.

In most of Asia, the Chinese New Year is already in full swing. Hong Kong, China, Singapore, Malaysia, India and a host of other countries are already starting to celebrate the 7 to 10 day long New Year. Millions of people have already traveled hundreds of thousands of miles to visit family throughout this massive celebration. We are certain that hundreds or thousands have traveled to all parts of the world by now. The potential for exponential growth in the threat from this virus could be just days or weeks away.

Far too many people are too young to have any knowledge of the 1855 Third Plague Pandemic that originated in China. This outbreak quickly spread to India and Hong Kong and claimed 15 million victims. It lasted until the 1960s when active cases of the Plague dropped below a couple hundred.

If we consider the broader scope of this issue, we have to take into consideration the results it may have on the broader global economy, commodities and consumer activity as skilled traders.

The world is much bigger than it was in 1855. We have more technology, more capability and faster response capabilities related to this potential pandemic. Yet, we also have a much greater heightened inter-connected global economy, currency, and commodity markets. What happened in China can, and may, result in some crisis events throughout the planet. It is not the same world as it was in 1855. (Source: history.com)

It is far too early to speculate on any future economic outcomes related to this potential outbreak, but it is fairly certain that China, most of Asia, India and potentially Africa could see extensive economic damage related to a contraction in consumer and industrial economic demand as a consequence of this outbreak. Once the Chinese New Year ends, in about 10 to 15+ days, people will return back to their home cities and we’ll begin to understand the total scope of this problem. If the problem continues to be isolated in China, Asia and within that general region, then we may see economic consequences isolated to these regions. If not, then we could see a much bigger and broader global economic consequence setting up.

The 1855 Plague Pandemic lasted for nearly 100 years and wiped out 1.25% of the total global population. This was at a time when air travel was very limited and global economics was a much smaller component of the total global economy. Everything is somewhat isolated at that time. In today’s world, a similar type of event could wipe our 1% to 5% of the total global population before we have any means to attempt to control it.

Bill Gates believes this outbreak could kill more than 30 million people within 6 months (Source: businessinsider.com)

It is time to get real about this and prepare for how the global markets will interpret this potential outbreak.

We’ve been warning that the market was “Rallying To A Peak” recently and believe this outbreak has changed the minds of traders. This could the catalyst that breaks the bullish trend for quite a while. Skilled traders will be trying to get ahead of this rotation in the markets and attempt to deleverage risk. As retail traders, we should be doing the same thing – deleveraging risk, buying metals, trimming open long positions and hedging into inverted ETFs.

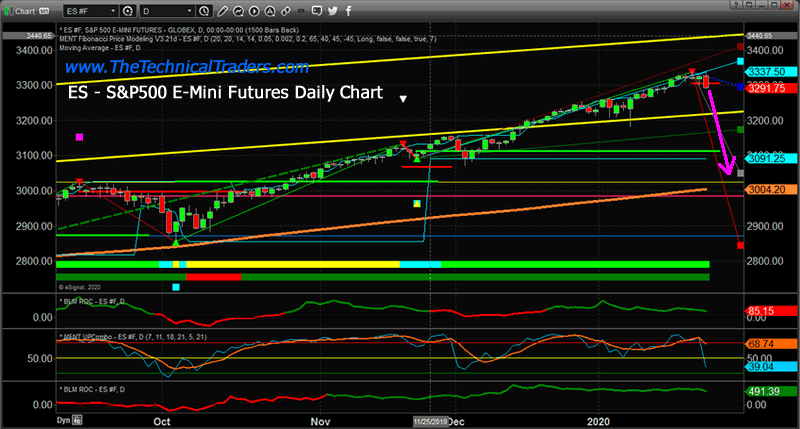

Daily ES Chart

This Daily ES chart highlights a very real support level near 3050 that also aligns with the longer-term Moving Average. A downside move like this would represent a -10 to -11% downside price reversion and take us back to December 2019 price levels. It could happen very quickly.

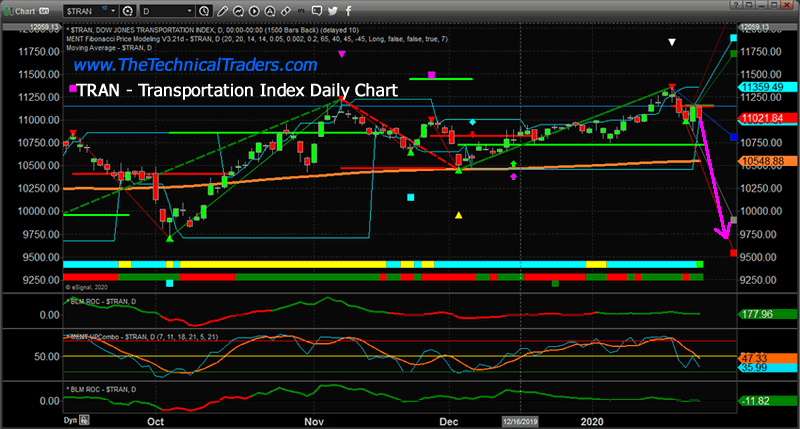

Transportation Index Chart

This Transportation Index chart highlights a potential downside price reversion of -11% to -12% – targeting the 9,750 level. We’ve recently authored an article about the weakness in the Transportation Index and how we believe it could be setting up for a downward price move. If a breakdown move like this happens in TRAN, it would suggest a massive contraction in the global economy is taking place.

DOW JONES (YM) Daily Chart

This last YM chart highlights support near 28,000 which would be an immediate downside target if the Dow Jones Industrials revert lower. And, again, this would put us back to December 2019 price levels. If this 28,000 level is broken, then we start looking at levels closer to 26,000 (roughly -20%).

Concluding Thoughts:

Right now, consider this situation as you are a captain of a ship sailing into a storm. You can either prepare for it and navigate through it to the best of your ability or ignore the warnings and hope for the best. It is far too early to panic at this point, but a certain degree of “preparation” is certainly in order.

We’ll know more in about 7+ days as we learn how far and how wide this problem has actually extended. In the meantime, watch your investments. Protect your assets. Prepare for the storm. Best case, you can always reposition your capital for clearer skies in a few weeks.

As a technical analysis and trader since 1997 I have been through a few bull/bear market cycles, I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

Join my Wealth Building Newsletter if you like what you read here and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.