The Crazy Stock Market Train to Bull Eternity

Stock-Markets / Stock Markets 2020 Jan 11, 2020 - 02:55 PM GMTBy: Gary_Tanashian

Once again I have to disclaim that at the moment (and for quite some time now) I hold not one single short position, in anything. I am only long US and global stocks. But also managing cash and portfolio balance as usual while feeling as though I’m playing a game of Musical Chairs while the music still plays (nothing nearly as good as Keith’s style, which has always resonated with me beyond most others).

I have to disclaim the bull positioning because book talkers tend to talk their book. My book is only long insofar as I have equity positions because in a manic up phase I have little interest in eroding the situation with short hedging. Besides, gold stocks are doing that balancing job right now and that balancing act has been working well since June.

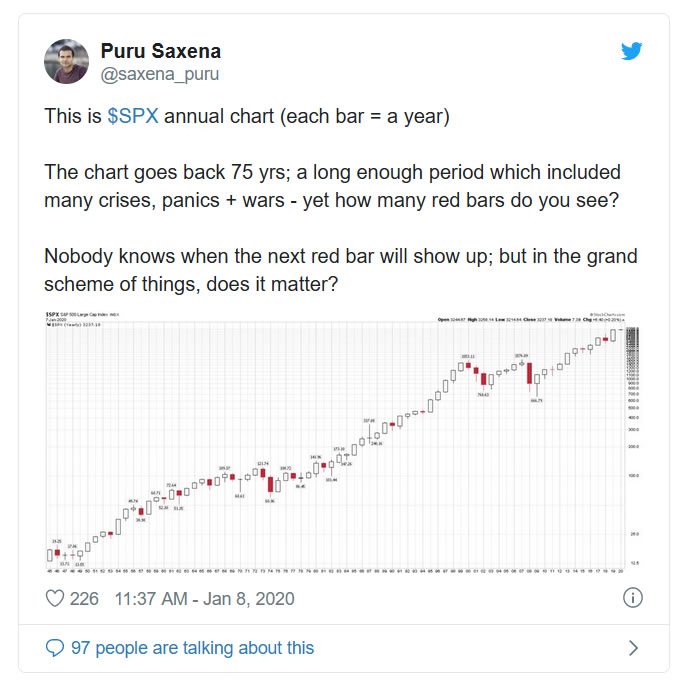

Anyway, here is a tweet from a well followed commentator that is framed so logically and paints the 2008 crash as merely a blip that you or I could do standing on our heads.

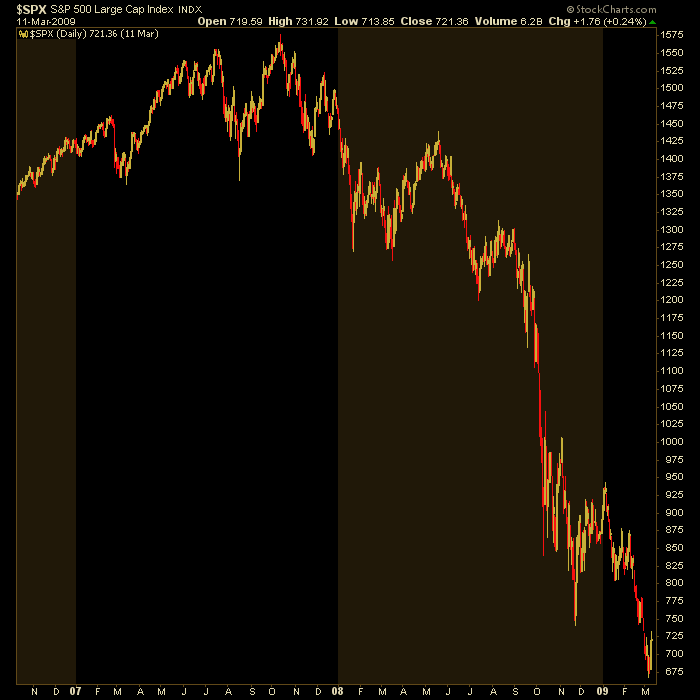

Equities… just stay in and prosper! No problem in real time because the US stock market always comes back… ALWAYS. This is the kind of stuff that appears near tops; like stuff that uses ultra long-term yearly charts in log scale to smooth out the problems.

So the next time this happens, try to forget that it was caused by epic policy distortions within the system the likes of which have been amped up exponentially since and just remember it’s actually a smooth ride assuming the next thing is like the last thing and you live long enough to reap the benefits.

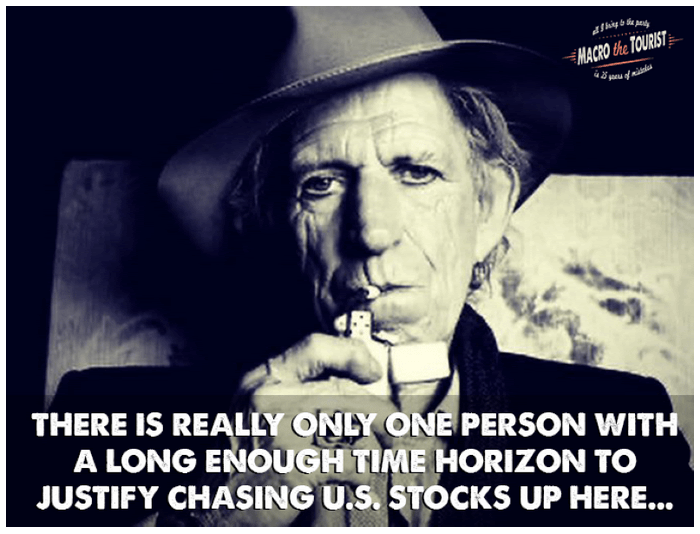

Allow the Macro Tourist to expand upon the theme…

He notes that CNBC anchor Becky Quick got into something of a competition with her wealth manager guest, who is only 80% exposed to stocks. Becky’s all-in at 100%!

However, I would like to point out that Becky was not bragging about this allocation at any time during the past decade. No, she has chosen December 2019 with the S&P 500 up more than 360% since the bottom to let us know about her over-allocation.

Herein lies my point. Just like this summer when bonds had already ripped 13 handles higher, market participants usually express this sort of arrogance at points when they feel confident. Extremely confident.

What do I take from this? It’s not the time to be reaching for exposure. I don’t need to know anything else except that CNBC anchors are competing with their guests about the size of their stock allocations.

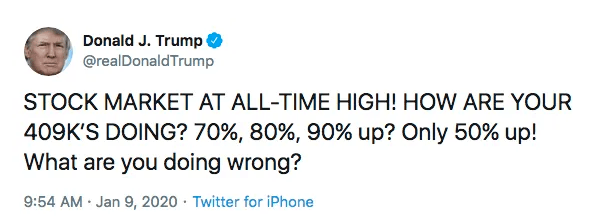

And of course yesterday there was the president with his dangerous ‘409 K’ tweet taunting casino patrons as if merely performing in line with the S&P 500 (as opposed to near doubling its performance) was a failure.

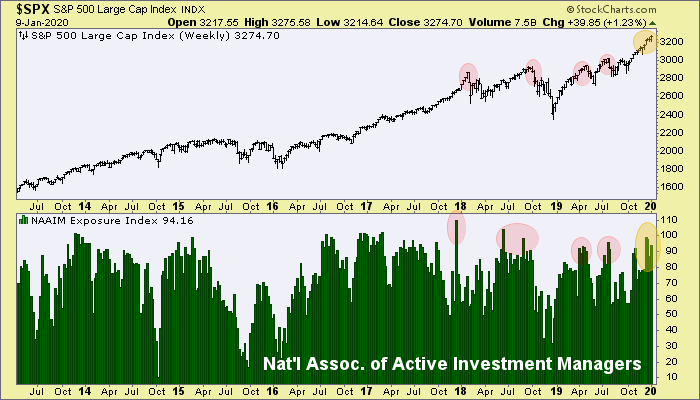

This is just one of several charts, graphs and indicators we use each week in NFTRH to gauge the sentiment situation (and folks, this is a sentiment event). NAAIM had pulled back their enthusiasm into year end and using this and other sentiment indicators that had twitched a bit bearish, we had a short-term bullish signal for the Santa seasonal, which we’ve allowed to extend into Q1 2020 (aided most recently by the US-Iran war drums).

And now? It’s as expected. Manic upside with investment managers all aboard, newsletters all aboard, CNBC anchors all aboard and all those discount brokerages that opened during the real sentiment blow off in January 2018… all aboard. All aboard the Crazy Train…

I’ve listened to preachers, I’ve listened to fools I’ve watched all the dropouts who make their own rules One person conditioned to rule and control The media sells it and you live the role –Ozzy

These sentiment knee-jerks have refreshed the market on very short-term bases. It’s dangerous but as yet ongoing… and barreling down the tracks.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2020 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.