European Banking Crisis Deepens as Germany Guarantees Savings

Currencies / Credit Crisis 2008 Oct 06, 2008 - 01:33 AM GMTBy: Mike_Shedlock

I am sure glad Paulson says the global financial system is sound. Otherwise I might be worried when I see reports like this: Financial Crisis: Germany guarantees all private savings; UK 'must follow'

I am sure glad Paulson says the global financial system is sound. Otherwise I might be worried when I see reports like this: Financial Crisis: Germany guarantees all private savings; UK 'must follow'

The move to protect private bank account deposits in Europe's largest national economy came after similar moves in Ireland and Greece were widely criticised.

There was anger in Whitehall where Treasury officials were taken by surprise by the German move, despite Gordon Brown having met German Chancellor Angela Merkel at the weekend in Paris to discuss the financial crisis.

In order to prevent further runs like the one on Northern Rock, Mr Brown has already announced that the guarantee level for private savings in the UK will be raised on Tuesday from £35,000 to £50,000.

The new Business Secretary, Peter Mandelson, has already criticised the unilateral guaranteeing of deposits by individual countries.

He warned it could spark a new wave of "economic nationalism" with each country looking for a "get out of jail free card" from the global financial crisis rather than working together to find a solution.

Ireland's decision to guarantee savings last week angered other countries, particularly Britain, after some depositors moved their savings to branches of Irish banks.

But Treasury officials accept that the more countries opt for a complete guarantee, the harder it will be for the UK not to.

But Treasury officials accept that the more countries opt for a complete guarantee, the harder it will be for the UK not to.

Liberal Democrat leader Nick Clegg said: "Germany is Europe's economic superpower. Where it leads, others are bound to follow.

"Ireland's action last week to guarantee all deposits made a common European approach to deposit guarantees necessary. Germany's decision today makes it completely unavoidable."

Ms Merkel acted as one of Germany's biggest banks teetered on the brink of collapse following the failure of a £28 billion rescue plan.

Hypo Real Estate, its second largest commercial property lender, is the fifth German bank to require a bail out in the wake of the global credit market turmoil that has stemmed from the United States.

As the credit crisis continued to unfold the Icelandic Government was in crisis talks with its central bank and pension funds over a plan to inject up to 10 billion euros (£7.78 billion) into the country's banking system.

The talks follow a steep devaluation of the country's currency and there have also been concerns about its biggest bank Kaupthing, although its chairman Sigurdur Einarsson continued to stress the banks is financially strong. An estimated 150,000 British savers hold money with Icelandic banks.

Belgium and Luxembourg are scrambling to protect depositors, and tens of thousands of jobs, by finding a buyer for what remains of the banking and insurance giant Fortis.

Mad Scramble Into Guaranteed Banks

If I lived in Great Britain, I would be scrambling fast to move every penny to a bank with guarantees. So far Ireland, Greece, and Germany have guarantees. The UK better act quickly or there is going to be a mad flight of capital bankrupting every bank in the country.

Government could take shares in high street banks

The Telegraph is reporting Financial crisis: Government could take shares in high street banks .

Alistair Darling, the Chancellor, could give the banks billions of pounds in return for shares in an emergency bailout plan to be enacted if the financial crisis worsens, The Daily Telegraph has learnt.

The Treasury has drawn up detailed plans for the scheme, which would put taxpayers' money at risk.

Ministers believe it may soon become necessary if banks do not begin lending money again to consumers and to each other.

Mr Darling hinted at the plan when he said he was "looking at some pretty big steps" to ease the lending crisis and was prepared to step in to help other ailing banks in the wake of the nationalisation of Bradford & Bingley and Northern Rock.

Details of the plan came as pressure intensified on the Government to offer a 100 per cent guarantee on all savings after Germany took the surprise step of announcing a blanket guarantee on private deposits in its banks.

David Cameron, the Conservative leader, appeared to give his backing to such a scheme.

He warned that an "ad-hoc approach" to the financial crisis was no longer appropriate and that a co-ordinated rescue package was now necessary.

The bail out plan would allow the Government to provide banks with billions of pounds without attaching conditions on how it is spent. By receiving shares - or an option to buy shares - in exchange for funding, taxpayers stand to profit when the banks recover.

A similar scheme was introduced in Sweden in the early 1990s when the country was facing a similar banking crisis.

In further developments over the weekend:

• Business leaders, economists and politicians called on the Bank of England to announce a sharp cut in interest rates this week. A reduction in the base rate of up to 0.5 percentage points is now predicted.

• A growing number of banks changed their economic forecasts and are now predicting a full-blown recession in this country. Citigroup, the world's biggest bank, expects British unemployment to rise by one million.

• Mr Darling indicated he will rewrite the Government's economic rules to allow borrowing to increase beyond the previously-permitted maximum limit. The new rules are expected to be outlined in a major speech on Wednesday.

Chancellor Alistair Darling Will Rewrite Rules

To hell with budget rules, who needs em anyway? If it's good enough for Bush and Paulson it must be good for Darling even if it's not good for the Pound.

British Pound vs. US Dollar Monthly Chart

The pound is sitting on major support. If that support breaks (and I expect it to), a test of the 155 area or even the entire move from the 2001 bottom could be in order.

Party's Over For Iceland

The Guardian is reporting The party's over for Iceland, the island that tried to buy the world .

Almost overnight, its population became the wealthiest on Earth. Tracy McVeigh in Reykjavik finds that the credit crunch is making the cash disappear.

Iceland is on the brink of collapse. Inflation and interest rates are raging upwards. The krona, Iceland's currency, is in freefall and is rated just above those of Zimbabwe and Turkmenistan. One of the country's three independent banks has been nationalised, another is asking customers for money, and the discredited government and officials from the central bank have been huddled behind closed doors for three days with still no sign of a plan. International banks won't send any more money and supplies of foreign currency are running out.

People talk about whether a new emergency unity government is needed and if the EU would fast-track the country to membership. On Friday the queues at the banks were huge, as people moved savings into the most secure accounts. Yesterday people were buying up supplies of olive oil and pasta after a supermarket spokesman announced on Friday night that they had no means of paying the foreign currency advances needed to import more foodstuffs.

Euro Fall as Credit Crisis Widens

Bloomberg is reporting Asia Stocks, Euro Fall as Credit Crisis Widens; Treasuries Gain

Asian stocks and U.S. index futures fell as deteriorating credit markets prompted European governments to pledge bailouts for troubled banks. The euro slumped to a 13-month low, while Treasuries advanced.

Germany and the nation's banks and insurers agreed on a 50 billion euro ($68 billion) rescue package for commercial property lender Hypo, which reported a 95 percent plunge in second-quarter profit because of debt-related writedowns. BNP Paribas SA, France's biggest lender, also agreed to pay 8.25 billion euros to purchase Fortis's Belgium bank after a government bailout failed.

The euro earlier reached $1.3610, the lowest since Sept. 5, 2007. It fell to 141.97 yen, the weakest since May 18, 2006, as investors cut holdings of higher-yielding currencies funded in the Japanese currency.

"Everything coming out has been fairly euro-negative," said Alex Sinton, a senior currency dealer at ANZ National Bank Ltd. in Auckland. "The euro zone is the second domino of the globe to be falling over after the U.S."

Treasuries rose for a fourth day, sending two-year notes to their longest winning streak in six weeks. Two-year note yields fell 5 basis points to 1.53 percent as UBS AG, the largest Swiss bank, said the Federal Reserve will halve its benchmark interest rate to 1 percent by March 31 to combat a recession.

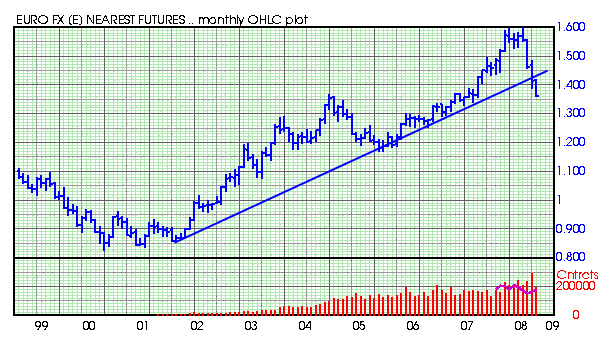

Euro vs. US Dollar Monthly Chart

The global credit contagion is very US dollar friendly. Europe will be cutting interest rates more aggressively, and a massive deleveraging of anti-dollar bets is still underway. If the Euro does not hold the 135 area, and I see no fundamental reason it should, a test of the 120-125 area could be in store.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.