Credit Chaos Next– The Mother of all Bank Runs?

Stock-Markets / Credit Crisis 2008 Oct 05, 2008 - 04:01 PM GMT

Nouriel Roubini: Next – the mother of all bank runs?

Nouriel Roubini: Next – the mother of all bank runs?

“It's plain that the current financial crisis is worsening in spite of – or perhaps because of – the Treasury rescue plan. “The strains in financial markets are becoming more, rather than less, severe in spite of the nuclear option of a $700 billion package: Interbank spreads are widening and are at a level never seen before; credit spreads are widening to new peaks; short-term Treasury yields are going back to near-zero levels as there is flight to safety; credit default swap (CDS) spreads for financial institutions are rising to extreme levels as the ban on shorting of financial stock has moved the pressures on financial firms to the CDS market; and stock markets around the world have reacted very negatively to this rescue package.

“Financial institutions in the US and in advanced economies are going bust. So, this is not just a US financial crisis. It is a global crisis hitting institutions in the UK, the Euro-zone and other advanced economies (Iceland, Australia, New Zealand, Canada, etc.).

“The strains in financial markets – especially short-term interbank markets – are becoming more severe in spite of the Fed and other central banks having injected $300 billion of liquidity in the financial system last week alone …

“In a solvency and credit crisis that goes well beyond illiquidity, no one is lending to counter-parties as no one trusts any counter-party (even the safest ones), and everyone is hoarding the liquidity that is injected by central banks. And since this liquidity goes only to banks and major broker-dealers, the rest of the shadow banking system has no access to this liquidity as the credit transmission mechanisms are blocked.

“When investors don't trust even venerable institutions like Morgan Stanley and Goldman Sachs, you know that the financial crisis is as severe as ever. When a nuclear option of a monster $700 billion rescue plan is not even able to rally stock markets, you know this is a global crisis of confidence in the financial system.

“The next step of this panic could be the mother of all bank runs, i.e. a run on the trillion dollar-plus of the cross-border short-term interbank liabilities of the US banking and financial system, as foreign banks start to worry about the safety of their liquid exposures to US financial institutions. A silent cross-border bank run has already started, as foreign banks are worried about the solvency of US banks and are starting to reduce their exposure. And if this run accelerates – as it may now – a total meltdown of the US financial system could occur.”

Source; Nouriel Roubini, Forbes , October 2, 2008.

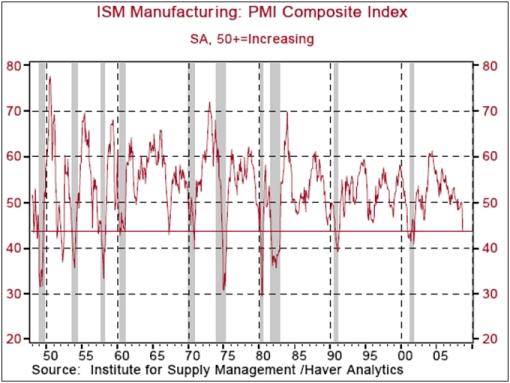

Asha Bangalore (Northern Trust): Factory sector recession is confirmed

“The ISM manufacturing composite index fell to 43.5 in September from 49.9 in August. With the exception of two occurrences, all post-war recessions are associated with readings similar to the level of the September 2008 composite ISM manufacturing index.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , October 1, 2008.

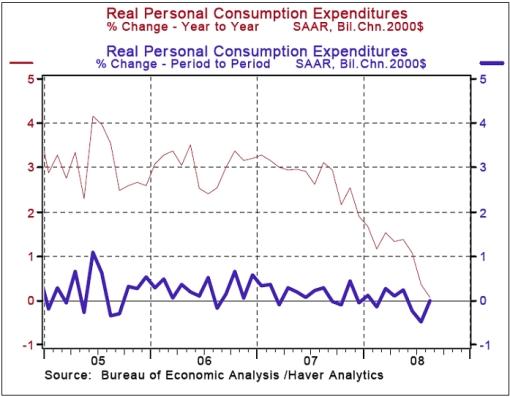

Asha Bangalore (Northern Trust): Q3 consumer spending should post first quarterly decline since 1991

“Inflation adjusted consumer spending held steady in August after two consecutive monthly declines. Purchases of durables rose 1.6% but outlays of non-durables (-0.3%) and services (-0.1%) declined in August. The July-August data point to a possible drop in consumer spending during the third quarter. If the forecast is accurate, it would be the first quarterly decline since fourth quarter of 1991. Given the importance of consumer spending in GDP, a drop in consumer spending in the third quarter raises the probability of a contraction in real GDP in the third quarter.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , September 29, 2008.

Bloomberg: Bank of America's levy sees “anemic” economic conditions

“Mickey Levy, chief economist at Bank of America Securities, talks with Bloomberg's Ken Prewitt from New York about the debate in Congress over Treasury Secretary Henry Paulson's financial-market rescue plan, JPMorgan Chase's acquisition of Washington Mutual's assets after it was seized by US regulators, and data showing that the US economy grew at an annual rate of 2.8% in the second quarter.”

Source: Bloomberg , September 26, 2008.

Richard Russell (Dow Theory Letters): US government to increase spending

“I watched the Obama-McCain debate. The two spent much of the time talking about how they were going to get rid of earmarks and about how they were going to cut way down on government spending. Neither of them get it, they just don't see the picture. Consumers are not going to be spending, they'll be cutting back. Just as corporations and businesses are cutting back on their overhead and on their spending where ever they can (much of it will be in the way of lay-offs).

“If the economy is going to improve, it will be up to the government to do the spending. Governments all over the world will have to run up big deficits and increase their spending. After all, what got the US out of the Great Depression of the 1930s? It was the massive spending of World War II that finally turned the US economy to the upside. The giant war effort and related government spending put everybody to work, including millions of America's women. Jobs were plentiful.

“And now Obama and McCain are competing in promises to CUT government spending! Forget it. To get out of this recession, the US government will have to spend as it never has spent before, along with running trillion dollar deficits. The government will have to embark on a giant ‘rebuild America program'. Our streets and freeways are shot, our bridges are tattered, the US government will have to engineer a massive ‘make work' program to rebuild America. Unfortunately, as I see it, Washington will be tempting to start another war.”

Source: Richard Russell, Dow Theory Letters , September 29, 2008.

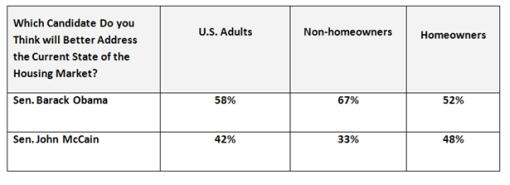

Zillow Blog: Survey – Obama expected to better address housing market issues than McCain

“The debate is on today, and there's certainly no shortage of issues that the presidential candidates must be prepared to contend with when one of them is elected this November. A new survey we're putting out today shows 58% of Americans think that, between the two major candidates, Sen. Barack Obama will better address the current state of the housing market than Sen. John McCain (42%). The survey of 2,016 US adults was conducted by Harris Interactive on behalf of Zillow.

“The perception of who is better equipped to address the housing market is heavily influenced by whether respondents own a home. For example, the spread between the two major candidates is much wider among those who have yet to become homeowners: 67% of non-homeowners think Obama will better address the housing market than McCain (33%). Among current homeowners, there is far less of a difference: 52% of homeowners think Obama will better address the market versus the 48% who think McCain will.

“The survey also showed housing market issues are among the top three most important issues affecting the United States that the new president should be prepared to address after taking office. The most important issues are:

• Energy/gas prices (82%)

• US debt (70%)

• Housing/mortgage/foreclosure (63%)”

Source: Katie Curnutte, Zillow Blog , September 26, 2008.

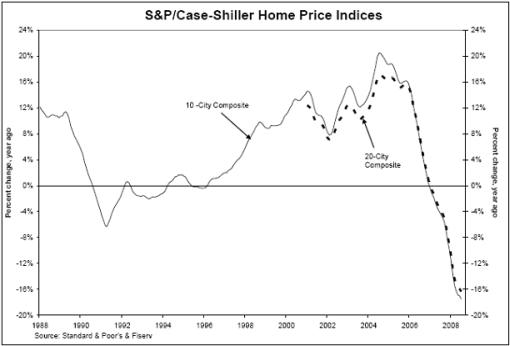

Standard & Poor's: S&P/Case-Shiller home price indices showing record declines

“Data through July 2008, released today by Standard & Poor's for its S&P/Case-Shiller Home Price Indices, the leading measure of US home prices, shows continued record declines and a continuation in the trend of double digit declines across many cities in the prices of existing single family homes across the United States.

“The chart above depicts the annual returns of the 10-City Composite and the 20-City Composite Home Price Indices. The indices reached new record annual declines of 17.5% and 16.3%, respectively.”

Source: Standard & Poor's , September 20, 2008.

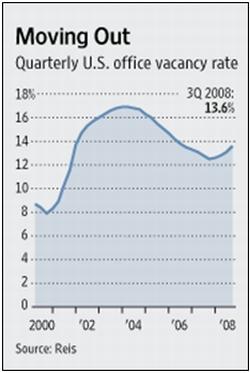

The Wall Street Journal: Office space is emptying out

The Wall Street Journal: Office space is emptying out

“Businesses are dumping office space at the fastest pace since the months after the September 11 attacks, increasing the financial stress on commercial-real-estate owners and their lenders, many of them already ailing financial institutions.

“Nationwide, rents on office properties – including landlord concessions and discounts – were flat in the third quarter, the worst result for office-property owners since late 2004 – when commercial real estate began to emerge from a prolonged slump, according to Reis Inc., a New York real-estate research firm.

“Rent stagnation and increasing vacancies put ‘strain on borrowers to make payments on mortgages,' said Sam Chandan, Reis's chief economist. ‘It hasn't shown up yet in terms of delinquency rates, but this is clearly an issue we need to be very attentive to,' he said. Almost every type of financial institution, from community banks to Wall Street, lends to office-building owners.

“The office market in suburban areas and smaller cities has been declining throughout the year. But now, with a recession looking inevitable, the pain is spreading to most large metropolitan areas. Previously immune cities such as San Francisco and Boston saw vacancy-rate increases in the third quarter. San Francisco's vacancy rate rose 0.6 percentage point to 9.9% in the quarter. Boston's rate rose 0.8 percentage point to 11.7%.”

Source: Alex Frangos, The Wall Street Journal , October 3, 2008.

John Authers (Financial Times): Hedge funds – terrible third quarter

“Wall Street's eyes are on Washington, but there are increasingly anxious glances towards Greenwich, Connecticut, the capital of hedge fund land.

“Hedge fund accidents have been remarkable for their absence throughout the crisis. While investment banks had acute difficulties, there has been no big hedge fund collapse. The industry as a whole got through the first half of the year with decent investment returns.

“But not any longer. In aggregate, hedge funds had a terrible third quarter. Many had relied on the ‘long energy, short banks' trade and failed to get out when it suddenly reversed in July. And they had a bad September, as the credit crisis entered its acute phase.

“Hedge Fund Research's HFRX index showed that ‘market directional' hedge funds, which attempt to beat the market, lost 8.9% last month and were down 11% for the year.

“Their ‘long' positions have performed terribly. Goldman Sachs' basket of the 50 stocks most widely held by hedge funds underperformed the S&P 500 by 11% during the third quarter, down 19%.

“Regulators have taken away a crucial advantage by banning much short selling, the only way to make good money over the past few weeks. And funds' investors were allowed to yank funds away from them at the end of the quarter.

“With funds losing cash and forced to pay down debts, the market bet is now that they must make a disorderly retreat from their favoured stocks.

“That contributed to sharp falls yesterday in tech, resources and transport stocks, all hedge fund favourites. Much now depends on Greenwich's continuing ability to avoid a major hedge fund accident.”

Source: John Authers, Financial Times , October 2, 2008.

Bloomberg: Fortis gets 11.2 billion euros rescue from governments

“Fortis, the largest Belgian financial-services firm, received an 11.2 billion-euro ($16.3 billion) rescue from Belgium, the Netherlands and Luxembourg after investor confidence in the bank evaporated last week.

“Belgium will buy 49% of Fortis's Belgian banking unit for 4.7 billion euros, while the Netherlands will pay 4 billion euros for a similar stake in the Dutch banking business, the governments said in a statement late yesterday. Luxembourg will provide a 2.5 billion-euro loan convertible into 49% of Fortis's banking division in that country.

“Fortis is the largest European firm to be bailed out in the global financial crisis that drove Lehman Brothers into bankruptcy two weeks ago and prompted US President George W. Bush to seek a $700 billion bank rescue package.”

Source: Martijn van der Starre and Meera Louis, Bloomberg , September 29, 2008.

Financial Times: UK nationalizes Bradford & Bingley

“The government on Monday confirmed it was nationalizing Bradford & Bingley after hammering out a deal with the Spanish bank Santander, which will buy the embattled UK mortgage lender's £21 billion deposit book and branch network for about £600 million.

“The bank was taken into public ownership on Monday after B&B saw retail savers withdraw ‘tens of millions of pounds' in recent days as uncertainty grew.

“In a statement, the Treasury said it had taken the decision in order ‘to maintain financial stability and protect depositors, while minimising the exposure to taxpayers. [The government] has worked over the weekend to bring about the part public, part private solution which best meets those objectives.'”

Source: Jane Croft and Kate Burgess in London and George Parker, Financial Times , September 26, 2008.

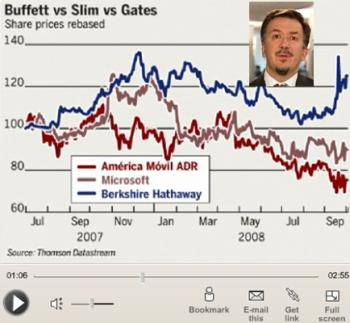

John Authers (Financial Times): Buffett's bold investments in the face of the crisis

Source: John Authers, Financial Times , October 2, 2008.

Francesco Guerrera (Financial Times): Tug of war over Wachovia

“Wells Fargo's bold $1.5 billion offer for Wachovia could spark an unprecedented legal fight between Wells and Citygroup, says Francesco Guerrera.”

Source: Francesco Guerrera, Financial Times , October 3, 2008.

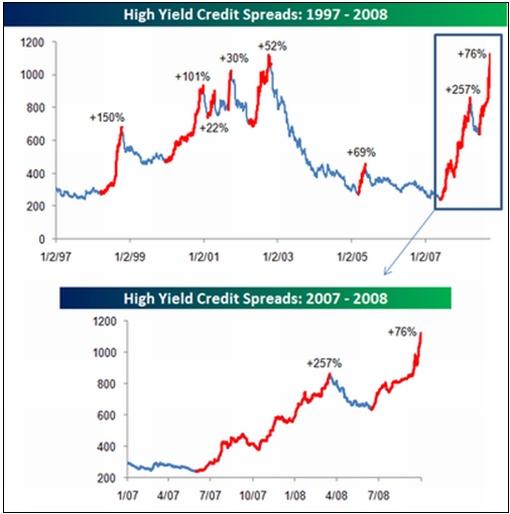

Bespoke: High yield spreads at record highs: up, up, and away!

“… high-yield spreads are now at record highs. As of yesterday's close, based on data from Merrill Lynch, the interest rate spread between high yield bonds and comparable Treasuries rose to 1,124 basis points. This breaks the previous record of 1,120 basis points that we saw in October 2002, and given today's market action, these spreads are only likely to rise.”

Source: Bespoke , October 2, 2008.

John Authers (Financial Times): Dow's biggest one-day fall

“As much as $1.1 trillion in market cap has been written down today while the Dow Jones Industrial Average closed down 777 points, say John Authers.”

Click here for the full article.

Source: John Authers, Financial Times , September 29, 2008.

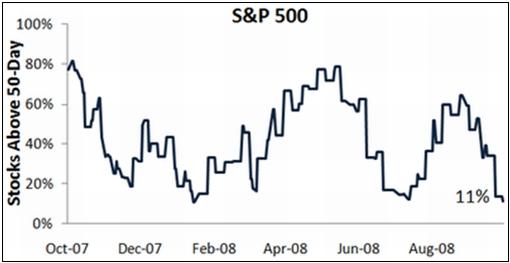

Bespoke: Percentage of stocks above 50-day moving averages

“Market internals are currently at levels typically followed by short-term rallies. As of yesterday's close, just 11% of stocks in the S&P 500 were above their 50-day moving averages. As shown in the chart below, this low of a reading has only happened a couple other times this year, and it did not last long. On a sector basis, three currently have no stocks above their 50-days — Industrials, Energy and Telecom. Technology is at 3%, Health Care is at 4%, and the Materials sector is at 7%. The Consumer Staples sector is the healthiest at 34%.”

Source: Bespoke , October 3, 2008.

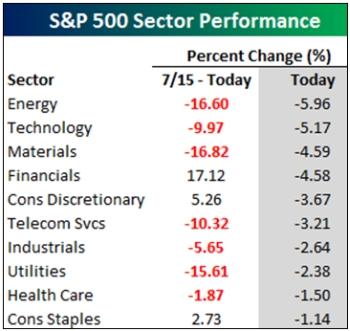

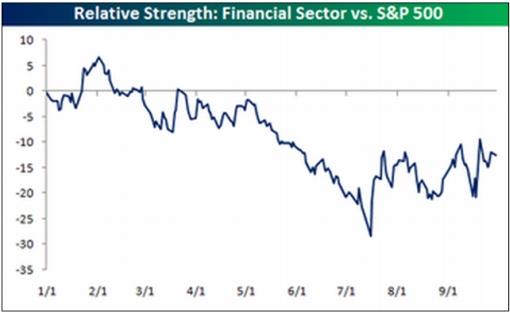

Bespoke: Sector performance – not what you'd expect

“On a day when the credit crisis has clearly reached global proportions, one would expect the Financials to be leading the market lower. However, as of mid-day today, three other sectors are doing worse than the Financials. As shown to the right, Energy, Technology, and Materials are all doing worse than the Financial sector. Additionally, since July 15th the Financial sector is by far the best performing sector, and only one of three sectors with positive returns.

“Looking at the relative strength of the Financial sector versus the S&P 500 so far in 2008 shows that while they have made up for lost ground over the last two months, the Financials are still underperforming the overall market by a significant margin. (In the charts below, rising lines indicate that the sector is outperforming the S&P 500, while a falling line indicates underperformance.)

“More specifically though, banks have been doing much better than the Financial sector. Even more surprising is that the KBW Bank Index (BKX) is actually performing inline with the S&P 500 so far in 2008. When stocks most associated with the problems aren't the ones leading the market lower, investors should take notice.”

Source: Bespoke , September 29, 2008.

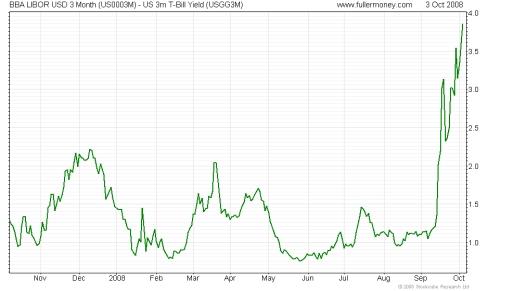

David Fuller (Fullermoney): Use Ted-spread as timing indicator

“How will it play out? No one knows, but having crossed their Rubicon in terms of involvement, western governments will do everything in their considerable power to prevent a collapse of their banking systems. They should succeed, although we do not know when.

“One of the technical signals should be a break in the progression of higher reaction lows on the daily Ted-Spread chart above, followed by the establishment of a clear downward trend. Stock markets are likely to struggle until this occurs but rally thereafter. Consequently, if central banks are unable to stem this accelerating credit freeze crisis soon, most stock markets will lurch lower before finding support prior to a yearend rally.

“Looking across the valley – perhaps the crevasse into which stock markets have already descended a considerable way is a more apt image – events are moving rapidly in the direction of my recent Back to the Future theme.

“Stock market valuations are much improved; the Peak Oil problem has been pushed further into the future; with most commodities tumbling the runaway inflation threat is in rapid retreat as fire (inflation) over ice (deflation) has been replaced by ice over fire; this enables central banks to target economic growth once again; long-term government interest rates are low; the US dollar crisis has passed, at least for the medium term.

“I maintain that we are well into the latter stages of this bear market and that a bottom of at least medium-term significance is within sight, with timing subject to an improvement in the Ted-Spread and equivalent measures of lending confidence. Anticipating some success from government efforts to alleviate the credit freeze, current and pending, I expect a technical rally to commence this month, which should carry into next year, helped by the current oversold condition, seasonal factors and the post-US election bounce.

“Looking further ahead, since the west's banking solvency and lending crisis now accounts for most of the remaining serious economic problems, I expect Asian emerging markets to lead the eventual recovery. Some commodity related markets may take longer to recover, because they were among the last to fall, but they will certainly benefit from the next synchronised economic recovery. Meanwhile, there is every indication that global GDP growth will weaken further before it next improves. Stock markets will lead that recovery, as they always have in the past.”

Source: David Fuller, Fullermoney , October 2, 2008.

Citywire: Anthony Bolton – I'm buying shares once again

“Anthony Bolton, the legendary ex-Fidelity fund manager, says he is spending his own money to buy shares again in the market.

“‘I have bought shares in the last couple of weeks for the first time for some time,' he told the BBC Today programme. ‘I see a lot of value in certain areas of the market.'

“‘I have been somebody who for quite a while has been cautious about the equity markets. In fact I started my caution about two years ago – I was a bit early. I have to say the events of the last few weeks for the first time have made me feel more optimistic that we are getting near the low in the markets.'

“On the financial crisis: ‘Well I have to say I haven't seen anything quite like this and the credit crisis that led to the banking crisis has some similarities with the 1970s which I did experience but the fact that it's global and the extent of it is quite different.'

“On whether it can get worse: ‘It can certainly get worse although I think a lot of the ingredients are now there to restore confidence – at the heart of banking is confidence

“On investing: ‘Investing in the stock market at first looks so easy – you buy when it's low and sell when it's high. But when you actually live though it it's much more difficult. All the environment tries to make you do the opposite of what it should do – it sucks you in when markets are high and the world looks wonderful.

“‘I think the real lesson in times like this is not be shaken out when the environment is very uncertain because those are the conditions that make the lows in stock markets.

“‘I've found over the years that investing is about buying the fundamentals of companies as investments. But the stock market is also a place of fashions. It is a voting machine as much as a weighing machine. So when everyone votes one way to me that suggests risks and that's not a good thing. On the other hand, at times like the moment when people are very negative, I want to be a contrarian and go against that.'”

Source: Richard Lander, Citywire , October 2, 2008.

Jeffrey Saut (Raymond James): Rollover?!

“This morning we have the recondite rescue bill on the table, yet it is anything but transparent, creating worries that it may not pass. And that has the preopening futures sharply lower. Nevertheless, two weeks ago today we suggested another tradable ‘low' was being made (the fourth of the year) and suggested trading types scale-buy into weakness using the indexes of their choice (ETFs).

“We also stated that more conservative types should probably wait for a session that exhibited positive closing action on the assumption that would lead to a skein of better days ahead. A week ago today we said, ‘The lows are ‘in' for the year' (a statement that will be tested today); to which we now add, ‘Provided the pandering politicians pass the ‘buyout' plan.'

“Accordingly, trading accounts should be ‘long' half of their index positions, having sold the other half into September 19th's 400-point Dow Wow on the premise the politicos don't have a clue as to how to fix the problem. Still, as we enter the fourth quarter participants should keep in mind that since 1960 the S&P 500 has produced positive returns in the final quarter of the year 77% of the time; and, that Technology has tended to be the best performer.

“Also worth considering is that the only sector with positive net earnings estimate revisions during the past month has been Telecom Services. Additionally, we have ‘warmed' to stuff-stocks again (particularly the oversold energy complex) now that the Olympics/Paralympics are over and China's factories are back ‘on line'. Speaking to China, the Shanghai Composite Index's plunge has left the average price/earnings ratio of listed Chinese firms at roughly 17 times historic earnings, making China again look interesting. Ditto a number of other international markets look attractive, but not so for Europe.

“Looking ahead to themes for the next 10 years, we continue to embrace agriculture (farming/forestry), water (water rights, water treatment, etc.), new technologies playing to energy conservation (including alternative energy and nuclear); as well as climate change, including environmental pollution and resource limitation.

“Meanwhile, our political leaders continue to pander to a mis/under-informed electorate while failing to address the nation's real issues. For example, the top 1% of wage-earners pay nearly 29% of the nation's total taxes, while the top 5% of wage-earners pay some 48% of the total tab. This fact seems lost amid the current political blustering; or as Oscar Wilde noted, ‘The public has an insatiable curiosity to know everything except what is worth knowing.'”

Source: Jeffrey Saut, Raymond James , September 29, 2008.

Clusterstock: Bernstein – Get ready for stock market plunge

“Why isn't the stock market ready to soar, now that the bailout's on its way, the DOW has declined 20%+, and cash has outperformed stocks more more than 10 years? Because:

• Stocks are still very expensive (25X trailing earnings)

• Analysts are still expected a V-shaped recovery in corporate earnings

“Merrill's Richard Bernstein lays out this case in Barron's.

What would make you turn more bullish on equities ?

We are looking for sentiment and valuation to improve, and we are looking for analysts' estimate revisions to actually capitulate.

So earnings estimates are not going down as much as you expected ?

No, not at all. Relative to history, you would never know there was an economic slowdown going on in terms of analysts' revisions. That is largely because investors over all have not come to grips with the relationship between the credit crisis and the knock-on effects on the real economy: The next thing to look for is more defaults.

We are also watching jobless claims, which have been rising. Employment is very, very critical to the future of the economy …

Could you talk a little more about stock valuations and your concerns there.

We have never had the combination of 5.5% inflation and about a 25 multiple on the S&P's trailing earnings. When we talk about a 25 multiple on the S&P, nobody can believe that it's actually the trailing earnings. And then people say, ‘Well, if that's true, it's only the financial stocks.' Well, it's not. It's much more broad-based.

The market is just legitimately expensive, and we are so hesitant to use forward earnings, because analysts haven't revised their estimates downward. So to say the market is selling at 13, 14, 15 times forward earnings is a meaningless statement.

What's ahead for the economy, and how much more pain will there be?

That's a hard question to answer, but investors who are looking for a sharp V-shaped recovery are going to be quite disappointed. I don't see that happening. That's because we are going through Phase I of this process, which is the deflation of the credit bubble. Phase II is the knock-on effects on the real economy, and we're just beginning to see that.”

Source: Henry Blodget, Clusterstock , September 27, 2008.

David Fuller (Fullermoney): Give US dollar's uptrend benefit of doubt

“The USD's rebound since July is one of the more important, albeit lesser discussed financial events of the year.

“… I have many reservations about the long-term sustainability of this new trend. However, I have also maintained from the beginning of this move that maintained breakouts and clear trend changes on the charts are more important than theories as to why it should not be happening. The trend will always be the sole determinant of our investment and trading success in any market.

“Currently, it looks as if the US Dollar Index is consolidating initial gains above this year's earlier trading range. We can all see some historic and extremely interesting psychological and lateral resistance above 80, but we should give the new uptrend the benefit of the doubt, provided it continues to hold above the recent reaction low near 76. Although I should also add that a move below that level would question rather than completely invalidate the USD's recovery hypothesis.

“Meanwhile, a firmer USD removes one of the main fears and risks for the global economy, as I have said before. Arguably, had the dollar collapsed in July rather than rallying up out of its trading range, this would have been an even bigger problem for the global economy than the west's credit crisis. After all, the greenback is still the world's main reserve currency.

“Consequently, if the current recovery is not only maintained but also extended, this would have many implications for other markets. For instance, it has already removed upward pressure on the euro, which had become the default reserve currency as people previously fled the dollar. This provides some welcome respite for Euroland's exporters, and those of other countries which saw their currencies soar, albeit at the expense of US multinationals if the USD's recovery trend is extended in the months head.

“Previously, a weak USD was a powerful tailwind behind commodity price rises, in addition to Fullermoney's Supply Inelasticity Meets Rising Demand theme during the synchronised global economic expansion. Now that the economic expansion has stalled, and with the USD also rallying, inflationary pressures are clearly in retreat.

“This is good news for central banks because they can shift monetary policy away from fighting inflation and towards supporting economic growth. This process has already commenced in many countries. I expect Asian emerging markets to be among the main beneficiaries of ebbing inflation, not least because they were caught out buy expensive and economically unjustifiable subsidies. A stronger USD is also a clear headwind for gold.

“ … fear was the main driver behind gold's recent rally from its September 11th low at $736.70. While favouring gold as an alternative long-term investment, I have repeatedly mentioned that it is best purchased following setbacks and that it was generally a good idea to take partial profits, or at least use trailing stops during accelerating advances.”

Source: David Fuller, Fullermoney , October 1, 2008.

Alistair Holloway (Fullermoney): Baltic Dry Index has biggest monthly, quarterly drop on record

“The Baltic Dry Index, a measure of shipping costs for commodities, had its biggest monthly and quarterly drops on record as Chinese holidays curbed chartering and raw-material demand from the country's steelmakers weakened.

“The index tracking transport costs on international trade routes fell 287 points, or 8.2%, to 3,217 points, according to the Baltic Exchange in London. That's a 66% drop for the quarter, a 53% monthly slide and the lowest since July 24, 2006.

“‘It's definitely been the effect of lower activity during the Olympics and the holidays now,' Rikard Vabo, an analyst with Oslo shipbroker Fearnley Fonds ASA, said in an interview today. Chinese steel demand is weakening as property prices fall and builders' focus shifts away from luxury housing that is more steel-intensive, he said.

“Property prices climbed at the slowest pace in 18 months during August, the National Development and Reform Commission said September 16. Some steel mills, forced to shut for the Beijing Olympics and Paralympics, have not reopened. China's financial markets are shut through October 5 for National Day holidays.”

Source: Alistair Holloway, Fullermoney , October 1, 2008.

Mineweb: GFMS' Walker looking for $1,000 gold soon

“Gold should surge above $1,000 an ounce as the financial crisis fuels safe-haven fund buying, but may then come under pressure as fickle investors slow purchases, the chief of metals consultants GFMS said on Sunday.

“‘In terms of core trading range for us, I have to say that gold going up towards the $1,000-level is not an impossibility at all,' Paul Walker, CEO of GFMS, told Reuters in an interview.

“‘I would be surprised given the scale of the economic crisis if gold doesn't scale above $1,000,' he said ahead of the London Bullion Market Association annual conference in the ancient Japanese capital of Kyoto.

“GFMS predicted on September 17 that prices would soar well above $900 an ounce in the fourth quarter as the US dollar weakened and investors scrutinised the US government's creditworthiness.

“Later that same day prices staged their biggest ever one-day rally in real terms, soaring from around $775 to end just shy of $863 an ounce. They jumped again on September 18, briefly topping $900 before falling amid unprecedented volatility.

“Walker said gold will be averaging above $900 in the next 12 months, but in a trading range, it could rise beyond $1,000, testing its record $1,030.80 an ounce peak from March 17.

“‘I think the depth of this crisis suggest to me gold prices will be at elevated levels for probably for another 12 months or 18 months,' Walker said.”

Source: Chikafumi Hodo, Mineweb , September 28, 2008.

Financial Times: Wealthy investors hoard bullion

“Investors in gold are demanding ‘unprecedented' amounts of bullion bars and coins and moving them into their own vaults as fears about the health of the global financial system deepen.

“Industry executives and bankers at the London Bullion Market Association annual meeting said the extent of the move into physical gold was unseen and driven by the very rich.

“‘There is an enormous pick-up in investment demand. I have never seen a market like this in my 33-year career,' said Jeremy Charles, chairman of the LBMA. ‘The gold refineries cannot produce enough bars.'

“The move comes as fears grow among investors over the losses at investment vehicles previously considered almost risk-free, such as money funds.

“Philip Clewes-Garner, associate director of precious metals at HSBC, added that investors were not flying into gold simply because they saw it as a haven amid Wall Street's woes. ‘It is a flight into gold because it is a physical asset,' he said.

Source: Javier Blas, Financial Times , September 30, 2008.

Financial Times: European central banks cut sales of gold

“European central banks have cut their sales of gold to the lowest level in almost a decade, reversing the practice of recent years when hefty sales helped depress prices.

“Institutions bound by the Central Bank Gold Agreement – the banks of the eurozone plus Sweden and Switzerland – sold about 343 tonnes of gold in the year that expired on Friday, the lowest amount since the first CBGA was signed in 1999.

“This compares with 475.8 tonnes in the year to the end of September 2007. Under the agreement, the banks are allowed to sell up to 500 tonnes of gold each year.

“The European trend is part of a global movement of reduced central bank selling and increased investor buying that is helping to underpin high prices at a time of turmoil in financial markets.

“GFMS, the precious metals consultancy, estimates global central banks will sell 269 tonnes of bullion in 2008, the lowest since 1995.

“Much of the selling by European banks took place between October and December last year.”

Source: Javier Blas, Financial Times , September 28, 2008.

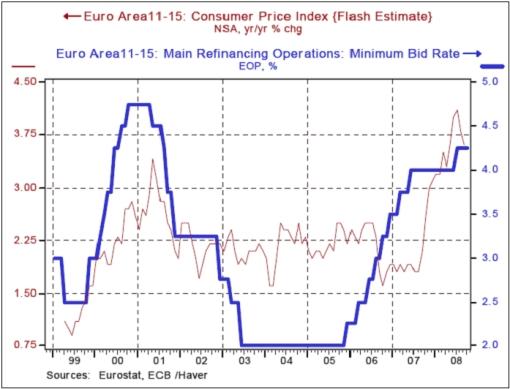

Victoria Marklew (Northern Trust): ECB shifts to easing bias

“For the first time in over five years the European Central Bank (ECB) today shifted its bias toward easing. In his subsequent comments, President Trichet stated that the ECB had “no bias” regarding future monetary policy moves, and refused to be drawn on the likelihood of a lower refi rate before year's end. However, the Council reportedly discussed only two options: leaving rates unchanged or easing.

“The focus of the Council statement was on the negative impact of the ongoing financial market turmoil. Trichet also pointed to clear evidence of a weakening Euro-zone economy as domestic demand contracts and financing conditions tighten. He stated that lower oil prices and ongoing growth in emerging economies ‘might support a gradual recovery in the course of 2009' – which is a distinctly more pessimistic assessment than he was making in early September.

“Trichet's inflation forecast also shifted somewhat this month, from seeing the annual rate fall back to the 2.0% target ‘in the course of 2010' to anticipating price stability ‘at the beginning of 2010'.

“… the overall tone of his press conference was decidedly dovish. The euro promptly fell against the US$ on expectations of a 25bps cut to the refi rate at the November 6 policy meeting. Interestingly, the Council and President also appeared to set the stage today for participation in a coordinated action with other central banks before then. With money market tensions still worsening despite massive central bank liquidity injections, rates at ECB auctions pushed to record highs, and Euro-zone economic data increasingly gloomy, the refi rate will very likely be 4.00% before the end of this year, and head still lower through the first half of 2009.”

Source: Victoria Marklew, Northern Trust – Daily Global Commentary , October 2, 2008.

Bloomberg: Brown, Merkel may be pushed into Paulson-type bailout

“European politicians are discovering what cometh after pride.

“A week after lambasting the US for allowing its banks to run out of money and after resisting calls to set up their own rescue mechanisms, leaders across Europe yesterday bailed out banks from Belgium, Germany and the UK. Dexia SA today received aid from France and Belgium, while Ireland's government said it would guarantee bank deposits and debt for two years.

“German Chancellor Angela Merkel and UK Prime Minister Gordon Brown may be forced to advocate a comprehensive approach of the kind US Treasury Secretary Henry Paulson and Federal Reserve Chairman Ben S. Bernanke are urging Congress to pass.

“‘The gods of the markets are punishing those who showed hubris,' said Marc Chandler, global head of currency strategy at Brown Brothers Harriman & Co. in New York. ‘Europe has been bashing the US, but it's realizing now it has its own problems.'”

Source: Simon Kennedy, Bloomberg , September 30, 2008.

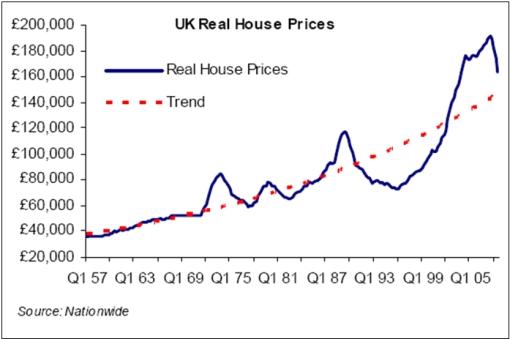

Nationwide: UK House prices still falling

“House prices fell by 1.7% in September. This brings the price of a typical house in the UK to £161,797, 12.4% less than at this time last year. House prices have now fallen for eleven consecutive months, but the monthly rate of fall has been almost unchanged in the last three months. The less volatile three-month-on-three month series has also barely changed for the last three months, after accelerating in the first half of the year. This may suggest the beginning of some stabilisation in the pace of house price falls.

“Casting back one year there have been some astonishing and unpredictable developments in the housing and financial markets. In September 2007 the credit crunch had just begun, house prices were rising at an annual rate of 9.0%, the number of house purchase approvals per month was averaging at around its long term trend, almost 40% of first-time buyers were borrowing over 90% and the Bank Rate was at 5.75%, but with many expecting it to increase to 6%. The situation in September 2008 could hardly be more different. House prices are falling, activity has contracted sharply, fewer than 20% of first-time buyers are borrowing above 90%, and the Bank Rate has fallen to 5% and is expected to fall to 3.5% by the end of 2009.

“The higher cost and lower availability of finance resulting from the credit crunch were clearly important factors in triggering the slowdown and bringing us to where we are now. Current unrest threatens to increase funding costs further, but the big question is how far will prices correct and how long before they begin to recover.”

Source: Nationwide , October 7, 2008.

Financial Times: Brown attacks Irish banks over guarantee

“Gordon Brown on Thursday piled pressure on Ireland to stop banks using a new €400bn (£313bn) government guarantee to poach business from British rivals, amid signs that it could trigger a flight of funds across the Irish Sea.

“Mr Brown wants Dublin to stamp out at once aggressive marketing campaigns by Irish banks and take measures to cap the market share of institutions now among the safest in Europe.

“Ireland's decision to prop up its six biggest lenders by guaranteeing all their debts and deposits was passed into law on Thursday, in the face of anger across Europe about the impact that it would have on the EU's single market.

“British bankers said there were already signs that some Irish lenders were approaching corporate and private banking customers in the United Kingdom and encouraging them to move their money.

“Companies and wealthy individuals are seen as prime targets because they are more likely to have cash balances in excess of the £35,000 at which the UK government guarantees deposits.

“Mr Brown raised his concerns with Brian Cowen, Irish prime minister. Downing Street wants to avoid a public row but officials say Mr Brown is determined ‘to restrict the inflows into these Irish institutions'.”

Source: George Parker and Peter Thal Larsen, Financial Times , October 2, 2008.

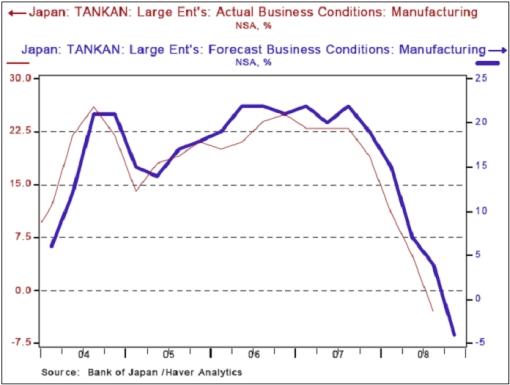

James Pressler (Northern Trust): Japan – weakening economic outlook

“Three weeks ago we commented about Japan's weakening outlook for the second half of 2008, and our anecdotal forecast amounted to, ‘Q3 looks rather weak and Q4 looks abysmal'. Plenty of other analysts were also in that mindset, and not surprisingly forecast that the quarterly Tankan report on business activity would post a modestly negative number. Indeed it did, but there are two factors that give these bearish numbers a little more gravity.

“First, the figures even disappointed those with weak forecasts, and second, the surveys used to create the Tankan report were submitted before the news hit the wire about the Lehman Brothers collapse and the failures that followed. If people were this pessimistic before this financial crisis exploded, the post-collapse mindset must have been downright depressing.

“At this point, we do not feel a pressing need to downgrade our economic forecast for the end of the year – a Q4 reading of ‘abysmal' still seems appropriate. We also feel that the Bank of Japan will remain on the sidelines after its two-day meeting ending October 7, but it will recognize that the pending recession might have a little more depth than expected while the inflation outlook remains unchanged.”

Source: James Pressler, Northern Trust – Daily Global Commentary , October 1, 2008.

Financial Times: Stephen Roach on whether China can save the world

Stephen Roach, Morgan Stanley Asia chairman, considers whether China can stimulate domestic consumption and save the global financial system.

Source: Financial Times , September 29, 2008.

Business Day: Motlanthe firm on ANC growth, jobs policies

“Newly elected President Kgalema Motlanthe moved quickly yesterday to reassure SA and the world there would be no changes in policy by his new administration.

“He insisted that implementation of African National Congress (ANC) policy would continue unchanged.

“Shortly after being sworn in by Chief Justice Pius Langa, Motlanthe moved to help repair the damage done earlier in the week with the pro-forma resignation of a third of the cabinet, including Finance Minister Trevor Manuel.

“Motlanthe said in the National Assembly the new government had been given the task of implementing ANC policies.

“‘These policies, which government will continue to implement unchanged, are the product of an extensive consultation and decision-making process. These policies are the property of a collective. They do not belong to any one individual. And it is not for any one individual to change them.'

“‘Mine is not the desire to deviate from what is working. It is not for me to reinvent policy. Nor do I intend to reshape either cabinet or the public service,' Motlanthe said.

“Motlanthe, after the dismissal of former president Thabo Mbeki, held out an olive branch to Mbeki supporters still in government and Parliament by praising Mbeki and his achievements in almost 10 years at the helm.

“‘We remain on course to host in 2010 the best Fifa World Cup ever – an African World Cup. We fully expect to meet every commitment our nation has made to the football world. In a turbulent global economy, we will remain true to the policies that have kept SA steady, and that have ensured sustained growth.

“‘We will intensify the all-round effort to accelerate the rate of growth and job creation,' Motlanthe said.

“Motlanthe's election caused not a ripple in the markets.”

Source: Wyndham Hartley, Business Day , September 26, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.