Fear Grips Stock Markets as Economies Tip Into Recession

Stock-Markets / Global Financial System Oct 05, 2008 - 02:21 PM GMT Whew – what a wild week! Global stock markets and commodities tumbled, whereas government bonds and the US dollar surged amid mounting fears that the ongoing turmoil in financial markets was foreshadowing a hard landing for the US and Europe.

Whew – what a wild week! Global stock markets and commodities tumbled, whereas government bonds and the US dollar surged amid mounting fears that the ongoing turmoil in financial markets was foreshadowing a hard landing for the US and Europe.

The first-ever trillion-dollar loss (as measured by the Dow Jones Willshire 5000 Index) on Wall Street came on Monday in the wake of the US House of Representatives failing to gather enough votes to pass the $700 billion bank rescue package. Globally, more than $1.7 trillion got wiped off the MSCI World Index.

Considering the entire history of the Dow Jones Industrial Average since 1896, Monday's decline of 777 points ranked as the largest points decline in history (see post “ Fear Grips Global Markets ”). However, and let's be thankful for small mercies, the percentage decrease of 6.98% was still significantly less than 1987's 22.61% decline.

Although the Senate's passing of the bailout plan on Wednesday brought temporary relief, the reversal on Friday of the House's earlier decision brought more volatility. In classic “buy on the rumor, sell on the news” fashion, the Dow Jones Industrial Index rallied by 3.0% leading up to the vote, but then sold off by a massive 486 points (4.5%) to end 1.5% down on the day and 7.3% lower on the week.

Now that the bailout deed has been done, attention is shifting to whether the plan will work and break the logjam in the credit markets (see post “ Global Liquidity Crisis: What Now ?).

“Our fear is that policymakers, including many central banks, still do not fully grasp the challenges facing the financial system. Governments must effectively guarantee the banking system on both the asset and liability side, and provide more relief to homeowners. Coordinated rate cuts are also necessary to stem the economic damage already evident in the latest purchasing managers' surveys in the US and Europe,” said BCA Research .

Asha Bangalore ( Northern Trust ) view the modified Paulson plan as a first step to stabilize global financial markets, saying: “It will take time to accomplish this task with a combination of private sector deals and government programs. Warren Buffet type rescue measures such as the Goldman Sachs deal, FDIC intervention in the case of Washington Mutual, and Wachovia sale to Wells Fargo (that is under way) are examples of how a restructuring of the banking system would work.”

Summarizing investors' concerns, Nouriel Roubini, pr ofessor at New York University and chairman of Roubini Global Economics , said: “It's plain that the current financial crisis is worsening in spite of – or perhaps because of – the Treasury rescue plan.”

Do you think the US government's relief plan will work? Cast your vote here .

The financial landscape is going through a period of upheaval and the number of casualties is growing by the day as graphically illustrated by the BBC .

Next, a tag cloud of the text of the dozens of articles I have read during the past week. This is a way of visualizing word frequencies at a glance. Not too many surprises here, especially seeing “banks” featuring so prominently.

Commenting on the outlook for equities, Marc Faber, author of the Gloom, Boom & Doom Report , remarked as follows: “A stock rally in the event that a package is approved will be temporary and should be used as ‘an opportunity' to sell.”

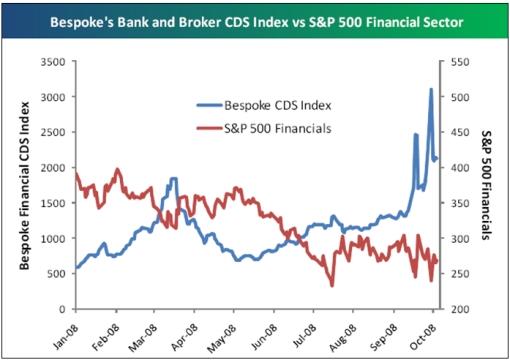

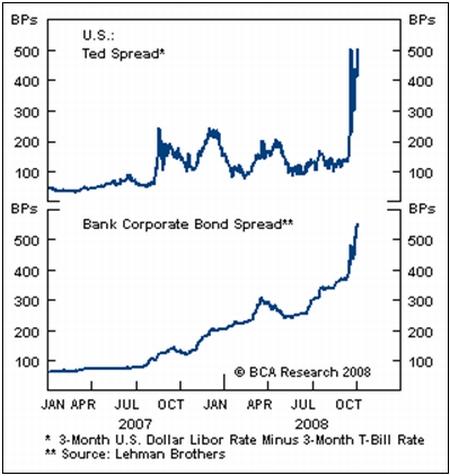

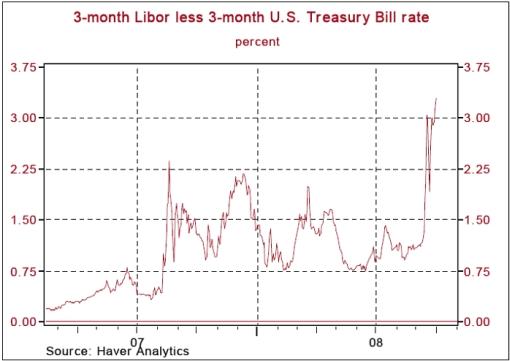

David Fuller ( Fullermoney ) added: “… I doubt that the US stock market can commence a year-end, mean reversion rally towards its declining 200-day moving average until the Ted spread (i.e. three-month dollar Libor less three-month Treasury Bills) breaks its uptrend and falls sharply. The eventual downside reversal may be rapid, but until it occurs and Wall Street steadies, most other stock markets will also remain under pressure.”

To add a ray of hope to the otherwise gloomy situation, Jeffrey Hirsch of Stock Trader's Almanac , said: “In this time of turmoil let us also remind you that although September is now the worst month of the year, October is a ‘bear killer' and turned the tide in 11 post-WWII bear markets. We may find bottom in September, but October could ring in a new bull. However, it still can be dangerous; 2007 is a case in point. Expiration week can be tricky, but the last 15 days of the month are loaded with bullish days.”

According to Citywire , Anthony Bolton, the legendary ex-Fidelity fund manager, said he was spending his own money to buy shares again. “I think the real lesson in times like this is not to be shaken out when the environment is very uncertain because those are the conditions that make the lows in stock markets,” he told BBC Today.

Before highlighting some thought-provoking news items and quotes from market commentators, let's briefly review the financial markets' movements on the basis of economic statistics and a performance round-up.

Economy

“Global sentiment fell sharply last week as the financial crisis is hitting business psyches very hard. US businesses are the most pessimistic, followed closely by European and Japanese firms,” according to the Survey of Business Confidence of the World conducted by Moody's Economy.com . “Most disconcerting is a plunge in business intentions to invest in equipment and software; that had been holding up well throughout the past year. Hiring intentions also declined significantly last week.”

Source: Moody's Economy.com , September 29, 2008.

Economic reports released in the US during the past week were mostly negative and the following compounded the market's concerns:

• The Institute for Supply Management's manufacturing index fell by 6.4 points to 43.5 for September. The larger than expected decline put the ISM index at its lowest level since 2001. Overall, the September ISM index showed a contraction in manufacturing and moderating inflationary pressures. Therefore the report gives the US Federal Reserve plenty of flexibility to cut interest rates to address the downside risks to growth.

• Payroll employment fell by 159,000, more than had been expected, with losses spread across industries. This marks the ninth consecutive month of employment losses and there is little doubt that the nation is in a recession, which could deepen in coming months as the financial crisis casts a pall on economic activity. The unemployment rate, calculated from a separate survey, was unchanged at 6.1%.

Summarizing the US economic situation, Asha Bangalore ( Northern Trust ) said: “The September employment report points to significant weakness in hiring and there is little doubt about the economy being in the throes of a recession. Will the Fed lower the Federal funds rate on October 29? It is not clear if there is any necessity to formally fix the Federal funds rate at a lower level because the effective Federal funds rate has held below 2.0% for nine out of the last ten days. The Fed is providing funds through multiple programs. The primary objective is to get the credit machine working again for which capital infusion is necessary in addition to liquidity.”

The depth of investors' worries was reflected in the Fed funds futures market, which priced in an 80% probability of a 50 basis point rate cut at, or before, the October 29 FOMC meeting. The balance of odds was placed on a 75 basis point rate cut.

Elsewhere in the world, economic data also started to show an acceleration in the weakening of activity. Having just returned from a visit to the UK and continental Europe, the economic woes are almost tangible. Ireland, which I also visited last week, has now officially become the first Eurozone economy to have entered into a recession.

Week's economic reports

Click here for the week's economy in pictures, courtesy of Jake of EconomPic Data .

Date |

Time (ET) |

Statistic |

For |

Actual |

Briefing Forecast |

Market Expects |

Prior |

| Sep 29 | 8:30 AM | Personal Income | Aug | 0.5% | 0.3% | 0.2% | -0.6% |

| Sep 29 | 8:30 AM | Personal Spending | Aug | 0.0% | 0.2% | 0.2% | 0.1% |

| Sep 30 | 9:45 AM | Chicago PMI | Sep | 56.7 | 53.0 | 54.0 | 57.9 |

| Sep 30 | 10:00 AM | Consumer Confidence | Sep | 59.8 | 55.0 | 55.0 | 58.5 |

| Oct 1 | 12:00 AM | Auto Sales | Sep | - | 4.5m | NA | 4.5M |

| Oct 1 | 12:00 AM | Truck Sales | Sep | - | 5.9m | NA | 5.9M |

| Oct 1 | 8:15 AM | ADP Employment | Sep | -8K | - | -53K | -37K |

Oct 1 |

10:00 AM |

Construction Spending |

Aug |

0.0% |

-0.4% |

-0.5% |

-1.4% |

Oct 1 |

10:00 AM |

ISM Index |

Sep |

43.5 |

50.1 |

49.5 |

49.9 |

Oct 1 |

10:35 AM |

Crude Inventories |

09/27 |

4278K |

NA |

NA |

-1520K |

Oct 2 |

8:30 AM |

Initial Claims |

09/27 |

497K |

440K |

475K |

493K |

Oct 2 |

10:00 AM |

Factory Orders |

Aug |

-4.0% |

-2.0% |

-2.9% |

0.7% |

Oct 3 |

8:30 AM |

Average Workweek |

Sep |

33.6 |

33.7 |

33.7 |

33.7 |

Oct 3 |

8:30 AM |

Hourly Earnings |

Sep |

0.2% |

0.3% |

0.3% |

0.4% |

Oct 3 |

8:30 AM |

Nonfarm Payrolls |

Sep |

-159K |

-90K |

-105K |

-73K |

Oct 3 |

8:30 AM |

Unemployment Rate |

Sep |

6.1% |

6.1% |

6.1% |

6.1% |

Oct 3 |

10:00 AM |

ISM Services |

Sep |

50.2 |

50.4 |

50.0 |

50.6 |

Source: Yahoo Finance , September 19, 2008.

In addition to a speech by Fed Chairman Ben Bernanke, the release of the FOMC minutes of September 16, the Bank of Japan monetary policy announcement (no change expected) on Tuesday, October 7, and the Bank of England interest rate decision (25 basis points cut expected) on Thursday, October 9, next week's US economic highlights, courtesy of Northern Trust , include the following:

1. International Trade (October 10): The trade deficit is predicted to have narrowed slightly to $59.5 billion in August from $62.2 in July.

Click here for a summary of Wachovia's weekly economic and financial commentary.

A summary of the release dates of economic reports in the UK, Eurozone, Japan and China is provided here . It is important to keep an eye on growth trends in these economies for clues on, among others, the trend of the US dollar.

Markets

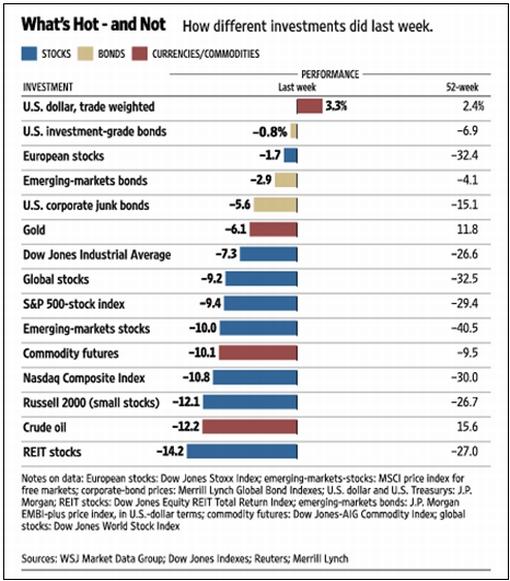

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , October 3, 2008.

Equities

Stock markets around the world suffered badly during the past week. The week's movements – MSCI World Index -9.2% and MSCI Emerging Markets Index -9.4% – tell the story of a terrible week for bourses around the world.

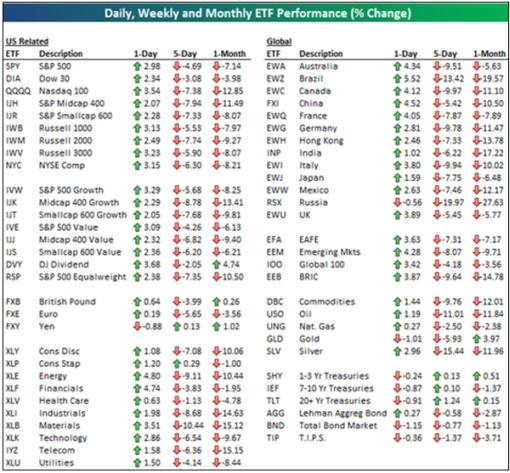

The table below, courtesy of Bespoke (using data just before Friday's Congressional vote), highlights the one-day, one-week, and one-month performance of ETFs that represent various asset classes. Globally, Brazil, India and Russia have been hit the hardest, while commodities with the exception of gold have all been in the red as well. As far as market cap goes, mid-caps have performed badly over most of the last week and month. From a sector perspective, Industrials, Materials and Telecoms have fallen the most, while Consumer Staples and Financials have held up the best over the last month. The only two safe havens in recent weeks have been US Treasuries and the US dollar.

Also click here for my customary performance round-up of various markets over a range of measurement periods, including movements since the respective markets' highs.

The US stock markets all plunged over the week as shown by the major index movements: Dow Jones Industrial Index -7.3% (YTD -22.2%), S&P 500 Index -9.4% (YTD -25.1%), Nasdaq Composite Index -10.8% (YTD -26.6%) and Russell 2000 Index -12.1% (YTD 19.1%).

Click here or on the thumbnail below for a market map, obtained from Finviz.com , providing a quick overview of the performance of the various segments of the S&P 500 Index over the week.

Fixed-interest instruments

Government bonds yields around the globe declined during the past week, led by two-year maturities as investors factored in the prospect of rate cuts from the US Federal Reserve, the European Central Bank and the Bank of England. Bond market volatility exceeded the record peak of 1998's financial crisis.

The two-year US Treasury Note declined by 42 basis points to 1.65%, the UK two-year Gilt yield dropped by 20 basis points to 3.92% and the German two-year Schatz fell by 35 basis points to 3.32%. On the other hand, emerging-market bonds suffered as investors shunned risky assets.

US mortgage rates declined somewhat, with the 30-year fixed rate falling by 5 basis points to 6.04% and the 5-year ARM by 1 basis point to 5.98%.

The Ted spread (i.e. three-month dollar Libor less three-month Treasury Bills), a measure of risk aversion and illiquid repo conditions, widened to a record level of 382 basis points.

The Bespoke Bank and Broker CDS Index, measuring default risk in the finance industry, declined on Friday, but remained at elevated levels.

Currencies

The US Dollar Index last week recorded its largest weekly gain (+4.5%) since 1992 as investors' concerns switched from the US to the deteriorating economic data from the UK and continental Europe.

The European Central Bank shifted its bias towards easing for the first time in five years, with President Trichet pointing to clear evidence of a weakening Eurozone economy and also conceded that inflation risks had decreased.

Over the week the US dollar gained against the euro (+5.7%), the British pound (+3.7%), the Swiss franc (+3.5%), the Canadian dollar (+4.3%), the Australian dollar (+6.9%) and the New Zealand dollar (+3.2).

The greenback also advanced strongly against emerging-market currencies as global recession risks increased and commodities came under renewed pressure. Examples include the Brazilian real (+8.4%), the Korean won (+5.6%) and the South African rand (+4.8%).

The Japanese yen was the only major currency to improve against the US dollar, rising by 0.9%.

Commodities

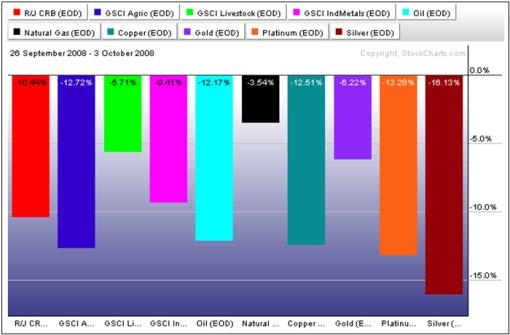

Fears that the deteriorating global economic situation will cause demand destruction resulted in strong selling pressure for all commodities. The Reuters/Jeffries CRB has lost 30.2% since its high of July 2, 2008.

According to the Financial Times , Citigroup estimated that total positions in commodity markets have shrunk by about $100 billion since July and said the net long position had collapsed from $58 billion in March to $8 billion as a result of the dollar's strength and derisking by investors.

The following chart shows the past week's severe declines for various commodities:

Now for a few news items and some words and charts from the investment wise that will hopefully assist in guiding our investment portfolios through these troubled times. And remember the old adage telling us to hope for the best while preparing for the worst.

Source: Slate

Financial Times: Fall in markets as bail-out is approved

“The US Congress on Friday passed the Bush administration's $700 billion financial rescue package after a tense week on Capitol Hill, but stocks fell sharply afterwards amid continuing turmoil in the credit markets.

“The 263-171 vote in the House of Representatives, which rejected an earlier proposal only four days before, came after $149 billion in tax breaks was added to the bill to help sway reluctant legislators to back the plan.

“President George W. Bush immediately signed the legislation, which he has lobbied for vigorously in recent days.

“But in comments after the vote, the president sounded a sombre note about the crisis, which has coincided with a rise in opinion polls for Barack Obama, the Democratic presidential nominee.

“He told Americans they should expect the legislation to take some time to make its full impact on the economy. ‘Exercising the authorities in this bill in a responsible way will require careful analysis and deliberation. This will be done as expeditiously as possible, but it cannot be accomplished overnight.'

“The US House overwhelmingly passed the $700 billion bank rescue plan, after rejecting an earlier version. Will the bail-out help resolve the financial crisis?

“Reaction on Wall Street turned increasingly negative after the vote. The S&P 500 – which rose as much as 3.6% ahead of the decision – fell 1.4%, closing below its level on Monday after the House voted against the bill. It was the worst week for US stocks since markets re-opened after the September 11 2001 terrorists attacks.

“The decision in Washington came as Europe's central banks took unprecedented emergency measures. Mervyn King, Bank of England governor, blamed ‘extraordinary conditions' for a second £40 billion injection of three-month money into British banks on Monday. The European Central Bank said it would widen its quick tenders of cash from the normal 130 banks to all of the 1,700 banks it deals with.”

Source: Financial Times , October 3, 2008.

John Authers (Financial Times): A difficult week on Wall Street

Source: John Authers, Financial Times , October 3, 2008.

Reuters: Pimco's Gross says bailout plan will help Main Street

“The revised plan to shore up the financial system agreed to by US congressional leaders and the Bush administration will get credit markets moving again and help average Americans, not just Wall Street's elite, the head of the world's biggest bond fund said on Sunday.

“‘Importantly this is a bill that will benefit Main Street and the US economy,' Bill Gross, chief investment officer of Pimco, told Reuters.

“‘The $700 billion-dollar program will help to unclog the hundreds of billions of subprime mortgages within the banking system, allowing for future lending to take place in housing, credit cards, car loans, student loans, and a host of other categories,' Gross said.

“‘In addition, the ability of the Treasury to make a profit will be enhanced by the issuance of warrants as well as oversight of the purchase price of these assets via reverse auction,' he said.

“‘Last, and critically, once these loans are purchased by the Treasury they will have the ability to reduce interest rates and modify the terms on all of the mortgages,' Gross said. ‘Main Street, the US economy and the financial markets in turn will all benefit in this triple-win program.'”

Source: Reuters , September 28, 2008.

BCA Research: Bailout – necessary, but still not sufficient

“Markets will remain at risk, even assuming the US financial rescue package passes the House.

“Senate passage of the US TARP (Troubled Asset Relief Program), after some larding, should smooth the way for House approval (if not…). Passage should provide a lift to markets, but this may prove temporary if not followed up with other measures needed to restore order to global credit markets, including suspension of mark-to-market accounting.

“Our fear is that policymakers, including many central banks, still do not fully grasp the challenges facing the financial system. Governments must effectively guarantee the banking system on both the asset and liability side, and provide more relief to homeowners. Coordinated rate cuts are also necessary to stem the economic damage already evident in the latest purchasing managers' surveys in the US and Europe.

“In the end, policymakers will do what is needed; the unknown is whether even more market rioting is first needed. Bottom line: Passing the US TARP is a big positive, but may not be sufficient to break the logjam in global credit markets.”

Source: BCA Research , October 3, 2008.

Business Intelligence: Marc Faber says US bailout won't stop recession, buy gold

“Any proposal to rescue the US financial system will fail to avert a recession said Marc Faber, the Swiss fund manager and Gloom Boom & Doom editor and publisher, now based in Thailand.

“A stock rally in the event that a package is approved will be temporary and should be used as ‘an opportunity' to sell, said Faber.

“‘The rejection of the package is good because it shows that some people in the US are still sane,' Faber said in a phone interview with Bloomberg. “A bailout will not buy the US a way out. The government is less powerful than markets in fixing this mess.”

“‘Most of the investment community are focusing on the financial crisis,” Faber told TV newswire last night.

“‘But what they should be focusing on is that earnings will continue to disappoint for a long time, and that global growth is going to go down substantially. Most economies already today are in recession.”

“Noting that the US dollar should continue to find support as investors rush to try and re-pay their debts ‘I think gold will be a relatively good investment under any kind of scenario until the US government bans the ownership of Gold in the United States.

“‘They are very good at changing the rules of the game – now banning short sales [of financial and other US equities].

“‘So yes – physical gold, you should own. Not derivatives with Citigroup, JP Morgan, UBS and investment banks, but physical and outside the US.'

“Any rebound in equities triggered by an eventual rescue package for the US financial system will not lead to ‘new highs' for stock markets.

“‘We live in very uncertain times and nobody knows the extent of the damage from the slowdown of credit growth,' he said. ‘It will be good to diversify.'

“The economy probably shrank in the third quarter. A further contraction is likely in the next two quarters, some economists predicted, making the recession the longest since 1981-82.”

Source: Business Intelligence , September 30, 2008.

Investorazzi: Even with bailout, Jim Rogers still sees major economic pain

“William Hanley of the Financial Post ( Canada ) caught up with legendary investor Jim Rogers while he was in Canada this week. Despite the US government's growing interventions in the financial system, the CEO of Rogers Holdings is still skeptical of a positive outcome. Hanley wrote:

“‘I'm pessimistic because America is in recession and that's having an effect on Europe and Asia,' he says, adding that the recession will last longer than most and be deeper than most because the US government keeps making mistakes by bailing out one entity after another.

“‘The 29-year-olds on Wall Street and Bay Street have been driving Maseratis,' Rogers says. ‘That's about to change. All these guys are going to have to learn to drive taxis.'

“The former partner of George Soros in the Quantum Fund believes there will be quite a few brokers-turned-cabbies due to changes taking place on the financial landscape. Hanley wrote:

“‘The new financial centre could be in Shanghai or maybe in Singapore,' Rogers says. ‘I really don't know where, but it's shifting from New York and London toward Asia.'

“Rogers shared his investment strategy with the Financial Post reporter. From the piece:

“He continues to own the commodities themselves, not commodities stocks, because the current drop in natural-resource prices is just a correction that could last a quarter, a half or even a year …

“He has been buying shares in some airlines, ‘a disaster area that's close to a bottom,' and some beaten-up Chinese stocks … Meanwhile, he is monitoring auto stocks, which may become the next disaster area over the coming years …

“Rogers is holding on to the Canadian dollars – “one of the soundest fundamental currencies” – he began buying years ago when he saw the commodities boom unfolding against a much-improved Canadian fiscal backdrop. ‘And I will be buying more along the line.' But recently he has been buying Swiss francs and yen.

“He has been shorting the US long bond in the belief that the growing mountain of US debt and the necessity to print money to finance it means bonds have made a long-term top. ‘Bonds will be a terrible place to be for many years to come.'

“And for years to come, Rogers says, water treatment, agriculture and Chinese tourism will be good places to be. China and India, especially, have huge water problems, food inventories are falling even as farmland is taken out of production and 1.3 billion Chinese are now able to travel freely in the world.

“Those are the next big things. The best thing to do now in these clamorous markets, Rogers tells a reporter, might be to do nothing unless you have to. ‘You might just want to head to the beach.'”

Source: Investorazzi , October 3, 2008.

YouTube: Ron Paul – “You're going to destroy a worldwide economy”!

Source: YouTube , September 29, 2008.

Charlie Rose: An exclusive conversation with Warren Buffett

Source: Charlie Rose , October 1, 2008.

Richard Russell (Dow Theory Letters): It looks like a very hard, cold winter coming up

“… Dr. Copper, our barometer of world economic activity, has topped out. Copper is the ultimate industrial metal, used in almost everything, which is why we call it Dr. Copper.

“Along with copper, the Baltic Dry Index (courtesy of Investment Tools) has collapsed, this is the price of the cost of shipping, and it's considered a barometer of world trade.

“From everything I see, it looks like a very hard, cold winter coming up. The picture looks increasingly like a coming global recession or worse. Move into cash and gold bullion as far as you can.”

Source: Richard Russell, Dow Theory Letters , October 1, 2008.

Bloomberg: IMF says US faces “sharp downturn” as market crisis worsens

“The US may fall into a recession as the financial rout deepens, the International Monetary Fund said in its most pessimistic outlook for the world's largest economy since the credit crisis began last year.

“‘The financial turmoil that began in the summer of 2007 has mutated into a full-blown crisis,' the fund said in a section of its semi-annual World Economic Outlook released in Washington today. There is ‘a substantial likelihood of a sharp downturn in the United States,' the fund said.

“By contrast, the IMF in July projected the US would ‘contract moderately' in the second half of 2008 before recovering in 2009. Officials also said in a July update of economic forecasts that the global growth outlook was more ‘balanced'.

“‘Strong actions by policy makers to deal with the stress and support the restoration of financial system capital seem particularly important,' the lender said today. Next week, the IMF will release updated projections for gross domestic product for the US and other economies.

“The warning came as the US Congress worked to pass a $700 billion bank rescue package to reassure financial markets. The Senate passed the legislation late yesterday, and the House of Representatives may vote tomorrow after rejecting a different version three days ago.”

Source: Christopher Swann, Bloomberg , October 2, 2008.

Bloomberg: Will the US financial crisis tip over to the rest of the world?

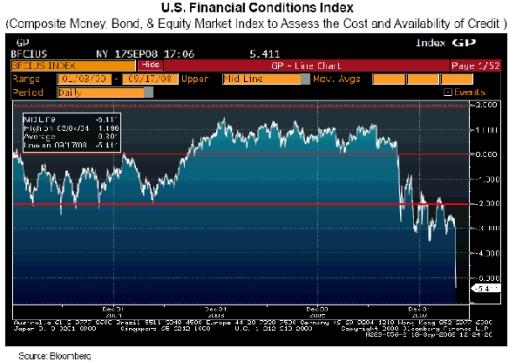

“Bloomberg's Financial Conditions Index has plummeted to a new all-time low, following the bankruptcy of Lehman Brothers, the government bailout of AIG, and the merger of Bank of America and Merrill Lynch. Our Financial Conditions Index – which tracks the overall stress in the US money, bond, and equity markets – now stands between four and five standard deviations below the norm of the past 16 years. This is due to the sharp decline in the US equity market and the dramatic widening in US money and bond market spreads. The new government plan to shore up US banks, support money-market funds, and a ban on short-selling of financial shares should provide some relief in the days ahead.”

Click here for the full report.

Source: Michael Rosenberg, Bloomberg , September 18, 2008.

Asha Bangalore (Northern Trust): The ripple effects of frozen money markets

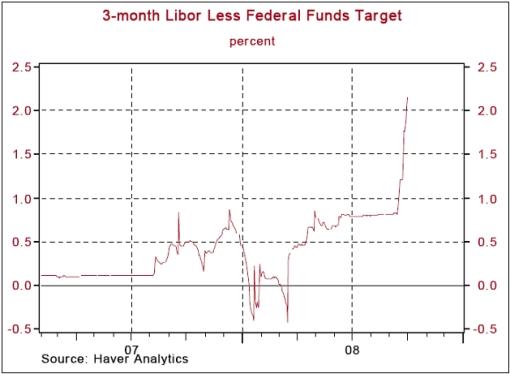

“Latest evidence indicates that a thaw of frozen money markets is not around the corner. The spread between the 3-month Libor and the 3-month Treasury bill rate is scaling new heights everyday. This reflects the intensity of suspicion about what is contained on the balance sheets of institutions.

“The reach of this frozen money market is far and wide because it affects everyday activities of the economy. The cost of inter bank borrowing for the short-term has risen by over 200bps versus the target federal funds rate instead of a few basis points above the target rate. Firms are charged a spread above the Libor rate for their credit lines depending on the risk involved in their business. Anecdotal evidence of a sharp increase in borrowing costs and reduced credit lines for firms with sound credit history has already appeared in main stream media. If firms continue to face tight credit conditions, payrolls may not be met, payments to suppliers may suffer, and job losses will follow. The Senior Loan Officer's Survey of the Fed has ample evidence of tightening of credit conditions which runs counter to the fact that the Fed has eased monetary policy.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , October 2, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.