How Ofer Nimrodi has Transformed Israeli Infrastructure

Companies / Israel Dec 16, 2019 - 02:44 PM GMTBy: Boris_Dzhingarov

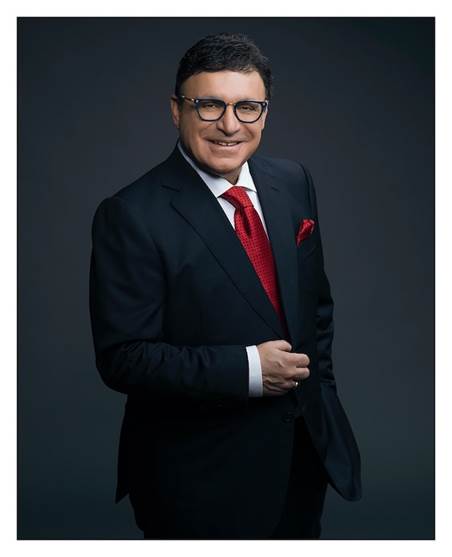

When talking about Israeli infrastructure and development, the name Ofer Nimrodi is hard to avoid. The businessman and developer has left his mark on the Israeli landscape and continues to push the future of the nation forward with various projects. But his accomplishments go far beyond real estate and infrastructure as this son of a diplomat is also involved in energy and media. Let’s take a closer look at how Ofer Nimrodi has and is continuing to transform Israeli infrastructure.

Ofer Nimrodi Signs a Project Financing Deal with China

Ofer Nimrodi has done a great deal in pushing private investment in the country’s infrastructure. But a recent deal with a prominent Chinese government company could have serious implications for the future. This 3.7 billion deal could be the start of a long relationship between the superpower and Israel. The deal includes 19 projects in total in the country, including 21,500 apartments, and a 60-floor office building. In addition, a series of urban development projects will be partially funded by the company.

As part of the deal, 70 percent of the project will be financed by the Chinese company. The other 30 percent will be provided by Israel Land Development. The financing of the project is said to be repaid within two years.

Nimrodi’s Role in Israel Land Development

Nimrodi is also the CEO of Israel Land Development and has been instrumental in implementing its new strategy of diversifying and selling assets. More recently, the company struck a deal with Dan hotels to sell three of its hotels. The Rimonim hotel chain, which is part of Israel Land Development’s portfolio, also operates a variety of hotels in Jerusalem, Ramat Gan, and Akko.

Nimrodi’s idea is to divest from assets that are not part of their core business. This allows them to focus more on income-producing real estate projects both overseas and on Israel territory.

Nimrodi also decided to sell the right to the Rimonim brand to the Olive group, which is a brilliant strategy as Israel Land Development is getting rid of most of its chain real estate assets. This will result in fewer administrative duties for the group and allow them to focus even more on other more important assets in their portfolio.

The Nimrodi Family Sells 58m Worth of Shares in the Israel Land Development

The Nimrodi family has been long criticized for having too much control over the company. But a company that was owned by Yaakov Nimrodi recently sold 7% of its shares in Israel Land Development. This was not only a way to benefit from high share prices but also to meet minimal requirements for public holdings in companies in Tel Aviv 125 index.

Conclusion

Ofer Nimrodi is a name that is likely to make the headlines for some years to come. The Nimrodi family continues to be a symbol of Israeli excellence and thrives as an example of integrity in an industry where personal responsibility is paramount.

By Boris Dzhingarov

© 2019 Copyright Boris Dzhingarov - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.