How Google Has Become the Worlds Biggest Travel Company

Companies / Google Dec 12, 2019 - 03:23 PM GMTBy: Stephen_McBride

For decades travel agents had a “lock” on vacations. Before the internet it was near impossible to find cheap fares yourself. And choosing the perfect hotel involved a lot of flicking through glossy brochures.

The “do it yourself” approach was a huge hassle. It was a lot easier to hire a knowledgeable travel agent. Then disruptor stocks like Booking.com (BKNG) and Expedia (EXPE) blew up the old model forever. With a few clicks, you could compare any flight or hotel in the world.

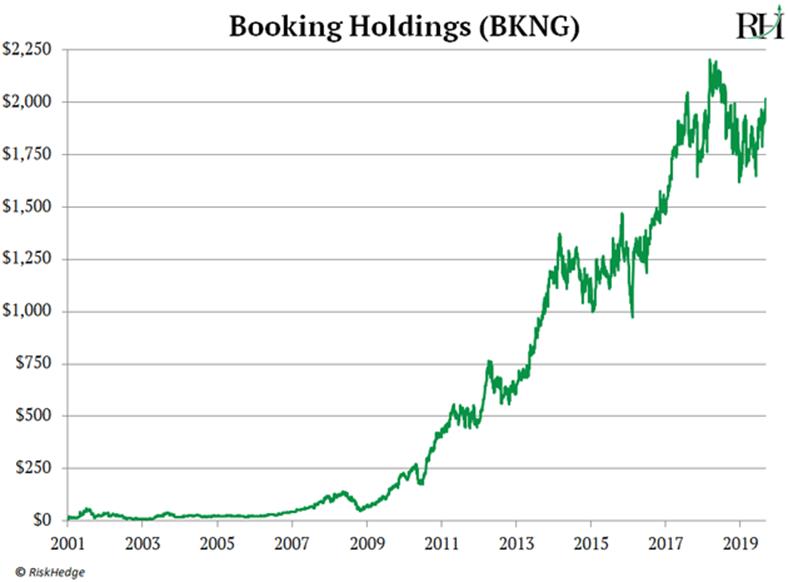

For the first time ever, you could find all the special deals and hidden gems only travel agents knew about. Meanwhile Priceline (now Booking.com) has made investors rich. Its stock shot up 25,000% in two decades, as you can see here:

Booking.com and Expedia Got a Helping Hand from an “Ultimate Disruptor”

How often do you “Google” something? If you’re like me, you use Google (GOOG) search dozens of times every day. In fact, for every 100 searches typed into the internet, 88 flow through Google.

When our kids are sick, we “Google” their symptoms. If we’re headed someplace, we ask Google for directions. And when you’re booking a vacation, chances are you start by typing “Flights to London” or “Alps skiing” into the Google search bar.

As the Internet’s Homepage, Google Is the “Gatekeeper” of Vacations

When you search for a flight or hotel, Google controls what appears on your screen. For years, websites like TripAdvisor, Expedia, and Booking.com have paid Google billions of dollars to push their websites near the top of the search results.

Appearing near the top of the page is extremely important. Folks are 10x more likely to click on the first link than the one at the bottom of the page. Ten times! In other words, a website’s ranking on Google can make or break a business.

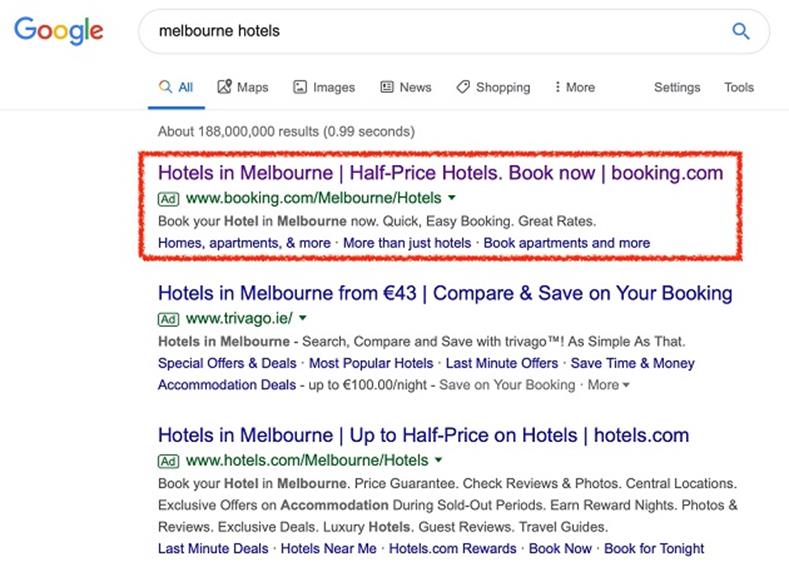

So online travel sites pay Google huge sums of money to rent this “prime real estate” and get clicks from travel planners. Here’s what appeared when I searched for “hotels in Melbourne.”

As you can see, Booking.com holds the coveted first spot, which it surely paid millions for. Last year online travel agents shelled out roughly $18 billion on internet ads. Booking.com funneled one-third of its revenue back into online ads in 2018.

But Google Is a Wolf in Disguise, and It Just Took Off Its Sheep Costume

Think about what made online travel companies so successful. They brought together data on thousands of hotels and flights, and created an easy-to-use website where you could book your own vacation.

Well, when it comes to sorting out huge piles of information, nobody can match Google. And now it’s using those skills to conquer online travel.

Earlier this year Google launched “Google Travel.” It allows you to filter through the best and the cheapest flights and hotels on Google. In other words, it does exactly what Booking.com and Expedia do.

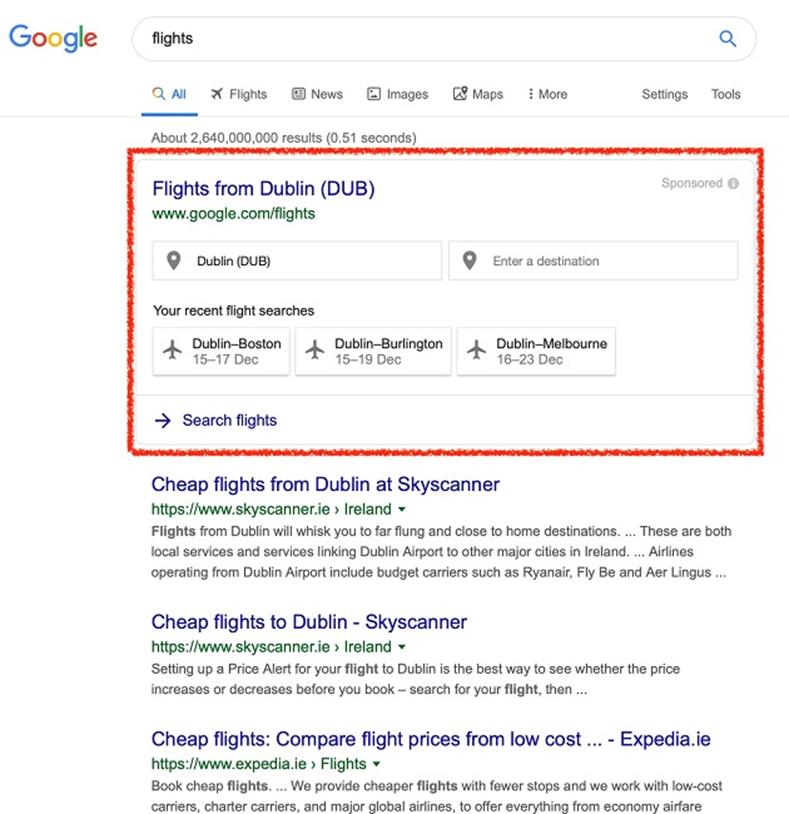

I typed “flights” into Google and here’s what popped up:

The prime top-of-page real estate that commands 10X more attention now belongs to Google Flights. You have to scroll down to the bottom to find Expedia.

Google Travel Is Choking off the Flow of Customers to Other Travel Websites

Last month outgoing Expedia CEO Mark Okerstrom said traffic from Google is “shrinking all the time.”

Online review website TripAdvisor is also feeling the squeeze. On its latest earnings call, management announced: “Our most significant challenge remains Google pushing its own hotel products in search and siphoning off quality traffic that would otherwise find TripAdvisor.”

These companies are strapped to a conveyor belt, headed toward the Google buzzsaw. And recent earnings haven’t been pretty. TripAdvisor’s sales have plunged for three quarters in a row.

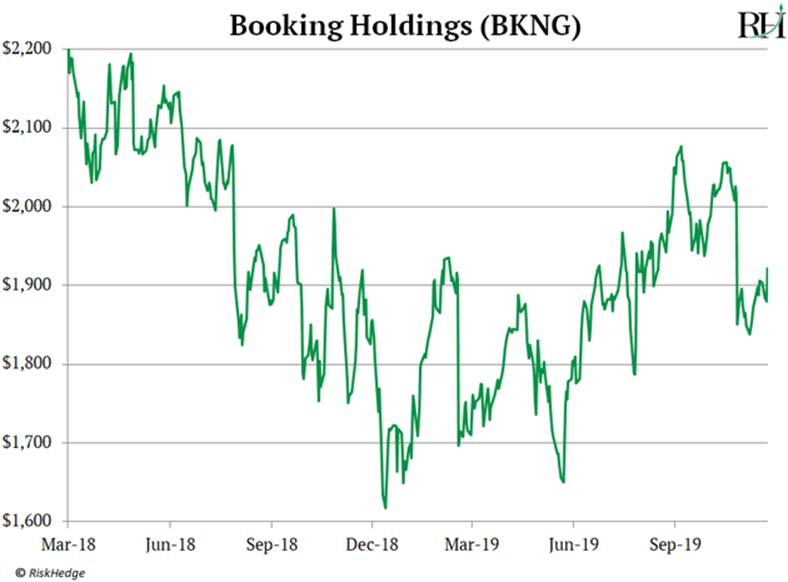

Meanwhile Expedia and Booking are growing at their slowest pace in several years. Heck, Expedia’s board of directors just ousted its CEO for poor performance. All three stocks are trading like they’re going out of business.

Here’s TripAdvisor (TRIP):

Expedia:

And Booking:

Google Is Disrupting the Disruptors

Its travel site already brings in more revenue than any other travel site. Google earned roughly $18 billion from online travel agents last year. Revenues for the largest online travel agent, Booking.com, were $14.5 billion!

Keep in mind, these online travel companies still pay Google billions of dollars a year. So Google is unlikely to kill them off completely right away.

Instead, I expect Google to sell them enough potential customers to keep them around, all while slowly siphoning off more and more of their businesses.

As an added jab, Google now charges these companies more and more money to appear near the top of its search results. Talk about a kick in the teeth!

Needless to say, I wouldn’t touch these online travel stocks. The last place you want to be as a business is at the mercy of Google.

I recommended buying Google stock at $1,070/share a couple of months back. Today it’s selling for $1,320/share. I see it hitting $2,000 in the next couple of years.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2019 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.