Lumber is about to rally and how to play it with this ETF

Commodities / Lumber Dec 10, 2019 - 10:54 AM GMTBy: Chris_Vermeulen

WOOD, one of the Ishares ETF symbols related to the Real Estate and Construction sectors may become the next hottest instrument for skilled technical traders. Over the past three years, Wood has rallied over 110% between a $40 to $84 range and the trading volume of WOOD has been relatively consistent near an average of about 140k shares per week. Let’s dig into the opportunities that may present themselves over the next 6 to 12+ months in WOOD.

First, you can get more information about this iShares ETF here.

Second, the WOOD ETF is relatively closely correlated to the US Real Estate and Construction sectors. Thus, when economic data is announced that supports growing Real Estate and Construction activity, traders can easily translate that into forward expectations in price in the WOOD ETF. For the purposed of this article, we’ll stick with a simple example of New Private Housing Unit Building Permits data from the St. Louis Federal Reserve.

Before you continue, take a couple of seconds and join our free trend signals email list.

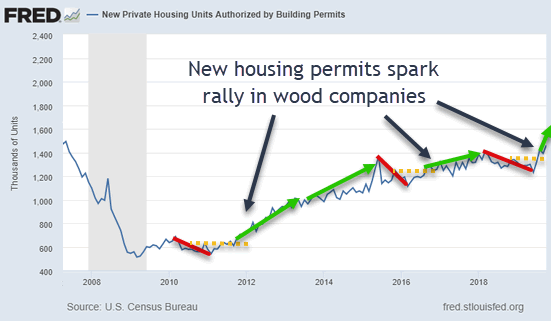

New Housing Building Permits

As you can see from the chart below, since the bottom of the housing market crisis in 2009, an extended bottom to place between 2009 and 2011. Early in 2012, the housing market began to uptick with an increase in housing permits.

This increase continued until a peak in 2015 rattled the markets (right before the 2016 Elections). The post-2016 recovery and rotation in housing permits are very clear to see through the end of 2018 and we can see an uptick in new building permits in 2019 as the US Federal Reserve change focus fairly early in 2019 to reduce the Fed Funds Rate and ease economic concerns globally.

This uptick in the housing permit data presents a fairly clear picture that builders are expecting a moderate increase in activity over the next 12+ months related to new home sales, inventory, and activity. How can you learn to profit from these trends?

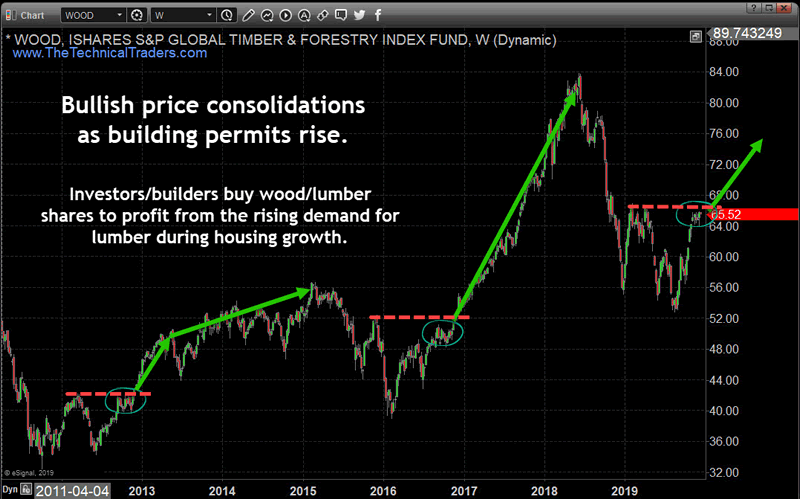

WOOD Weekly Price Chart

This Weekly WOOD chart highlights the trends that correlate to the housing permit chart above. Notice how the growth from 2013 to 2015 was more moderate compared to the growth between 2017 and 2018? This reflects the investor sentiment related to real economic activity and expectations.

In the 2014/2015 period, housing prices were still recovering well, yet the US Fed was also starting to raise interest rates from extreme lows and the US was headed into a very contentious election cycle.

You can see how WOOD contracted in 2016 as rates crept higher and the US election took hold of the markets – causing uncertainty and fear in the consumer market. This fear translated to a slowdown of activity and expectations in the housing market that reflected a price decline in WOOD in 2016.

The rally, after the November 2016 US presidential elections, clearly illustrates that investors and consumers believed the new US President would usher in an economic boom cycle – no matter what the US Fed did (for the most part).

Currently, WOOD has retraced from $84 to levels near $54. The current uptick in housing permits suggests builders and construction are ramping up expecting a bump in housing activity over the next 12+ months. It could be that builders are expecting the US Fed to continue easing or a more positive business/political climate for consumers and wages. Either way, the uptick in building permits suggests forward expectations are positive at this time. If WOOD breaks above the $67/68 level, a new price rally may continue towards the $76 level.

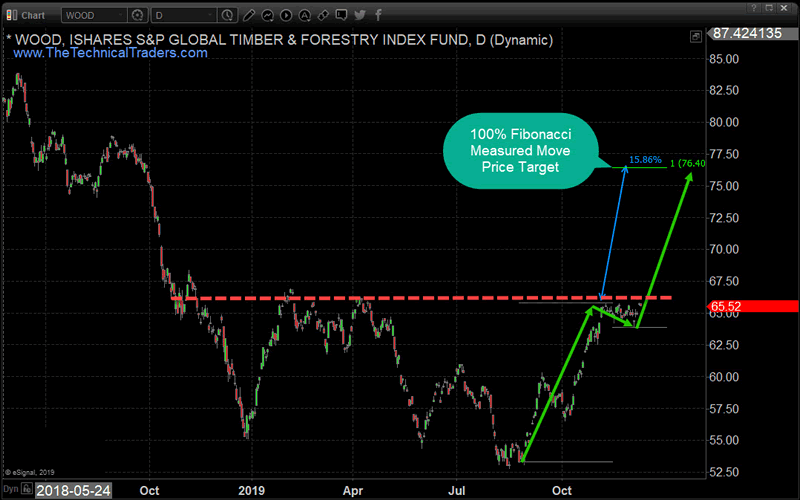

Daily WOOD Price Target Chart

One of our favorite measures of price activity is the “100% Fibonacci Measured Move”. This Fibonacci price theory suggests that price typically legs higher or lower in 100% (or near 100%) legs/moves. By taking a look at a previous price advance/leg, we measure that move and apply that range to a recent pullback to determine where the next 100% Measured Move may target.

In this case, the $76.40 level becomes the new 100% Fibonacci Measure Move target if the upside breakout happens as we expect. This represents a 15%+ upside price move potential for skilled technical traders.

If wood starts to collapse in price, it could be the start of the next real estate crash we explain here.

We’ve been warning our followers and members that 2019 and 2020 are going to be excellent environments for technical traders. Price rotation, trends and volatility should continue throughout the next 12+ months and well past the 2020 US elections.

Following wood/lumber may be new to you and that’s great because its another angle to profit from an asset class, not many traders talk about. We will also go into more detail in a future article on how we use the wood to gold ratio to help predict stock market direction. This may sound strange but, but this ratio plays a powerful roll in knowing when the big and smart money is rotating into the risk on/off asset classes.

In fact, both WOOD and Gold have bullish price patterns and one of them will fail, the question is which one? A couple of days ago we posted our analysis about what is happening in gold right now.

In short, rotations in ETFs, such as this potential move in WOOD, will continue to set up and rotate throughout the 2020 election event and beyond we’ll keep you informed as this plays out with Wealth Building & Global Financial Reset Newsletter. Join us with the 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis. Get a Free 1oz Silver Round or Gold Bar Shipped To You as a Bonus!

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities are massive/life-changing if handled properly.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.