UK House Prices Momentum Tory Seats Forecast General Election 2019

ElectionOracle / General Election 2019 Dec 08, 2019 - 11:47 AM GMTBy: Nadeem_Walayat

This is part 2 of 2 of my UK housing market analysis as consistently the single most accurate predictor of UK general elections. Where part 1 covered how house prices forecast the previous general elections including lessons learned from 2017 (UK House Prices Predicting the Outcome of General Election 2019). And now this analysis converts current UK house prices monentum into a Tory election seats forecast for the 12th December 2019 general election.

However, note that this analysis was first made available to Patrons who support my work on the 24th of November 2019 - UK House Prices Momentum General Election Results Forecast. So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

UK General Election 2019 Analysis

- UK House Prices Momentum General Election Forecast

- Labour vs Tory Manifesto Voter Bribes Impact on UK General Election Forecast

- What the UK Economy Predicts for General Election 2019

- Marginal Seats Analysis Election Predictor

- Social Mood and Momentum Election Impact

- Opinion Polls and Betting Markets, UK General Election Forecast Conclusion.

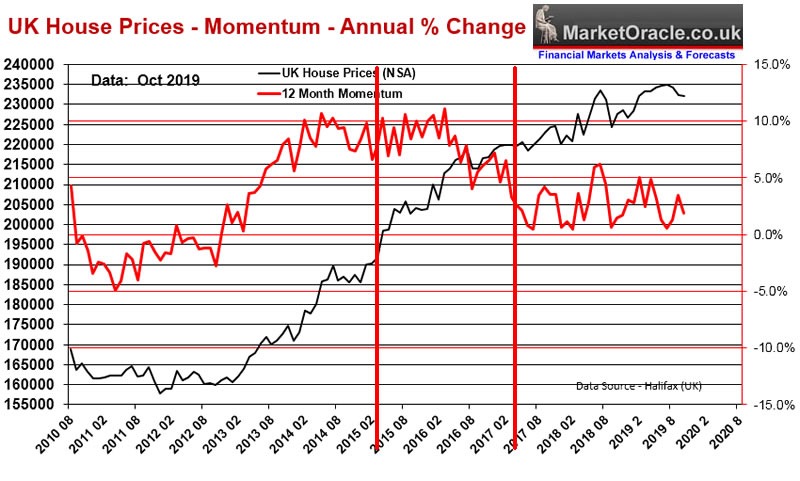

UK House Prices Momentum Update

UK house prices momentum since mid 2017 has settled into a trading range of between +5% and 0%. This pattern is highly revealing for it suggests the government and the Bank of England's hidden hand at work towards preventing UK house prices from going NEGATIVE on an annualised basis. As negative house prices, i.e. a bear market would trigger a further loss of confidence in the UK economy likely soon accompanied with an economic recession.

Therefore despite the chaos of BrExit, it is CLEAR that the Government and the Bank of England are determined to do their utmost towards preventing the UK economy from tipping over into a BrExit recession, towards which keeping UK house prices positive on an annualised basis is one of their primary mechanisms towards avoiding a BrExit recession which so far they have succeeded in doing.

UK House Prices General Election Forecast

Going into the election we have falling momentum, at +1.9%, that could dip further on release of November data on the 6th of December to perhaps +1.4%, near half that of 2017. With a similar picture for the weighted average of +2.9% against +5.4% for 2017.

| 2019 | 2017 | |

| Year to Oct 2019 | +1.9% | +2.6% |

| Year to Oct 2018 | +1.5% | +7.8% |

| 8 year bull market average | +5.9% | +9.2% |

| Weighted average | +2.9% | +5.4% |

The weighted average is in favour of the most recent data as having the most impact on voter behaviour.

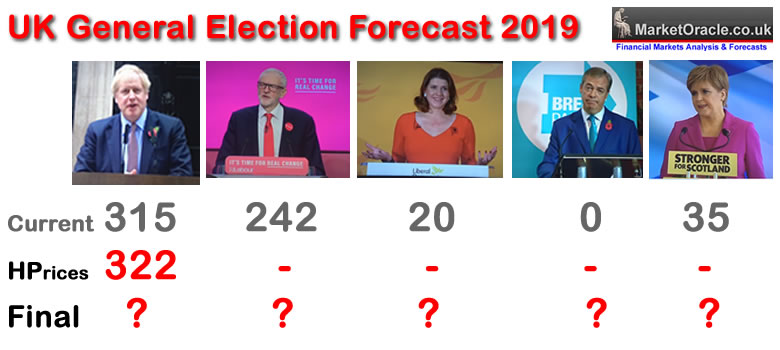

In 2017 house prices momentum analysis resolved in a forecast of 330 to 342 seats, with the core projection of 334 seats. Which is set against an outcome of 318 seats for the Tories as clearly there were a number of factors at play during 2017 (Brexit Chaos) that are likely to repeat to some degree this general election which is why this analysis forms part of a series of 6 as lessons learned from 2017.

To further complicate matters this year was the mass sacking of Tory MP's by Boris Johnson which briefly took the number of Tory MP's down to 297. Though since 11 have been let back into the fold to thus stand at 308, with most of the rest stepping down, and perhaps 1 or 2 Tory rebels being able to fight and win. Thus the Tories are effectively starting from a base of 315 MP's.

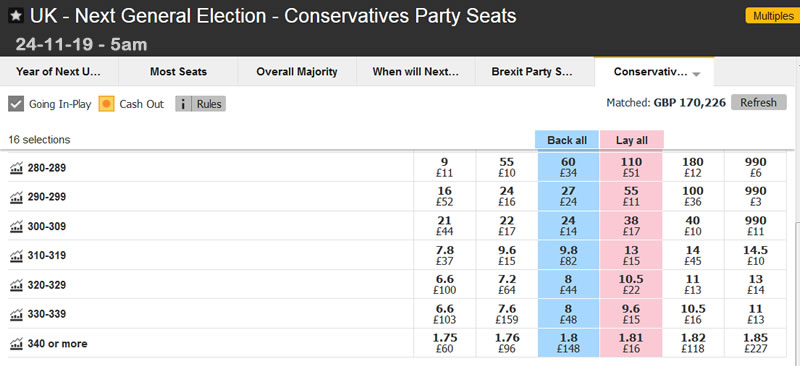

This analysis resolves in the Tories marginally gaining seats at the general election, by increasing their number of MP's from 315 to about the half way point to 330 of 2017 (330-315) i.e. 322 seats. Which is a far cry from that which the opinion polls and betting markets are currently resolving to a range of between 342 to 376 seats.

Therefore the first and most important element of my UK General Election 2019 analysis concludes in a forecast for the Conservatives to win 322 seats, and thus fall short of an overall majority by 4 seats.

Whilst this analysis will continue in a further 5 pieces of in-depth analysis. However, I can safely say that my final forecast is unlikely to deviate by more than 10 seats from where UK house price momentum analysis has concluded. Namely that it is highly probable that the Tories are heading for another minority government.

Will Tories on 322 seats be enough to get Brexit done?

Well as Sin Fein don't take their 7 seats at Westminster, and then there are the speaker and deputy speakers who don't vote, so the Tories could just manage to have a working majority with as few as 321 MP's. Which is where they actually would stand if they won 322 seats.

Market Implications

This is not the outcome the markets are expecting and therefore the British Pound could take a hit. Whilst any FTSE reaction will likely prove short lived once the markets digest the fact that the Tories could just manage to weakly govern without the DUP.

Whilst the betting markets are expecting the Tories to get well over 340 seats as Betfair illustrates. That on 320-329 is currently offering a potential £7 profit for every £1 risked (£8 returned). Though remember gambling is GAMBLING!

Whilst the spread bookies such as SpreadEx are trading at 347.

So the starting point of my extensive UK general election analysis is what the UK housing market us saying in terms of the probable outcome. Will Boris Johnson get his Get Brexit Done majority, or will Corbyn go into coalition with the Scottish Independence Fanatics who would make the Northern Ireland border look like a girls scout picnic compared to what would follow an Scottish Independence vote. So far we appear to be heading for a minority Conservative government.

My next analysis in this series will look at the debt fuelled spending voter bribes of both main parties and to what degree they are likely to convince the electorate, especially considering the Corbyn socialist revolution that has taken Labour 2017 spending bribes and then doubled them for 2019!

The rest of election forecast analysis has first been made available to Patrons who support my work.

- UK House Prices Momentum General Election Forecast

- Labour vs Tory Manifesto Voter Bribes Impact on UK General Election Forecast

- What the UK Economy Predicts for General Election 2019

- Marginal Seats Analysis Election Predictor

- Social Mood and Momentum Election Impact

- Opinion Polls and Betting Markets, UK General Election Forecast Conclusion.

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.