You Should Be Buying Gold Stocks Now

Commodities / Gold and Silver Stocks 2019 Dec 06, 2019 - 06:09 PM GMTBy: Jordan_Roy_Byrne

A few weeks ago we noted the bullish setup for 2020.

Macro developments, one way or another will tend to favor Gold. There isn’t a realistic scenario that isn’t Gold bullish.

Note the comments from various Fed-heads last week. They are laying the groundwork to target higher than 2% inflation and won’t consider raising rates anytime soon.

And if they have to resume cutting rates Gold will obviously move higher.

On the technical side, GDX and GDXJ are in solid uptrends and trading within huge long-term bases.

The setup is there for a very profitable 2020 and recent developments should make us even more bullish.

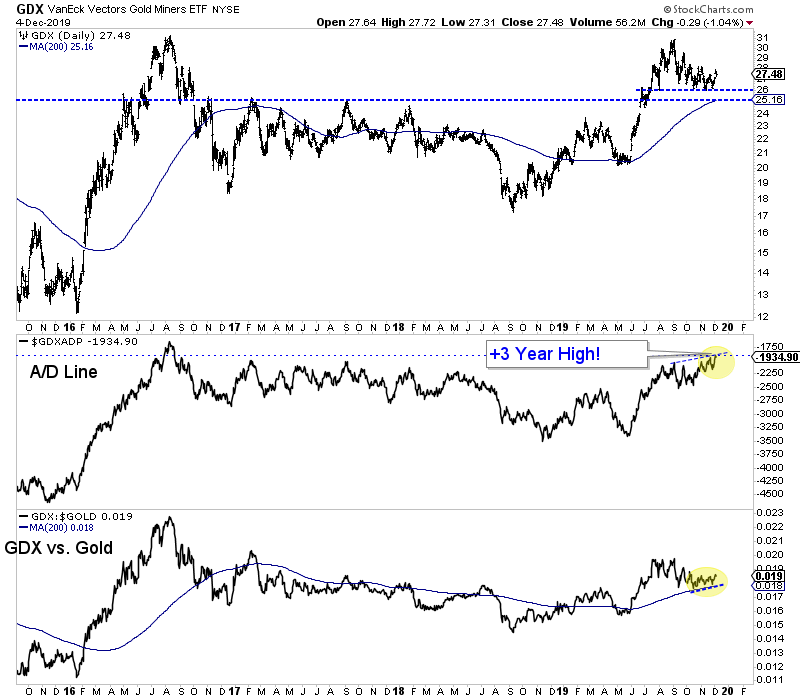

Take a look at the chart of GDX and the GDX advance decline (AD) line below.

There are several very bullish developments.

First, note the price action. GDX has held above $26.00 three times. Its been so strong that it hasn’t tested the 38% retracement from the September 2018 low of $25.70.

Second, on Tuesday the AD line (an important leading indicator) hit a three year high! That is an incredibly strong and significant positive divergence.

GDX, GDX Advance/Decline Line, GDX vs. Gold

Finally, GDX has been outperforming Gold. The GDX to Gold ratio closed Tuesday at a two month high. Keep in mind, this is during a correction for GDX.

While there are quite a few positives for GDX, it isn’t even the strongest part of the sector! The riskier parts of the sector such as juniors and silver stocks are outperforming.

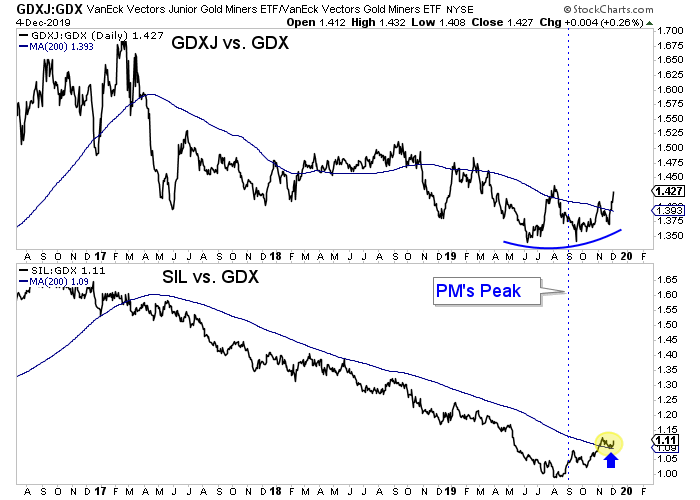

Below we plot GDXJ against GDX and SIL against GDX.

The sector peaked at the start of September and even as it has corrected, both SIL and GDXJ have clearly outperformed GDX and the ratios have broken above their 200-day moving averages.

GDXJ vs. GDX & SIL vs. GDX

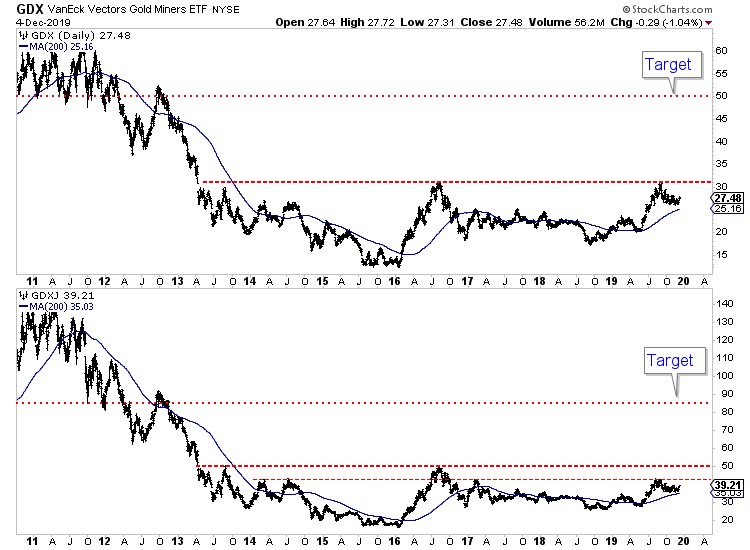

There are quite a few bullish developments as the sector has corrected and when we consider the massive bases in GDX and GDXJ (see below), it should make us all the more bullish for the next 12 to 18 months.

GDX & GDXJ Daily Bar Charts

The strong breadth (GDX AD line), the outperformance against Gold and the outperformance of the riskier groups (SIL, GDXJ) are exactly the things we want to see ahead of a major breakout. In other words, the market is leaving hints.

If you have followed my work, you know that I’m usually conservative. At times over the past few years I have been too cautious. But I have been a long-term bull.

Make no mistake. The next 12 to 18 months have a chance to be extremely profitable in gold stocks, silver stocks and gold and silver juniors.

Get positioned soon, buy on weakness and hold.

To learn the stocks we own and intend to buy during the next correction that have 3x to 5x potential, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.