Labour vs Tory Manifesto Debt Fuelled Voter Bribes Impact on UK General Election

ElectionOracle / UK General Election Nov 30, 2019 - 04:16 PM GMTBy: Nadeem_Walayat

My first article in this UK general election series concluded in a core forecast of seats for the Conservative party based on the single most accurate predictor of UK general elections - UK house prices momentum.

The remaining articles in this series in the countdown to voting day (December 12th) aim to fine tune my core expectation towards a final seats per party forecast.

- UK House Prices Momentum General Election Forecast

- Manifesto Debt Fuelled Voter Spending Bribes

- UK Economy Current State

- Marginal Seats, Social Mood and Momentum

- Opinion Polls and Betting Markets

- UK General Election Forecast Conclusion and Market Opportunities.

If one looks back to 2017 then two things stick out where the Manifesto's of the two main parties were concerned.

1. Jeremy Corbyn promising to ramp up government spending by nearly £50 billion per year or about 2.8% of GDP to be funded by tax hikes of £50 billion on the top 5%! That included a "Robin Hood" tax on financial transactions. Where in reality Labour would have been lucky to get half the tax hike they were budgeting for and thus set to increase the deficit by £25 billion per year. Where Brexit is concerned, Labour had ruled out a No Deal Brexit.

2. Theresa May's "strong and stable" promised to get Brexit done but no new voter bribes, just to continue to move towards raising the personal tax allowance to £12,500. A manifesto full of weak pledges with the underlying aim of balancing the budget by 2020 that translated into more economic austerity, hoping that the voters were too stupid to notice that they are getting nothing in exchange for the Tories wanting an increased majority. Which included the disastrous social care policy for the elderly and what came to be known as the "Dementia Tax" that cost the Tories many seats.

So the 2017 much like 2019 was supposed to be about Brexit which on face value should have favoured the Tories, but that's not how it things turned out. Instead the contrasting manifestos of Freebies vs Pain played a pivotal role in the Tories LOSING seats to Labour which was NOT reflected in any of the opinion polls at the time as it was deemed to be inconceivable that the Tories would actually lose seats on June 8th!

Have the Parties Learned Lessons from 2017?

Has Labour upped the ante and have the Tories learned their lessons from 2017 that the Voters EXPECT to be BRIBED at elections?

Labour - A Socialist Revolution Manifesto!

Labour under Jeremy Corbyn is literally promising the voters everything under the sun! Scrapping Universal Credit, Giving all public sector workers a 5% Labour pay bribe. Free personal care fore the elderly. Increase in annual NHS spending of £30 billion per year!

All of which translates into an increase in government day to day spending by £80 billion, 10% per year!

AND additional 'investment' spending of £55 billion a year. For a total annual increase in spending of £135 billion, more than 2.5X the tax bribes of 2017.

How does labour propose to pay for this spending binge?

TAX the rich! Corporations and the top 5% who already pay over 50% of the tax base are going to pay a whopping £83billion extra in tax per year!

What's going to happen if many of these corporations and individuals decide to migrate themselves and operations abroad. Which is much easier to do in the digital age!

Which means you can take Labour plans for raising an extra £83 billion per year with a giant mountain of salt. At best Labour will be able to reap a £30 billion increase which is set against a spending increase of £135 billion, resulting the budget deficit soaring by as much as £105 billion!

Conservatives - Promising to Under spend Again!

The Tories are promising tax cuts in the form of raising the National Insurance threshold and a modest spending programme that totals some £7 billion. Financed by scrapping plans to lower Corporation tax from 19% to 17% which is worth about £6 billion. So a a net give away of about £3 billion.

No wonder the Tories continuously bang on about "Get BrExit Done" because despite the propaganda of pumping extra money into the NHS and recruiting 20,000 more police officers, and building 40 new hospitals (actual 6). The Tories 2019 manifesto amounts to business as usual. Which is not going to go down well with the electorate who were repeatedly promised an END to Austerity.

Therefore Boris Johnson, for whatever reason is making a similar mistake to Theresa May by pinning too much on the getting Brexit Done slogan which like 2017 is not going to carry as much weight as they expect it to do. Not given the gap between Labour and Tory Manifestos that is even wider today than 2017. £105 billion of net Labour deficit spending vs about a net £3 billion of Tory deficit spending.

DEBT AND DEFICITS

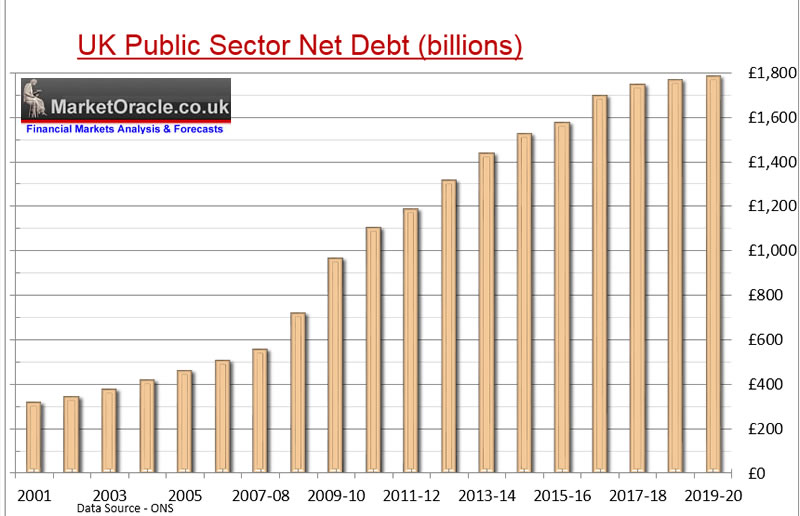

Looking at total government debt that partially includes Bank of England cooking the books (QE) projects to an estimated £1791bn for the year to April 2020 (ONS Data).

The debt graph on face value implies that the Tories over the past couple of years have managed to get a grip to some degree on what was a rampant build up in debt the consequence of which at the very least are stagflation. That should in theory allow the government some room to borrow for election bribes.

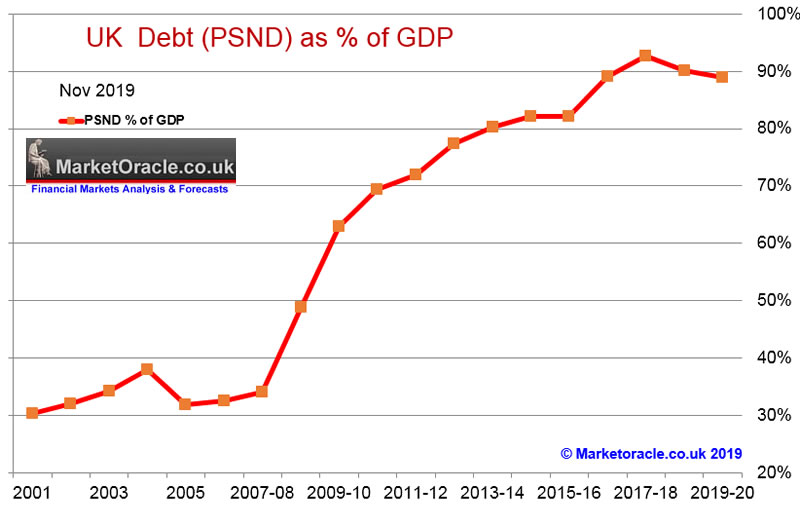

However, real debt to GDP paints a picture of an highly indebted economy that has NO ROOM TO BORROW! Let alone to go on a £135 billion Labour spending spree!

Note: Where Debt to GDP is concerned I am using official ONS figures that currently treat £170 billion of QE as a Government borrowing liability. However the central bank has monetized £430 billion of UK government debt (Gilts). What this implies is that the ONS is being selective in what it treats as government liabilities. Real Debt to GDP is actually far higher than what debt to GDP based on official figures implies. The only reason I am sticking with the official figures is because it is difficult to quantify the real world impact of total QE i.e. at what point does QE impact negatively given that the Government is effectively paying ITSELF interest on the £430 billion of Gilts held by the Bank of England, much of which is transferred back to the Government. So maybe £250 billion is the amount above where subsequent QE is treated as an increase in debt burden. Something to keep an eye on, especially if the ONS starts trending in the other direction by further cooking the books in the Governments favour that according to my calculations stands at £430 billion and not the £170 billion that the ONS factors into it's debt statistics.

The graph explains why Theresa May in 2017 had a net neutral election manifesto as the Government had literally no room to manoeuvre with Debt to GDP standing at 93% that looks set to fall to 89% by the end of the current financial year.

Current Debt to GDP of about 90% also answers the question why the likes of the IFS are warning that the Conservatives are likely to spend MORE than that which has been costed in their Manifesto because unlike Corbyn's Labour party the Tories in government understand that there really is NO room to borrow more unless forced to do so due to commitments, instead the debt to GDP chart is flashing a RED WARNING LIGHT for future tax hikes and spending cuts!

So it is s no wonder the Tory manifesto is weak and vague on spending, barely touching on the big elephant in the room, one of financing the growing burden of an ageing population which will likely result in higher spending and deficits than the Government is budgeting for.

Labour 's £135 billion annual spending spree resulting in a net increase of £105 billion of borrowing per year is just NOT GOING TO HAPPEN! Labours spending binge would see debt to GDP increase by about 5% per annum! Which means within a couple of years of a Labour government we would be passing 100% of GDP! A trend that would be accompanied by a severe sterling bear market prompting interest rate hikes and Inflation taking off even on the highly manipulated fake CPI inflation measure that tends to under report REAL inflation that people actually experience by half! I.e. Current real inflation is about 3% not 1.5%! whilst RPI a more accurate measure of UK inflation stands at 2.4%. Unfortunately the Government has plans to bastardise the RPI measure further by making changes to RPI to manipulate the rate lower towards that of CPI so as to complete the job of hiding Britain's real inflation from the general public which typically is twice the CPI rate i.e. currently 3%.

Manifesto's Impact on the General Election Forecast

The rest of this analysis has first been made available to Patrons who support my work: Labour vs Tory Manifesto Voter Bribes Impact on UK General Election Forecast

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.