Why You Should Buy Trailer Park Stocks

Companies / Investing 2019 Nov 28, 2019 - 05:35 PM GMTBy: Robert_Ross

10,000 baby boomers retire every day.

But retirement won’t mean endless rounds of golf or trips to Tuscany for a lot of these folks, who are now 55–75 years old.

In fact, retirement will lower the living standards of 40% of boomers, according to The Wall Street Journal. That translates to a lifestyle downgrade for 15 million American households.

It gets worse: One in three boomers has zero money saved for retirement. Zilch. Nothing. And 6 in 10 have less than $10,000.

Then there’s the debt problem. The average boomer is $99,000 in debt, according to the Wharton School.

This is all pushing boomers to rethink their retirement plans. For many, that means trailer parks…

They’re Called “Manufactured Homes” Now

The trailer parks I’m talking about look more like budget resorts. At least, that’s what I’d been told. And they’re called “manufactured homes” now.

Still, I had to see for myself. So I drove up to Napa to see one of these communities.

After parking at the entrance, I walked over to a perfectly manicured mini-golf course. Behind me, kids splashed around in an Olympic-size swimming pool. About 100 yards away, a community library sat in the shade of giant palm trees.

This certainly wasn’t a “trailer park” in the traditional sense. It was downright pleasant. The allure started to make sense.

For one, manufactured homes cost nearly $300,000 less than traditional houses. For retirees worried their nest egg won’t last as long as they need, it can be the perfect fit.

John Mauldin calls this problem longevity risk. And it’s something many retirees are coming to terms with.

Most retirees simply can’t afford their dream beach house. Far from it. So they’re turning to plan B: manufactured home communities like the one I visited.

4X the S&P 500

Investing in manufactured home real estate investment trusts (REITs) is a great way to ride this trend.

REITs own and operate real estate—everything from hospitals to warehouses to trailer parks. They trade just like stocks, but they’re required pay out 90% of their profits as dividends. So they’re great for income investors like us.

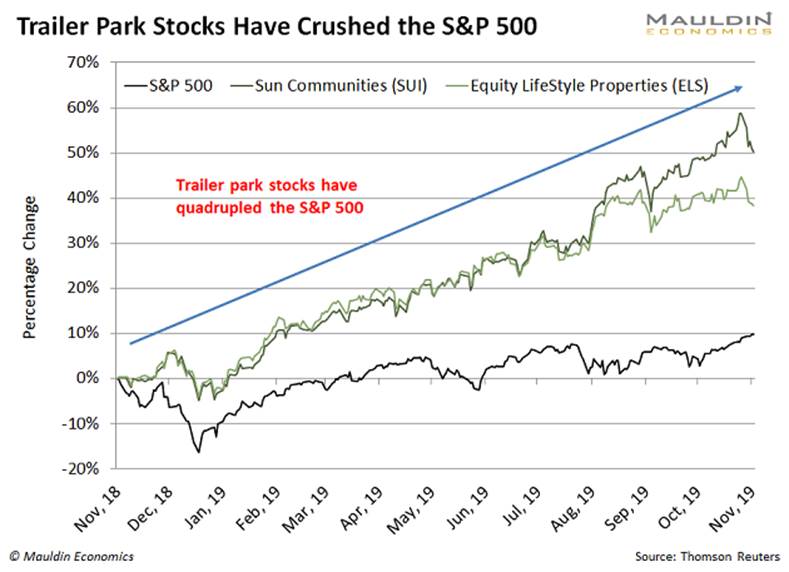

Last November, we talked about investing in two manufactured home REITs: Sun Communities (SUI) and Equity LifeStyle Properties (ELS). Since then, they’ve surged 53% and 42%, respectively. (The S&P 500 has risen 12.3% over the same period.)

Sun Communities and Equity LifeStyle have more or less quadrupled the S&P 500 over the last 12 months. But I think these stocks are just getting started.

The Great Downsizing Is Coming

Remember, 10,000 boomers are retiring every day with nowhere near enough money. But there’s a solution: 60% of US households own a home.

Duke University economics professor Charles M. Becker thinks many retirees will sell their traditional houses and move into manufactured homes.

"Trailer parks can be thought of as gated communities for people who aren't so wealthy,” says Becker.

In fact, manufactured homes have been the largest source of affordable housing in the US for 30 years.

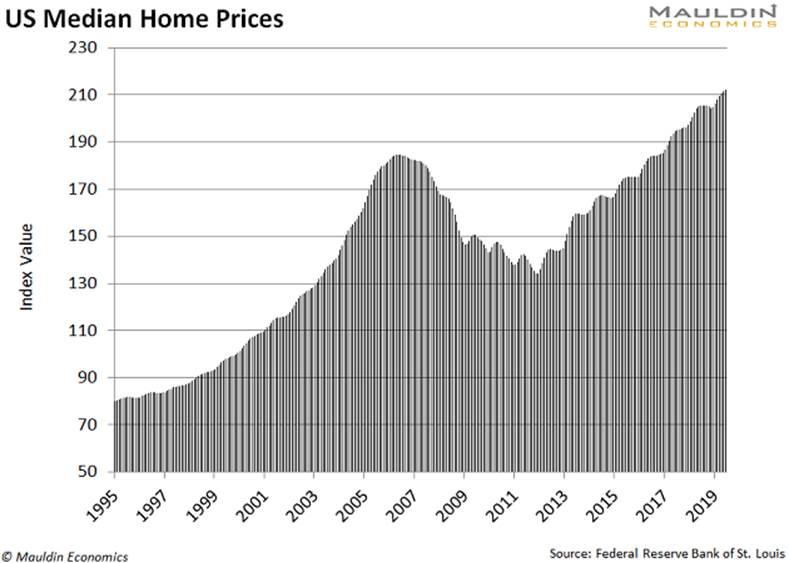

Meanwhile, US home prices are at all-time highs:

This means two things:

- Retiring boomers can sell their homes on the highs; and

- They can buy a much cheaper manufactured home and use the rest of the money for retirement.

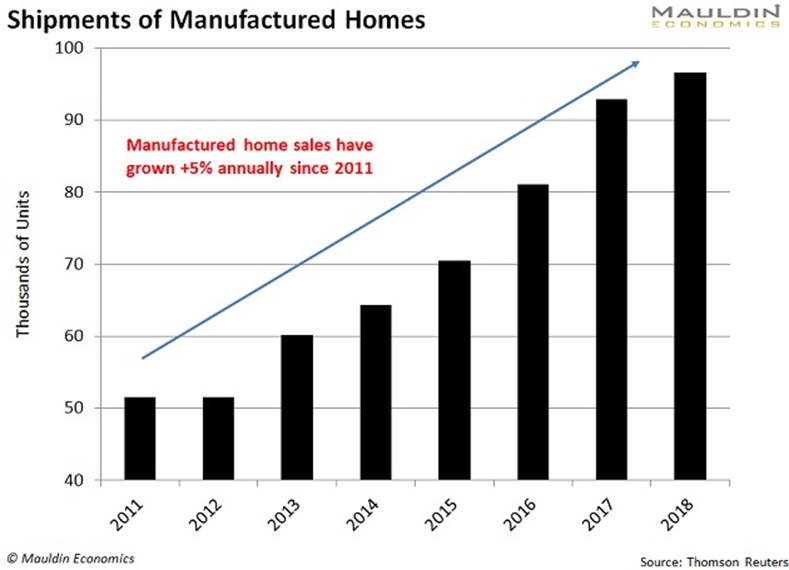

This trend is already in motion. Sales of manufactured homes are surging:

It’s no fluke that manufactured home sales started rising in 2011. That’s around the time boomers started to retire.

I’m not the only one connecting the dots here. Legendary investor Warren Buffett was an early mover in the manufactured homes space.

Buffett’s holding company, Berkshire Hathaway, bought Clayton Homes for $1.3 billion in 2003. Clayton is the largest builder of manufactured homes in the US.

Another Recession-Proof Trend

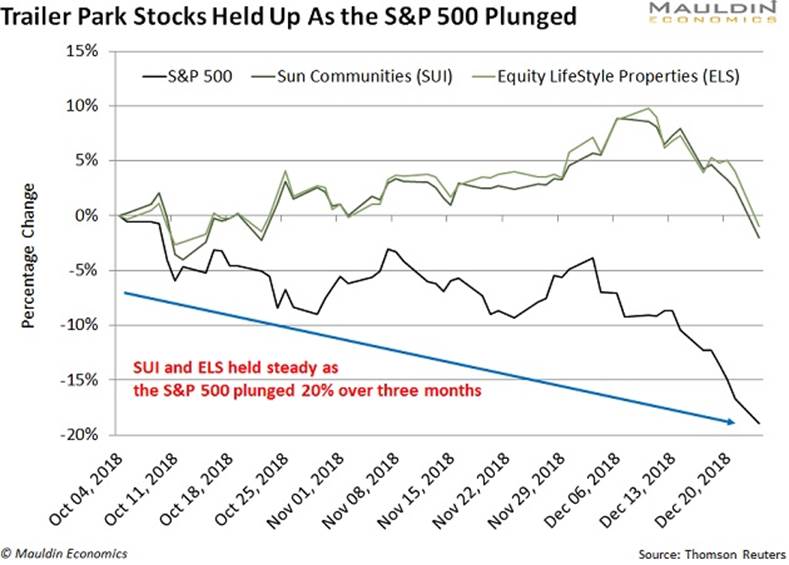

One of the best parts about manufactured home stocks is they’re incredibly resilient—just like Walmart (WMT).

Remember when the S&P 500 plunged 20% over three months late last year?

Sun Communities and Equity Lifestyle held up remarkably well during the freefall. Their respective stocks only dipped 2.7% and 1.5%.

Retirees will continue downsizing into manufactured homes for at least the next decade. Meanwhile, manufactured home REITs pay fat dividends. And they’ve been rising over three-times faster than the S&P 500.

Ever better, they also hold their value during a downturn—making them a good fit for any income investor’s portfolio.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

By Robert Ross

© 2019 Copyright Robert Ross. - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.