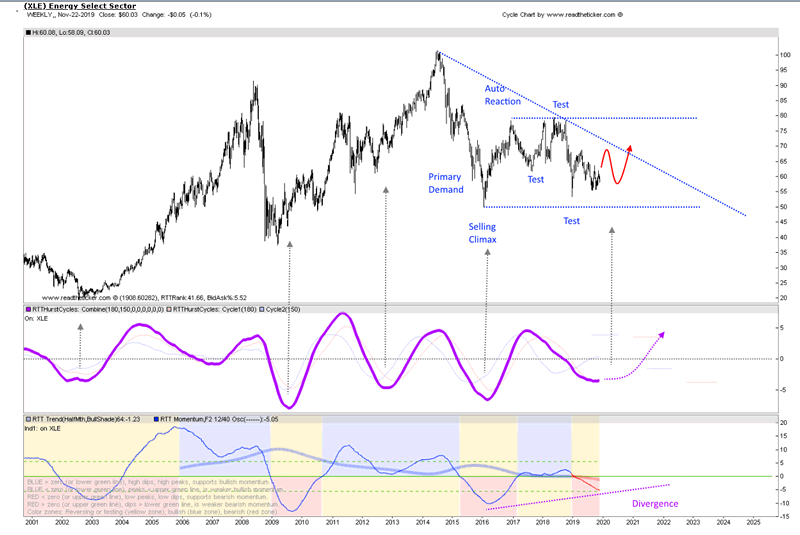

Energy Sector to Bounce Off Cycle Bottom into 2020

Commodities / Energy Resources Nov 26, 2019 - 06:51 PM GMTBy: readtheticker

Low prices fix low prices, and eventually the shorts will be forced to cover and buy back their shares and force prices higher. This sector is 'this close' to such and event. Both Hurst cycles and Wyckoff supply and demand action are warming up to the bullish side for the energy sector (XLE). This is on the back of growing inflation fears. Inflation sourced from wage growth in the US and world wide central bankers (Japan [BOJ], Europe [ECB] and the USA [FED]) printing money at the same time. You should note this has never happened before, all three at the same time, printing. Yes, the energy sector has suffered from the lower oil prices but soon the shorts will have to judge how much lower energy stocks can go, as you can see the SPDR Energy Etf (XLE) has been unable to get below $50. Demand is present. What to do? Watch for significant Wyckoff demand foot prints to see price test upper resistance (sign of strength), and then take action from a strong change of character.

SPDR Energy (XLE) dominate cycle.

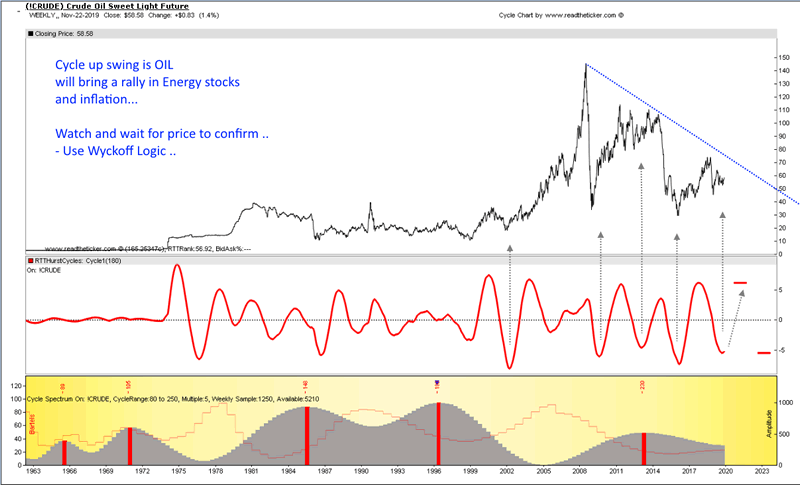

The energy sector leading commodity and the crude oil dominate cycle.

If the wider SP500 holds up into the US elections then energy stocks percentage returns could out perform. Bullish oil fundamentals from Mark Gordon

Fundamentals are important, and so is market timing, here at readtheticker.com we believe a combination of Gann Angles, Cycles, Wyckoff and Ney logic is the best way to secure better timing than most, after all these methods have been used successfully for 70+ years. To help you applying Richard Wyckoff and Richard Ney logic a wealth of knowledge is available via our RTT Plus membership. NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net Investing

NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net

Readtheticker

My website: www.readtheticker.com

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2019 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.