Latin America Sinks Under The Weight Of Its Third-Rate Currencies

Currencies / Fiat Currency Oct 27, 2019 - 12:41 PM GMTBy: Steve_H_Hanke

Latin America is plagued with many endemic economic problems. As a result, slow growth and economic instability are the order of the day. Latin America is sinking. In the grand scheme of things, it’s become irrelevant.

Latin America is plagued with many endemic economic problems. As a result, slow growth and economic instability are the order of the day. Latin America is sinking. In the grand scheme of things, it’s become irrelevant.

When it comes to listing culprits that account for the zombie growth rates in Latin America, the laundry list usually includes: high levels of corruption, a weak application of the rule of law, poor public services, a lack of public safety, and so on.

A quick look at the International Monetary Fund’s (IMF) most recent World Economic Outlook tells the tale. Six months ago, the IMF predicted that the region would grow at an anemic 1.4% this year. Now, the IMF has downgraded Latin America’s growth rate for 2019 to a measly 0.2%. Given the recent turmoil in Ecuador, Bolivia, and Chile, I think the IMF’s most recent forecast might be too rosy. And, if that’s not bad enough, the IMF forecasts for the next five years indicate that the prospects for the region are bleak. Indeed, the IMF’s five-year forecasts indicate that most of the countries in Latin America will grow below the global average for emerging market economies

The real problem that plagues most Latin American countries is the fact that they have central banks that issue half-baked local currencies. Although widespread today, central banks are relatively new institutional arrangements. In 1900, there were only 18 central banks in the world. By 1940, the number had grown to 40. Today, there are over 150.

Before the rise of central banking, the world was dominated by unified currency areas, or blocs, the largest of which was the sterling bloc. As early as 1937, the great Austrian economist Friedrich von Hayek warned that the central banking fad, if it continued, would lead to currency chaos and the spread of banking crises. His forebodings were justified. With the proliferation of central banking and independent local currencies, currency and banking crises have engulfed the international financial system with ever-increasing severity and frequency. What to do?

The obvious answer is for vulnerable emerging-market countries, like those in Latin America, to do away with their central banks and domestic currencies, replacing them with a sound foreign currency. Panama is a prime example of the benefits from employing this type of monetary system. Since 1904, it has used the U.S. dollar as its official currency. Panama’s dollarized economy is, therefore, officially part of the world’s largest currency bloc.

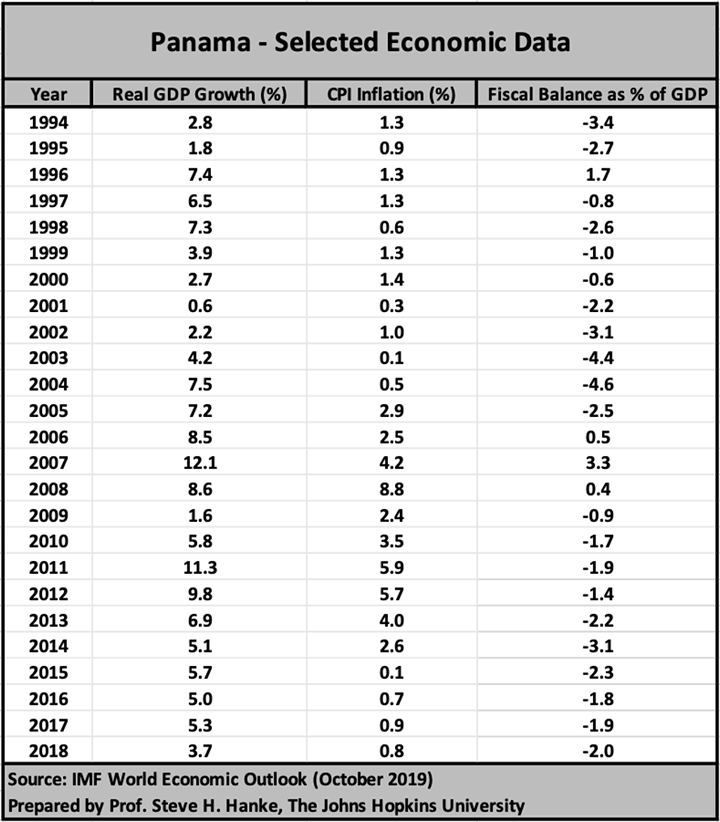

The results of Panama’s dollarized monetary system and internationally integrated banking system have been excellent (see the table below).

- Panama’s GDP growth rates have been relatively high. Since 1994, when the Mexican tequila crisis commenced, real GDP growth has averaged 5.7% per year.

- Inflation rates have been somewhat lower than those in the U.S. Since 1994, CPI inflation has averaged only 2.2% per year.

- Since Panama’s fiscal authorities can’t borrow from a central bank, the fiscal accounts face a “hard” budget constraint dictated by the bond markets. In consequence, fiscal discipline is imposed, and since 1994, Panama’s fiscal deficit as percent of GDP has averaged 1.6% per year.

- Interest rates have mirrored world market rates, adjusted for transaction costs and risk.

- Panama’s real exchange rate has been very stable and on a slightly depreciating trend vis-à-vis that of the U.S.

- Panama’s banking system, which operates without a central bank lender of last resort, has proven to be extremely resilient. Indeed, it weathered a major political crisis between Panama and the United States in 1988 and made a strong comeback by early 2000.

To avoid the pain described in the IMF’s World Economic Outlook, Latin American countries should dump their central banks and local currencies. They should follow Panama’s lead and adopt the greenback.

Follow me on Twitter. Check out my website.

By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2019 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.