The Coming Great Global Debt Reset

Interest-Rates / Global Debt Crisis 2019 Oct 22, 2019 - 01:17 PM GMTBy: Richard_Mills

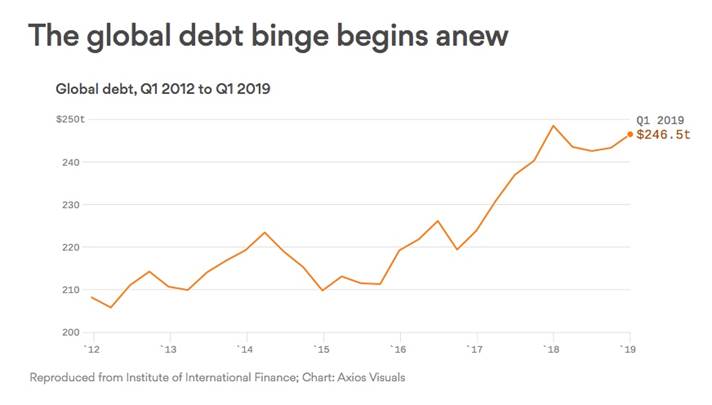

In the first quarter of 2019, global debt hit $246.5 trillion.

In the first quarter of 2019, global debt hit $246.5 trillion.

Encouraged by lower interest rates, governments went on a borrowing binge as they ramped up spending, adding $3 trillion to world debt in Q1 alone. It reverses a trend that started in the beginning of 2018, of reducing debt burdens, when global debt reached its highest on record, $248 trillion.

The first-quarter spending spree brought the debt pile to 318% of global GDP, the first quarterly increase in two years, according to the Institute of International Finance, “amid record levels of corporate and household debt in many mature markets,” CNBC reported.

Finland, Canada and Japan saw the largest increase in debt-to-GDP ratios of all the countries tracked by IIF, in a one-year period. The IIF study is alarming because high levels of debt put countries in a vulnerable position in the event of a downturn and could endanger the world's economic recovery, Axios reported in July.

According to the World Bank, countries whose debt-to-GDP ratios are above 77% for long periods experience significant slowdowns in economic growth. Every percentage point above 77% knocks 1.7% off GDP, according to the study, via Investopedia. The United States’ current debt-to-GDP ratio is 106.5%.

In other words, the country is accumulating about the same amount of debt – currently $22 trillion – as its annual economic output. Each year another trillion dollars gets added to the national debt.

Rising interest rates compound the problem. In 2008 interest on the national debt was $253 billion, and consumed 8.5% of the federal budget. By 2026 the interest is projected to be $762 billion and take up 12.9% of the budget. This is approaching the US Military’s current budget of $989 billion, which is the second largest line item in the budget, behind only Social Security.

According to its latest projections, the Congressional Budget Office says debt-to-GDP will reach 150% by 2047, well past the point where financial crises typically occur. The budget deficit is also likely to rise, nearly tripling from 2.9% of GDP to 9.8% in 2047.

This can't go on forever. It’s not a stretch to envision a scenario whereby the world’s reserve currency, the US dollar, collapses under the weight of unmanageable debt, triggered say, by a mass offloading of US Treasuries by foreign countries, that currently own about $6 trillion of US debt. This would cause the dollar to crash, and interest rates would go through the roof, choking consumer and business borrowing. Import prices would skyrocket too, the result of a low dollar, hitting consumers in the pocket book for everything not made in the USA. Business confidence would plummet, mass layoffs would occur, growth would stop, and the US would enter a recession.

All the countries that sold their Treasuries would then face a major slump in demand for their products from American consumers, their largest market. Eventually companies in these countries would begin to suffer, plus all other nations that trade with the US, like Canada and Mexico. Before long the recession in the US would spread like a cancer, to the rest of the world.

Nothing, not even the $, lasts forever

Apocalyptic visions like these have pundits emerging from strange places offering outside-the-box solutions. One of them is Canadian Mark Carney. The out-going Bank of England governor dropped a bombshell during a recent luncheon speech. In it Carney devoted 23 pages to describing why the US dollar's “destabilizing” reserve status in the world economy has to end.

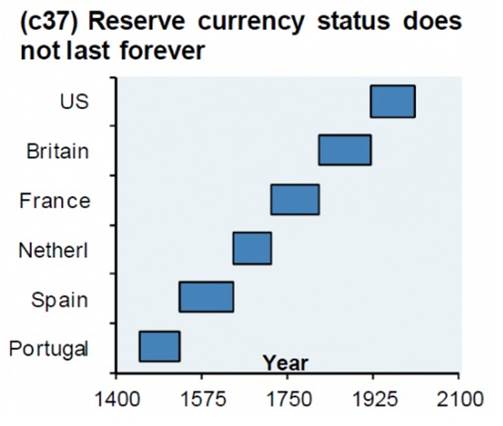

We find it interesting how Carney placed the dollar in historical context, stating in his speech that “[h]istory teaches that the transition to a new global reserve currency may not proceed smoothly.” We only have to look back to the shift from pound sterling to the US dollar in the early 20th century, to see that is true - “The disruption wrought by the First World War allowed the US to expand its presence in markets previously dominated by European producers.Trade that was priced in sterling switched to being priced in dollars; and demand for dollar-denominated assets followed.”

As the graphics below show, every couple of hundred years there has been a change in the world currency, dating all the way back to the denarius of ancient Rome.

Even more radical, but music to the ears of gold bugs, was his explanation of why central banks need to join together to create their own currency to replace the dollar, backed by either gold or a cryptocurrency. More on that below.

Global reset

Then this week, a central bank said gold could serve as a “trust anchor” for a renewed international monetary system, in the event of a “global reset”.

In an article on its website the De Nederlandsche Bank boldly claims, “If things go wrong, prices may fall. But, crisis or not, a gold bar always holds value.”

This of course is a likely scenario to gold enthusiasts who invest and believe in gold for its utility as a store of value when everything else - ie. fiat currencies - fails. But it was unusual to hear it from a central bank. We know central banks have been hoarding gold bars for going on two years now, in 2018 reaching an accumulation last seen in 1971; what we didn’t know was what they plan to do with it. In the article the Dutch National Bank gives us an intriguing clue:

“Gold is... the trust anchor for the financial system. If the whole system collapses, the gold stock provides a collateral to start over. Gold gives confidence in the power of the central bank's balance sheet.”

Indeed holders of dollars would find their once-powerful greenback reduced to monopoly money. People with gold would be the only ones left with any purchasing power to pay bills and buy day-to-day goods and services.

The Dutch central bank's comments about gold playing a key role in the event of a financial collapse begs a couple of questions: First, what is the reset that catalyzes the collapse of the financial system? Second, what are the consequences of this reset?

At Ahead of the Herd, we think the Dutch bank is talking about an unsustainable level of spending and debt, that is the catalyst for diminishing the US dollar and ending its reign as the world's reserve currency. Gold then takes over as a backstop to a new world currency.

The dollar's wane

The gist of Carney's argument is that the dollar's reserve status has conferred on it a status that it no longer deserves. While emerging-market economies have become more important to the world economy, contributing 60% to global activity versus 45% before the financial crisis, their currencies have not seen a corresponding increase in importance, viz a viz the dollar. The best example is the Chinese yuan.

Also, the dollar's use in half of international trade transactions is out of proportion to its share of world imports – five times more in transactions than imports - which fuels demand for US assets and exposes many countries that hold US Treasuries to damaging spillovers from swings in the US economy.

What Carney is hinting at here is the US dollar's loss of “exorbitant privilege”.

In the 1960s French politician Valéry d’Estaing complained that the United States and its exporters enjoyed an “exorbitant privilege” due to the dollar’s status as the world’s reserve currency. He had a point.

The dollar is the most important unit of account for international trade, the main medium of exchange for settling international transactions, and the store of value for central banks. The Federal Reserve is the lender of last resort, as in the 2008-09 financial crisis, and is the most common currency for overseas borrowing by governments and businesses.

While the attendees at the Bretton Woods conference in 1944 envisioned the USD enjoying these advantages in perpetuity, the reality is the greenback has been in decline for some time.

Since the Federal Reserve was created in 1913, the dollar has lost 95% of its value – its worth eroded by inflation.

The US debt currently sits at over $22 trillion and grows daily. In 2011 Standard & Poor, a ratings agency, downgraded US sovereign debt from AAA to a lowly A.

The 2008-09 financial crisis which started in the US through the sub-prime mortgage debacle, was another flag to the rest of the world signaling a move away from the dollar toward other currencies.

The quantitative easing (QE) programs that saw the Fed’s assets skyrocket from $900 billion to $4.5 trillion between 2019 and 2015 (through the buying up of mortgage-backed securities and US Treasuries, paid for by printing money), made it inexpensive for the US government to continue to borrow and spend - with rates close to zero.

However, three rounds of QE showed other countries that the United States was no longer following a sound fiscal policy; all they were doing was printing money.

Countries started to diversify their foreign exchange reserves and reduce their dependence on the dollar. According to the IMF, USD foreign exchange reserves fell to 61.63% in the second quarter of 2019 – the lowest they've been for six years. The euro, yen and yuan all increased their share from the previous quarter.

The dollar's, and the United States', loss of status has been exacerbated by the Trump administration, which has engaged in harmful trade disputes and a series of indelicate foreign policy blunders that cause others to question US leadership.

The two most obvious examples are the trade war with China and Trump's decision to throw out the mulit-national nuclear agreement with Iran and renew sanctions. The president also started a reckless war of words with Kim Jong-un over missiles tests, tried and failed to reach a deal “mano-a-mano” with the North Korean dictator, raised Germany's hackles over NATO contributions, and appeared to support Saudi Arabia's cover-up of a journalist's murder in Turkey. Most recently Trump has thrown former Kurdish allies under the bus and abandoned them to the tender mercies of Turkish armed forces intent on removing them from their homeland along the Turkish border with Syria.

US sanctions on Russia due to alleged meddling in the 2016 US election and the invasion of Crimea prompted Russia to sell 85% of its US Treasuries in 2018. Both China, Russia and Turkey have all been big gold buyers lately, rejecting dollar purchases as they look to distance themselves from Uncle Sam.

Runaway spending

And why wouldn't they? The US under the Trump administration has been punching above its weight. The country no longer walks softly and carries a big stick. If anything it's the other way round. Trump (and Joe Biden a Democrat presidential nominee) is like Mike Myers' “groovy” character Austin Powers who, cryogenically frozen in the 1960s, is revived in the '90s, not realizing that the world has changed.

Hence the testing of decades-old alliances, picking fights with adversaries, inciting racism at home, stacking the Supreme Court, sowing division amongst Republicans, all amid allegations that Trump interfered with an investigation into whether Russia helped get him elected, and pressured the Ukrainian leader to investigate Joe Biden – the subject of an impeachment inquiry.

But as America fights against those who threaten her hegemony and wealth – North Korea, China, Mexico, the EU, Iran, etc. - and tries to borrow and spend its way out of the financial quagmire it finds itself in, through low interest rates and monetary stimulus – others see a country that is no longer operating an economy responsibly enough for its currency to rule the world.

Its almost as though Trump is out to destroy capitalism. While that may sound crazy, he's doing all the things that capitalism's ultimate foe said would result in its downfall:

As Vladimir Lenin once said, “the best way to destroy the capitalist system is to debauch the currency” - subject it to an unsustainable level of government debt, then increase the money supply such that the value of the currency drops sharply. Think Weimar Germany, Mugabe’s Zimbabwe, Maduro’s Venezuela, where carts replaced wallets and purses as shoppers’ means of transporting paper money.

Obviously we aren't there yet, but we're moving in that direction.

The United States since World War Two has been the bully on the global block - challenged but not yet surpassed in economic nor military power.

World domination however comes at a heavy price to the national budget. Military spending is the main reason for the spiraling debt over the past few years; as a line item, it is second only to Social Security.

Last year President Trump signed off on a huge increase in defense spending. The 2019 National Defense Spending Authorization Act, with a budget of $717 billion, raises America’s troop levels to the highest in a decade. The NDSAA allocated $616.9 billion for the Pentagon, $69 billion for overseas operations and $21.9 billion for nuclear weapons programs.

According to the Stockholm International Peace Research Institute (Sipri), as the largest military in the world by far, the US has spent an average $650 billion every year since 2010. It spends more on defense than the next nine countries combined.

Not only does the US have easily the most powerful military with enough weapons to destroy the world many times over - about 6,550 at last count compared to Russia’s approximate 6,800 - it is also the biggest arms dealer.

The US now exports 34% of global arms sales. US arms sales are rising as Russia’s, the next largest arms dealer, are falling.

Indeed military spending is big business - the “military-industrial complex”, a term coined by President Eisenhower, is thriving.

Cuts are unlikely to happen due to the inertia of military spending that US defense contractors and the United States’ allies have grown used to.

The Washington Post recently published an article that examined this long-running nexus between defense and industry. It found that networks have expanded well beyond traditional “corporate giants bending metal for the Pentagon.” For example since 9/11, more agencies are involved in national security, stemming from the Department of Homeland Security’s creation in 2002-03. Large defense contractors like Lockheed Martin and General Dynamics now deliver a wider range of goods and services to the federal government. WAPO summarizes:

Since 9/11, an increasingly diverse array of firms have a significant stake in federal national security spending. Those funds now flow from a large portion of the federal government and into many sectors of the U.S. economy. If anything, Eisenhower’s complex has become more complex and potentially influential.

Americans used to look to Republicans to be fiscally responsible, but President Trump has proved anything but.

According to an analysis by The Balance, former President Obama added a total of $8.5 trillion to the debt during his two terms – including his 2009 stimulus package that caused a deficit of $1.4 trillion. However despite a lack of recession, Trump's full-year 2020 budget creates a $1.1 trillion deficit.

Trump has his supporters and a whole army of opponents on the left, many of whom will come out in November 2020 to try and turf him from the White House. Unfortunately however, Democrats lining up for a shot at the title of 46th President are following an equally ruinous road with respect to the economy.

Modern Monetary Theory is a new way of approaching the US federal budget that is both unconventional and absurd. It posits that rather than obsessing about how large the debt has grown (over $22 trillion) and the ongoing annual deficits that fuel debt, we should focus on spending, specifically, how the government can target certain spending programs that will cause minimal inflation. Fiscal policy on steroids is, according to its proponents, to be the new engine of US growth and prosperity.

Government is therefore given a free pass on spending, because the only thing that we have to worry about with the national debt is inflation. Curb inflation and the debt can keep growing, with no consequences. This is because the US government can never run out of money. It just keeps printing money, because dollars are always in demand (with the dollar being the reserve currency, and commodities are traded in dollars).

One of MMT’s main proponents is Stephanie Kelton, an economics professor who advised Bernie Sanders’ 2016 presidential campaign. Among the statements she makes in a video explaining MMT, Kelton says “The US dollar is a simple public monopoly. In other words, the United States currency comes from the United States government.”

That means the federal government doesn’t need to “come up with the money” in order to be able to spend. It just prints money and spends it.

From this follows the logical conclusion that deficits don’t really matter; the only thing that matters is inflation. According to Kelton, “The only potential risk with the national debt increasing over time is inflation. To the extent that you don’t believe the US has a long-term inflation problem, then you shouldn’t believe the US has a long-term national debt problem.”

Is MMT not the very definition of “debauching the currency” as Lenin predicted?

If you think MMT is only a theory that will never be put into practice, consider that the leading contender for the Democratic presidential nomination, Elizabeth Warren, has not exactly rejected the idea, as reported by Vox:

While emphasizing that “debt matters,” Sen. Elizabeth Warren (D-MA) recently noted, “we need to rethink our system in a way that is genuinely about investments that pay off over time.”

If Democrats win the presidency and Congress in 2020, look for four years of runaway spending, piling even higher deficits onto the national debt, and casting further doubt on the US dollar's ability to handle its reserve status. Do bond-holders still believe the US is incapable of defaulting on its monstrous debt?

Modern Monetary Theory and the ideas of the Democratic Party’s far left fit like hand and glove. Pleas for universal medical coverage, free college tuition and a minimum $15 per hour wage can all be paid for by setting the money presses free.

That to me sounds a lot like kicking the proverbial can down the road. Only this can is more like a grenade that is going to blow up in your face.

The Manhattan Institute cited in an article by The American Interest estimated that this year, the US government will spend $35,148 per household and collect only $26,677 -

nice for us, not so nice for our children and grandchildren. That $8,471 gap must be paid back somehow, some day. [Neo-Keynesians such as Harvard's Larry] Summers and [colleague Jason] Furman, not ones to obsess about budget deficits in the here and now, concede that “running budget deficits does not replace the need to raise revenue or cut spending. It merely defers it. Sooner or later, government spending has to be paid for.” Sooner if by your children, later if by your grandchildren. Herbert Hoover had it right when he told the Nebraska Republican Conference in 1936: “Blessed are the young, for they shall inherit the national debt.”

Conclusion

The conclusion we reach from this coming US move towards socialism, MMT and increasing the feeding of the bloated military industrial complex, is that the only for investors to protect themselves against a massive financial shock radiating from the collapse of the US dollar under a mountain of spending-fueled debt, must be to own gold.

We're not sure when the global reset will happen, or what will be the trigger – ie. a corporate debt timebomb that could crash the global economy. Almost $19 trillion dollars of debt is owed by companies that don’t earn enough to cover interest payments.

We are absolutely sure the reset will happen and gold will play a very important role in the transition to a new world currency.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.