$100 Silver Has Come And Gone

Commodities / Gold & Silver 2019 Oct 16, 2019 - 08:42 AM GMTBy: Kelsey_Williams

In January 1980, the price of silver peaked at just under $50.00 per ounce. From its low in October 1971 at $1.27, silver had risen thirty-nine fold in little more than eight years.

In January 1980, the price of silver peaked at just under $50.00 per ounce. From its low in October 1971 at $1.27, silver had risen thirty-nine fold in little more than eight years.

There was talk about higher silver prices, as much as $100.00 per ounce and more. Yet, only a few months later, silver was down to $10.00 per ounce. That amounted to a decline of nearly eighty percent from its peak.

Silver bulls were not deterred, however. They continued to stress the “fundamentals” which would lead to higher silver prices, but their dreams turned into nightmares. The price of silver continued to fall.

By January 1993, thirteen years after knocking on the door at $50.00 per ounce, silver was priced as $3.36 per ounce. The pain continued for eight more years as silver continued to trade under $5.00 per ounce.

Finally, silver started moving higher. Eventually, after thirty-one years, silver was back at the same door. In April 2011, silver knocked again at $50.00. The door still did not open, and silver fell back again. Within four years, silver’s price had fallen below $14.00 per ounce, a decline of more than seventy percent.

Now, once again, people are giving voice to expectations of silver suddenly rocketing much higher. But why? Even after its recent price rebound, silver is sixty-five percent cheaper than it was eight years ago.

Of course, $100.00 per ounce is just the beginning; that is, according to those who throw those numbers around. That’s good, because even if silver were to immediately jump to $100.00 per ounce from here, it would still be forty percent cheaper than it was in January 1980 at $50.00 per ounce.

That is because silver’s price in today’s dollars already exceeded $100.00 per ounce on that same date; and it has never come close again.

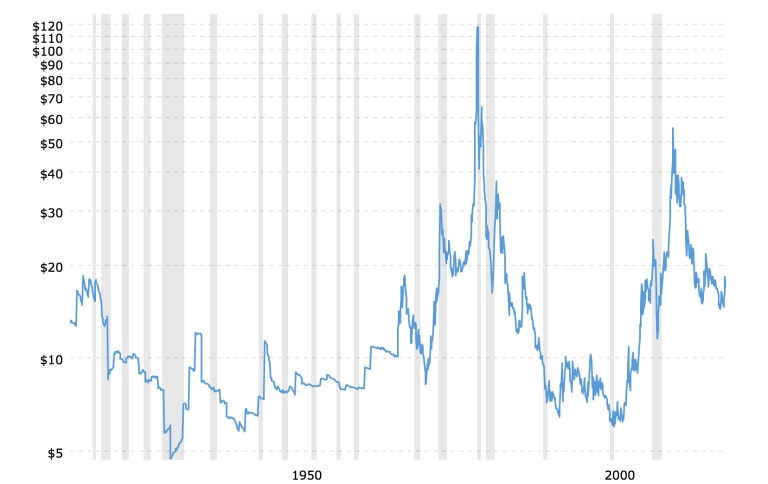

You can see what this looks like on the chart below, which is a one hundred year history of silver prices on an inflation-adjusted basis…

On an intraday basis, the high of $49.45 was the equivalent of $163.00 per ounce in today’s dollars. (The average closing price of $35.75 per ounce is shown on the chart. This equates to $118.00 per ounce in today’s dollars.)

When silver again approached $50.00 per ounce again in 2011, it did not come close to matching its previous high in 1980. In inflation-adjusted dollars, silver’s peak price ($48.60) in 2011 was only one-third as high as in 1980 – $55.50 compared to $163.00.

At $17.50 per ounce, today, silver needs to increase by almost five hundred percent to reach the $100.00 mark. And, it needs to be at least $163.00 per ounce just to match its January 1980 high.

Think about that.Even if it manages to reach the vaunted $100.00 price, silver will still be forty percent cheaper than it was fifty years ago.

The next time you hear that silver’s big day is just around the corner, ask yourself what has changed. Silver’s fundamentals are not much different today than they have been for the past half-century. And silver’s price history doesn’t indicate anything that supports or justifies projections of $100.00 per ounce and higher. (see Silver Is Cheap – And Getting Cheaper)

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2019 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.