Free Market Capitalism: Laughably Predictable

Stock-Markets / Financial Markets 2019 Oct 07, 2019 - 02:38 PM GMTBy: The_Gold_Report

Sector expert Michael Ballanger offers his observations on recent market fluctuations.

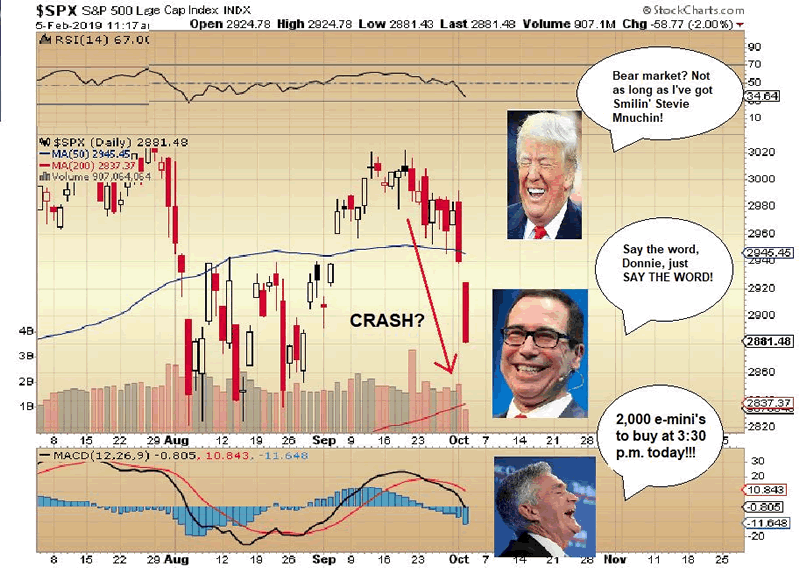

On Wednesday, as the kiddies were upset over a swooning S&P, then trading a paltry 5% from the all-time high of 3,027, I tweeted out this graphic that perfectly describes my cynical view of the paper markets around the world.

What prompted me to exercise my artistic flair was that the screams were loudest in the world of social media where the Millennial Horde had leveraged Mommy's 2018 BMW Roadster convertible in order to trade S&P futures from the long side. "Cut rates!" they type-screamed using CTRL-B,U,I for emphasis; "Do the China Deal, Donald!" as margin calls came flooding into their inboxes. And as surely as the sun rises and gold gets hammered on an NFP Friday, the invisible hand reached out and rescued them with mercurial deft and timely precision. All is now right with the world, and stocks are charging back toward the highs with a 57-point turnaround in the S&P in less than two trading sessions. As I tweeted out [yesterday], it was (and is) laughingly predictable.

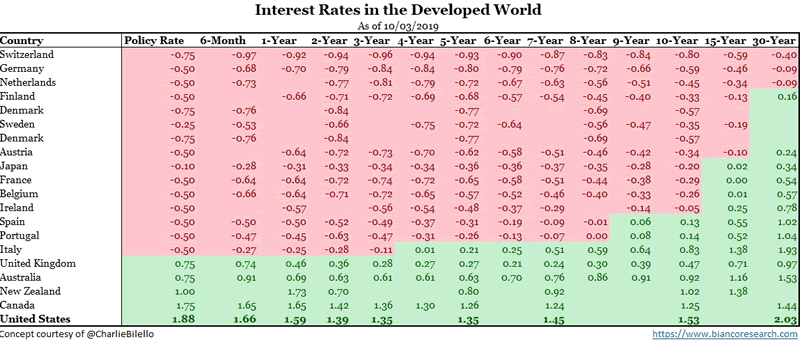

Now, to underscore the absurdity of this obsession with rising stock markets, take a peak at the next graphic courtesy of Bianco Research. The pink section is all bonds trading at a negative yield, while the green is what would be historically "normal"—you know, a bond that pays the holder that is taking all of the risk a positive return. Is it any wonder that money managers around the world are all flooding into stocks, when over 50% of sovereign (not corporate) bonds are penalizing their owners?

Do any of you recall the term "lender of last resort?" That term refers to the reason why sovereign bonds and bills are assigned a heavenly credit rating, which assumes that, because they own and control the power of taxation, there will always be a working population upon which governments can rely for interest coverage. Where corporations and individuals can file for bankruptcy protection in favor of the bondholder, sovereign nations enjoy the realm of privilege and are blindly obeyed until exogenous shocks to the status quo occur, which place a sovereign nation in default.

The last two countries to default on debt were Greece and Venezuela, and while Greece has had its standard of living stabilized under the shelter of the ECB (European Central Bank) umbrella, Venezuela has no such safety net and its citizens are suffering a malaise not unlike Wiemar Germany 1921–1923 or Zimbabwe post-1986. Now look at this list of countries on "credit default watch," as measured by spreads on credit default swaps.

- Ukraine

- Pakistan

- Egypt

- Brazil

- South Africa

- Russia

- Portugal

- Kazakhstan

- Turkey

- Vietnam

Around the turn of the century, there was an acronym that combined four countries believed to be global growth drivers for the new millennium, then known as BRIC (Brazil, Russia, India and China). They were the darlings of the Wall Street analytical community for years until quite recently. For reasons beyond all logic, two out of four of them are now on the "watch list" (Brazil and Russia), with China's current trade war with the West and its suspect shadow banking system making them a soon-to-be-added member. South Africa used to be one of the most dependable and credit-worthy countries on the planet until a socialist thug took over (sharing a common history with Venezuela), and Brazil was once lauded and applauded for its thriving mining and agricultural foundations. Even Germany, the industrial and political backbone of the ECB, has not one bond or bill yielding positive returns.

I submit to you, my friends, that the malaise to which I refer, starting with the blatant control of all markets (bonds, stocks, Forex and commodities) by government interference is symptomatic of the accelerating early stages of a massive global debt disease. You have read my thoughts on "mistrust"; now you actually can quantify it in the chart shown above. Those negative yields are a wailing air-raid siren, just like 1941 London, and the 2019 version of the Luftwaffe is debt, pure and simple.

The best and only real defense against a debt implosion is to have your wealth held outside of the traditional banking system, because as we have seen in the countries over time that have defaulted, governments, aided and abetted by their police and armed forces, think nothing of confiscating your wealth "for the common good," meaning, for their "job security." They cannot confiscate that which they don't see, which is precisely why they are jamming the notion of a "cashless society" down your throat. However, this is a very well-trodden path of discussion and debate that you have all heard and read before, so I shall move along.

Nothing new to be seen here:

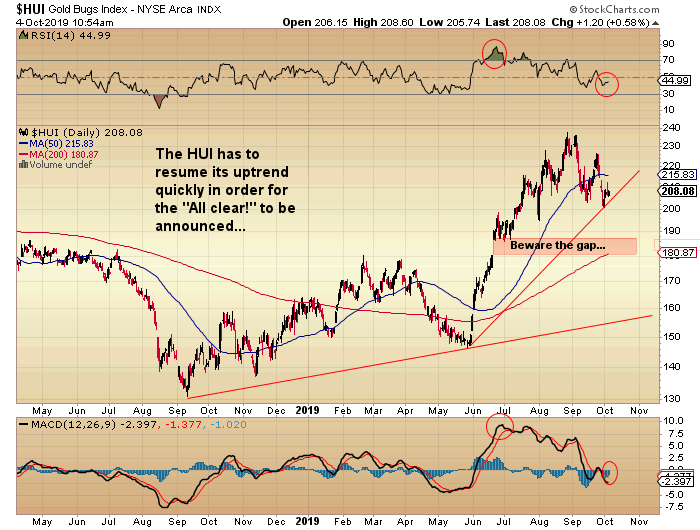

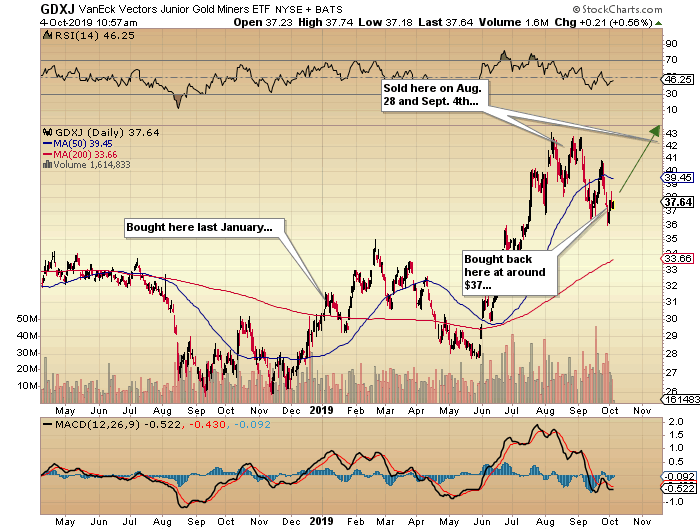

The gold miners, as represented by the HUI (ARCA Gold Bugs Index), have treated me very well thus far in 2019, and while I lament the early exit from the leveraged ETFs (NUGT/JNUG), I did make decent money on both. But where I made "the cut" was on the exits of GDX, GDXJ, GBR.V., and the SLV calls, all in that topping window from Aug. 28 until Sept. 5.

The hate mail I received was nothing short of profane, and in some cases threatening. While I looked on dispassionately, I dumped all of my precious metals paper holdings while retaining all physical positions in gold and silver. I have now started accumulating from the long side of the paper markets (miner ETFs), and have initiated a small position in the SLV December $18 calls, with two purchases in the past two weeks at $0.23 and $0.47, for an average price of $0.35. I look for a retest of the $18.35 high before year-end. As I stated a few missives ago, I feel far more comfortable owning these positions, with small losses or break-evens, than being on the sidelines with a pile of rotting cash, just sitting there in the full envious view of bankers and government bureaucrats.

As to gold and silver, my only point of concern is the gap shown above in the HUI chart. There is an old saw —all gaps must be closed—and whether or not this one proves to be true shall remain to be seen. I have chosen to disregard it because the cause of the gap was a runaway up-thrust in gold after the $1,375/ounce breakout. Like so many other "rules" that gold and silver have tossed aside since June, I am aware of the gap but simply not acting upon it.

As I am writing this on Friday morning due to an afternoon engagement, I will not be able to comment on the COT until Monday. But suffice it to say that I expect a massive reduction in the aggregate shorts in gold held by Commercials, offset by a similar reduction in longs held by Large Speculators. Watching the plunge in open interest and the sudden and very mysterious halt in the declines of the precious metals, it is eerily reminiscent of the same "mysterious" action when it topped on Sept. 4. It is the Commercial Cretins at work doing exactly what they have been doing for ages because it is obvious that the RICO action brought against JP Morgan has done squat to deter their criminal behaviors.

I urge you all to follow me on Twitter (@Miningjunkie ) in order to get all of the intraday musings (and trading suggestions) that pertain to this abomination called the stock "market." The month of October is hard upon us and as the intraday events happen too fast for e-mail, Twitter notifies followers of opportunities within seconds. In this world of algobots and managed prices, speed is a tactical advantage and Twitter is one application that delivers.

Follow Michael Ballanger on Twitter ;@MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver Ltd., Great Bear Resources, Western Uranium, Stakeholder Gold, Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My firm no longer does consulting work for Stakeholder Gold.. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium and Aftermath. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Getchell Gold, Western Uranium and Stakeholder Gold and Aftermath, companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.