Corporations Implodes, GE Credit Default Swaps Soar, Ford Sales Plummet

Companies / Credit Crisis 2008 Oct 01, 2008 - 02:56 PM GMTBy: Mike_Shedlock

MarketWatch is reporting U.S. Sept. ISM manufacturing index plunges to 43.5%

MarketWatch is reporting U.S. Sept. ISM manufacturing index plunges to 43.5%

WASHINGTON - The nation's manufacturers cut back production at a much faster pace than expected in September, the Institute for Supply Management reported Wednesday. This is the lowest level since October 2001. The ISM index plunged to 43.5% in September from 49.9% in August. This is the biggest drop in the index since 1984. The drop surprised economists. The consensus forecast of estimates collected by Marketwatch was for the index to slip only a bit to 49.6%. Readings below 50 indicate contraction. The ISM index has been holding near 50 since the summer. The previous low this year was 48.3 in February. Economists said the ISM index was near recessionary levels.

A Surprise?

Why that was a surprise would normally be a surprise, except for the fact that economists have been negatively surprised for months on end. Thus, the surprise would have been if there was no surprise.

GE Credit Default Swaps Widen

GE has suspended its buyback program as CDS Spreads Widen, Shares Fall .

General Electric Co. said it has been able to sell corporate paper and fund operations without tapping bank lines, seeking to quash speculation that led to a surge in its credit default swaps and a slump in the stock.

Chief Executive Officer Jeffrey Immelt last week said 2008 profit will be less than previously predicted, the second time this year he cited turmoil in financial markets in lowering the forecast for the second-largest U.S. company. GE today repeated Chief Financial Officer Keith Sherin's Sept. 25 comment that the $62 billion in bank lines backing up its corporate paper will "absolutely not" be tapped.

Credit-default swaps protecting against a default by GE Capital Corp. for five years climbed as much as 125 basis points to 740 basis points and last traded at 700 basis points, according to broker Phoenix Partners Group. An increase in the contracts, used to hedge against losses or to speculate on creditworthiness, suggests a decline in investor confidence.

General Electric last week suspended its stock buyback, shifting capital to protect its dividend and AAA credit rating. The company said it has slashed its commercial paper to below $90 billion, a goal Sherin announced last week to investors.

Credit Line Will "Absolutely Not" Be Tapped

If the credit line will Absolutely Not Be Tapped, then GE should get rid of it. Banks would love to free up those credit lines.

Market Calls GE's Bluff

GE Weekly Chart

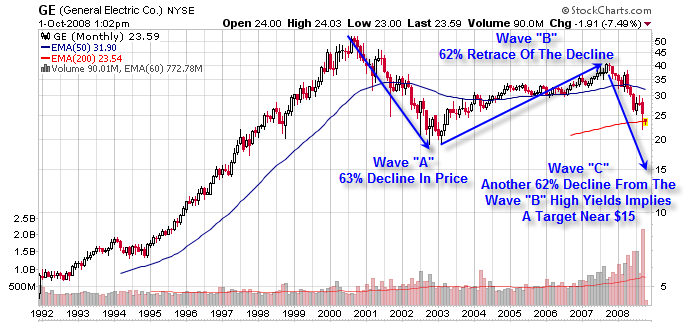

GE Monthly Chart

An Elliot Wave ABC count yields a target near $15 for the bear market low. There is no guarantee it gets there. Also note a clean 5 waves down from the 2007 high on the weekly chart. That suggests a possibility there could be a short term bounce now. However, that 5th wave down could easily extend. Longer term, I am sticking with the ABC count as being the best count.

Ford Sales Fall 35%

Bloomberg is reporting Ford, Honda U.S. Sales Plummet as Credit Tightens

Sales at Ford, the second-largest U.S. automaker, fell 35 percent from a year earlier, the Dearborn, Michigan-based company said in a statement today. Honda reported a 24 percent drop.

Industrywide sales probably will fall for the 11th month in a row, the longest slide in 17 years, as the financial crisis caused lenders to toughen loan standards and consumers curbed spending. Sales already had dropped 11 percent through August, in part because of high gasoline prices.

Ford said its sales fell to 120,788 cars and trucks from 184,612 a year earlier, the 22nd decline in the past 23 months. U.S. sales of pickup trucks, sport-utility vehicles and vans for its U.S. brands tumbled 39 percent, as it sold 42 percent fewer F-Series pickups. Car sales for the Ford, Lincoln and Mercury brands fell 19 percent.

Honda, Japan's second-largest automaker, sold 96,626 vehicles, down from 127,200 a year earlier, spokesman Chris Martin said in an interview. Sales fell across the Tokyo-based company's product line, except for the revamped Fit subcompact, he said.

"We've done nothing different, but customers just weren't coming into dealerships," Martin said.

No one in their right mind can deny the consumer led recession has started. It will be long and painful regardless of whether any bailout plan is passed. In fact, the recession will be much longer if the Paulson Plan does pass. $700 billion of taxpayer money will be wasted bailing out failed banks and failed foreign owners, and that money could have been put to far better use rebuilding infrastructure.

Please see Trichet, Brown Pressure Bush To Pass Bailout Plan and Rep. Brad Sherman On Bailing Out Foreign Investors for more details on Paulson's faulty bailout proposal.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.