Increased Pension Liabilities During the Coming Stock Market Crash

Stock-Markets / Pensions & Retirement Sep 12, 2019 - 01:33 PM GMTBy: Nick_Barisheff

Many Canadian companies have significant unfunded pension liabilities on their balance sheets. With the traditional 60/40 allocation to stocks and bonds, pension deficits may become unmanageable during the next market correction if they are not dealt with urgently. Governments can afford to ignore this looming disaster and act irresponsibly largely because they can print money; however, corporations cannot afford the risk of unfunded liabilities nor can they eliminate pension deficits as easily. We would like to take this opportunity to illustrate how these pension deficits can be taken in hand.

Many Canadian companies have significant unfunded pension liabilities on their balance sheets. With the traditional 60/40 allocation to stocks and bonds, pension deficits may become unmanageable during the next market correction if they are not dealt with urgently. Governments can afford to ignore this looming disaster and act irresponsibly largely because they can print money; however, corporations cannot afford the risk of unfunded liabilities nor can they eliminate pension deficits as easily. We would like to take this opportunity to illustrate how these pension deficits can be taken in hand.

President Barack Obama’s administration racked up nearly as much debt in eight years as in the entire 232-year history of the US before he took office. He entered office with $10.7 trillion in total debt, and he bowed out with the country owing $19.9 trillion. That’s an average tab of $1.15 trillion a year.

Under President Donald Trump, the debt has continued to climb. The $2.18 trillion increase works out to about $1.05 trillion a year, or slightly less than the pace Obama set.

While the magnitude of direct debt is a formidable problem, unfunded liabilities are a much bigger predicament—promises that the government has made that need to be paid in the future. As of 2019, total unfunded liabilities in the US, consisting of Social Security and Medicare liabilities, amount to $122 trillion. To put this into perspective, it works out to over $380,000 per US citizen. This hidden liability brings the total debt-to-GDP ratio to 120.15%.[1]

Compared to the US, Canada’s total household debt seems much smaller at $1.8 trillion, plus unfunded liabilities for Canada Pension Plan, Old Age Security and Medicare adding another $2.2 trillion, for a total of $4 trillion. This is only slightly less, proportionately, than the US, but it still equates to $243,000 per citizen, or 97% of GDP.

The biggest problem hidden under the surface is unfunded pension liabilities in private and government pension funds. In Canada, total pension assets are $1.63 trillion. According to Bloomberg, 103 companies listed on the TSX have unfunded liabilities of $15 billion. While many companies have switched to defined contribution plans for new employees, there are still many grandfathered defined benefits plans for past employees. These liabilities are part of corporate liabilities on the balance sheet, and they have a negative impact on the company’s share price. While the large pension funds that have in-house portfolio managers also own real estate and infrastructure, the smaller pension funds only hold the traditional 60/40 portfolio of stocks and bonds. According to Willis Towers Watson, a global advisory, broking and solutions company, the average return for global pension funds in 2018 with a 60/40 allocation was -5.7%, and this disappointing performance was during the longest bull market in history. Over the past ten years, it averaged 4.46%[2]; however, even these returns were below the target benchmark, resulting in growing pension liabilities. Adding to pension shortfalls is increased longevity, reduced birthrate and the increase in retirement in the largest sector of the population. When pension funds were initially set up in the 1950s, there were 16 working employees per retiree. In 2030, however, after the last baby boomer turns 65, there will be only about 2.3 workers per beneficiary.

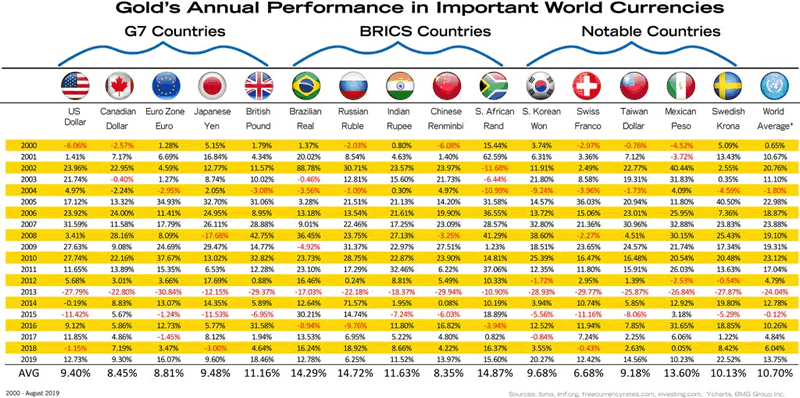

What is astonishing to me, after having read dozens of white papers and reports written by the most prominent pension fund consultants, is that not a single one even mentioned gold or REITs as an asset class, let alone recommended a portfolio allocation. This is very surprising, since REITs have been the best annual performing asset class, followed by gold. Stocks and bonds have trailed behind for over 40 years. The average annual return for gold since 2000 has been 9.9% per year in US dollars, far in excess of the 4.46% average return for pension funds. Gold’s 10-year return averaged 10.5 % in all currencies. It must be reiterated that gold and REITs were never even mentioned in any of the papers on portfolio allocation.

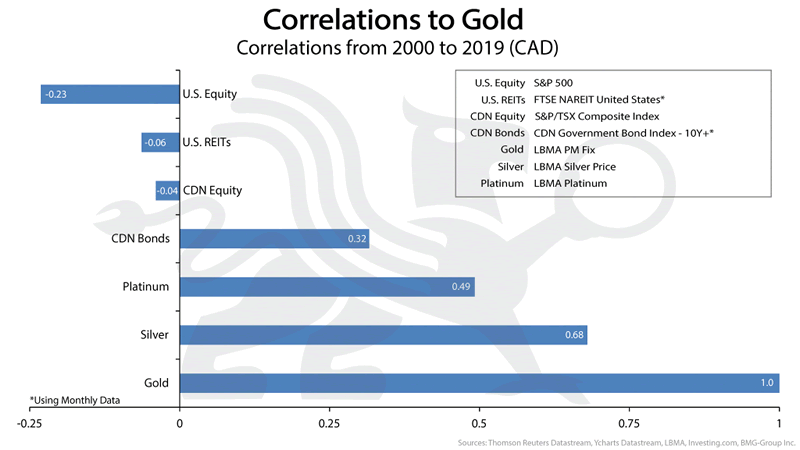

It is hard to believe that, even though almost everyone agrees with portfolio diversification, no one actually does it. There are seven asset classes: cash, stocks, bonds, commodities, real estate, precious metals and alternatives. Most pension portfolios only hold two asset classes—60/40 stocks and bonds. According to business management consultants Ibbotson Associates, Inc., stocks and bonds have been correlated since 1969 and, as a result, will not reduce losses in a broad market correction.

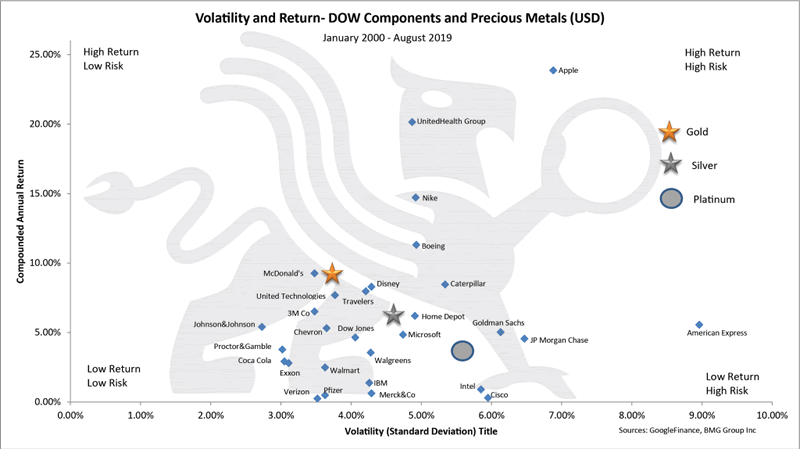

If you analyze gold with an open mind, you will find that it is less volatile than most of the DOW components and it reduces portfolio volatility and improves returns with allocations between 10% and 20%.

The BIS, OSFI and FDIC have all rated gold as a zero-risk asset equal to US dollars and US Treasuries.

“At national discretion, gold bullion held in own vaults or on an allocated basis to the extent backed by bullion liabilities can be treated as cash and therefore risk-weighted at 0%.” Bank of International Settlements (BIS)

“Gold held in an institution’s vault(s), or held in trust (i.e. monetary gold) now qualifies as a 0% risk weighting for risk-based capital purposes.” Office of the Superintendent of Financial Institutions (OSFI)

“A zero percent risk weight to cash owned and held in all of a banking organization’s offices or in transit; gold bullion held in the banking organization’s own vaults, or held in another depository institution’s vaults on an allocated basis to the extent gold bullion assets are offset by gold bullion liabilities.” US Federal Deposit Insurance Corporation (FDIC)

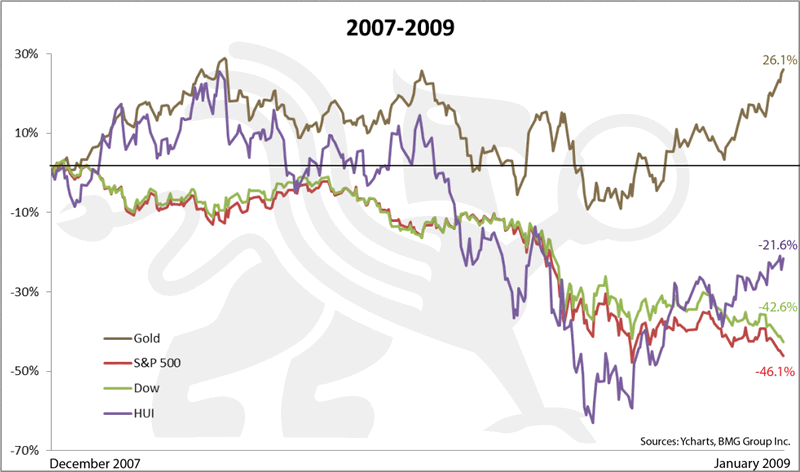

Gold’s primary benefits are most prevalent during financial market declines, as in 2008. Equities declined by about 40% and mining stocks by 21%, while gold increased by 26%.

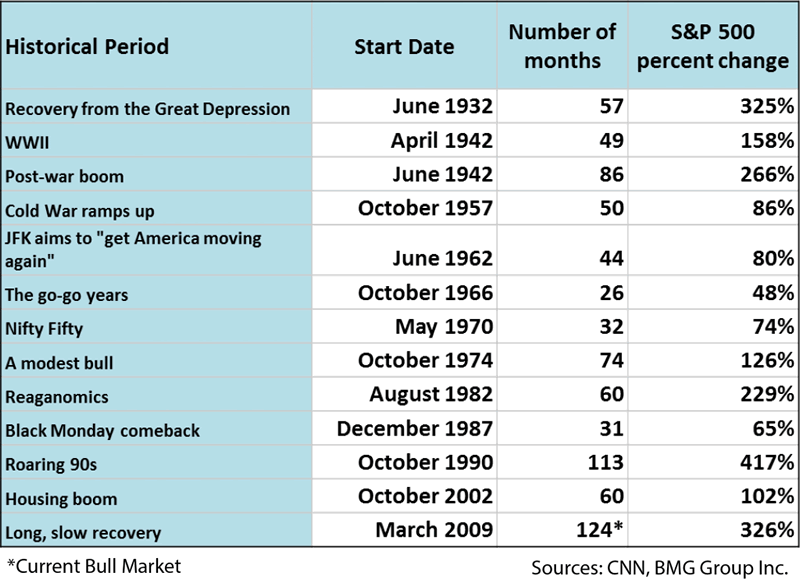

The problem facing most Canadian public companies today is that they have accumulated unfunded liabilities during the largest bull market in history. Currently, we are on the precipice of a triple bubble in stocks, bonds and real estate. The current bull market is the longest in history, and most conventional valuation metrics show that stocks are grossly overvalued. A major market correction is overdue, and many experts believe it will be worse than the 2008 financial crisis. Some believe that it will be worse than the market crash in 1929.

Following a conservative example, if 60% of the $171 billion of pension assets allocated to equities decline by 40%, as they did in 2008, unfunded liabilities would increase by the amount of reduction in assets. If interest rates rise, many bond portfolios will also suffer significant declines. Pension equity assets could decline by $41 billion to $130 billion, while unfunded liabilities increase from $15 billion to $57 billion.

This could have a major impact on both the stock price and executive bonuses during a correction, as $41 billion would be added to company liabilities that would have to be paid for out of earnings over ten years.

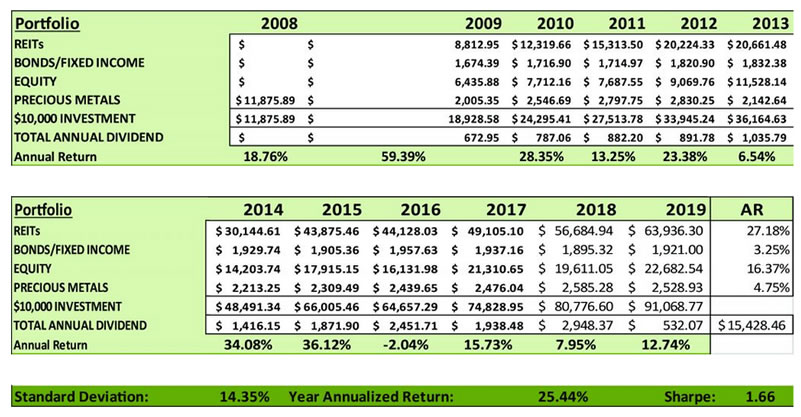

The BMG Diversified Hedge Fund (BMG Hedge Fund) is designed to avoid losses during the coming correction by being invested in gold bullion only. At the completion of the correction, it will reallocate into a truly diversified portfolio of stocks, bonds, REITs, gold and silver. It will invest in the ‘best of the best’ underlying Canadian and US funds that have outperformed their indexes and their peers for the past 10 years. The BMG Hedge Fund will also have the benefit of buying these underlying funds at the completion of the correction at significant discounts. The table below is a back-tested example of what would have happened if this strategy was followed during the 2008 crash. This model portfolio didn’t suffer any annual losses. The average annual return was 25.4% at a standard deviation of 14.35 and a Sharpe Ratio of 1.66. In addition to capital gains of over $91,000 for a $10,000 investment, the dividend yield would have been an additional $15,000.

Corporate CEOs can continue to follow the failed advice of their pension consultants, or decide to follow an alternative fully diversified strategy that will correct the problem of unfunded pension liabilities.

[1] https://www.usdebtclock.org/

[2] https://www.oecd.org/daf/fin/private-pensions/Pension-Markets-in-Focus-2018.pdf

By Nick Barisheff

Nick Barisheff is the founder, president and CEO of Bullion Management Group Inc., a company dedicated to providing investors with a secure, cost-effective, transparent way to purchase and hold physical bullion. BMG is an Associate Member of the London Bullion Market Association (LBMA).

Widely recognized as international bullion expert, Nick has written numerous articles on bullion and current market trends, which have been published on various news and business websites. Nick has appeared on BNN, CBC, CNBC and Sun Media, and has been interviewed for countless articles by leading business publications across North America, Europe and Asia. His first book $10,000 Gold: Why Gold’s Inevitable Rise is the Investors Safe Haven, was published in the spring of 2013. Every investor who seeks the safety of sound money will benefit from Nick’s insights into the portfolio-preserving power of gold. www.bmgbullion.com

© 2019 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.