The Great Gold and Silver Precious Metals Melt-Up

Commodities / Gold & Silver 2019 Sep 05, 2019 - 03:22 PM GMTBy: The_Gold_Report

Technical analyst Clive Maund presents his dystopian view of the future. The distinguishing feature of fiat money systems is that they are licentious—they are created by corrupt politicians so that they can act without restraint by, for example, promising the citizens the earth in order to improve their chances of being re-elected. The population can pick up the tab later in the form of devalued money that buys them less. The current dollar fiat money system was created by then President Richard Nixon in 1971, hardly an edifying character, and, thinking about it, it was very apt that it was him who created it by getting rid of the gold standard.

Technical analyst Clive Maund presents his dystopian view of the future. The distinguishing feature of fiat money systems is that they are licentious—they are created by corrupt politicians so that they can act without restraint by, for example, promising the citizens the earth in order to improve their chances of being re-elected. The population can pick up the tab later in the form of devalued money that buys them less. The current dollar fiat money system was created by then President Richard Nixon in 1971, hardly an edifying character, and, thinking about it, it was very apt that it was him who created it by getting rid of the gold standard.

It is inherent in fiat money systems that they self-destruct, since they are essentially fraudulent, their modus operandi being to enable politicians to go on endless spending binges, knowing that society at large will foot the bill as a result of their money being devalued. The current fiat money system, which can be dated back to the ending of the gold standard in 1971, is 48 years old and in its death throes. What happens with fiat is that money becomes increasingly worthless at an accelerating rate until it enters the final terminal phase which is a hyperinflationary vortex that results in it becoming utterly worthless—and we are right on the doorstep of that phase now.

When the global financial crisis hit in 2008—2009 the world was at a crossroads—it is was the last chance to clean up the mess and get back to the straight and narrow. Cleaning up the mess would have involved letting the banks and brokerage houses that created it go bust, but those responsible for it didn't want to "face the music" and they had the political influence to make sure they didn't have to. So, society at large had to pick up the tab for their misdemeanors. They were bailed out at huge cost and the system put on life support in the form of massive fiat creation—quantitative easing—which enabled them to drop interest rates to zero to stop debt compounding and then use the cheap money to engage in an orgy of speculation, while the "little guy" continued to be charged usurious rates if he wanted to borrow any money.

One unsavory result of the low interest rates of the past 10 years was that debt continued to grow at an exponential rate, since there was no penalty for incurring it, and now corporate, public and private debt has risen off the scale, examples being auto and student debt and the debt that has helped fuel stock buybacks, and as a result of all this the central banks—not just the Fed but all of them—have painted themselves into a corner—debt is at such astronomic levels that interest rates have to be close to zero, or even beneath it, to stop them compounding and getting even more out of control. They simply cannot permit rates to ever return to normal levels, and as we know the recent attempt by the Fed to partially normalize rates threatened to implode the economy and it had to abort it. The method used in the U.S. to clamp rates close to zero is that the Fed monetizes Treasuries, since no one else but a lunatic or a pension fund would buy this stuff, but the low or non-existent returns on capital resulting from these extremely low rates make the dollar extremely vulnerable, and if the U.S. dollar should ever lose its reserve currency status, which it is getting ever closer to doing, then it will collapse and interest rates skyrocket creating an instant credit crisis of mammoth proportions.

Faced with a choice between rising rates leading to a dramatic widespread default and an economic implosion, and slashing rates to zero and returning to QE on a massive scale to keep the zombified economy limping along, it is clear that central banks will opt for the latter course, as it buys them more time. However, this course of action represents the final terminal end game phase of this fiat cycle, which must end in a hyperinflationary depression—that is where we are now headed, and fast. That is what gold and silver—and now platinum—are picking up on, which is why the sharp rise in all three metals in recent weeks is not regarded as a normal uptrend that will require to be corrected, but instead marks the start of a gargantuan melt-up that will take the prices of all three metals to fantastic levels that even those who know what's going on, or think they do, can scarcely imagine.

A key point to keep in mind in all this is that although the metals will be appreciating in price, they are simply moving to hold their value, which is intrinsic, as the value of fiat collapses. Of course, we can expect them to do more than that, to gain in value even after factoring in the depreciation of fiat, as investors scramble to find safe haven as the hyperinflationary vortex draws ever closer.

A related development at this time is the recent huge appreciation in Treasuries, caused by investors seeking safe haven in these vehicles too, despite the U.S. government being technically bankrupt and having over $100 trillion in unfunded liabilities that it cannot and never will honor. It is hard to overstate the stupidity of investing in the paper of a bankrupt government that is destined at some point to go "belly up," but of course, most investors in these instruments are putting other people's money into them. The way this will play out is as follows—the low or negative interest rates coupled with the efforts of various countries around the world to end trading in dollars will together cause a severe decline in the dollar and interest rates to soar. At this point the Treasury market will crash and burn and the U.S. will enter a period of very hard times indeed. The precious metals are already picking up on all this and starting a rally that could end up being of stupendous proportions.

The reason for setting out all of the above is to make sure you understand why the current rally in the precious metals is not "just another rally" that will lead to another heavy correction or a reversal. It looks very much at this point like the start of a mammoth melt-up. This is vital to grasp, because if this is the case, then once you find worthy investments in the sector, you can take positions and then sit on them.

Now let's review the charts in order to gain perspective on what's going on.

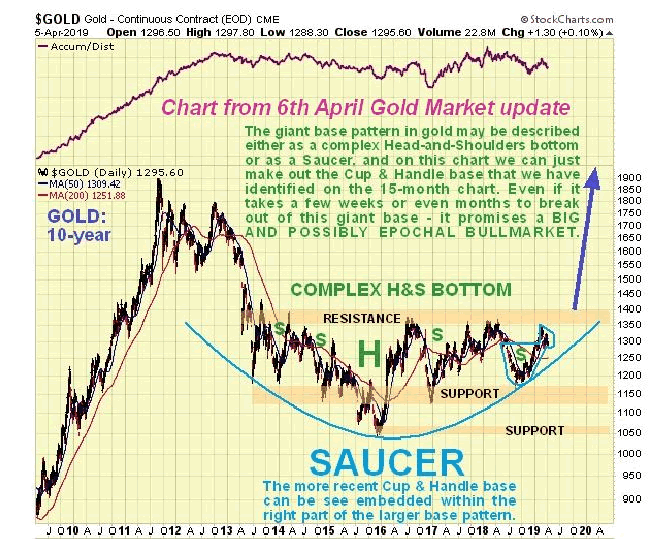

I had been pounding the table all year about an impending breakout by gold from its giant complex Head-and-Shoulders bottom or Saucer base until it happened, as can be seen on the chart from the 6th April Gold Market update…

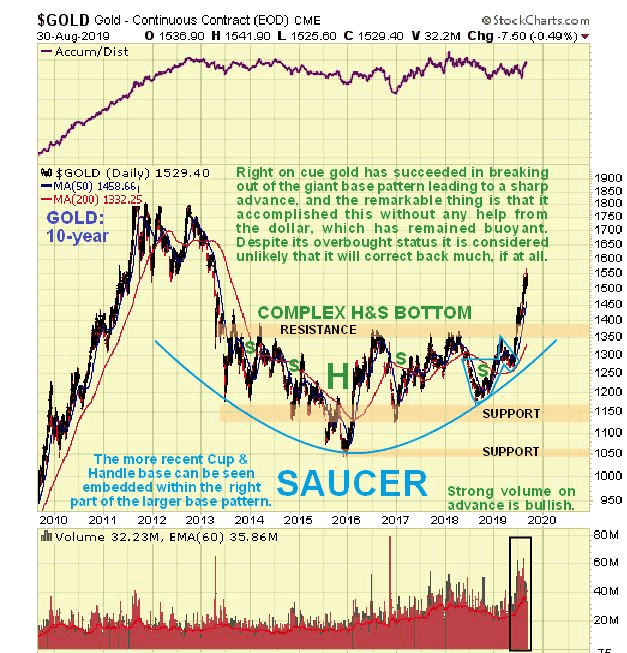

and this latest chart shows that it has succeeded in making a decisive breakout resulting in a sharp advance…

Now it's on its way, and notwithstanding the occasional correction, it should not have too much trouble breaking out to new all-time highs in due course, especially given what is going on. Yes, it's overbought, yes COT readings are at high levels, yes it could correct, perhaps quite sharply, but the big picture is that it has broken out to start a bull market that is expected to be of epic proportions as the cornered banks take the only route left open to them, which is low or even negative rates, bail-ins (theft from customers' accounts) and rampant QE on a gargantuan scale that will lead to hyperinflation.

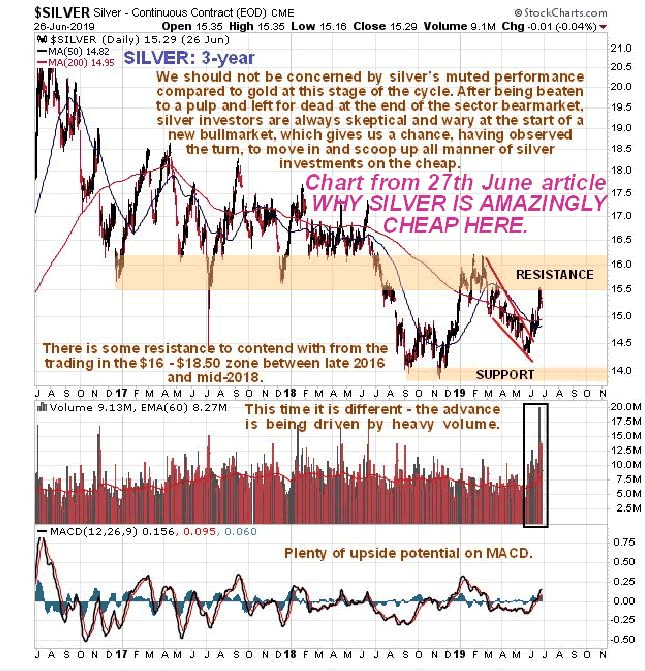

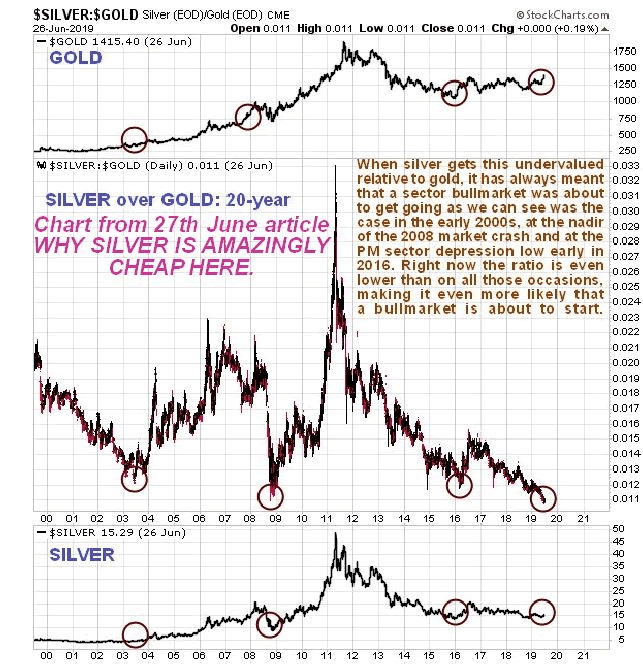

A few months ago the weak performance of silver relative to gold had many investors wary, but they had got things the wrong way round as usual. The extremely low silver to gold ratio had created an explosively bullish situation for silver, as we had observed in WHY SILVER IS AMAZINGLY CHEAP HERE posted on 27th June. Here are a couple of charts from that report…

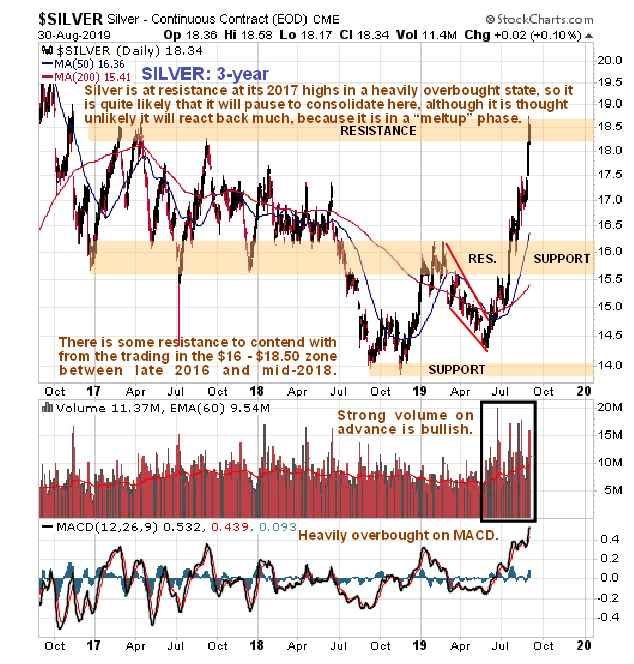

And here is the latest 3-year chart showing what followed…

The following chart is what really alerted us that a major silver bullmarket was about to start…

Looks overbought, doesn't it? Well, it is, but that doesn't mean that it will react back much, if at all. There are a lot of investors who missed this move and are waiting on a correction to climb aboard, which of course makes a significant correction a lot less likely. On the 10-year chart (not shown) this move looks like the start of a major melt-up that could take silver prices much higher, which is hardly surprising considering what is going on.

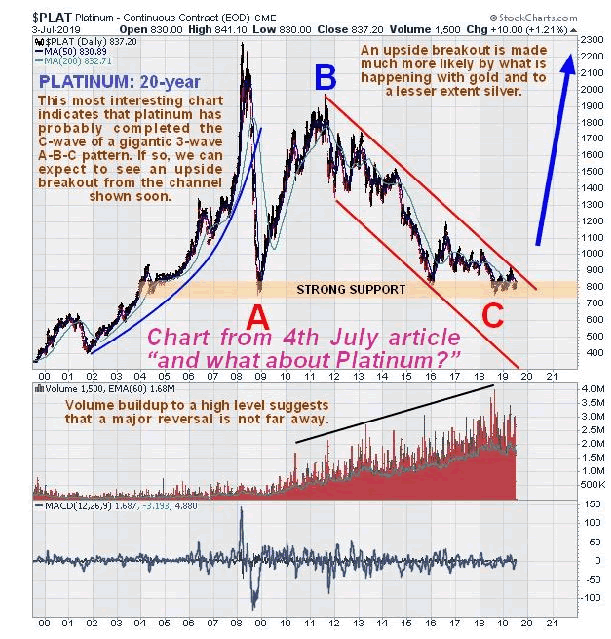

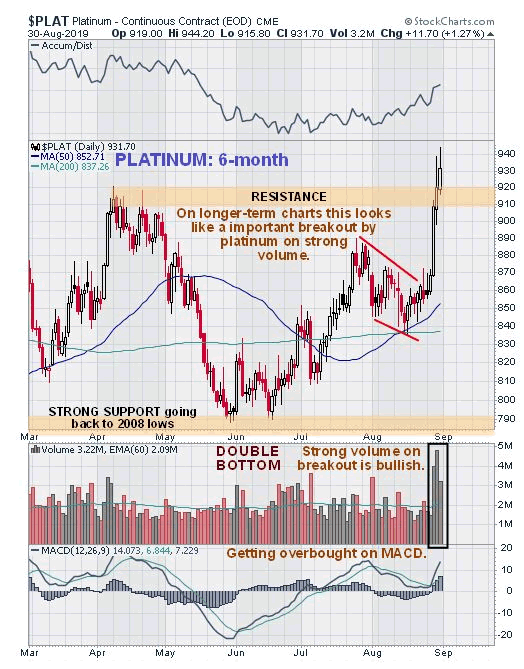

And what about platinum? On several occasions earlier this year I had pointed out that platinum was an even more undervalued precious metal than silver, especially considering that the envy-riddled, racist, tribal Marxist buffoons now running South Africa are hell bent on turning it into another Zimbabwe, and it just happens that South Africa produces almost 70% of the world's platinum. But as usual, no one was interested. Here is a chart from the update and what about Platinum, that was posted on the site on 4th July, showing what was expected…

And here is the latest 6-month chart showing that in just the past 3 days platinum has broken out on heavy volume to join its buddies gold and silver in a major melt-up…

Thus, we now have all three precious metals advancing strongly in lockstep and because of the extraordinary circumstances now prevailing it looks unlikely that they will correct back much, if at all. Instead, it is considered likely that they will march higher and higher.

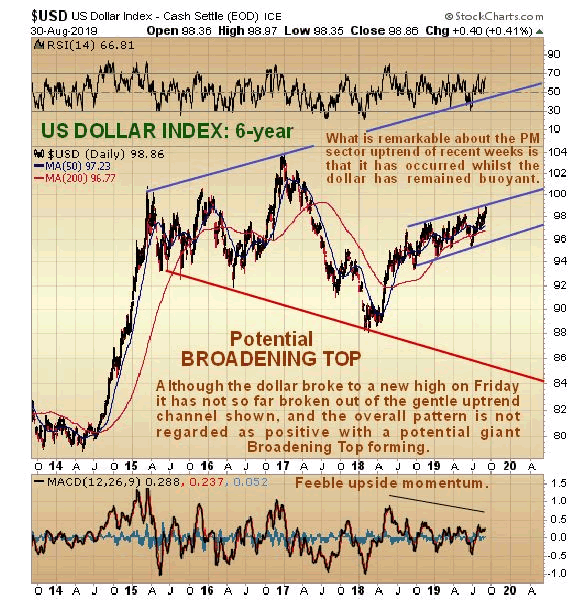

One of the most extraordinary aspects of this new vigorous bull market in gold and silver (and now platinum) is that it is happening without any help from the dollar, which has remained buoyant. The reason for this is that both the dollar and the Precious Metals are viewed as a safe haven at this time. If they continued to raise rates threatening a rapid economic stall out, then the dollar would soar as overseas holders of dollar debt raced to cover (poor old Argentina, eh?), but they are going to do the opposite, lower rates to zero or lower and pump money like crazy to stop the system seizing up, which will push the dollar off its perch, at which point the afterburners will be lit driving gold and silver higher at an accelerating rate, as rates rise and the Treasury market collapses, at which point you can kiss your pension goodbye, as the stock market will have cratered by then too.

If you would like an insight regarding where all this will ultimately end, I recently took a trial run trip in the time machine that I have been working on to the America of the future. I set the time to about 10 years in the future and then hit the button. At first I thought there was some mistake because when I got there, there were derelicts lying around on the sidewalks, with bottles, syringes and excrement everywhere, garbage fires and packs of wild dogs—I thought I was in the present day socialist paradise of Sacramento or San Francisco, but then some guy walked past me with a big wheelbarrow full of bundled banknotes. "Where are you going," I enquired? "To buy a house in Silicon Valley?" "No," he replied, "I'm just going to buy a loaf of bread." It was then I realized the awful truth that the machine had worked and that I was indeed in the America of the future. Before he left, he let me have a banknote which I brought back with me and is shown below.

Now you will never be able to say that you weren't warned.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosure: 1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure: The above repr0esents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.