Has the Basing Setup In Natural Gas Completed?

Commodities / Natural Gas Aug 28, 2019 - 07:03 AM GMTBy: Chris_Vermeulen

Back in June 2019, we posted a research article suggesting that Natural Gas was setting up an extended basing pattern below $2.35 preparing for a seasonal rally that typically initiates in late August or early September. We believe the basing pattern has nearly completed and now is the time to begin positioning for the upside price rally that we believe will hit in Natural Gas as early a September 5th or so.

Our original research posts to review :

June 10, 2019: NATURAL GAS MOVES INTO BASING ZONE

June 25, 2019: NATURAL GAS SETS UP BOTTOM PATTERN

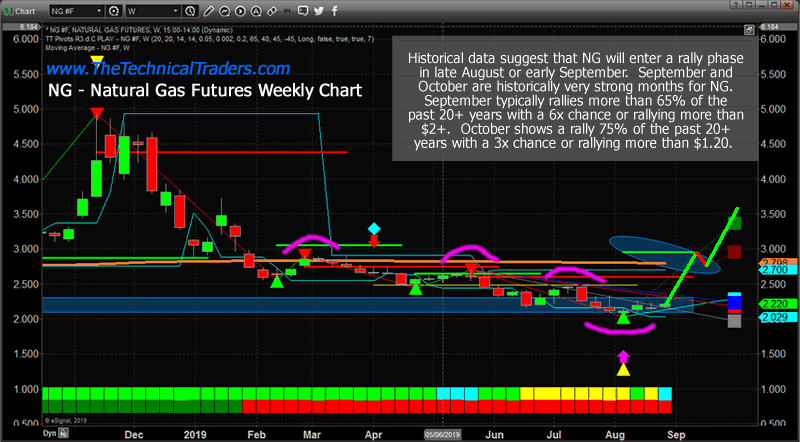

Our research tools suggest that September has a 65% probability of rallying more than 6x the historical range. This would suggest a rally potential of more than $2 exists in September for Natural Gas. Our tools also suggest that October has a 75% probability of rallying more than 3.2x the historical range. This would suggest a potential rally of more than $1.20 in October.

Combine those potential moves and probabilities over a 60-day span and we are talking about a $2.50 to $3.50 potential price rally with a 70%+ historical probability of success. But first, be sure to opt-in to our free market forecast newsletter.

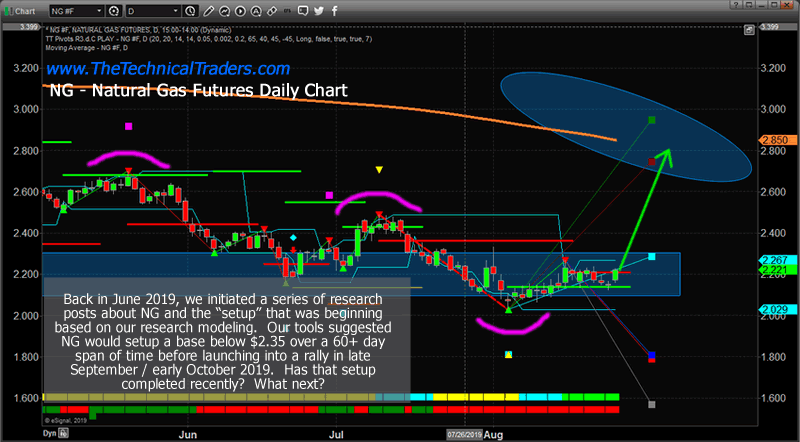

Daily Natural Gas Chart

This Daily Natural Gas Chart highlights the price rotation as price continued to base below the $2.40 level. We’ve also highlighted the basing range as a blue rectangle on this chart. We expect the upside move to begin in early September and to continue to rally towards the $2.75 level before finding initial resistance. It is very likely that this rally will build momentum as we end October and start into September. It will not be “straight up” as we have drawn on this chart.

Weekly Natural Gas chart

This Weekly Natural Gas chart highlights our longer-term expectations for the price rally. The initial move will likely end just below $3.00 (likely in the $2.75 to $2.95 range). After that level is reached, we expect a bit of resistance as price rotates near the Bullish Fibonacci Price Trigger Level, then rallies beyond it to target levels above $3.65. Once price moves above $3.50, we could experience a price spike as we had in 2018 where price reached as high as $5.00 in Natural Gas. Skilled technical traders could play this move for incredible profits if they time their entries and exits well.

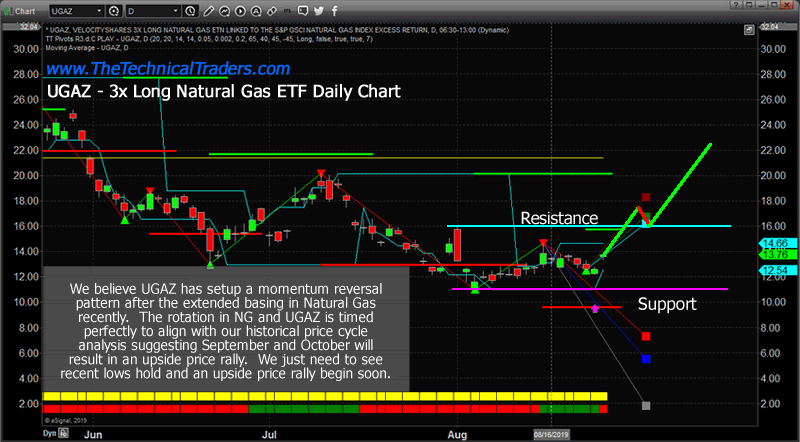

UGAZ 3x Long Natural Gas ETF Chart

We believe most skilled technical traders that want to avoid massive leveraged risks should consider trading UGAZ – the 3x Long Natural Gas ETF. Yes, risks still exist in this trade as any further downside price rotation before a rally begins could present a moderate degree of loss. Yet, we believe the upside potential for the rally and the historical data supporting the very strong probability for an upside price rally outweighs the risks at this time. Support near $11 would be our ultimate downside price risk. Any entry below $14 would be acceptable given the current setup and expectations. Immediate upside expectations are for price to move towards the $18 level, then pause before moving even higher towards the $22 to $24 level.

CONCLUDING THOUGHTS:

Remember, we called this move over 60 days ago and are alerting you to the very real possibility that the basing pattern is complete. We expect the upside price rally to begin very early in September at this point and the timing of this trade seems perfectly aligned with our historical price modeling systems and other predictive modeling tools.

This could be one of the best short term trades going into the end of 2019. You won’t want to miss this one.

Check out these exciting charts full of opportunities that we will be sharing.

In short, you should be starting to get a feel of where commodities and asset class is headed for the next 8+ months. The next step is knowing when and what to buy and sell as these turning points take place, and this is the hard part. If you want someone to guide you through the next 12-24 months complete with detailed market analysis and trade alerts (entry, targets and exit price levels) join my ETF Trading Newsletter.

Join me with a 1 or 2-year subscription to lock in the lowest rate possible and ride my coattails as I navigate these financial market and build wealth while others lose nearly everything they own during the next financial crisis.

Be prepared for these incredible price swings before they happen and learn how you can identify and trade these fantastic trading opportunities in 2019, 2020, and beyond with our Wealth Building & Global Financial Reset ETF Newsletter. You won’t want to miss this big move, folks. As you can see from our research, everything has been setting up for this move for many months.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for both short-term swing trading and long-term investment capital. The opportunities starting to present themselves will be life-changing if handled properly.

FREE GOLD OR SILVER WITH MEMBERSHIP!

Kill two birds with one stone and subscribe for two years to get your FREE PRECIOUS METAL and get enough trades to profit through the next metals bull market and financial crisis!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.