Range Bound Financial Markets and Economy in Good Shape

Stock-Markets / Financial Markets 2019 Jul 27, 2019 - 12:15 PM GMTBy: QUANTO

Markets at all time highs and considerably calmer option market VIX index suggest that we could be in a slow grind higher for risk markets.

Markets at all time highs and considerably calmer option market VIX index suggest that we could be in a slow grind higher for risk markets.

ECB Drahghi hits at easing

Christopher Graham, economist at Standard Chartered, notes that the European Central Bank (ECB) kept rates on hold at its 25 July meeting, but President Mario Draghi sent a strong signal that further easing would be delivered in September as per expectations. Key Quotes “By adjusting its forward guidance to note that rates would remain at current “or lower levels” until at least mid-2020 (in line with our expectations), the ECB has reinforced our view that interest rate cuts will be delivered after the summer break.” “We continue to expect a 10bps deposit rate cut in September and a further 10bps cut in December, to -0.60% by year-end.” “The Governing Council (GC) is also considering a broader package of measures; Draghi noted that committees have been tasked to explore other options, including new net asset purchases (both in size and composition), tiered deposit rates, and ways to reinforce forward guidance on policy rates.” “In a sign that the ECB has become increasingly concerned about the euro-area inflation outlook and persistently low inflation expectations, it also noted its “commitment to symmetry in the inflation aim”, implying that an overshoot of 2.0% would now be tolerated.” “The bar to other policy measures remains higher than for rate cuts, in our view, and Draghi admitted that agreement on the GC was not unanimous. Nonetheless, the likelihood of QE being restarted by year-end has increased considering press release, particularly if euro-area economic activity remains weak or deteriorates further.” “At the same time, we reiterate that a convincing QE programme would need to be open-ended and would require controversial rule changes, most likely a change to issuer limits.

US Funds withdraw

The US-based equity funds witnessed more than $8.4 billion of cash withdrawals in the week ended Wednesday, according to Refinitiv's Lipper. The withdrawals have come ahead of next week's Federal Reserve meeting. The central bank is widely expected to cut rates by 25 basis points. The move has been priced in and the outflow of funds from equities indicate the market may see "sell the fact" action following a rate cut on July 31. While equities saw outflows, the US-based money market funds attracted $26 billion, their fifth consecutive week of inflows.

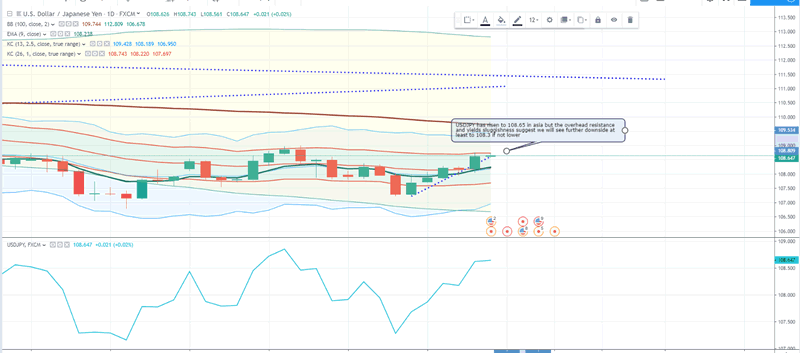

US to Japanese yield spread

US to Japanese yield spread is in a downtrend. Any moves to widen the spread is being met with resistance which suggests that USDJPY will be sold at every rally.

USDJPY has risen to 108.65 in asia but the overhead resistance and yields sluggishness suggest we will see further downside at least to 108.3 if not lower

AUDUSD bond spreads

The Aussie 10 year yield spread to US 10 year yield has broken to new lows. This is suggestive that AUDUSD could fall further possibly to new lows under 6800

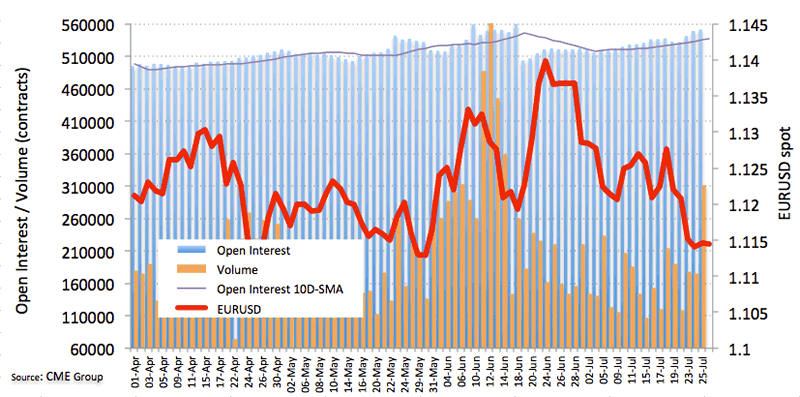

EURUSD analysis

Preliminary figures for eur futures markets from CME Group noted open interest increased for the third session in a row on Thursday, this time by more than 2.1K contracts. In the same line, volume rose by nearly 135.7K contracts, the largest single day uptick since June 12. EUR/USD a drop below 1.1100 looks unconvincing EUR/USD met strong support in the 1.1100 neighbourhood, or fresh 2019 lows, and rebounded to the 1.1190 region on Thursday, all amidst increasing open interest and volume. Unclear price action against this backdrop leaves spot somewhat neutral in the short term, with the key 1.1100 handle holding the downside for the time being.

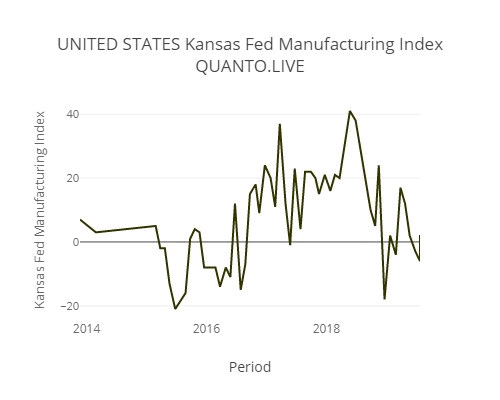

Fundamental Analysis Kansas FED manufacturing Index

The index is at 2019 lows. Trade wars have started to impact manufacturing in a big way and FED will be watching the numbers.

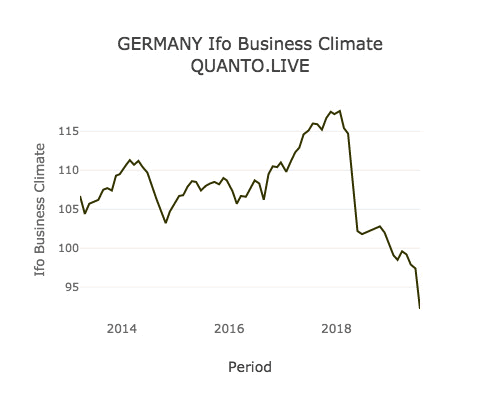

German IFO Business climate

The IFO German Business climate index is crashing. It is now under 50 mark for 3 months which is enough to signal the onset of a recession. Germany could be the first developed economy to tip into recession and we believe the rest will follow suit fairly quickly by the end of 2019.

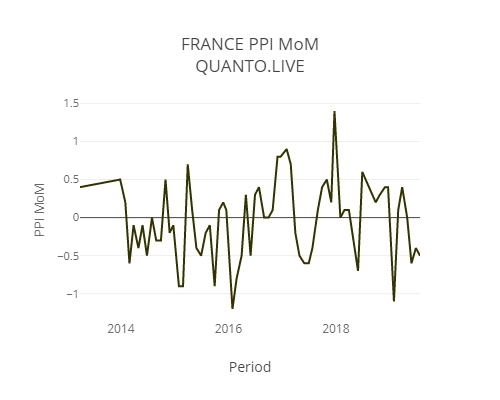

France PPI

Supply side inflation is on a slippery path in france. The current actual data at -0.5 is lower than the previous release at -0.4. The mean for " PPI MoM " over the last 68 releases is -0.1. The current actual data is lower than the mean of the last 68 releases. The last reported data was on 2019-07-26

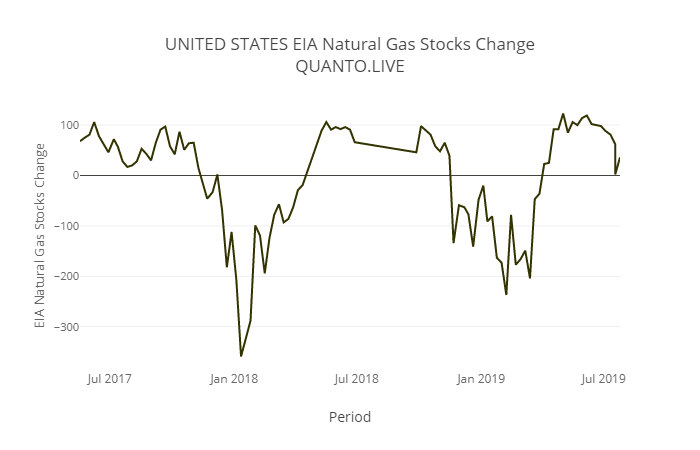

EIA Natural Gas Stocks Change

Natural gas stocks have fallen in latest report filing. The current actual data at 36 is lower than the previous release at 62. The mean for " EIA Natural Gas Stocks Change " over the last 100 releases is -2.5. The latest release is greater than the mean of the last 100 releases.

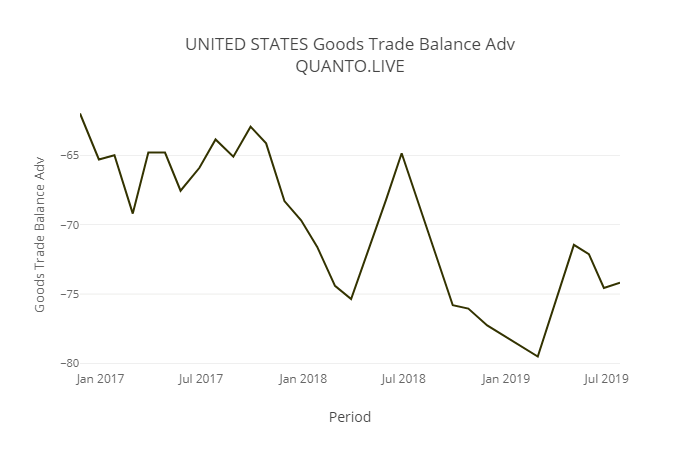

Good Trade balance (US)

The good and trade balane is worsening for US. There is a minor improvement but still overing in deep red at -75 bn. Tariff does not seem to have improved the negative balance and it will be worrying sign for US. The current actual data at -74.17 is higher than the previous release at -75.0. The mean for " Goods Trade Balance Adv " over the last 27 releases is -69.4. The current actual data is lower than the mean of the last 27 releases. The last reported data was on 2019-07-25

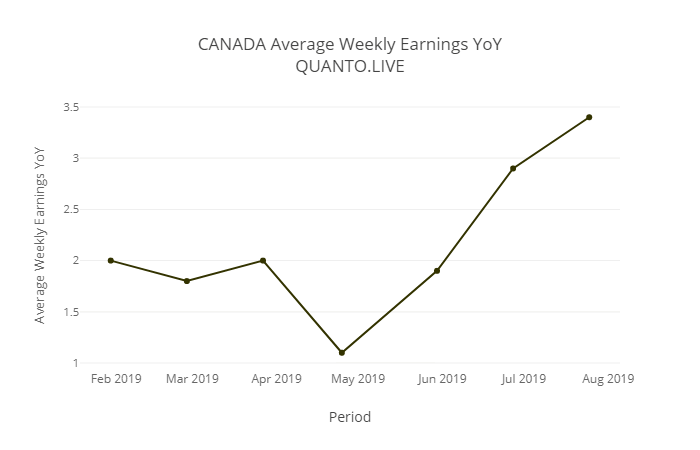

Canadian Weekly earnings: better than previous

Average Weekly Earnings YoY MAY 3.4% previous 2.6%. There seems to be blip in earning as we see some inflaiton creeping in. The current actual data at 3.4 is higher than the previous release at 2.6. The mean for " Average Weekly Earnings YoY " over the last 7 releases is 2.2. The latest release is greater than the mean of the last 7 releases. The last reported data was on 2019-07-25

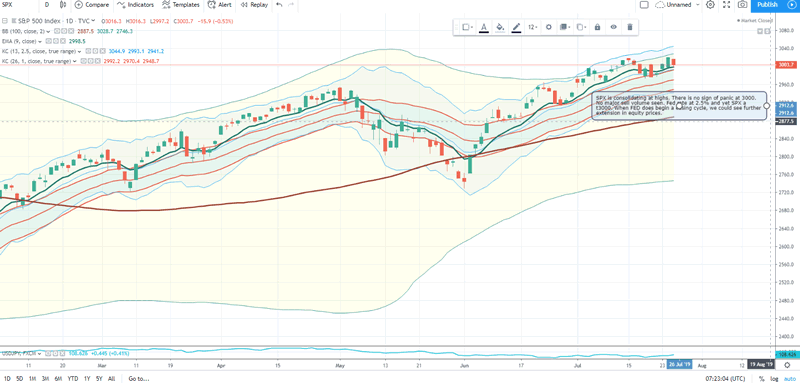

SPX consolidation at highs

SPX is consolidating at highs. There is no sign of panic at 3000. No major sell volume seen. Fed rate at 2.5% and yet SPX a t3000. When FED does begin a easing cycle, we could see further extension in equity prices.

QUANTO Trade copier

We run a stable income and wealth generating trading system called QUANTO. It is the ONLY trading system available to copy for retail clients which works on the bond market yield fundamentals. It has been performing briliantly all thru summer months and has a record of 9 years of sublime trading.

Equity curve since launching for retail clients in May 2019.

July monthly returns are at +21%. This comes after June made +10% and May made +22%. These are almost unbelievable returns but forex market trading system is known to generate these returns for about 0.5% of traders. Real wealth generation at display.

We have kept the system free to trial out for any amount before you go pro on it. Contact us to get started

By Quanto

Quanto.live is a Investment Management firm with active Trading for clients including Forex, Crypto. We send our trades via trade copiers which are copied to clients trading terminals. Top notch fundamental analysis and trading analysis help our clients to generate superior returns. Reach out to us: http://quanto.live/reach-us/

© 2019 Copyright Quanto - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.