Bitcoin Wyckoff Accumulation Pattern

Currencies / Bitcoin Jul 26, 2019 - 02:38 PM GMTBy: readtheticker

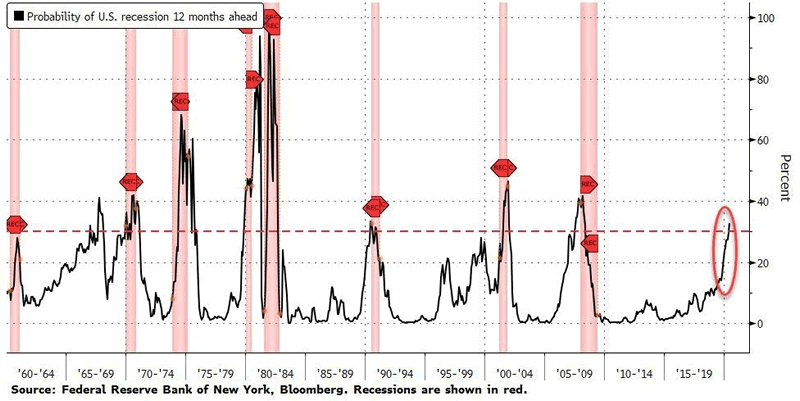

Many see a US recession in the first half of the 2020 decade. The first half of many previous decades suffered a recession, it is normal. But this time it may be different, well kinda different bad!

Many see a US recession in the first half of the 2020 decade. The first half of many previous decades suffered a recession, it is normal. But this time it may be different, well kinda different bad!

A reminder of US recessions in a first half of a decade: 1953, 1961, 1970-73, 1980-82, 1991, 2001-2002

Of course the 2007 to 2009 GFC was just short of a new decade. Yet the reader can see the trend of recessions in the first half of a decade is established, and not unusual.

US Recession

Yes, there is another one coming. The US and German 10 year interest rates signal this very clearly.

A recession is a lit match of asset price deflation, but what it will set fire to has yet to determined.

Possible names for the crisis lit by a recession in early 20XX ?

- Corporate Bond Debt Crisis of 20XX

- US Pension Crisis of 20XX

- The Great China Debt Implosion of 20XX

- We are all European Now. The world of negative interest rates.

- The Great Sovereign Bond Crisis of 20XX

- The Passive Investing Crash of 20XX

- The Great Liquidity Crisis of 20XX

- The Leverage Loan Crash of 20XX

[Or all of the above]

We know from the recent crisis of 2008 these things can happen:

- change in accounting rules

- printing money

- debase of currency

- create bad banks

- freeze bank accounts

- execute bank bail ins

- spreads explode

- fund redemption freeze

- bank holidays

- the world plunges further into a negative interest debt mess

- On and on!

On a US (or World) recession, Bitcoin (and its sister Litecoin) will attract scared money, and it will not take a lot of scared money to get bitcoin to double from current levels. Of course if bitcoin attracts scared money so will silver, gold and the US dollar.

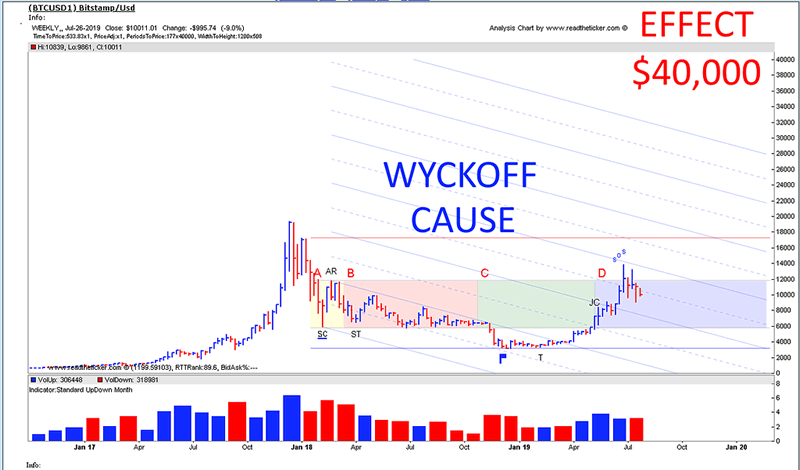

Here are some price charts showing bitcoins current situation.

Accumulation looks good so far.

Wyckoff Bitcoin

Is it crazy for a single bitcoin to be worth $40,000+ USD, that depends, consider this, Jason Pollock No 16 sold for $32M (Nov 12 2016). Perceptions change. If the market decides, the market decides.

Pollock No 16 Painting below, $32.6 M smackers ... really!

Pollock Jason No 16

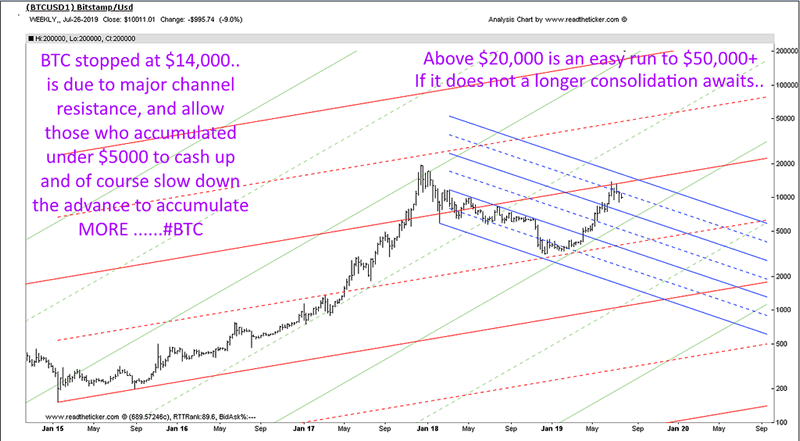

Price working through parallel channels

BTC Channel

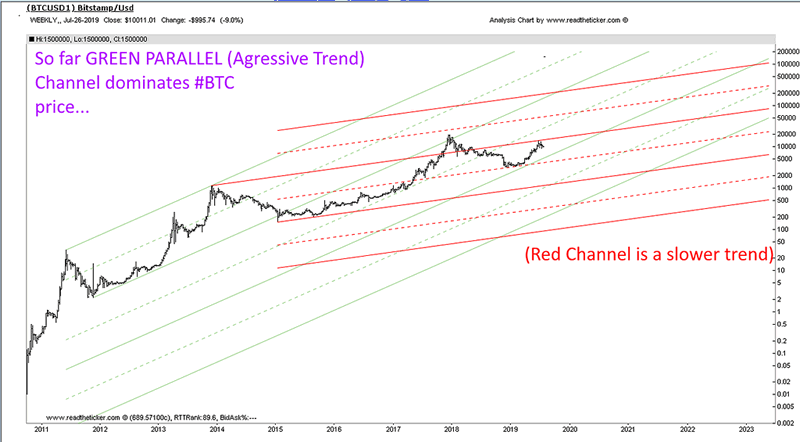

Major Channels View: Green aggressive. Red moderate.

BTC channel parallel

Bitcoin is here to stay.

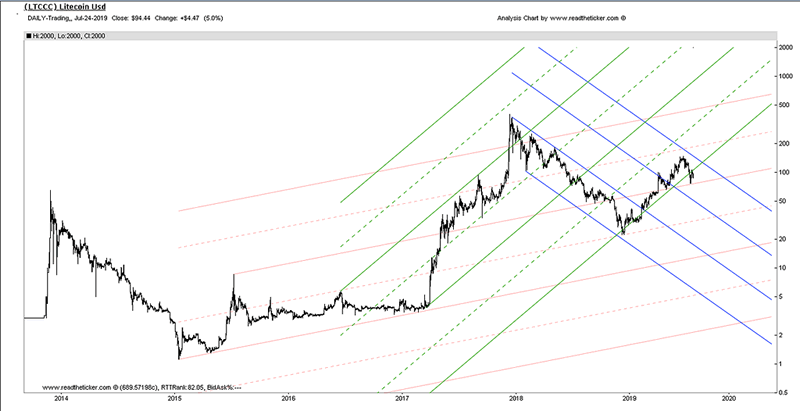

Litecoin Log Chart, Parallel Charts supporting price action

Fundamentals are important, and so is market timing, here at readtheticker.com we believe a combination of Gann Angles, Cycles, Wyckoff and Ney logic is the best way to secure better timing than most, after all these methods have been used successfully for 70+ years. To help you applying Richard Wyckoff and Richard Ney logic a wealth of knowledge is available via our RTT Plus membership. NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net Investing

NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net

Readtheticker

My website: www.readtheticker.com

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2019 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.