SPX Consolidating, GBP and CAD Could be in Focus

Stock-Markets / Financial Markets 2019 Jul 18, 2019 - 12:09 AM GMTBy: QUANTO

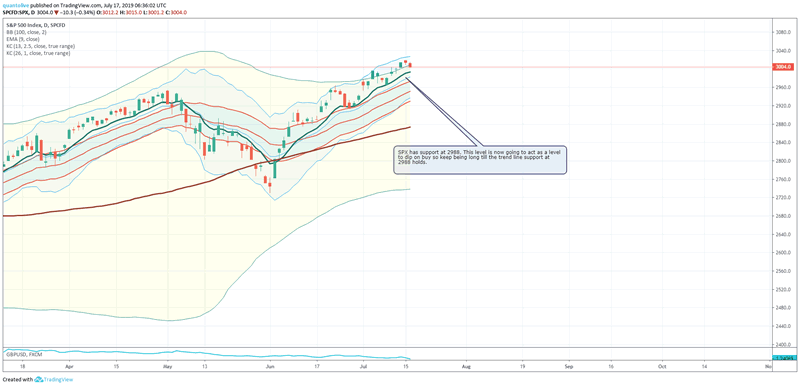

SPX may now be consolidating at 3000 levels for some time. If the market does not selloff aggressively at these levels, then we will melt higher.

The support at 2990 is important and will serve as a launching pad for further gains to 3040 and 3080. The last leg of a rally is often fast and furious and it takes support at the 9 EMA as seen above. Could this be that explosive move higher ?

Our Twitter feed has relevant news released fast: Follow Us

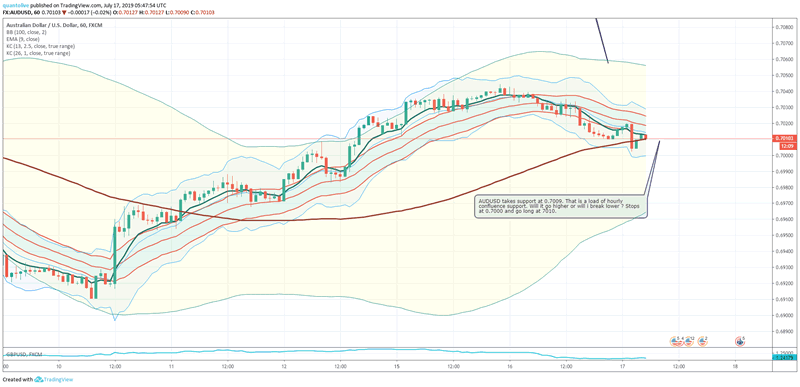

Forex trades and setups Aussie bulls have been left exhausted as the pair has found it difficult to break higher despite CAD doing well against USD. The answer lies in the bond spreads.

AUDUSD takes support at 0.7009. That is a load of hourly confluence support. Will it go higher or will i break lower ? Stops at 0.7000 and go long at 7010.

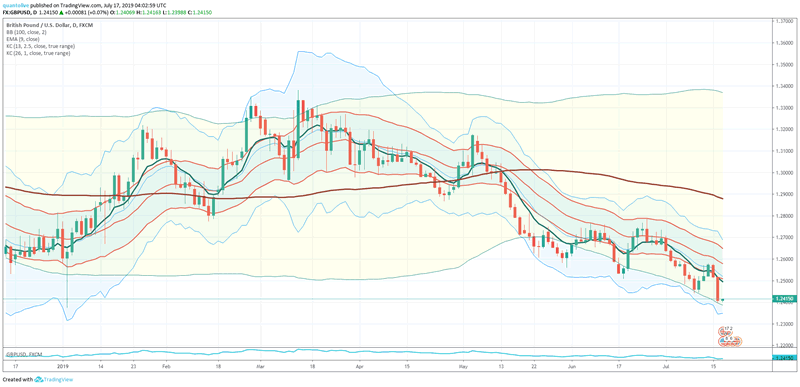

GBPUSD could have about 70 pips more downside but a swing test of 1.2440 is on the cards. If GBPUSD pushes above 1.25, we see upside to extend to 1.2640. Looking ahead today, we'll have the release of UK CPI data for June but data holds little support at this time. On GBPUSD we had a deeper analysis on potential reversal points: Read here

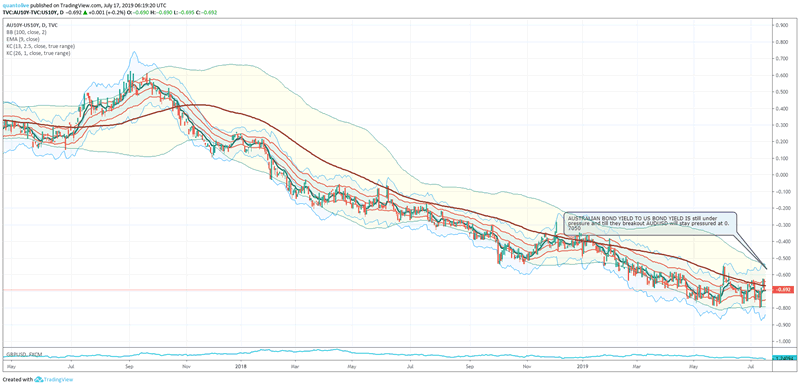

Australian spreads over US bonds

Australian bond yields to US bond yields have largely been contained to lower end at -0.650. This has meant AUDUSD has not got any potential upwards trigger yet.

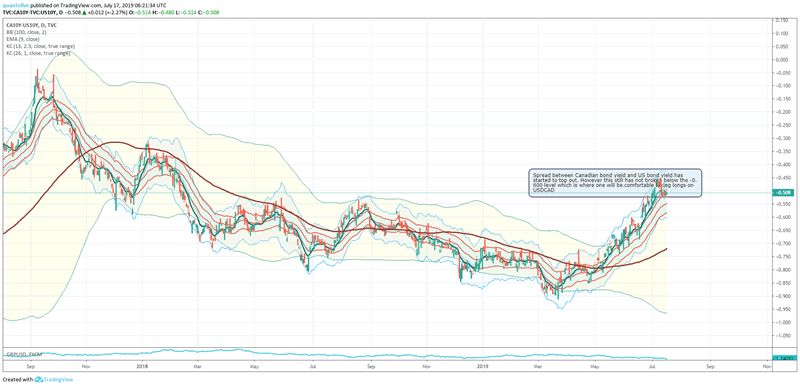

Canadian spreads over US bonds

Spread between Canadian bond yield and US bond yield has started to top out. However this still has not broken below the -0.600 level which is where one will be comfortable taking longs on USDCAD

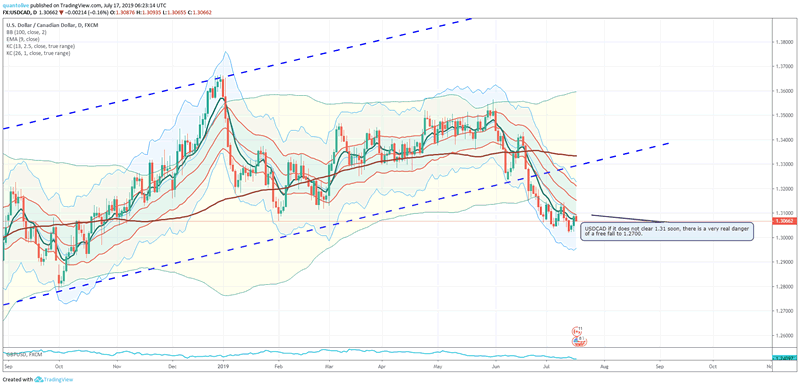

USDCAD

USDCAD if it does not clear 1.31 soon, there is a very real danger of a free fall to 1.2700.

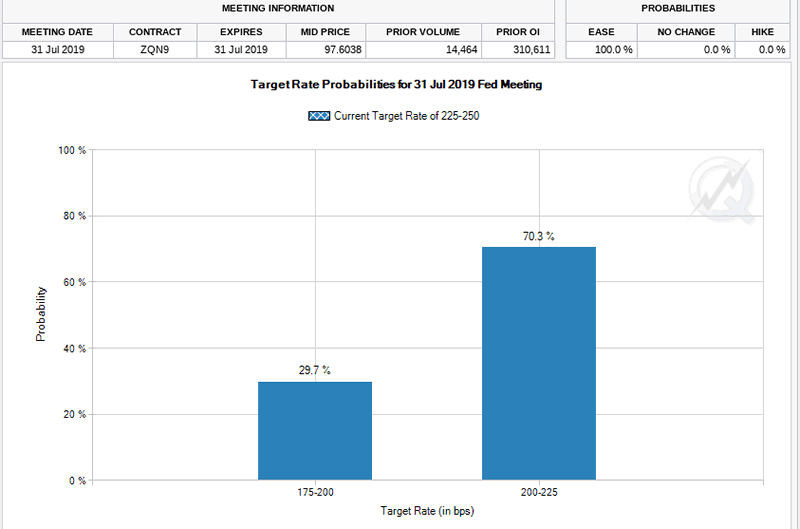

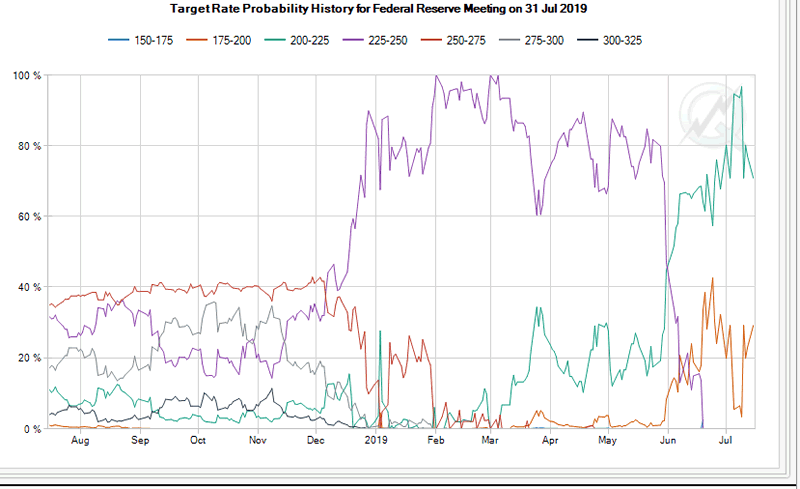

Fed probablity

The fed probability of rate cut is 70% for a 25bps and 30% for 50 bps. The chances fell from 95% to 70% in space of 10 days.

Trade Copier Forex Markets is the most rewarding market in the world. However it is also the most brutal market. Every day, we walk over the graves of thousand of retail traders who were slain trying to trade forex with manual charts and setups. Forex is way too complicated to trade looking at patterns. There are trillion of dollars and euros flowing around chasing yields around the world. Forex is best traded with the help of a automated bond market based trading system like QUANTO. It differs with everyone else in its ability to reaad the source of forex movement which is yield spread and then build on it via market profile theory and finally uses day to day tech indicators to get precise entry and exit.

The system has an extraordinary record from 2012.

Currently it is offered as a Trade Copier to clients since May 2019. It has already nothced up +53% return

July returns cross +15%. Overall since May 2019, the copier client is sitting on at least 54% return achieved at low DD under 35%.

The system is available free to try and trade till satisfaction. So you make significnt money before you ever a penny as fee. If you are interested, fill this form (do check your spam box if you do not see our reply in your inbox)

Source: https://quanto.live/2019/07/17/daily-setups-and-charts-gbp-could-be-in-focus/

By Quanto

Quanto.live is a Investment Management firm with active Trading for clients including Forex, Crypto. We send our trades via trade copiers which are copied to clients trading terminals. Top notch fundamental analysis and trading analysis help our clients to generate superior returns. Reach out to us: http://quanto.live/reach-us/

© 2019 Copyright Quanto - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.