Stock Market Minor Cycles Peaking

Stock-Markets / Stock Markets 2019 Jul 08, 2019 - 03:23 PM GMTBy: Andre_Gratian

Current Position of the Market

SPX: Long-term trend – Finallong-term phase on the way? How much longer, is the question.

Intermediate trend – The intermediate-term correction continues to unfold.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Daily market analysis of the short-term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com

Minor Cycles Peaking

Market Overview

“Enough congestion was produced at last week’s low to take the index up to about 2995-3000.”

On Tuesday, SPX surged to a new all-time high of 2995.84 and closed at 2995.82, meeting the projection target set for this move. On Friday, prices dropped to 2968 in the first 2 hours of trading, but then started to recover and finished down only 5 points for the day!

Last week’s action may have spelled the perfect scenario for a short-term top! A climactic move to the target, an initial reversal and a re-test of the high! Considering that a minor cycle peak was expected in this time frame, you could not have asked for better cooperation from the index – providing that we resume the short-term downtrend on Monday and continue to decline into next Thursday or Friday. Even a slightly higher high into the low 3000s would be acceptable, if less perfect.

If the above does occur as foreseen, the correction should continue into early August, at least! Recent strength which drove the index to new all-time highs has bolstered the technical position of the intermediate indicators, and the risk of an imminent return to or beyond the December low has pretty much evaporated. But this does not mean that we have eliminated the possibility of still being in some type of corrective structure.

Technical Analysis (Charts appearing below are courtesy of QCharts.)

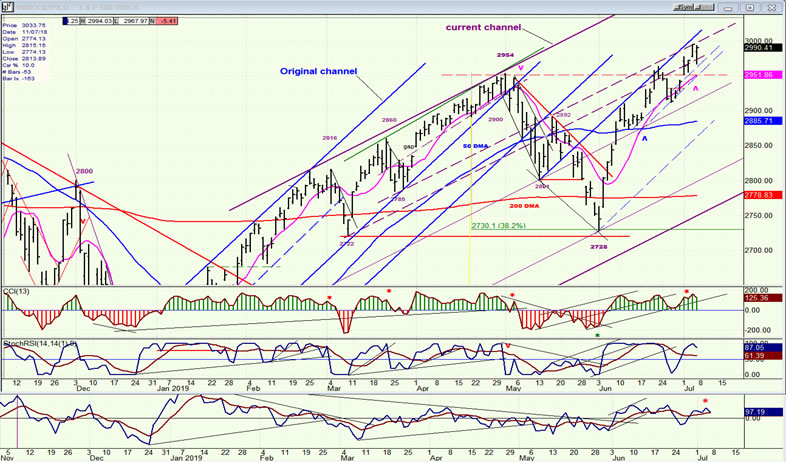

SPX daily chart

The original (blue) channel was broken after prices reached a high of 2954, and the decline continued until it had retraced exactly .382 of the move from 2346. The index is now progressing in a new (purple) channel which could still be a corrective major wave IV in spite of the fact that SPX has now risen to a new high. We will know better after seeing the path taken by the index over the next few weeks. If, after the anticipated near-term retracement, we make significant new highs, it will be time to revise our thinking. In order to show that we are still in a corrective pattern, we should come out of the purple channel before making new highs.

As stated above, the market action suggests that it made a short-term top on Wednesday. If so, a reversal from here is likely to find initial support in the area of the dashed red line drawn at the former 2954 top. But we could easily go beyond if enough selling pressure is exerted by the minor cycle which is expected to make its low next Thursday or Friday. Since the top formation may not be complete on the P&F chart, we do not have a firm count for the first leg down, although an immediate reversal would likely generate a decline of about 50 points which would correspond to a retracement to the dashed line or slightly lower.

The daily indicators also suggest that we have arrived at a short-term top. All three have started to roll over and two are showing some minor negative divergence which is more defined in the A/Ds.

SPX hourly chart

The holiday caused a time gap not adjusted by Qcharts which is somewhat affecting the accuracy of the trend lines, but does not render them totally useless. And it did not affect the heavy blue trend line (// to the blue channel lines on the daily chart) which connects the first two tops of the rally and was not reached at the top of the third peak. This created divergence in the hourly momentum oscillators which worsened on Friday, but not nearly as much as it did in the A/D indicator.

A reversal on Monday-Tuesday would probably target the bottom of the last gap that was left partially unfilled on the last retracement. This is also the area of the (blue) 50-hr.MA which will eventually have to be broken to signal that we have started something more than a minor decline.

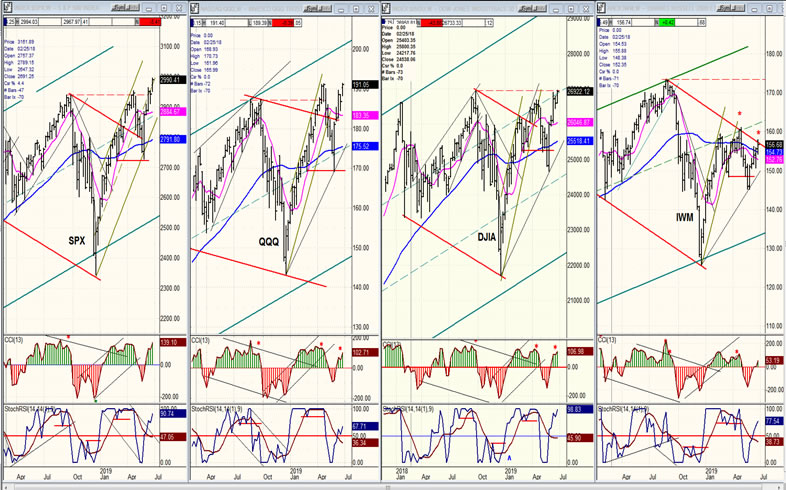

QQQ, SPX, DJIA, IWM (weekly)

If strength in the daily SPX chart creates uncertainty about what the market is doing, this is immediately dispelled when we look at the relationship between the weekly charts. Although DJIA has somewhat caught up with SPX and QQQ, IWM (on the contrary) has recently lost even more RS to the other indices with not just one, but two diverging tops. This should be a clear signal to the bulls that the market strength -- which is confined to SPX now that QQQ has started to underperform – is illusory!

UUP (dollar ETF)

UUP has rallied to the top of its minor declining channel. Best bet is that it will now retrace again; but if it does not and keeps going, it will prolong the intermediate trend represented by the blue channel

GDX (Gold miners ETF) daily

If UUP retraces right away, it will allow GDX to push a little higher to the top channel resistance (dashed line). It’s unlikely to go beyond that level until it has undergone a more prolonged correction.

ACB (Aurora Cannabis) daily

ACB probably has more correcting to do before it can break out of the purple downtrend, especially if the market undergoes the anticipated correction.

BNO (U.S. Brent oil fund) daily

BNO has completed a consolidation phase and is likely ready to extend its correction.

Summary

Various technical conditions listed above suggest that a market correction should take place as early as next week.

Andre

FREE TRIAL SUBSCRIPTON

For a FREE 4-week trial, send an email to anvi1962@cableone.net, or go to www.marketurningpoints.com and click on "subscribe". There, you will also find subscription options, payment plans, weekly newsletters, and general information. By clicking on "Free Newsletter" you can get a preview of the latest newsletter which is normally posted on Sunday afternoon (unless it happens to be a 3-day weekend, in which case it could be posted on Monday).

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.