The Bad News About Record-Low Unemployment

Economics / US Economy Jun 24, 2019 - 06:20 PM GMTBy: Robert_Ross

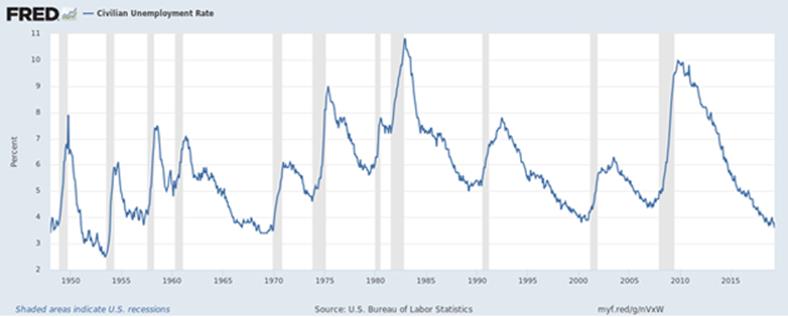

Unemployment is the lowest it’s been in 50 years.

Unemployment is the lowest it’s been in 50 years.

That means most people who want to work can find a job. It also means people are making more money and buying more stuff.

All good. More people working is always positive. But a low unemployment rate is a double-edged sword.

See, the unemployment rate is cyclical. It’s always moving up or down. And at this point—3.6%—there’s almost no room for it to drop more.

That’s where the trouble starts: When the unemployment rate bottoms out, like it’s doing now, it means the economy has peaked. And a recession is probably coming…

We’ve Been Here Before

Notice that every time the unemployment rate hits a low, a recession (highlighted in gray) soon follows:

Source: Federal Reserve Bank of St. Louis

It doesn’t come immediately, though.

Over the past 70 years, a recession has started an average of five months after the unemployment rate bottomed.

Source: Federal Reserve Bank of St. Louis

Also, remember that the unemployment rate lags behind the actual economy. That means it rises and falls after major shifts in the economy, not before.

That makes sense when you think about it. People don’t often lay off employees the first day business starts to slow. There’s a lag.

So the unemployment rate won’t start rising until the US has already fallen into a recession.

More Signs Flashing Red

A bottoming unemployment rate isn’t the only sign that the economy has peaked.

Like the unemployment rate bottoming, the inverted yield curve has preceded every single recession over the past 50 years.

Keep in mind, neither of these indicators means a recession is imminent. And they don’t tell us how severe the recession will be. But it’s certainly coming.

So is the market downturn.

Remember, we’re at the tail-end of the longest bull market in history. So a major pullback is not out of the question. And, since stocks fall an average of 32% in a bear market, you want to start preparing your portfolio now.

That means adding recession-proof stocks and other assets that will rise when the broader stock market falls.

This Is How You Prepare for a Recession

Dividend-paying stocks—especially in sectors like consumer staples, utilities, and defense—are some of the best ways to buoy your portfolio as we head into this recession.

Consumer staples are a great refuge when the economy hits the skids. These businesses sell things like toilet paper, laundry detergent, and dog food—things people buy no matter what’s happening in the economy.

Right now, my favorite way to invest in consumer staples is the Vanguard Consumer Staples ETF (VDC). It pays a safe and stable 2.7% dividend yield.

Utilities, of course, are about as recession-proof as it gets. People pay their power bills even when the economy tanks. So these businesses are very stable.

My top utility pick right now is the Fidelity MSCI Utilities ETF (FUTY). It pays a 2.9% dividend yield. That’s 50% higher than the yield on one-year Treasury bills.

Then there’s the defense sector, which is one of my favorite recession-proof sectors. In fact, US defense spending usually goes up during a recession.

The iShares US Aerospace & Defense ETF (ITA), which pays a 1.1% dividend yield, is a good way to invest broadly in this sector.

The Sin Stock Anomaly: Collect Big, Safe Profits with These 3 Hated Stocks

My brand-new special report tells you everything about profiting from “sin stocks” (gambling, tobacco, and alcohol). These stocks are much safer and do twice as well as other stocks simply because most investors try to avoid them. Claim your free copy.

By Robert Ross

© 2019 Copyright Robert Ross. - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.