Fed May Trigger Wild Swing In Stock Index and Precious Metals

Stock-Markets / Financial Markets 2019 Jun 19, 2019 - 11:08 AM GMTBy: Chris_Vermeulen

As our research team continues to pour over the charts and look for any signs of direction regarding tomorrow’s Fed news, we put together a couple the charts that may highlight some expectations and in at what the markets may do the rest of the week.

As our research team continues to pour over the charts and look for any signs of direction regarding tomorrow’s Fed news, we put together a couple the charts that may highlight some expectations and in at what the markets may do the rest of the week.

The expectations that the US Federal Reserve may maintain rates at current levels or potentially drop rates by a quarter percent leaves an open interpretation as to how the global markets will digest this news. Obviously, leaving rates unchanged would be the most benign action the Fed could take. Often though, the markets interpret this as a sign of weakness. Whereas a quarter percent decrease in the US fed rates would suggest that the Fed is preparing for future economic weakness in the US and potential global economy, yet investors may consider this as a very bullish reaction to the Fed.

Our belief is that the Fed will leave rates unchanged and possibly hint at adjusting rates lower later this year or early next year in preparation for the US presidential elections. The US economy is still moderately strong and the recent trade deal with Mexico as well as policy advancement in DC leads us to believe the Fed has no reason to adjust rates right now. Of course, a quarter percent decrease would allow the Fed to spur additional economic growth and potentially jump-start the waning housing market in the US.

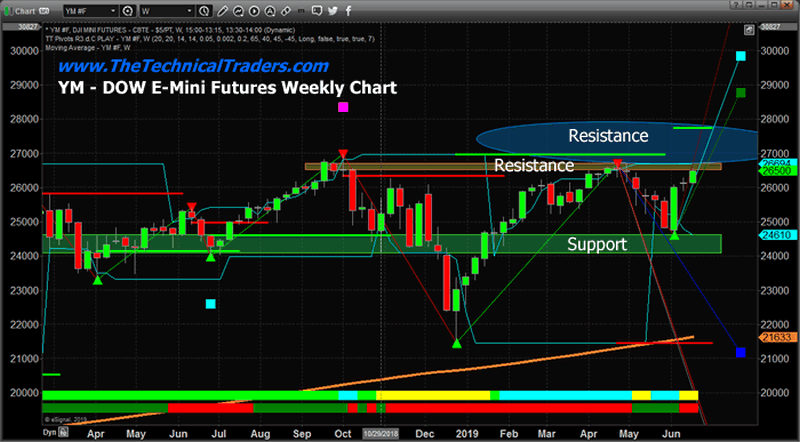

This first chart of the YM, the Dow E-mini futures, highlights key price technical support and resistance that will likely come into play over the next 3 to 10 weeks. We ask you to pay special attention to the dual resistance levels above 26,500. These double resistance levels act as a double ceiling in regards to price advancement. In other words, some type of strong price advance of 27,000 would have to take place in order for the price to move beyond these resistance areas.

Should the Fed surprised the market and the market interpreted this move as strongly bullish, there is a moderate chance that the YM could advance beyond 27,000 before the end of this week or early next week. We believe the Fed news tomorrow will be interpreted as a protectionist stance and the market made move lower from current highs. Any big rotation lower after the Fed announcement tomorrow could prompt a new downside trend to retest our pennant/flag formation base near 25,000. Either way, our automated technical analysis prediction software will keep or get on the right side of the market.

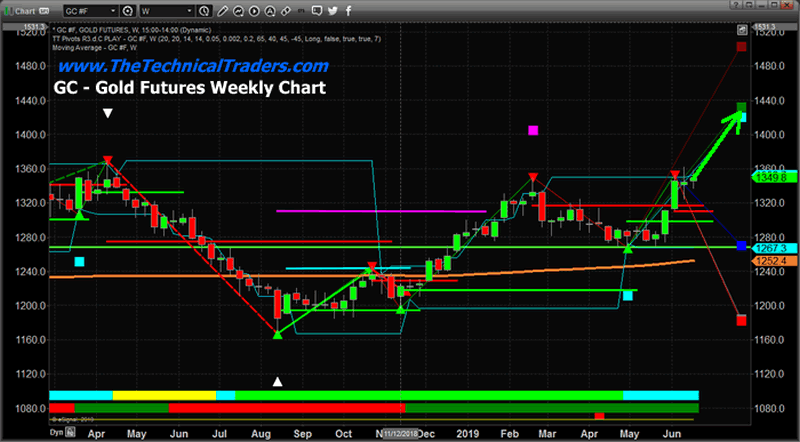

Additionally, after the Fed announcement tomorrow, it is very likely that the US dollar may, under some pricing pressure and that precious metals could rocket hire and continue their advance towards $1450. Any market reaction to the downside in the US stock market and/or the US dollar would likely push precious metals well above recent highs. It all depends on how the market reacts to the US Fed announcement tomorrow, June 19.

We believe we have positioned our gold trades appropriately for the Fed news tomorrow. Either way, we believe gold, precious metals, and the miners will advance after the Fed news tomorrow. A close above $1375 in gold will prompt a very quick rallied towards $1440.

We’ll continue to watch how the markets react to the Fed news tomorrow with the knowledge that precious metals and gold should advance either way as fear and greed drive the metals higher. We’ll look for new trades near the end of next week after the Fed news shakes out the short term traders. There is nothing wrong with being on the right side of a profitable trade in precious metals and miners.

If you want to trade profitably with us and fellow traders from in 87 other countries be sure to join our Wealth Building Newsletters Today!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.