US Stock Market Setting Up A Pennant Formation

Stock-Markets / Stock Markets 2019 Jun 13, 2019 - 08:39 AM GMTBy: Chris_Vermeulen

As we’ve been warning over the past few weeks and months, the current price rotation in the US stock market is very much related to the strength of the US Dollar and the continued Capital Shift that is taking place as trade issues and currency valuations drive investors into the US equity and debt markets as protection against risk. We talk about some of these new Super-Cycles starting and how we can take advantage of them in this new guide.

As we’ve been warning over the past few weeks and months, the current price rotation in the US stock market is very much related to the strength of the US Dollar and the continued Capital Shift that is taking place as trade issues and currency valuations drive investors into the US equity and debt markets as protection against risk. We talk about some of these new Super-Cycles starting and how we can take advantage of them in this new guide.

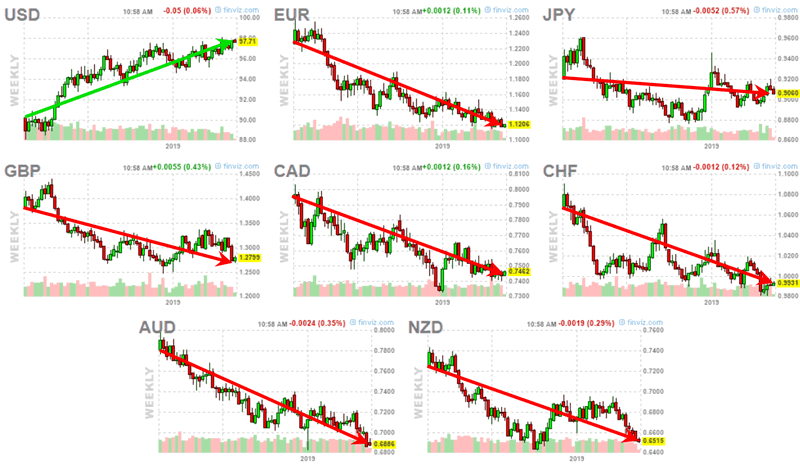

The US Dollar stalled today after a recent price decline from just above $98 to a current level near $96.60. Over the past 15+ months, the US Dollar has risen from lows near $88 to highs near $98 – an 11.2% price rally. Meanwhile, many other foreign currencies have collapsed over this same span of time.

We believe the continued Capital Shift is driving further investment in the US stock market and debt market as a way to avoid the risks of further currency valuation declines and as a means of protecting wealth. Until this currency dynamic changes, we expect the strength of the US economy and US Dollar to continue to push investors into the US equity markets.

This being said, a very interesting dynamic is starting to set up. Gold and Silver have started to move higher while Oil, Natural Gas and other commodities are pushing lower. This type of activity in the commodity markets suggests some increased fear is driving investors away from speculating on increased global economic activities and pushing capital into expectations of a market top or deeper correction.

We’ve read recently where institutional traders have started initiating heavy short positions in the US markets and we believe these investors have jumped the gun a bit. We don’t see how or where a massive US market collapse is likely given the current strength in the US Dollar and the US economy. Yes, at some point this dynamic may shift and at some point, we may see a fairly deep correction of 12% to 18%. We believe that a top may happen in August or September 2019 – after the US stock market (DOW) reaches new all-time highs above $30k.

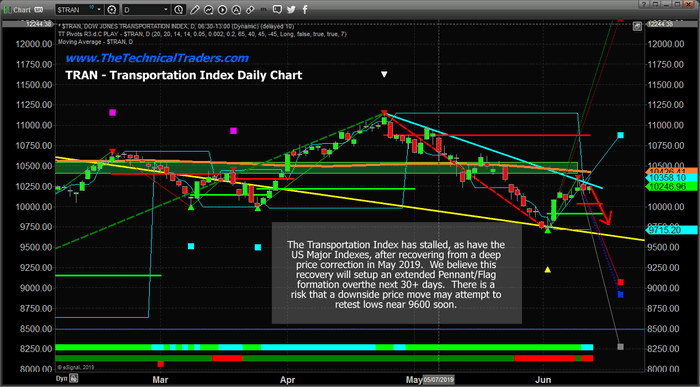

Right now, we believe the first rotation of our expected Pennant/Flag formation is starting to set up and we look for early signs in the DOW and TRAN charts.

This TRAN chart shows price rotation near the CYAN resistance level originating from the late April peak and spanning the early May price high. We believe this resistance level may play a key role in understanding how and when the next upside price leg begins to advance. We expect a downside price rotation to take place pushing the TRAN towards the $9600 level over the next few days/weeks.

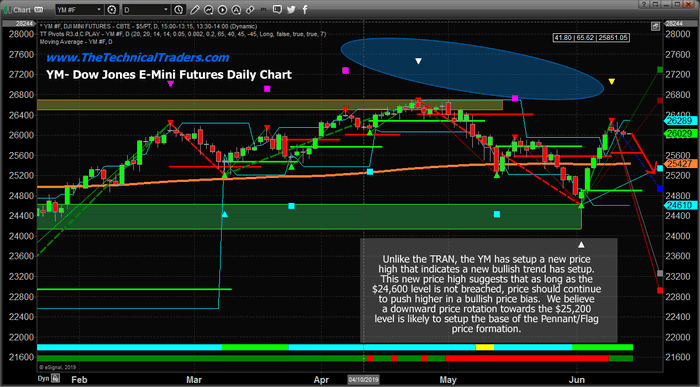

This YM chart highlights a similar price pattern, but clearly illustrates one key difference – the New Price High. This fundamental element of Fibonacci price theory is that any attempt to break a past critical price high which results in a “new price high” designates the current trend as Bullish. Within Fibonacci price theory, price is always seeking to establish new price highs or new price lows – AT ALL TIMES. Therefore, a new price high or new price low is very significant.

The TRAN chart may continue to consolidate below the CYAN resistance level whereas the YM chart may attempt to push higher, with a bullish bias, setting up a Pennant/Flag formation as we expect. This would indicate that even though economic and transportation expectations are waning, the bullish bias in the YM suggests the Capital Shift factor is still pushing the US stock market upward.

Pay close attention to that big blue ellipse near the top of the chart. We drew that in place many months ago as an indicator of where we believe critical resistance is should the markets attempt to push higher and attempt new all-time highs.

We still believe this resistance is valid and as price rotates into the Pennant/Flag formation, we’ll extend this resistance forward – carrying the same slope and angle forward. If the YM is going to attempt a move to above $30k before our expected August/September 2019 top setup, it will have to push well above this resistance zone to accomplish this move.

Watch Gold and Silver over the next 3 to 4 weeks as any perceived weakness will push the precious metals higher still. We believe Gold will reach $1450 this summer and possibly higher before August as smart money rotates into the safe havens in anticipation of a bear market.

If you wanna become a technical trader with use and trade ETFs then be sure to join our Wealth Building Newsletter today and get our daily video analysis and swing trade alerts. In the past 17 months, our newsletter trade signals have generated 91% ROI for its subscribers, be sure to join before the markets start making new big moves and profit with us!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.