Why Blue-Chip Dividend Stocks Aren’t as Safe as You Think

Companies / Dividends Jun 12, 2019 - 07:00 AM GMTBy: Robert_Ross

A man pulled a gun on me last week.

A man pulled a gun on me last week.

I was in the Ipanema neighborhood of Rio de Janeiro.

Ipanema is one of the wealthiest areas of Rio. You get iconic views of the Brazilian shore line and white sand beaches.

I was two blocks from Ipanema Beach when a man on a bike pulled in front of me.

At first, I thought he was going to sell me something. Then I saw him starting to pull a gun out of his backpack.

Fight or flight kicked in, and I started running.

In hindsight, this probably was not a good idea. But thankfully, I made it home safely.

Keeping an Eye Out for Warning Signs

I knew Rio was dangerous before visiting.

All my Brazilian friends told me not to visit because it’s so dangerous.

I figured if I stay in iconic Ipanema, I would be safe. But staying in Ipanema turned out to give me a false sense of security.

People do the same thing with investing. They convince themselves that their money is safe in a company’s stock because they took the precautions. They did their research. Everyone owns it.

But just like staying in iconic Ipanema turned out to give me a false sense of security, buying iconic “tried-and-true” stocks can yield the same result.

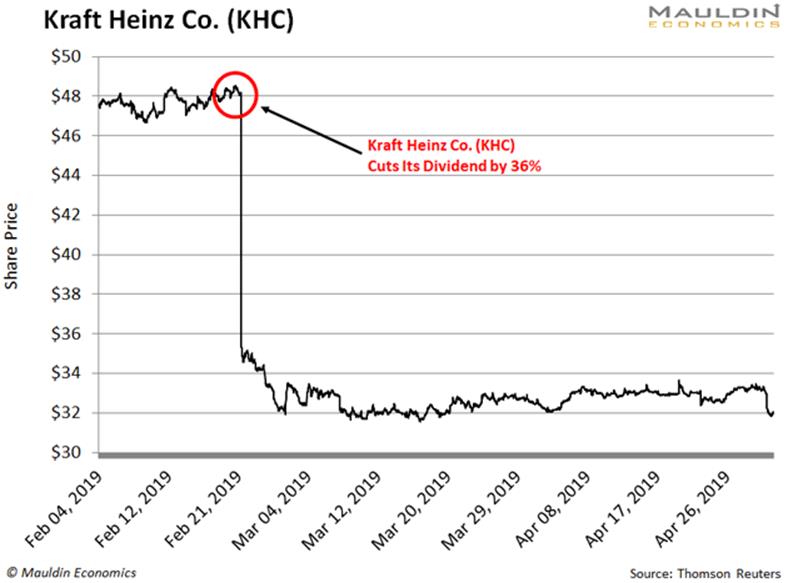

Take a look at Kraft Heinz.

The iconic brand lost 30% of its value in one day.

That’s despite having one of the world’s most recognizable brands, a seemingly stable business, and the backing of Warren Buffett.

Kraft Heinz had many issues. But one of the reasons the stock tanked was because management cut the company’s dividend.

And that’s a death sentence for any investment.

Bigger Can Be Better (If You Know Where to Look)

High dividend-paying stocks like Kraft Heinz (KHC) can often leave investors with regret.

And that makes sense. Many companies must pay high dividends to compensate investors for the risk of owning the company’s stock.

Some of these companies borrow money and use the debt to pay their dividend.

That’s exactly what Kraft Heinz was doing. And this strategy often ends up being a disaster for investors.

Lucky for you, I’ve spent my entire career looking for safe stocks that pay high dividends. I developed a tool that helps gauge the safety of a company’s dividend.

I call it the Dividend Sustainability Index (DSI).

How to Select the Right Dividend-Paying Stock

You must look at three key things when evaluating dividends.

The most important is the payout ratio.

The payout ratio is the percentage of net income a firm pays to its shareholders as dividends.

The lower the payout ratio, the safer the dividend payment.

The second is the debt-to-equity ratio.

The more debt a company has, the harder it gets to run a business. This includes—you guessed it—paying the dividend.

The third is free cash flow. This is the amount of cash left over after a company pays its expenses.

If any of these measures is flashing red, you know the dividend is in trouble.

A low DSI score tells me that the odds are high that a company will be forced to cut its dividend.

And that’s bad news for shareholders.

A Dividend Cut Can Wipe Out Your Profits

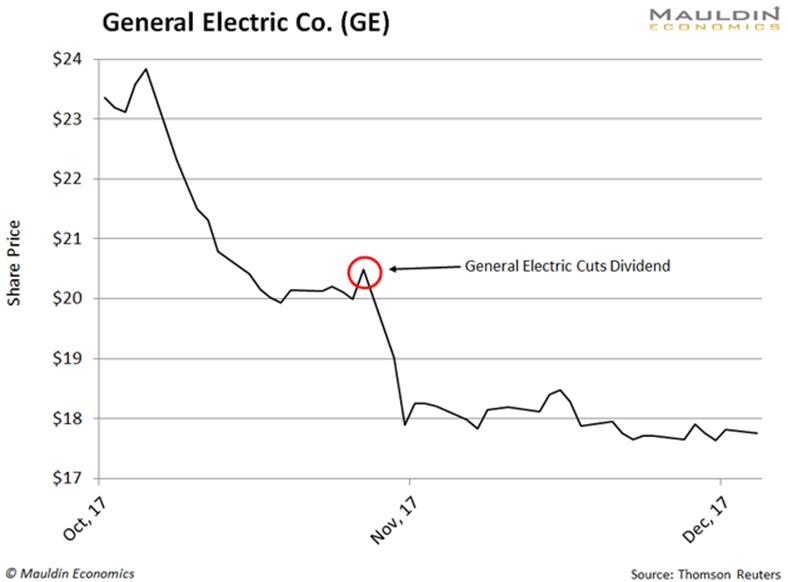

Kraft Heinz wasn’t the only iconic brand to tank on a dividend cut as of late.

Take a look at what happened to General Electric (GE) when it surprised investors and slashed its dividend 50% in November 2017:

GE shares were punished on the news, getting chopped over 10%.

One year and a second dividend cut later, shares have been smashed 57%.

The Dividend Sustainability Index (DSI) will keep you out of stocks like Kraft Heinz and GE. By using methods like the DSI, you can have real security with your income investments.

By Robert Ross

© 2019 Copyright Robert Ross. - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.