US ECONOMY and House Prices Trend Forecast

Housing-Market / US Economy Jun 02, 2019 - 02:10 PM GMTBy: Nadeem_Walayat

GDP

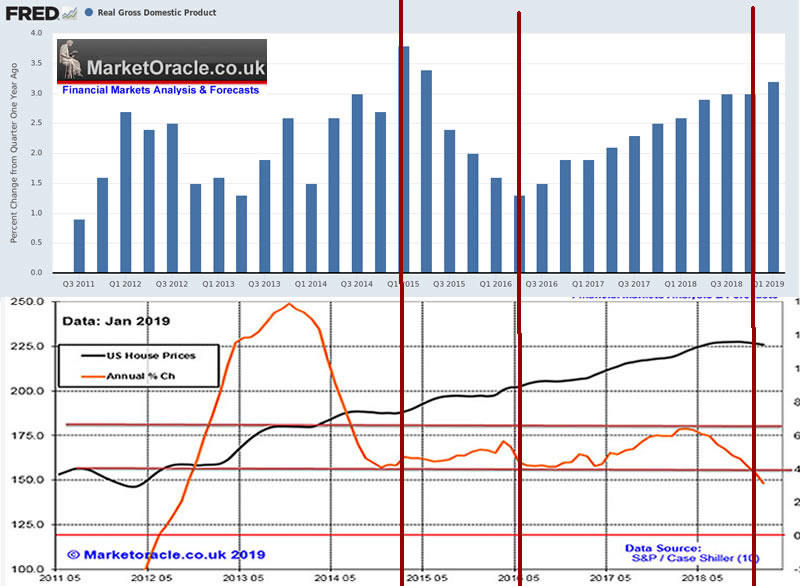

The US economic fundamentals appear good as real GDP is rising at an annualised rate of +3.2% up from +2.6% a year ago. Whilst not a boom is still definitely not deflationary so supportive of house prices as the economy continues to chug along and thus implies US house prices should revert towards the 4% to 6% trend.

This is the third in a series of articles that concludes in a new multi-year trend forecast for US house prices that seeks to replicate the accuracy of my last US House Prices trend forecast.

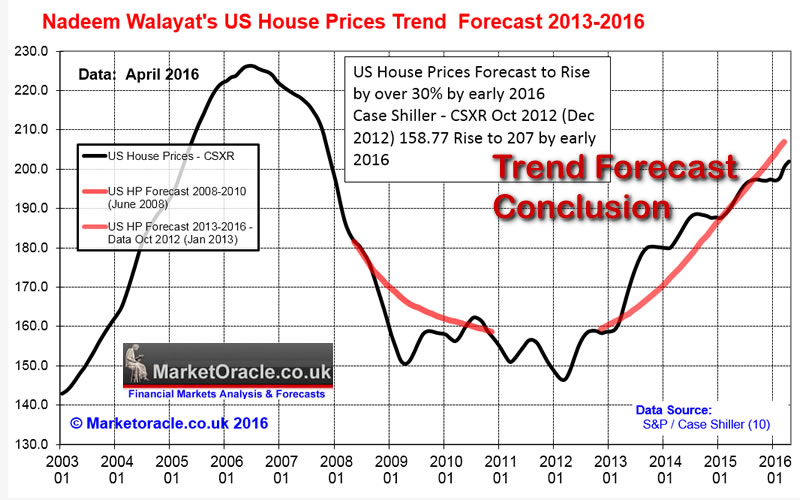

12 Jan 2013 - U.S. Housing Real Estate Market House Prices Trend Forecast 2013 to 2016)

US House Prices Forecast Conclusion - As you read this, the embryonic nominal bull market of 2012 is morphing into a real terms bull market of 2013, with each subsequent year expected to result in an accelerating multi-year trend that will likely see average prices rise by over 30% by early 2016, which translates into a precise house prices forecast based on the most recent Case-Shiller House Price Index (CSXR) of 158.8 (Oct 2012 - released 26th Dec 2012) targeting a rise to 207 by early 2016 (+30.4%).

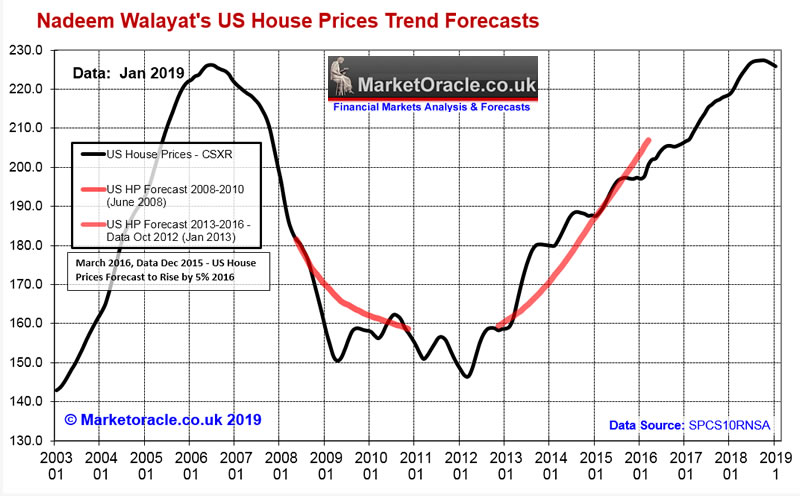

And here's how the US house prices trend forecast concluded early 2016, resulting in only a -2.5% deviation against the forecast so proving remarkably accurate, as had my preceding forecast during the bear market.

Which brings is to the present. Where despite all of the mainstream media noise and the usual perma doom mantra, the US housing bull market has continued to rage on upwards all the way to NEW ALL TIME HIGHS!

U.S. House Prices Analysis and Trend Forecast 2019 to 2021

The whole of this analysis has first been made available to Patrons who support my work: https://www.patreon.com/posts/us-house-prices-26484438

- Current State

- Momentum Analysis

- US ECONOMY - GDP

- Unemployment

- Inflation

- Producer Prices Index

- Yield Curve

- US Debt

- QE4EVER!

- DEMOGRAPHICS

- US Home Builders Index (XHB)

- US Housing Market Real Terms BUY / SELL Indicator

- US House Prices 2019 to 2021 Trend Forecast Conclusion

- Peering into the Mists of Time

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Scheduled Analysis :

- China Stock Market SSEC

- UK Housing market analysis

- Betting on the Tory Leadership Contest

- Stock Market Trend Forecast June 2019 Update

- Machine Intelligence Investing stocks sub sector analysis

Recent Analysis:

- Gold Price Trend Forecast Summer 2019

- How Many Seats Will BrExit Party Win - EU Parliament Elections Forecast 2019

- Stock Market US China Trade War Panic! Trend Forecast May 2019 Update

- US House Prices Trend Forecast 2019 to 2021

- Bitcoin Price Trend Forecast 2019 Update

- Stock Market Dow Trend Forecast - April Update

- Top 10 AI Stocks for Investing to Profit from the Machine Intelligence Mega-trend

So again for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my FREE Newsletter to get my public analysis in your email in box (only requirement is an email address).

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.