US Bond Market You Have to Invite the Vampire Into Your House

Interest-Rates / US Bonds Jun 01, 2019 - 02:17 PM GMTBy: Gary_Tanashian

A vampire needs to be invited in order to enter your house. So the story goes. But in this case, we are talking about the Macro house, with its nexus in the USA and its Central Bank.

A vampire needs to be invited in order to enter your house. So the story goes. But in this case, we are talking about the Macro house, with its nexus in the USA and its Central Bank.

You see, the Federal Reserve inflates money supplies as a matter of doing business, which is why I noted so strenuously in Q4 2018 that Jerome Powell’s then-hawkish stance in the face of a declining stock market made perfect sense… because the 30 year Treasury bond was not bullish; it was bearish and getting more so under the pressure of rising inflation expectations.

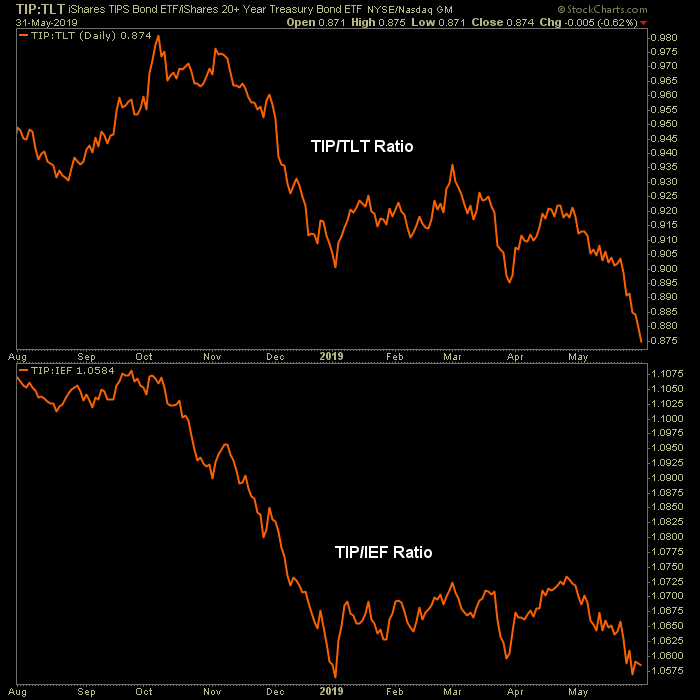

But now as we noted the other day the inflated Sub is losing pressure. As we noted before that Goldilocks is being threatened. Here are the updated ‘inflation gauges’ from that post, continuing to lose pressure.

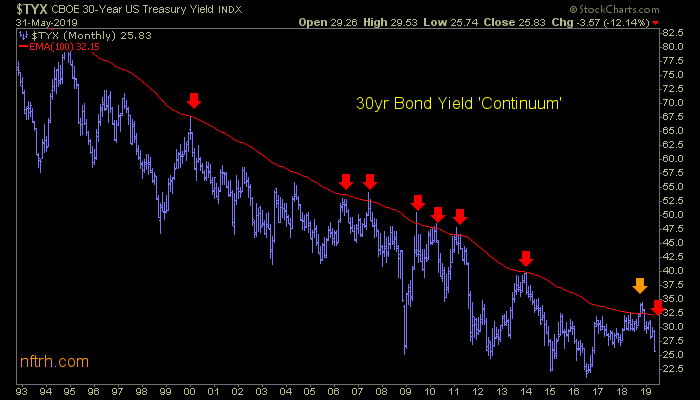

But in Q4 the Fed had a threat if its own to deal with as the repercussions of its previous inflationary operations could be exposed to the light of day by the breakout through the Continuum’s limiter if it were not arrested promptly. The orange arrow on the chart below shows the point of concern for the Fed.

Our thesis of the time was that an impulsive breakout in long-term bond yields would end the Fed’s inflationary racket and thus, end the Fed itself (as we know it). Our view was that given the choice between an imploding stock market and a fatal breakdown in the long bond (break up in the yield) the choice for the Fed would be a no-brainer. And what do you know… the Continuum’s limiter held yet again.

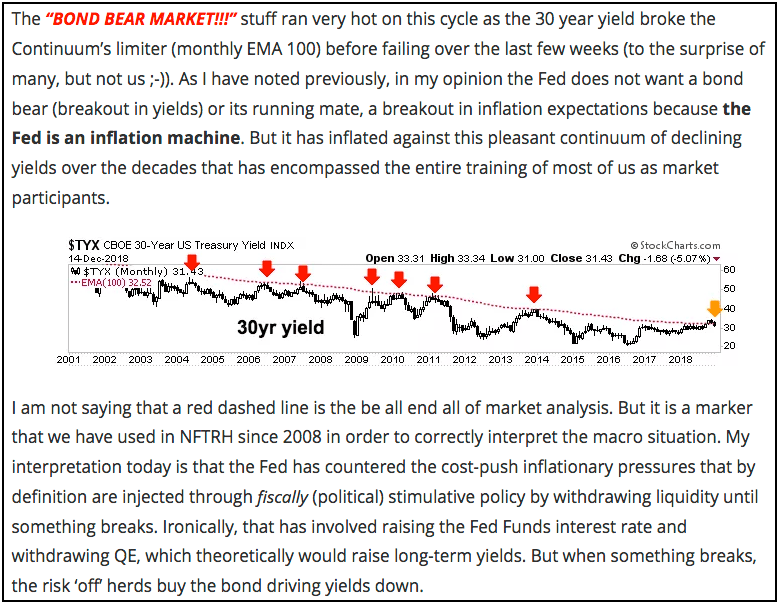

Here is an excerpt from the December 19th edition of Notes from the Rabbit Hole…

NFTRH 530 (FOMC at Center Stage)

And here is an excerpt from that excerpt…

And as to the last sentence above, the herd buys the bond and invites the damn vampire into the house!

You see, the current Continuum looks a lot different now than it did in Q4 2018, doesn’t it? Inflation is absolutely not an issue right now and if it is an issue, that issue is that it is not high enough to sustain bloated bubble markets that depend on more inflation to come.

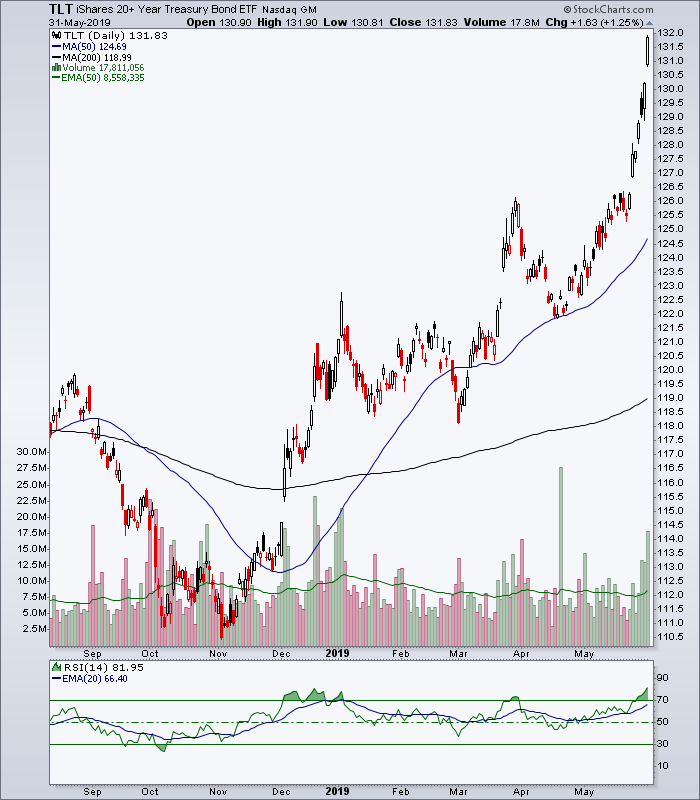

What is happening now is that the Fed’s inflation gun is being re-loaded, gold is breaking out again and of course the CME Fed Funds futures boyz have been predicting increasing odds of a rate cut in 2019 as the year moves along. By piling into the long bond, market players (man, machine, casino patron, Ma & Pa) are inviting the Fed’s next inflationary action. Unlike in Q4 2018 when Trump was haranguing the Fed chief relentlessly, the table is set and the vampire is coming to dinner.

Aside from T bonds, the gold sector is the first and best mover in pre-inflationary cycles like this. The move usually comes amid destruction in the cyclical world. We noted some of the improving macro fundamentals for the gold sector on Thursday. On Wednesday we noted that some markets you would not expect are out-performing the US.

It all makes (macro) sense and so it is recommended that casino patrons shift from a US-centric view and also start taking precious metals more seriously now. After all, that sector was under revolt from its own patrons just a couple days ago. The Golden Bull Horns sounded back in February, the sector was appropriately punished and lessons were learned (yet again). But as with the cleaner backdrop that the Fed operates against today vs. Q4 2018, gold bug sentiment is much cleaner than it was in February (and as a bonus, the inflationists are all gone).

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2019 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.