Told You So: The Bearish Momentum in Crude Oil Accelerates

Commodities / Crude Oil Jun 01, 2019 - 11:54 AM GMTBy: Nadia_Simmons

Oil price is melting down like there’s no tomorrow. How else could we describe the bloodbath? Fresh monthly lows being hit on a daily basis. Slicing through important supports. With such a weak close to the trading week, how will black gold fare the next one? Clearly, the most recent Mexico tariff announcement hasn’t helped and it’s widely felt in the markets, including this one. Better news on the horizon?

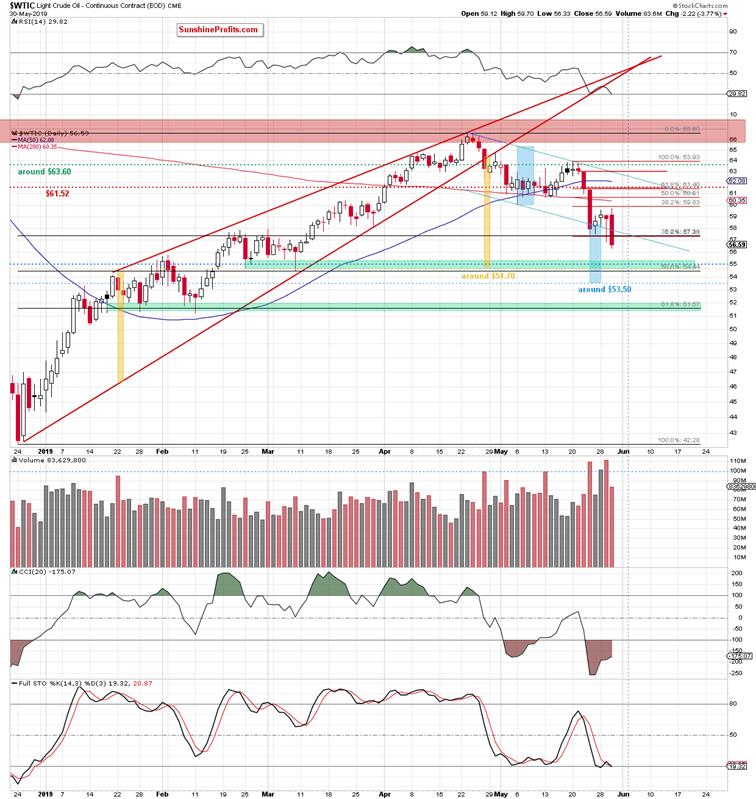

Let’s take a closer look at the chart below (charts courtesy of http://stockcharts.com and www.stooq.com).

We wrote these words yesterday:

(…) After hitting a fresh May low, black gold (…) rose not only above last week's lows, but also returned back inside the declining blue trend channel.

This way, crude oil has invalidated two earlier breakdowns. While this may seem bullish on the surface, (…) we have already seen something similar not so long ago.

(…) the breakout attempt above the 38.2% Fibonacci retracement evaporated. Such a swift reversal increases the likelihood of further deterioration targeting at least a test of the lower border of the blue declining trend channel in the very near future.

The bulls have been unable to reach the 38.2% Fibonacci retracement yesterday and crude oil price went on to slide below previous day’s intraday lows.

Black gold has closed the day not only below Wednesday’s lows, but also below the 38.2% Fibonacci retracement (marked with green). The situation doesn’t look good for the bulls in the coming day(s).

This view is supported by looking at today’s crude oil futures action so far:

Light crude has opened today with another red gap. The losing streak continues and the bearish overtones are very much on – just look at the current oil price of $55.00 approximately. It’s a fresh May low, approaching our next downside target – the green support zone based on the 50% Fibonacci retracement and the late-February lows.

Should the commodity continue on its downward path, it’s high time to think about the downside targets. Take a look at our website for more. You’ll find there some timeless and fitting trading wisdom for a situation like this, too.

Summing up, the outlook for oil is bearish. Yesterday, the bulls have been finally unable to stop the bearish momentum. Black gold continues to trade lower, making our short position increasingly profitable – literally day by day. The weekly indicators and volume comparison continue to support lower prices and the daily picture concurs. Our downside targets are within a spitting distance and the short position continues to be justified.

The full analysis covers also the targets of this downside move. You are welcome to check more of our free articles on our website, including this one. If you enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Oil Trading Alerts as well as Gold & Silver Trading Alerts. Sign up now!

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.