Eurosceptics Gained Seats in the EU. Will Gold Shine Now?

Commodities / Gold & Silver 2019 May 29, 2019 - 12:56 PM GMTBy: Arkadiusz_Sieron

More than 200 million people in 28 nations voted in the second-largest democratic elections in the world. What interesting information can we glean from their vote – which way the wind blows now? Crucially, how does it reflect on gold?

Populists and Greens Gain Seats in the EU Parliament

People across the European Union have voted for in the European Parliament elections. Turnout was 50.5 percent, the highest level in 20 years. Last time, it stood just 42.6 percent. However, despite high turnout – which usually supports mainstream, big parties – the two biggest voting blocs have lost their majority in the European Parliament. The centre-right European People’s Party and the centre-left Socialists and Democrats will remain the two largest blocs, but they lost 74 seats. They had 403 of the 751 seats in the EU parliament, now they will have just 329 seats.

Does it mean that the populists have taken over the EU? Not really. Of course, the nationalist and populist groups have gained several seats. According to provisional estimates, the major Eurosceptic groups will make up around 25 percent of the chamber, growing from around a fifth. In particular, the populists did the best in Italy and France, where Marine Le Pen’s National Rally recorded a strong 23.5 percent of the French vote, a narrow symbolic victory over Emmanuel Macron’s party. However, the eurosceptics performed below than expectations and in some countries worse than in previous, national elections. The pro-EU parties hold around two-thirds of seats.

Actually, Greens and Liberals achieved the greatest success, as they jumped from 52 and 68 MEPs in 2014 to around 70 and 107 now. These parties surged to second or third place in several countries. Together with eurosceptics’ gains, it implies that less orthodox views will have greater importance in the EU.

What does it all mean for the gold market? Well, first of all, the far-right earthquake didn’t quite shake the parliament’s foundations, as some people worried before the elections. It’s bad news for gold, as we will not see a surge in a safe-haven demand for the shiny metal (however, we will see some political turmoil in the EU: the new president of the European Commission will be elected now, there will be snap elections in Greece, etc.).

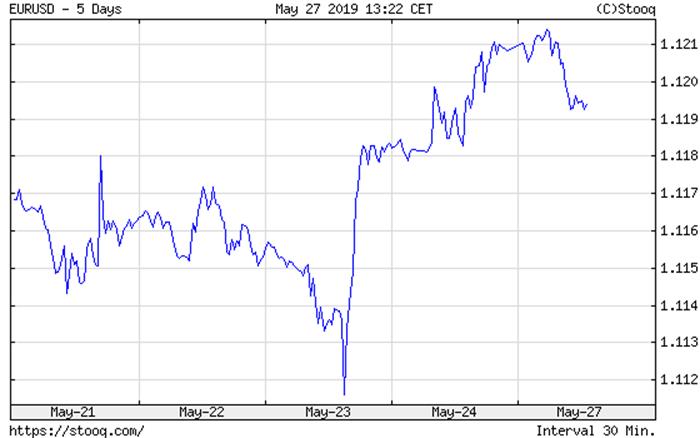

Moreover, the Green wave among the Europeans could force the EU executive to adopt a tougher line on environmental protections and the global warming agenda. The problem is that pro-environmental agenda very often stifles the industry and economic growth. Hence, the EU is likely to still grow slower that the US, which is more business-friendly. That divergence will support the greenback, being a headwind for gold. Who knows – maybe this is why the euro declined against the US dollar on Monday morning?

Chart 1: EUR/USD exchange rate from May 21 to May 27, 2019.

Brexit Drama Continues

In the UK, which took part in the elections despite the desire to leave the bloc, the Brexit Party was the clear winner. Nigel Farage’s party, which was launched just six weeks ago – received 32 percent of the vote, the highest share. The ruling Conservative Party got just 9 percent, the worst performance since 1832. The Labor Party got just 14 percent, also recording a plunge in support. It seems that the endless debate about Brexit hurt the biggest parties. The voters clearly showed their dissatisfaction with the failure of Prime Minister Theresa May to take the United Kingdom out of the European Union.

Oh, did I say “prime minister”? Oops, my mistake – May resigned on Friday, as another political twist in the protracted Brexit drama. It should not be surprising, as May strived to please both fractions within the Conservative Party, trying to prevent division, but she ended annoying everyone. As David Cameron did not sense the mood of society, May did not sense the mood of the Parliament. Anyway, a few months after the Brexit deadline, we still do not know how, when or even whether the country will leave the EU. May’s resignation only adds further uncertainty as the ruling party has to choose the new prime minister among several candidates who hold different views on the Brexit.

However, just like British voters, gold investors seem to be fed up with the Brexit saga, and they do not react strongly to the news about the UK’s exit. If any at all, the impact of further uncertainty may be negative on the yellow metal – after all, the US dollar strengthened initially against the British pound after the May’s resignation. It seems that the rising tensions between the US and Iran have more potential to support the gold prices. We will write about them in the future editions of the Gold News Monitor – stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.