Bitcoin Price Stalls Near $8100

Currencies / Bitcoin May 27, 2019 - 06:17 AM GMTBy: Chris_Vermeulen

After an incredible 7+week rally in Bitcoin, from $3700 to above $8000, the current price action is setting up for what may become an extended Pennant/Flag formation with quite a bit of sideways trading ahead.

After an incredible 7+week rally in Bitcoin, from $3700 to above $8000, the current price action is setting up for what may become an extended Pennant/Flag formation with quite a bit of sideways trading ahead.

Our researchers believe the past 7+ weeks rally in Bitcoin was prompted by a shift away from risk in Asia/China and into more suitable protection assets. Cryptos appear to be the easy choice for many as this rally coincided with the April 3rd through 6th US/China trade talks in Washington, DC (https://www.scmp.com/economy/china-economy/article/3004961/us-says-theres-still-significant-work-be-done-trade-talks). It appears that many investors were preparing for a difficult deadline after the March 1st deadline for a deal was pushed back. These early April trade talks may have been interpreted as a “do or die” effort from both sides. Again, shortly after the May 1st US/China trade talks in Beijing, Bitcoin began another rally from the $5200 level all the way up to the $8000 level.

Our contacts, although we admit they are fairly limited in total quantity, have stated the sentiment from locals in China are very pessimistic on the US and President Trump. A few of our contacts have recently stated they have been laid off or terminated from their jobs and, as we understand, locals have already started to react in a protectionist mode. This happens when economies contract quickly. Consumers attempt to protect their wealth and assets by moving any capital they have into something more efficient than their local markets – thus Cryptos.

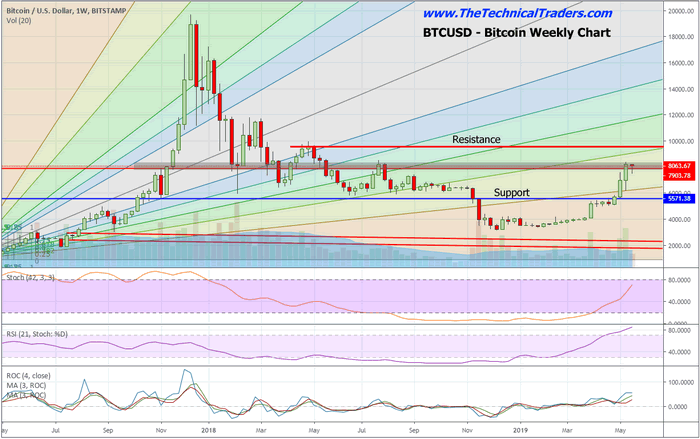

This Weekly Bitcoin chart highlights areas that we believe our current support and resistance levels. The $8000~8100 level goes all the way back to the February 2018 low. This is a critical level for trading as it became a massive price support level back in 2018 – and eventually became critical resistance in July 2018. Additional resistance is found near $9900.

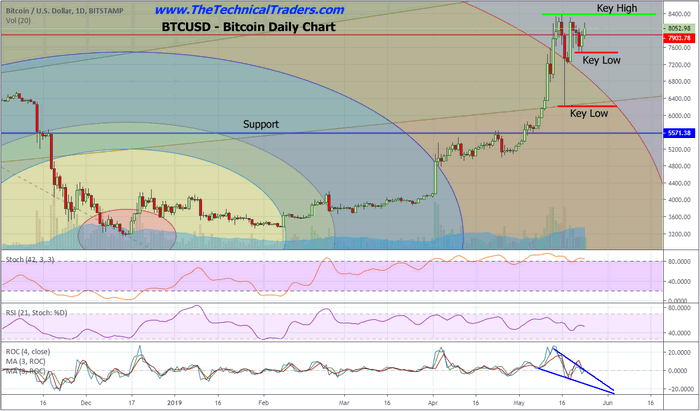

This Daily Bitcoin chart highlights what we believe are the current Key Highs and Key Lows that will tell us if the next phase will be a continued rally or a breakdown in price. The Key Low near $7480 must hold for any further upside price advance. If $7480 is broken, we would expect the next Key Low price to be targeted (near $6200). Otherwise, if another rally breaks out and price rallies above the Key High, then we could see an upside target range between $9200 to $9700 very quickly.

You can see from our BLUE CHANNEL levels on the lower indicator that we believe a Pennant/Flag formation may be setting up in Bitcoin right now. This type of price rotation is not uncommon after a big move like we’ve seen already and it could be a fairly wide price rotation as this sideways Pennant/Flag pattern continues. The current range between Key Highs and Key Lows is about $2000 – lots of room for trading/traders.

The key to understanding this move is the protectionist thinking of the people of China. They are very likely attempting to move their capital into something that is not Chinese Yuan based and away from traditional holdings (Gold, Real Estate, Jewelry or other assets). Eventually, we will likely see Gold/Silver follow the rally in Cryptos if fear continues to hit the markets. Cryptos, although, appear to have executed the first leg of the “fear trade” originating from the breakdown in the US/China trade negotiations.

An additional word of warning should be that any resolution to the US/China trade talks over the next 60+ days could remove any long term support for this upside move in Cryptos. Pay attention to the news cycles and what is happening in China, the EU and the rest of the world. As fast as it went up, it could easily break down as news hits.

Lots of great price action unfold to take advantage of. Subscribers just closed out a 24% winner and another 3.46% as the markets prepare for a new move. If you want my trade signals and alerts be sure to check out my Wealth Trading Newsletter.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.