Capitalism Works, Ravenous Capitalism Doesn’t

Economics / Economic Theory May 23, 2019 - 02:53 PM GMTBy: Raymond_Matison

For more than a century, capitalism has proven to be successful in expanding the efficient manufacture of goods and agricultural products, increasing jobs and incomes, promoting technological innovation, decreasing poverty and improving the general welfare of humans globally. By contrast, socialism and communism with its centrally planned economy and collectivism historically have produced misery, war, need and poverty through oppressive totalitarian governments.

For more than a century, capitalism has proven to be successful in expanding the efficient manufacture of goods and agricultural products, increasing jobs and incomes, promoting technological innovation, decreasing poverty and improving the general welfare of humans globally. By contrast, socialism and communism with its centrally planned economy and collectivism historically have produced misery, war, need and poverty through oppressive totalitarian governments.

Super hedge fund manager Ray Dalio, the president of Bridgewater Associates, the very successful and largest hedge fund in America recently released a thoughtful and timely report stating that “capitalism is broken” - pointing to, among other things, the gross income disparity between high and low earners. Ray Dalio’s judgment of broken capitalism relates to his observation that the vast majority of wages going to the top 5% wage earners does not benefit the overall economy, destabilizes society and is destructive to capitalism. The fact that a true-blue capitalist wrote the article should alert industrialists, globalists, bankers and all capitalists that perhaps “capitalism with American characteristics” has veered off its previously successful course. Capitalism does work; but ravenous capitalism is indeed self-destructive. The bounty of capitalism must be shared not only with its owners or investors, but also with its other “significant partners” – the nation’s workers.

Democracy and capitalism have expanded in the 20th century largely due to America’s successful example and its persistent replacement of socialist or left-wing rulers in countries around the globe, installing democratic governments and promoting market concepts. Communism during this same time period has withered to the point of extinction, while socialism surprisingly appears to have grown significantly among democratic and capitalist nations.

Part of the problem in understanding the ebb and flow of these economic systems is related to the changing definition of words. For example, communism was the end point of socialism with all the means of production owned by the centrally controlled totalitarian state. Today hardly anyone in the world would propose that the socialism of the day will end in such communism. So the definition of these words and the systems themselves have changed, and they keep evolving today. For a more comprehensive view of capitalism and socialism see: Subversion and Constructive Synthesis of Capitalism and Socialism - http://www.marketoracle.co.uk/Article59089.html .

President Trump at his 2019 State of the Union message stated that “America would never become a socialist nation”. That of course depends on the definition of this word. When President Roosevelt created the Social Security System and large national infrastructure programs such as building a national water dam and electric generation system, and started welfare programs - by a strict definition of the word of that time America was already on its way to becoming a socialist country. President Trump, and most people today, have a different understanding of socialism. However, it is clear that never before has socialism had so much support from our younger generation, and never before have there been so many convinced socialists in Congress. In this context President Trump’s comments are sounding an important alarm similar to that provided by Paul Revere’s ride at the time of America’s revolution.

This article highlights the reasons why “capitalism with American characteristics” is in trouble, and why ravenous capitalism is self-destructive. An approach is suggested which can return capitalism to its healthier days – an approach which does not penalize companies nor government. A less ravenous and more humane capitalism would increase the well-being of our citizens, reduce socialist demands, and build a stronger more secure America.

Corporate profit

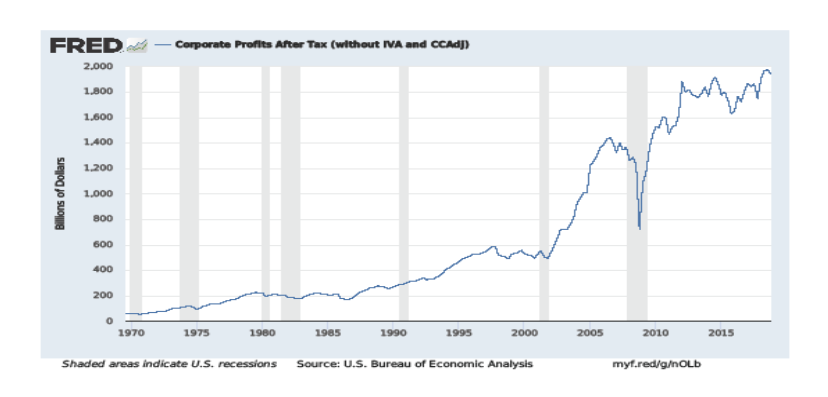

One effective way to measure the success of capitalism is to track the rise of corporate profits over a period of time. The following table shows after tax profits for corporations filing with Federal Reserve Economic Data base.

What we can see from the preceding graph is that with the exception of a dramatic decline in earnings in the 2007-2009 period, and some periods of relatively flat earnings (1995-2001, and 2012-2018) that corporate profits have grown steadfastly over time.

Corporate earnings over 2012-2018 period hovered around $1.8 trillion annually.

Dividends to shareholders

A measure of a corporations comfort level with respect to its continuing earnings power, and its ability to have necessary capital for future operations is determined by the amount its directors are willing to pay to shareholders as dividends. A young faster-growing company may pay no dividends to shareholders at all, since its capital can be effectively used in building its business. By contrast, a more mature company with all the production capacity needed already in place will pay out a significant portion of its earnings to shareholders in the form of a cash dividend.

In the marketplace the stock of a younger company will appreciate even without paying any dividends because it is growing faster and expanding its market. As a company matures and slows its growth, its stock price appreciation will slow, but the payment of increasing dividends adds to the total return of the investor to make an attractive long-term investment.

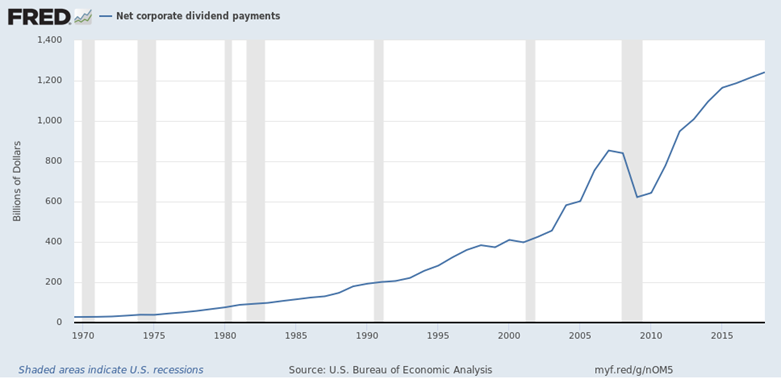

The following chart shows a rising growth of dividends to shareholders over decades.

Note the similarities of two charts, showing a reduction in dividend payments during the 2012-2118 period when earnings declined. However, dividend payments have persistently increased over time. During the 2012-2018 period annual dividends increased to average about $1.1 trillion, but rose to over $1.2 trillion in 2018 – indicating a dividend payout ratio to earnings of about 67%. Traditionally, corporations have paid out 33-50% of earnings as dividends, with the balance being retained to increase capital. A high dividend payout ratio indicates that a company has more than sufficient capital for its ongoing business needs.

Corporate share repurchases

In recent years America’s corporations have repurchased their own stock in the marketplace by record amounts. Of course managements and directors are easily influenced by investment bankers to repurchase stock, since it will invariably initially increase the market price of any company announcing or implementing such a program. Company directors, management and employees owning shares and options would all benefit. Some companies will even borrow funds to finance a repurchase program.

Whether a company’s own funds or financing is used to implement a stock repurchase program, it is also a strong indicator that a company has too much capital for its own operations. Stock repurchases once were disallowed as they were deemed to manipulate the market, but industry attempts to deregulate reversed this rule in 1982.

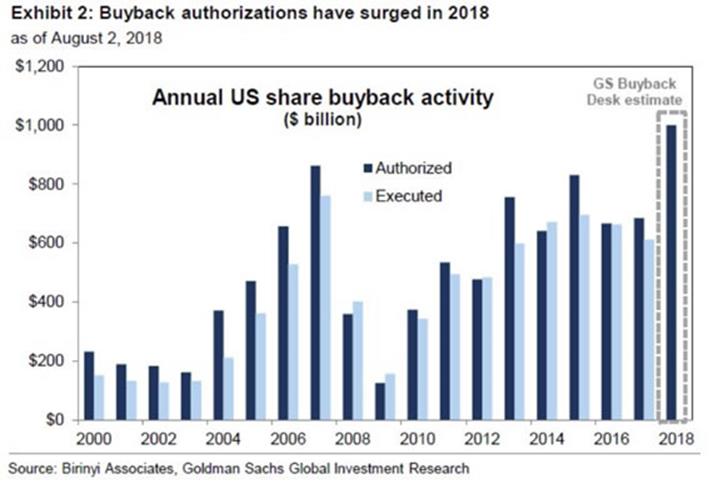

The following chart, courtesy of Birinyi Associates and Goldman Sachs shows the amount in dollars used for stock repurchases in recent years. It appears that since 2012 corporate share buybacks have averaged about $600 billion per year, while data from the previous chart shows that approximately $1.1 trillion was paid out in dividends. The total of these two numbers is close to the $1.8 trillion total earnings of corporations.

Companies such as Apple, Exxon, Sears, and General Electric have previously implemented share repurchase programs over years. Share repurchase programs can and do encounter problems, since markets can decline independently or despite a large purchase of stock. As just one example, General Electric, once considered a highly rated “one decision” almost an heirloom stock, expended $40 billion to repurchase stock about two to four years ago, which is now trading at about one fourth its repurchase prices. With hindsight, that money could have been spent more effectively.

Wage history of the American worker

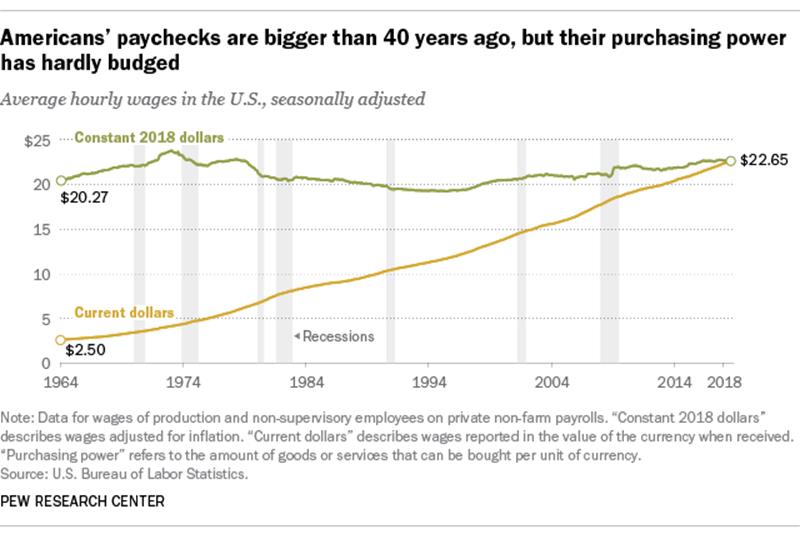

It is already a well-worn statistic that the American wage earner has not seen his inflation-adjusted wages increase since the early 1970s. During this long time period industrial productivity has increased dramatically – as corroborated by the impressive increase in earnings over this period. The following table, produced by the Pew Research Center, shows that inflation adjusted wages since 1972 and today are essentially unchanged. Given the dramatic increases in production efficiencies and corporate offshoring of jobs, reduction in pension guarantees to employees over these many decades, confirms that corporations are not sharing equitably their great and growing prosperity with employees.

Avoidance in sharing this corporate prosperity with workers is shortsighted. Wages of capitalism should be high, such that workers can afford to individually build enough savings for their independent health care and retirement. Wages also must be high enough so that this economic system’s workers can afford to purchase all the products it produces – which insures the capitalist system’s continuing success. Today, the financial frailty of today’s common worker is such that he fears for having or keeping a stable living-wage job, is justly suspicious that neither a corporate pension nor Social Security will be able to provide adequately for retirement, as historically low interest rates detract from savings accumulation and pension fund viability, while continued expansion of fiat money reduces future purchasing value.

We propose that it has been the lack of adequate wage increases, failure of the Bretton Woods monetary system after 1971 and subsequent Federal Reserve’s pervasive and persistent monetary inflation which diminished the effective income of the American family’s breadwinner that required women to join the workforce, led families to resort to devastating credit card debt, and to borrow against their home equity, which has shoved those exposed families over an economic cliff. It has created this huge chasm between financially comfortable the top 30% of wage earners, and the bottom 70%. The disparity between this lower 70% of wage earners and the top 1-5% is now so wide as to create a realistic risk of violent revolt – as we are witnessing already today in France with the “yellow vests”.

The following chart constructed by Dent Research from data of the St. Louis Federal Reserve demonstrates that as the rate of corporate profits has been rising relative to GDP, the rate of wages relative to GDP has been declining.

Note that the decline of wages as a fraction of GDP has been steady since 1971. While earnings fluctuate much more year to year, it is also clearly visible that earnings as a fraction of GDP has been steadily increasing.

The average U.S. GDP of the last five years is $18.9 trillion. Applying an average rate of 9.5% from the chart to the GDP number yields earnings of $1.8 trillion. Contrariwise applying a 9.25% rate to the 2018 GDP of $20.5 trillion yields profits of $1.9 trillion. So the profit to GDP numbers of this chart confirm the numbers of our previous corporate profits chart. If we now apply the wages and salaries ratio from the above chart, we get a good estimate of wages and salaries. Applying a 43% rate from the chart to the 2018 GDP yields the estimate of wages and salaries of $8.8 trillion. These numbers do not require decimal point precision to prove a concept - so this number is precise enough.

Evolving socialism, changing capitalism

Communism and socialism originally took hold because the common people were dirt poor, and revolutionaries simply promised them more – a better future. However, having little by itself would not be able to create the animus for armed revolution – it took realization that country leaders lived lives of unimaginable riches in comparison to common citizens as serfs in order to rise up against their oligarchs.

Today’s American citizen may have a cell phone, computer, television, an automobile, and even a house – so it appears difficult to characterize this person as being dirt poor. However, these items are ubiquitous even among the less prosperous in our society today, and represent relatively inexpensive technologies which didn’t exit a hundred years ago. But when the homeowner is without a stable or full-time job, has built up a large credit balance, which based on his income is not repayable, while he doesn’t know how to make the next payment on his mortgageor or his auto loan, and no more reductions in expenses, even in the purchase of food supply can be made – the gap between today’s common citizen and the top one percenters is for practical purposes as vast a gulf as that between the peasant and the king of a century ago. So the danger of violent revolution is becoming real – particularly as the internet is making these income disparities known to everyone who has a computer or smart phone.

Both capitalism and socialism have changed over decades. There is no support among common folk for communism and its totalitarian, despotic rule. Socialism has many forms as demonstrated by that practiced in Sweden, Venezuela, China, and Europe. Perhaps the most interesting of these is that now practiced in China: it self-professes to be “Socialism with Chinese characteristics”. China is really practicing state-led capitalism, an amalgam of Communist political rule and government-supported capitalism. It has private ownership of means of production, rich people, and managers figuring out how to improve profit margins and gain market share. In building their new silk road, the Belt and Road Initiative, or in its business development in Africa or Latin America no proselytization of communism or socialism has been observed. That represents an amazing communist/socialist evolution.

Europe immediately after WWII through today has had large political influence from socialist parties. That influence over the last half century has been exercised in promoting attractive living wages to Europe’s citizens rather than the classical uprising to overthrow traditional government by force. Its socialist welfare has promoted wages which rise with profits, and programs for health, education, and retirement. Few citizens from Sweden, Norway, or Germany could be convinced to claim that their welfare program is destructive to their capitalist economies. Indeed, it would be more precise to observe that Sweden, Norway, and Germany are capitalist nations which simply subordinate maximum profits to providing adequate wage income such that the high tax rates they do pay can provide a financial safety net to all working citizens.

Sweden has constantly been cited as an example of successful socialism. Given that Sweden is a constitutional monarchy and a parliamentary democracy, has a stock exchange, private ownership of property, does not have a despotic central government, and no impediments for disgruntled citizens to move out – perhaps Sweden has been grossly mischaracterized. Could it not more accurately be considered as an example of successful capitalism, capital with humanistic caring and compassion, or capital humanism?

Does it really matter whether Sweden’s government and economic system is characterized as socialism with Swedish characteristics, capitalism with Swedish characteristics, humane capitalism, non-totalitarian socialism, or anything else? The system works in that people have a real voice in its government, and vote for the benefits it wants for its people. The country consistently ranks high when measured for comparable global citizen happiness.

Capitalism as it is practiced in South Korea, Japan, and Latin America is also distinguished from that practiced in America. The important observation to be made is that “capitalism with American characteristics” is now killing the goose that lays the golden eggs for their capitalists. A Federal Reserve study indicating that one-third of our middle class cannot afford a $400 emergency expenditure, or that half of Americans are just one paycheck away from financial hardship or disaster in the wealthiest nation in world history should ring some alarm bells indicating that something in its economic system is broken. Record-level homelessness is another symptom of a severe economic or social malaise. An over-indebted consumer who has questionable job security, with income lagging behind asset inflation cannot long support capitalism.

Repairing capitalism

As we reward company owners with shareholder dividends, we should reward also our other significant partners, company employees – by paying to them a bonus out of after shareholder dividend earnings of the company. This is done by a company first reporting its normal financial results in terms of earnings and dividends to shareholders unchanged from current practices. Then the company declares a special variable annual bonus to employees out of the remaining after tax earnings of the corporation. To provide an added incentive for corporations to pay this bonus, that portion of earnings to be paid out to workers is not previously taxed to the corporation. This action is attractive to the corporation in that it allows it to report marginally higher earnings, and is revenue neutral to the government, since this income tax will be paid by the income earner. Indeed, the government may gain moderately as individual income tax rates are higher than corporate rates.

Stock repurchases do affect markets, but often that money is simply wasted since after a stock repurchase program the stock can still decline below the repurchase price. Since stock repurchase is an indication of over-abundant capital, and a stock repurchase program does manipulate the market at the time of repurchase – we should go back to the rule that stock repurchases are not legal. Such funds are better spent by paying them out in a normalized annual amount of a presumed stock repurchase plan spread out over several years – as a special annual bonus to company employees.

Such payments of variable annual bonuses to company employees does not penalize companies which demonstrably have an over-abundance of capital. Yet such added income to employees would have a meaningful effect to their financial stability, would improve overall economic activity, and would do a lot for repairing capitalism.

Recall that wages and salaries of workers currently is about $8.8 trillion. Note that corporate repurchases have recently averaged about $600 billion per year. Then consider that dividends have averaged $1.1 trillion out of corporate earnings of $1.8 trillion, reflecting a higher than historically normal dividend payout ratio. As earnings continue to grow, the dividend payout ratio can be brought down to historic norms providing even more potential funds for employee bonuses.

It appears that the current level of $8.8 trillion in wages and salaries could be increased anywhere from $0.7-1.5 trillion (8.0%-17.0%), at a 50% dividend payout ratio on current earnings. That large increase in worker wages and salaries would create a quick leap to a higher earnings plateau, improve cash flow to workers and rehabilitate capitalism quickly.

The present Federal Reserve policy towards low interest rates accommodates our profligate government spending for the global hegemon. This policy extends the period of time our government doesn’t have to declare bankruptcy, but perversely it destroys accumulation of individual savings, and underfunds all existing pension funds – severely endangering our capitalist economic system. If the Federal Reserve would raise interest rates by favoring America’s citizens instead of its government, such that workers can accumulate meaningful interest to savings, and corporations, investment managers, and insurance companies can partially rehabilitate their vastly underfunded pension plans, then American capitalism would be back on the right track. Perhaps we could become again that exceptional nation.

Financial markets would respond positively to such changes, because it would be recognized as an overall boost to our economy. Middle class workers with increased earnings and savings also would be able to invest some funds in the markets, helping maintain or expanding current price/earnings multiples.

Conclusions

American capitalism, in its solitary decades-long quest to increase corporate earnings has eviscerated the country’s middle-class citizens, as wages have not increased with corporate profitability. While there are many other issues to address as well, income inequality is the major issue. In this report we have shown that the dramatic rise in corporate profits since the 1970s has been partially at the expense of their “industrial partners” – the wage-earning worker. Over decades this gradual shift has increased worker wages at rate that has been insufficient for people to prosper, and created unintended or undesirable consequences to previously successful capitalism. This approach to capitalism is failing, creating many economic and social distortions and is thereby has been self-destructive to capitalism. Ray Dalios words: “capitalism is broken”, is insightful and correct.

Redirecting over-abundant corporate capital away from stock repurchases and using such funds to increase worker wages via a bonus is one possible way. After the payment of corporate dividends to shareholders, utilizing a portion of the remaining corporate earnings to pay a variable bonus to workers is another component. Tax law adjustments can make such payouts attractive to both corporations and government. The payouts themselves are attractive and necessary to the nation’s workers, and fundamental to rehabilitate capitalism with American characteristics – and to have capitalism survive.

Raymond Matison

Mr. Matison was an Institutional Investor magazine top ten financial analyst of the insurance industry, founded Kidder Peabody’s investment banking activities in the insurance industry, and was a Director, Investment Banking in Merrill Lynch Capital Markets. He can be e-mailed at rmatison@msn.com

Copyright © 2019 Raymond Matison - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.