US - Iran War Safe-haven Reasons to Own Gold

Politics / GeoPolitics May 20, 2019 - 12:14 PM GMTBy: Richard_Mills

“It’s the tail that wags the dog” is defined by Urban Dictionary as a way of persuading a large group of people. The phrase is usually employed in a situation wherein a cause that expects to elicit a certain effect, is in fact reversed.

“It’s the tail that wags the dog” is defined by Urban Dictionary as a way of persuading a large group of people. The phrase is usually employed in a situation wherein a cause that expects to elicit a certain effect, is in fact reversed.

The 1997 film ‘Wag the Dog’ is about a powerful political strategist who tries to get a fictional president on board with a PR campaign involving the US invasion of Albania, a tiny country in eastern Europe, in order to divert attention from a scandal at home just two weeks before an election.

Of course, you don’t need to watch a movie to know this. There are plenty of real-life examples of presidents who used foreign invasions, coups, wars, etc. to demonstrate strong leadership and thereby shore up faltering popularity at home.

US President Donald Trump is just the latest.

In this article, we take a look at the situation that is developing off the coast of Iran, and how a military engagement could seriously backfire on the US. We’ll also detail the reasons why starting a shooting war wouldn’t be a bad idea for Trump to get eyes off the constitutional crisis that is developing over his administration's refusal to follow established legal procedures; and share a few thoughts on the US-China trade war. All three situations carry the risk of a major destabilization of the world order, and are excellent reasons to own gold, the best safe-haven asset money can buy.

Constitutional crisis

On Sunday, Trump’s national security advisor, John Bolton, announced that the United States would send an aircraft carrier, the USS Abraham Lincoln, into the Strait of Hormuz, between Oman and Iran, to “send a message” to the leadership of Iran which has been threatening the US in the strategically critical region.

Is it a coincidence that the White House is ordering a display of US power in the Middle East now, just as the Trump administration is being attacked from all sides by House Democrats? We think not. If there was ever a need to change the negative narrative in Washington, over abuse of executive power, that time is now.

To summarize the crap storm swirling around Trump and his administration:

- Lawmakers are holding Attorney General William Barr in “contempt of Congress” (referring to the power of Congress to demand witnesses and documents, as part of a Senate or House investigation) for rejecting their demand for an un-redacted version of special counsel Robert Mueller’s report on Russian interference in the 2016 election.

- There are so many contempt of Congress citations, House Democrats are considering putting them all under one “package” to vote on. The latest include Treasury Secretary Steven Mnuchin, and Don McGahan, Trump’s former White House counsel who refused a subpoena to testify before the judiciary panel.

- There are 17 known investigations (including those contained in the Mueller report) into Trump’s activities before and during his presidency, by federal, state and local prosecutors. This Time Magazine article details an extensive list of investigations which includes the ongoing criminal trial of Trump confidant Roger Stone; the “hush money” investigation over payments Trump’s lawyer Michael Cohen made on his behalf, while Trump was running for office, to a former Playboy model and a retired porn star, who allegedly had affairs with him; a lawsuit against the Trump Foundation for a “shocking pattern of illegality”; and a defamation lawsuit filed by Summer Zervos, a former contestant of ‘The Apprentice’, who claims Trump sexually assaulted her in 2007;

- The Senate Intelligence Committee has subpoenaed Donald Trump Jr., to testify before the committee for a second time.

- Democrats subpoenaed Donald Trump’s tax records that showed the New York real estate tycoon racked up over $1 billion in losses over a decade.

- Around 800 federal prosecutors signed a letter expressing their belief that, if he were not president (and protected under justice department guidelines prohibiting the indictment of a sitting president), Trump would face “multiple felony charges of obstruction of justice”.

If the chaos on Capitol Hill is making you give your head a shake, you’re not alone. What does it all mean? Will Trump be impeached? Or jailed? What’s next? The Los Angeles Times provides some guidance on the constitutional crisis that is unfolding between the executive and legislative branches of the US government.

The newspaper states that, if Congress holds someone in contempt, they can refer the case to a federal attorney. If found guilty, the punishment is up to a $10,000 fine and a year in jail. f the courts take too long to address contempt of Congress charges, House Democrats could fine Trump administration officials up to $25,000 a day, until they comply with the request to testify.

If federal prosecutors don’t bring charges against those accused of contempt (and they would be reluctant to do so, especially powerful officials like the attorney general), Congress can also go to federal court. The House or Senate would file a lawsuit arguing that the person must comply with the congressional subpoena.

The Democrat-controlled Congress could try to impeach Trump, but to be successful, letters of impeachment must pass both the House of Representatives and the Senate. Because the Senate is controlled by Republicans, impeachment would likely be blocked there, the same as what happened when the Republican-controlled House voted to impeach President Clinton but the majority-Democrat Senate refused to convict him.

The tail wagging the dog

If the deployment of an aircraft carrier to Iran is, in fact, an attempt to get the media talking about something other than Trump’s legal woes, it wouldn’t be the first time a diversionary tactic was rolled out.

Newsweek reminds us that, last summer, Trump blasted out a tweet saying North Korea would face “fire and fury” if the reclusive dictatorship continued to test an intercontinental ballistic missile with a nuclear warhead, that could reach the United States. His alarming tweet came the day after Mueller enrolled a grand jury to investigate Trump’s alleged collusion with Russia to win the election.

Other “tail wagging the dog” examples of presidential diversion events include George H.W. Bush’s decision to deploy 25,000 troops to Panama in 1989. The plan to forcibly remove drug-running dictator Manuel Noriega from power was Bush Sr.’s response to concerns he wasn’t a strong commander-in-chief. His popularity surged to 90% with his invasion of Iraq shortly thereafter; George W. Bush was never so popular as when he bombed Afghanistan following the 9/11 attacks; and John F. Kennedy’s standing in the polls rose dramatically for his handling of the Cuban missile crisis. War, apparently, is good for politics, as well as business.

The Strait of Hormuz

That must be what John Bolton, Trump’s national security advisor, was thinking when he said on Sunday that an aircraft carrier would soon be sailing towards Iran “to send a message”.

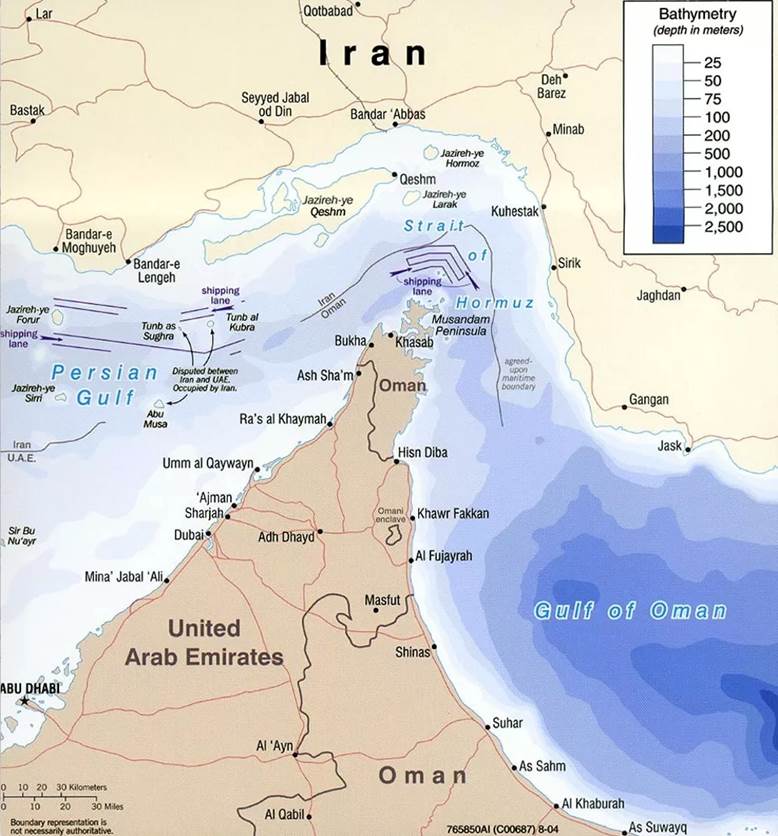

That message was in response to information passed to the US from the Israelis, Iran’s historical adversary, saying that Iran may attack US forces, or its allies, in the Persian Gulf. Four ships off of Fujairah, a port about 140 kilometers from the Strait of Hormuz, were reportedly sabotaged, of which two oil tankers were significantly damaged. US aircraft carriers regularly transit the Strait of Hormuz, a narrow waterway between Oman and Iran, through which a third of all seaborne oil is shipped. But deploying the USS Abraham Lincoln carrier strike group, which includes the carrier, its powerful carrier air wing, one cruiser and four destroyers, is an inescapable escalation.

Last Thursday US Air Forces Central Command said F-15C Eagle fighter jets were repositioned to the Gulf; the next day, the Pentagon doubled down by sending the USS Arlington amphibious landing ship, and a Patriot surface-to-air missile battery.

This decision “represents a prudent repositioning of assets in response to indications of a credible threat by Iranian regime forces,” acting Secretary of Defense Patrick Shanahan said last Monday, via Business Insider.

Tensions between Iran and the United States have been on high alert since Trump withdrew the United States from the 2015 nuclear deal and restored sanctions against the country, whose arch-enemy is Saudi Arabia, a key US ally.

CBC News reported that Iran warned last week it would start enriching uranium again, which is required to make nuclear weapons, in two months if world powers failed to negotiate a new nuclear deal.

A projection of force may have been necessary given the existing tensions between the US and Iran but deploying an aircraft carrier to move through the highly defensible strait may have been a huge miscalculation.

A US aircraft carrier and its strike group represent the highest order of naval power, but the show of force is the wrong choice for the shallow choke point that is the Strait of Hormuz. Business Insider quotes Caitlin Talmadge, an associate professor of security studies, saying that aircraft carriers are designed for operations on the open ocean, where they are beyond the range of missiles fired from shore.

The “confined waters of the Persian Gulf make carriers tremendously more vulnerable to asymmetric air, land, and naval threats,” Talmadge wrote on Twitter. Take a look at the map below, showing the shallowness of the 33-km-wide waterway.

In this geography, the vast superiority of an aircraft carrier strike group would be diminished, giving Iran a home-field advantage. The flotilla would be vulnerable to attacks from submarines, missiles, Iran’s fast torpedo boats and hundreds of drones capable of dropping bombs on targets.

Abraham Lincoln carrier battle group

Even if Iran decided not to take such a risk, it could disrupt trade flows through the strait by damaging commercial shipping with anti-ship missiles, patrol boats, submarines and mines.

“Even threats and modest disruption to commercial shipping could trigger economic damage in the form of higher marine insurance rates, crude oil supply concerns and unsettled stock markets,” said The Conversation, noting that during the Iran-Iraq War in the 1980s, the combatants tried to sink each other’s oil and gas exports in the Strait of Hormuz.

A 2018 column in Forbes argues that Tehran plays an even more destabilizing role in regional conflicts in the Middle East than North Korea plays in the Asia-Pacific. For example, Iran supports the Assad regime, the Shia political forces in Iraq, the Houthi rebels in Yemen, and the Lebanese Hezbollah, the A-team of international terrorism.

Since the U.S. withdrew from the Iran nuclear deal, President Trump has deliberately brought Iran hawks into his Administration, including Secretary of State Mike Pompeo and National Security Advisor John Bolton. The temptation within the administration to escalate is arguably stronger than it has ever been before. One miscalculation could lead to disastrous consequences to the oil fields, shipping lanes, and other critical infrastructure in the region.

China miscalculation

As we argued last week in Trade impasse threatens US lithium, rare earth imports, dealing with China is different from negotiating with fellow North Americans, or Europeans. It’s important to come across as respectful, and calm. Shrewdness is valued. Bluster and strong-arming are frowned upon.

We don’t know what went on behind closed doors between the US and Chinese trade delegations last week, but we must assume that the US negotiators did not come armed with background on how to deal with the Chinese.

Chinese negotiators will seldom agree to the first draft of a deal; the more common practice is to go back on what was discussed and amend the agreement, knowing full well that the other side won’t accept. But that’s ok. Like a chess game, the Chinese delegation was likely awaiting the next US move. Instead the American delegation slammed its fist on the chess board, immediately ending the game.

In fact, we now know that is exactly how it happened. Trump admitted to a press scrum at the White House on Monday that a trade deal was 95% done about a week ago. Then, when Trade Secretary Mnuchin and U.S. Trade Representative Lighthizer were told the points the Chinese had previously agreed were not in the agreement, “I said, ‘Fine. Put on the tariffs.’”

So, the negotiators only had to work out the finer points of the agreement, just 5% of it still left unresolved, yet Trump, unaware of who he was dealing with, foolishly failed to make a counter-offer! It’s like going to a car dealership, negotiating with the salesperson a price that includes everything except the floor mats, and then when they don’t throw in the floor mats, you walk away.

For the audacity of holding out on 5% of $635 billion in two-way trade (2017 figures), America’s largest trading partner got slapped with a 15% increase on $200 billion worth of Chinese imports; tariffs on another $325 billion - all remaining imports from China - are being set in motion.

China hit back Monday, with countervailing duties on $US 60 billion of American imports. Beijing hiked tariffs from 5% to 25% on over 5,000 US products, including beef, lamb pork, vegetables, fruit juice, cooking oil, coffee and tea.

As for the tariffs’ effect on the US economy, US GDP is expected to be dinged by 0.3 percentage points next year if the dispute isn’t resolved, according to Oxford Economics and Moody’s Analytics.

Companies with a greater export exposure would obviously see more impact on revenues and profits than service companies or those with a limited volume of goods shipped overseas.

USA Today reported that farmers and chemical makers will be worst hit; on Monday soybean futures dropped seven cents - hurting US soybean farmers who have had to accept a US government bailout to prevent bankruptcies.

Last year chemical exports to China increased by just 2.7% after double-digit gains in 2016 and 2017; about $200 billion in new factories are planned for the US, where cheap natural gas, a feedstock, allows for fat margins. Some could move to other countries if the tariff remains, USA Today wrote.

As for investors wondering how to play a trade war, “The key questions to ask are: what’s priced into the market right now, what’s the direct earnings and [price-to-earnings] multiples impact, and what’s the long-term impact?” Forbes quoted Savita Subramanian, head of U.S. equity and quantitative strategy at Bank of America Merrill Lynch.

US consumers will notice higher prices for goods made by companies that passed on the tariffs to customers. Quartz analyzed how much the higher (5% to 25%) tariff would reflect on the prices of runners, boots and children’s shoes. The website found a typical pair of runners that sold for US$48.18 would now be priced at $60.93. Boots that cost $66.74 would sell for $97.08, and kids’ shoes that retailed for $13.96 would go for $18.36. These are not insignificant price hikes. The cost of the tariffs to the average American family of four is estimated at $800 a year.

Conclusion

What do scared citizens do when they fear an economic or political crisis initiated by a renegade foreign leader like Trump? They turn to hard assets like gold.

Indeed, gold’s status as store of value, as money, the only currency available when yours is worthless, has come into play with respect to the drama that has been unfolding in the Persian Gulf.

Gold gives all of us something that fiat currencies (paper money), or any other financial innovation, cannot deliver. Gold is insurance, irreplaceable in its functions.

The US Federal Reserve has indicated no more rate hikes this year. If economic headwinds blow harder against the US, like more negative fallout from the trade war with China and continued low growth in China, affecting all its trading partners, there may even be a rate cut.

That would weigh the dollar down, pushing commodities up, including precious metals.

The usual indicators show the US economy is doing just fine, knocking down the odds of a rate cut, but a deeper analysis shows signs of trouble. For more on this read our Make America’s economy great again.

On Monday, upon digesting the escalation of the trade war, the S&P 500 and the Dow suffered their worst day since Jan. 3; more ominously, the yield curve between 10-year and 3-month Treasury notes re-inverted, after dipping in March into negative territory for the first time since 2007. MarketWatch reported the yield on the 10-year note fell to 2.402%, below the 3-month note’s 2.406% yield. An inverted 10-year/ 3-month yield curve is a reliable recession-indicator.

Middle East tensions, an escalating trade war, and a constitutional crisis that is brewing in the United States over the Trump administration’s legal troubles.

Add it all up and now is as good a time as ever to buy physical bullion (coins and bars) as a safe haven. Or even better, in terms of potential upside imo, take a look at junior gold stocks.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.