Gold Mind Reader's Guide to the Global Markets Galaxy: 'Surreal'

Commodities / Gold & Silver 2019 May 15, 2019 - 03:02 PM GMTBy: The_Gold_Report

Sector expert Michael Ballanger muses on the effects of Twitter and political maneuvers on the markets, and specifically on a favorite gold explorer.

Sector expert Michael Ballanger muses on the effects of Twitter and political maneuvers on the markets, and specifically on a favorite gold explorer.

I have a confession to make: There are no free markets anymore; there are only interventions. Of course, I bow to Gold Anti-Trust Action Committee (GATA) cofounder Chris Powell, who coined that brilliant phrase a few years ago, because it was certainly my exposure to GATA in 2005 that changed my perception of the insidious role of the bullion banks in controlling price and sentiment.

That, in fact, has since been expanded to include not just gold and silver but LIBOR, Fed funds, corporate bonds and, finally, stocks. The delivery method used to be one of the hired mouthpieces on CNBC, like former reporters Charlie Gasparino or Maria Bartiromo, but both have moved on and were replaced not by reporters with a "scoop," but rather central bank governors themselves. This has been the case for most of the pre- and post-global financial crisis period—up until the election of the current president, who has, along with several cabinet members such as Larry Kudlow and Smilin' Stevie Mnuchin, discovered that sending out messages to either roil or calm markets is best carried out via Twitter.

The Donald derailed the current stock market "melt-up" on Sunday, May 5, when shortly after noon he sent out a tweet telling the world that the U.S.–China trade deal was "dead" and that he intended to raise tariffs to 25% on Friday, May 10 (which he did). The impact of the POTUS pronouncement was a $1.3 trillion haircut in global market values, and while it looked as though Friday was headed for a major crash I sent out a tweet asking: "Will Smilin' Steve Mnuchin be the voice that turns the market?" This was in response to a CNBC headline plastered in super-large font across the TV screens where Mnuchin was quoted as saying that trade talks today were "constructive." I also included the time that Mnuchin made the statement via Twitter, which was shortly after 11 a.m. and within one hour—one hour—of when the S&P tacked on 35 points, at which point I tweeted out this: "Now we have the (sickening) answer. . ."

Everywhere I turn, what was once the "invisible hand" of government intervention and interference has lost its cloaking device and is now in full view of any and all that were trained in the era of free markets. To use the term "surreal" is understatement of the highest order.

You have to understand that I am not a mind reader and I am certainly anything but a shaman (content to occupy all time and space through connectivity with my ancestors), but if I can smell collusion and interference and intervention and send out humorous tweets predicting a 55-point reversal in the S&P from 11 a.m. to 4 p.m., as I did on Friday, then something is glaringly wrong with our system of price discovery and execution.

The greater failing in today's market posture is not that an acting president is demonstrating his narcissistic tendencies while gleefully massaging the global markets via Twitter; it is that any market unable to withstand comments from an acting head of state is not a market that I would classify as healthy. I submit to you all that the current environment of tweets and tariffs and tensions is most certainly not an enviable setup for as assault into new high S&P ground. However, it is a wonderfully friendly setup for the precious metals, and while many out there are bemoaning the state of the mining shares (especially the juniors), gold is actually looking fine.

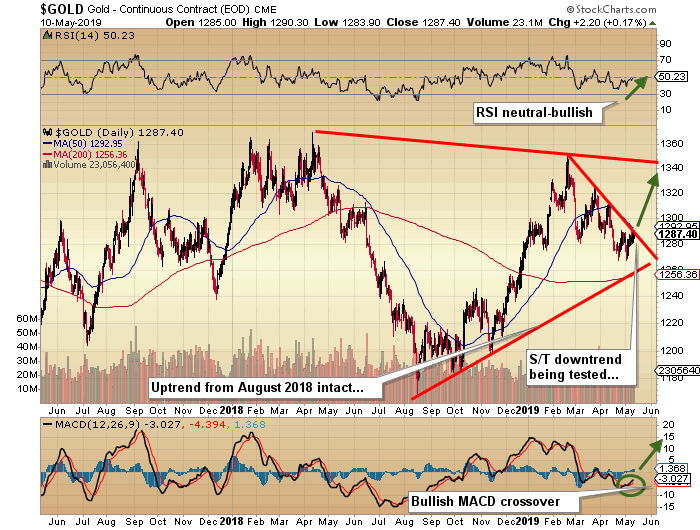

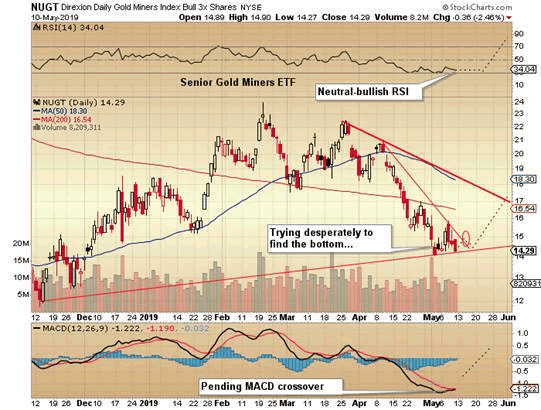

The Gold Miners are also in a state of flux right now not because the gold price looks vulnerable, but more because the tweet storms are buffeting the markets around like corks in the Pacific—and by that I mean specifically common stocks. Three charts shown below all convey a message of "bottoming" versus "topping," and nothing in the RSI or MACD for either of the three is prompting me to liquidate the leveraged positions. I am long JNUG from the $7.30 level and while offside, I still have about 50% cash in the trading account, which I intend to deploy once the broad markets settle down.

That being said, there is one indicator that cannot be placed on any chart and that is the "investor sentiment" gauge. Right now, sentiment for the senior miners is poor; sentiment for the junior miners is worse; and sentiment for the micro-cap junior explorcos is dreadful.

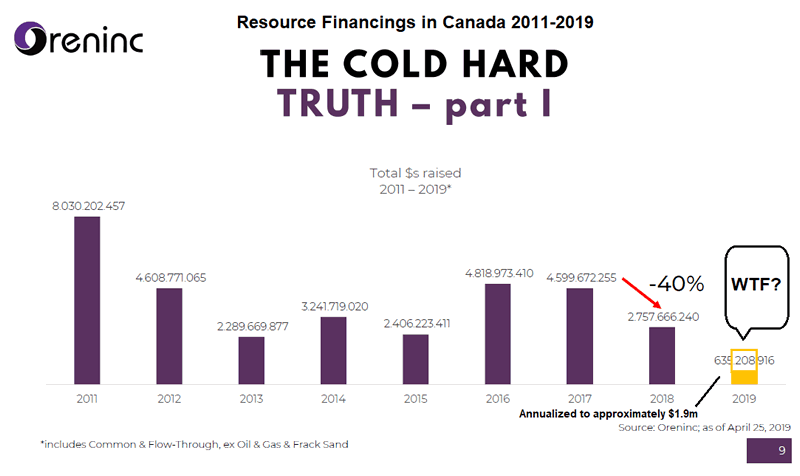

I recently ran across a public document compiled by Kai Hoffman of Oreninc detailing the state of the financing markets or junior resource companies, both explorers and developers, and needless to say, if the trend for 2019 continues, it will be the worst year for raising money for the juniors dating back to 2011. The next worse was 2015, the year that gold bottomed at $1,045, with the HUI bottoming only a couple of weeks after 2015 ended with the 99.17 low seen on January 19, 2016. It has been my experience, which dates back to the late '70s, that when customers/clients/colleagues are sporting the current level of disinterest/dislike/revulsion in the junior exploration sector, it is always—not often or frequently, but always—a formidable bottom-spotting indicator for not just the "little guys," but for precious metals (and other commodities) as a group.

Just as crowds were clamoring to own crypto in 2017 and weed in 2018, manias are the psychological opposite of desperation/capitulation bottoms. From conversations I am having daily, we are either at that desperation/capitulation extreme now or we are very close to it.

Another example of shredded sentiment is found in the example of my current favorite junior explorer, Getchell Gold Corp. (GTCH:CSE) (CA$0.195), whose Hot Springs Peaks project in gold-rich Nevada carries all of the attributes that have, in the past, attracted thousands of new investors both young and old. Without getting into a four-paragraph promotion of this project, it has location (Nevada), geology (abundant gold-friendly indicator minerals), scale (1X1X1-kilometer resistivity anomaly), and personnel (Tim Master delivered a major gold discovery for GSV.V in 2015).

The company is in the midst of a financing that is still open (for reasons mentioned above) but is still drilling two to four diamond drill holes into an anomaly that, if mineralized, could yield a 2 billion tonne ore body. Now, until they assay it, it is not an ore body; it is still just a target. But the upside potential is unlike most others because they are hunting in elephant country, with the two major game wardens being Newmont Goldcorp Corp. (NEM:NYSE) and Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) (who basically own the state). One sniff of a major gold discovery and GTCH is in play.

With a story like this one, in past times, (back when people actually enjoyed speculating on something other than a 100-acre weed field with zero earnings and no business plan, or a software program that mines digital coins and assigns a value of U.S.$19,891 per coin because the Geek Squad "says it is so"), markets would have assigned values of anywhere between $25 million ($25M) and $100M (GTCH is currently CA$5.1M). That is because any kind of drill hole of economic grade and width would automatically and immediately launch the company into play, with takeover premiums many times in the billions of dollars. By example, when Inco took out Diamondfields in 1997, there was no preliminary economic assessment or preliminary feasibility study assigned to the Voisey's Bay deposit; there was only drill hole data, and when Inco joined the (Friedland-orchestrated) dots, before you knew it, they were spending $4.3 billion to acquire a $20 billion ore body—not a mine, an ore body.

So when I get rejections from people who agree with my optimism, and agree with the potential, and like the personnel, and love the location, and still tell me that they are going to "pass," I just bang my forehead on my desk and ask myself why I even bother to try, as I have done for most of my years in business, to help incubate these highly promising fledgling companies. It is an exercise in masochism, and I truly long for the moment when Tim Master delivers a major economic intercept for GTCH and its long-suffering shareholders. I have been here many, many times before, and when the pessimism is the thickest, the risk is always the thinnest. Think about it.

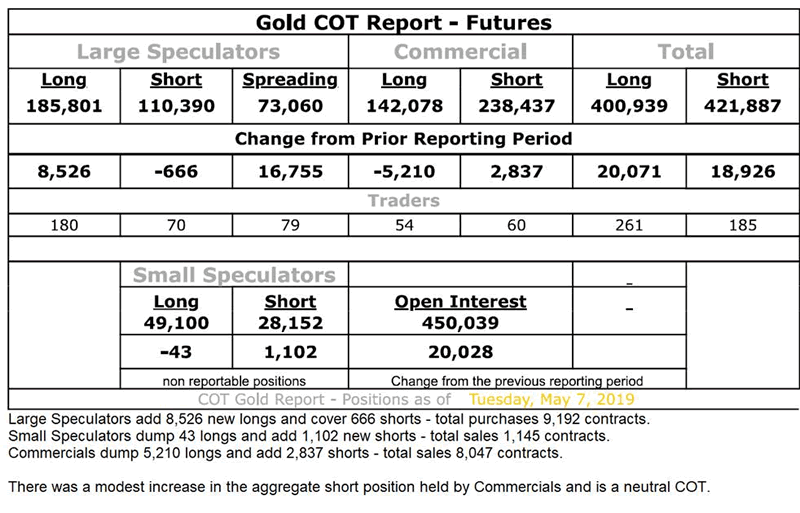

The COT Report Nothing new in the zoo here, with marginal changes and nothing to shift the needle in terms of urgency to buy.

I have been exploring the universe of finance since the mid-'70s and I liken my trade to a comment made by Hall of Fame golfing legend Sam Snead who, while seen sitting in the club house after a rousing 18-hole loss with a smile on his face, was asked why he was smiling. He replied, "I just learned a new shot." Sam was 85.

There is a life lesson in that remark and one that gold and silver believers should heed. Since it is a known truism that "money moves to where it is best treated," it is no wonder that with central banks supporting stocks and suppressing gold, money has been treated best in areas away from the metals,

Or has it? Investors in Venezuela would not agree despite the fact that their Zimbabwe-esque stock market has been a stellar, inflation-fueled rocket ship, just as was happened in Argentina, Turkey, and of course, the 1920s Weimar Republic. The degree to which both elected (government) and non-elected officials (central bankers) are now allowed to tweet, wink, nudge, whisper, and drum-bang market-moving messages to the world is immorality verging upon surrealism. And the cartoon depicted below is a graphic interpretation of the bedlam we are experiencing. I repeat what I have been saying (and tweeting): Markets that soar or swoon from tweets by politicians are not healthy markets.

Time for us all to learn a "new shot." Thank you, Sam.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.