Make America’s Economy Great Again

Economics / US Economy May 10, 2019 - 05:51 PM GMTBy: Richard_Mills

A lot of Americans find themselves in a quandary over Donald Trump. On the one hand they can’t stand the braggadocious billionaire for his lack of principles, business ethics, exorbitant wealth, his treatment of women, minorities, the list goes on and on. But they also have to admit, the economy is in better shape now than when Barack Obama was installed in the White House.

A lot of Americans find themselves in a quandary over Donald Trump. On the one hand they can’t stand the braggadocious billionaire for his lack of principles, business ethics, exorbitant wealth, his treatment of women, minorities, the list goes on and on. But they also have to admit, the economy is in better shape now than when Barack Obama was installed in the White House.

Can Trump justifiably take credit for the economic expansion of the last two and a half years? Why is the US economy growing? In this article, we’ll take a deep dive into the question, “Why is the American economy great again?”

The sweet spot

The facts would appear to support that notion - the evidence shows that the economy has done extremely well since Trump was inaugurated as president in January, 2017.

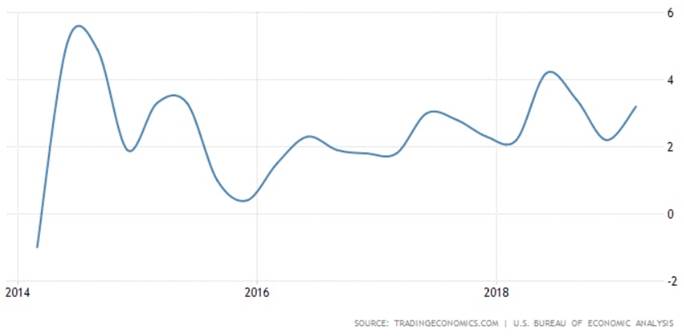

In the first quarter, the US economy barreled along at 3.2%. A year ago it was at 4.2%. That’s not the highest growth the American economy has seen historically, but it’s pretty good. Taking a look at the chart below by Trading Economics, we can see that economic growth peaked in 2014, at close to 6%, when Obama was president, then dropped under 1% as the US election cycle began, in 2015. Since Trump has taken the helm, the trend line is clearly up.

Examining the usual economic indicators, we find employment has fallen to 3.6%, which is the lowest since the mid-1960s over 50 years ago. African-American unemployment is at a record low.

The stock market is loving it. After hitting an all-time high of 26,828, on October 3, 2018, the Dow Jones Industrial Average traded sideways until April 5, 2019, when the closing bell rang on a yearly top of 26,424. The S&P 500 is up about 25% since its December low. Bubble? What bubble?

The economy has added over 5.4 million jobs since Trump and his team entered the White House.

The usual response to low unemployment is to argue that wages haven’t kept pace. But we can’t say that. After a decade of stagnation, real wages (hourly pay accounting for inflation) have grown 3.2%.

An economy that shows those kind of numbers usually has high inflation (not just wage inflation but goods and services inflation). But even here, the United States is well within a comfortable range. At 1.6%, it’s actually below the Fed’s 2% target.

June will mark the 10th year of a growing US economy.

iPolitics sums it all up nicely:

Never before has there been such a perfect economic sweet spot: solid growth, low inflation, steady increasing wages and full employment. In practical terms, everyone who wants a job can find one, everyone with a job is taking home a bigger paycheque, inflation isn’t eroding savings and — most Americans — just got a bigger refund check courtesy of Trump’s tax cuts.

Fed reaction

On May 1st the US Federal Reserve decided to hold interest rates steady at between 2.2% and 2.5% - going against the president’s desire to cut them in order to stimulate the economy.

Donald Trump tweeted that the Fed should slice 1% off borrowing costs to help the US economy “go up like a rocket”. Mike Pence, the vice president, has made similar statements in support of a cut.

But Chairman Jerome Powell and the rest of the Fed’s Open Market Committee ignored them, by sticking to their position of not changing interest rates for the rest of the year. Since 2015 the US central bank has raised rates nine times, lifting them from near 0% to 2.5% (four of the raises were last year), as it transitioned from stimulating economic growth, through quantitative easing, to stabilizing it.

In economics there is a direct relationship between economic growth and interest rates. When an economy is doing well, rates should be allowed to rise because businesses can handle the increased cost of borrowing. A raise also keeps inflation - a by-product of a strong economy - in check. When an economy is in trouble, as the United States was in 2008-09, cutting interest rates has the opposite effect - it stimulates the economy. Rates can remain at rock-bottom levels as long as inflation (the higher costs of goods and labor) doesn’t increase too much.

This year the Fed has given mixed signals as to what it’s going to do. In the second half of last year interest rate hikes and the ongoing US-China trade war caused a stock market correction. That, and recessionary signals such as a flattening Treasury yield curve during the first quarter, had the Fed backtracking on planned rate hikes for 2019. Now that the stock market has bounced back and the US economy is doing well, the Fed has less reason not to raise rates.

On the other hand, US core inflation, a sign of a growing economy, has lessened from 1.7% in February to 1.6% in March. Some economists argue that low inflation supports the case for interest rate cuts, which may be needed to stimulate the economy. Others caution that the Federal Reserve should keep stimulus, in the form of interest rate cuts and bond-buying (QE), in its back pocket for when the Fed really needs it, not when the economy is on a tear.

Raking it in

Let’s pause for a moment to consider the situation as it stands. The US economy is doing very well, even though it’s in the midst of a trade war with China.

Farmers whose crops have been slapped with tariffs are having to get bailed out. The US dollar index has risen, helped by interest rate hikes, from February 2018 when it was at 89.10, to its current (as of Wednesday) 97.60, a gain of 9.4%. Dollar strength is indicative of the US economy’s health, so it’s a good thing, even though Trump wants a lower dollar to boost exports and to mend the US trade deficit.

Eight months ago, the stock market was faltering over worries that Trump would enact $200 billion worth of tariffs on Chinese goods. A month later, those worries were forgotten. Now they’re back, or should be, with the US government about to escalate tariffs on Chinese imports from 10% to 25%. Yet the Dow and the S&P have barely flinched. Meanwhile the national debt continues to mount, but nobody, especially Democrats, seems very perturbed. (in September 2018 the House of Representatives passed a $3.8 trillion tax cut, adding to the $1.5 trillion slash in 2017; the debt is currently $22 trillion and counting…)

What gives? Shouldn’t the US economy be hurting? Why is it doing do well?

The clue lies in corporate profits which, despite concerns over labor shortages and wage inflation, are holding up well. Earnings have beat expectations.

Buyback bonanza

In December 2017 the Trump administration passed the Tax Cuts and Jobs Act. The legislation slashed the corporate tax rate from 35% to 21% and the top individual tax rate shrunk to 37%. It also cut income tax rates, doubled the standard deduction and eliminated personal exemptions.

But the most important change concerned the repatriation of profits that US corporations were holding overseas. Under the Tax Cuts and Jobs Act, companies were incentivized to bring their overseas profits to the United States, where they would be taxed at a one-time rate of 15.5%, which is lower than the regular corporate tax rate of 21%. Previously, companies would “defer” (really, avoid) US tax on profits held in low-tax jurisdictions like Switzerland and Ireland, until they brought their profits into the US, where they would be taxed at 35%.

In 2018, US multinationals took full advantage of the “tax holiday”, sending home over half a trillion dollars held overseas, to be taxed at the lower rate.

Suddenly these companies found themselves flush with cash, and they needed to find a way to spend it. The options are typically to plough funds back into the company via capital expenditures like new buildings, products or equipment. Or, distribute the money back to shareholders in the form of dividends, or through share buybacks which don’t go directly to shareholders, but reduce the number of outstanding shares, thereby making the share float less diluted.

Share buybacks are a relatively new phenomenon. For most of the 20th century they were illegal because they were considered to be a form of stock market manipulation. But that all changed in 1982 when the SEC legalized them.

Since then buybacks have been a popular tool for management to stuff cash back into the company, indirectly, by reducing the share float. They've been on the rise for over a decade. From 2007 to 2016, S&P companies bought $4.2 trillion of their own stock – almost double the $2.4 trillion purchased 2003-12.

Purchasing company stock generally inflates the share price and boosts earnings per share – a key metric on which CEO bonuses are calculated.

In 2018 US companies set a record $1 trillion in stock buybacks. Apple is the biggest re-purchaser, having poured a quarter trillion dollars into buying its own stock over the last decade, according to CNBC. Among the top five companies on the 2018 buyback train, reported Yahoo Finance, were Oracle, Wells Fargo, Microsoft and Merck. Out of the S&P 500 companies, 444 repurchased stock in 2018, compared to 424 in 2017.

As an example of how companies have used buyback programs to improve their metrics, consider tech giants Apple and Alphabet. Since 2012, Apple's buyback program cut its outstanding shares by one quarter, doubled its earnings per share, and ended up with a 150% increase in its share price.

Since Alphabet launched its buyback program in 2015, Google's parent company has repurchased $17 billion worth of stock, thereby helping to reduce its total share count and, like Apple, double its per-share earnings. Over the past four years, Alphabet's stock has run up 123%.

There is clearly a strong connection between repatriation, stock buybacks, and higher-than-normal corporate earnings. Is it any coincidence that half a trillion dollars worth of overseas profits were brought home in 2018, during which time the United States saw the most share buybacks in history, along with sky-high corporate earnings (data firm Refinitiv estimates profit growth among S&P 500 companies at 23% in 2018; S&P stocks were up 13% in the first quarter of 2019, the best Q1 performance since 1998) and a booming stock market? I don't think so. And even though repatriation has run its course, buybacks are popular on Wall Street.

Share repurchases have increased every quarter of the last four quarters, and the buying frenzy is set to continue.

Bank of America Merrill Lynch says repurchases have almost doubled (up 91%) year over year, and at the current pace, will probably eclipse the 2018 record.

No surprise, then, that the $1.5 trillion tax cut passed by the Trump administration has had little impact on business investment or hiring plans.

Reuters quotes a poll conducted by the National Association of Business Economics, that found 84% of respondents had no plans to accelerate investments because of lower corporate taxes. It’s not a stretch to assume that’s because any money left over from repatriation was used to buy back their own stock, rather than investing in the companies themselves, or increasing orders.

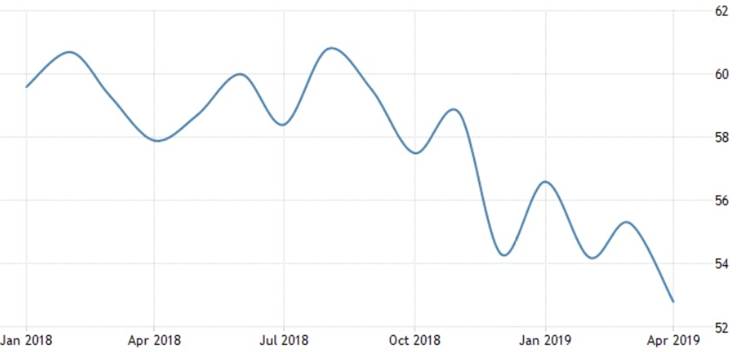

The US Purchasing Mangers' Index plunged from 60 in the beginning of January, 2018, to 55 last fall. It currently sits around 53. PMI is a forward-looking economic indicator that typically includes new orders, factory output, employment, supplier deliver times, and stocks of purchases.

There are plenty of pros and cons to stock buybacks. As my previous articles on this topic show, I’m in the “con” camp.

On the positive side of the ledger, reducing a company’s outstanding shares makes each dollar of earnings more valuable on a per share basis, which is good for investors.

Another plus for shareholders: executives seemingly know how much their company is worth so if they are buying back shares, it’s a signal that the stock is undervalued – otherwise, why would they buy high?

Really though, the most insightful thing to say about share buybacks is that they’re good for management, not shareholders. Buybacks make it easier for executives to hit targets by reducing the number of shares. Management receives compensation - usually in the form of stock options - that is tied to the company’s stock price. The higher the stock price the more they make cashing out their options.

But executives are foregoing the opportunity to put that extra cash back into the business instead, which could potentially grow the company. Studies have linked increased spending on buybacks to decreased corporate investment – such as expansion plans, more hiring or raises. Buybacks have been used as a punching bag for Democrats in particular who argue that buybacks enrich companies and wealthy shareholders at the expense of workers.

Unequal spoils

But isn’t the fact that companies are able to purchase their own stock, even if it doesn’t benefit shareholders directly, a sign of a healthy economy? Surely if they didn’t have confidence in the future of their own corporations, they wouldn’t invest in them, preferring to save their cash for a better day.

In other words, is corporate enrichment the answer to the question, what is making the American economy grow? The short answer is yes. According to the Congressional Budget Office (CBO), about 0.3% of the 2.9% GDP growth in 2018 can be attributed to the $1.5 trillion tax cut.

The problem is, in allowing companies to keep more of their profits, the government is depriving itself of tax revenue. The CBO forecasts the tax cut (and this is just the first tax cut, the $1.5 trillion) will add $1.5 trillion to the national debt over the next 11 years. How will the government pay for such massive-ticket items as the $2 trillion infrastructure plan just proposed? Print more money I guess, and heave it onto the mountainous debt pile.

As for the old trickle-down effect, CNN quotes the congressional Joint Committee on Taxation in reporting that two-thirds of taxpayers paid around $100 less in taxes in 2018 (about the cost of a nice dinner for two).

For households making under $50,000 in 2018, their after-tax income rose by 0.6%, whereas those making between $500,000 and a million were an average 5.2% richer.

Consumption is the largest component of GDP, but it is very unlikely that households hanging on to a few hundred dollar more per year due to tax cuts, will increase their consumption enough to have any impact on GDP.

Another day older and deeper in debt

So far our investigation into what is making the US economy grow, has found that corporate earnings - which in turn drive the stock market - are a key piece of the puzzle to understanding why the US economy is booming when, in many ways, it shouldn’t be.

Another way to test this idea is to look at the amount that business investment contributed to GDP in 2018. Business investment is the amount that businesses purchased to produce consumer goods. According to The Balance, in 2018 US business investments amounted to $3.39 trillion - 18% of GDP - double the recessionary low of $1.5 trillion in 2009.

So, although many companies used the opportunity of a tax cut, and repatriation, to buy back their own shares, they were still purchasing a lot of inputs needed to make consumer goods. This of course benefits suppliers to those companies.

Speaking of consumers, we know that consumer spending makes up 68% of the US economy. If most businesses are doing well, and they appear to be from the statistics, employees should theoretically have more to spend on goods and services. People are keeping their jobs and their wages are going up.

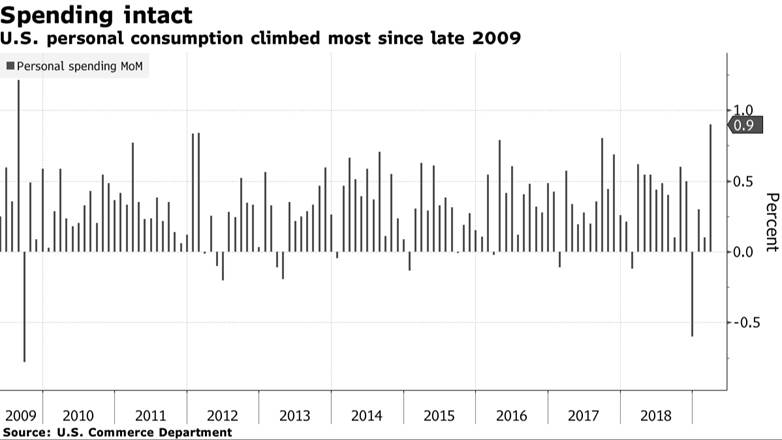

This in fact is what we find. The Balance reports that consumer spending increased by 1.2% in the first quarter of this year, and notes that “Strong consumer spending is the main reason the GDP growth rate has been within the 2-3% healthy range since the Great Recession.”

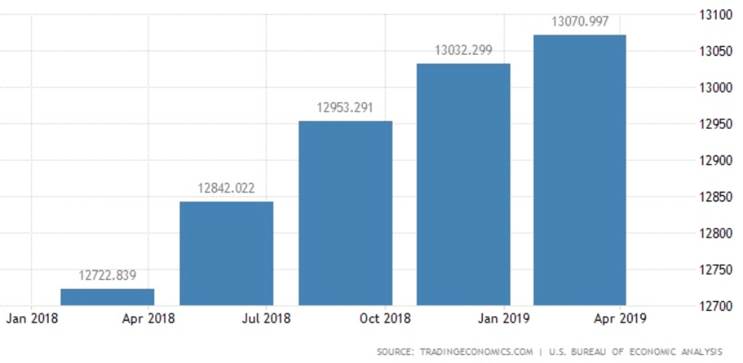

The chart below from Trading Economics shows consumer spending going up steadily since the first quarter of 2018, when it was $12.7 trillion, to $13 trillion in Q1 2019.

In March, when inflation hit a one-year low, consumer spending increased by 0.9%, the most in nearly a decade, Bloomberg said.

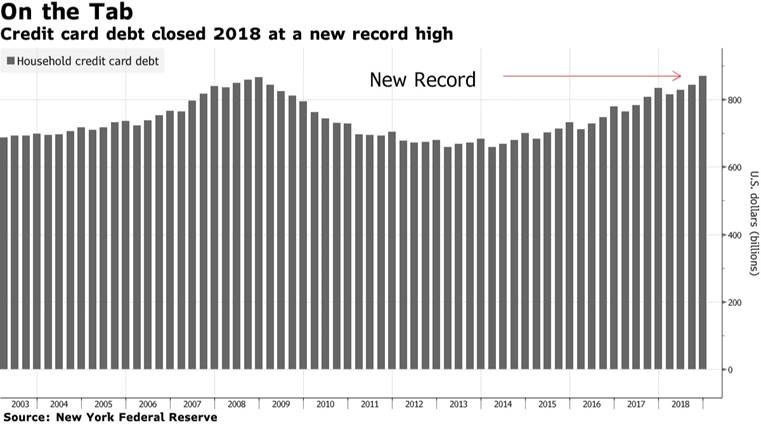

That got me curious, as to where people are finding the money to spend $13 trillion in the first quarter. The answer appears to be… Uncle Visa. Another Bloomberg article reports that US credit card debt skyrocketed to $870 billion in 2018, a new record.

Conclusion

This article started with a simple question: Why is the US economy doing so well? Our answer is two-fold. First, the high GDP is due to rising consumer spending, on the back of personal tax cuts (a very minor portion IMO), and enough confidence in one’s own financial circumstances and the overall economy, to rack up unprecedented credit card debt. To this we should add that, for high income earners, the extra 5.2% (on average) of income saved due to personal tax cuts, likely did translate into significant consumer spending, especially big-ticket items like houses, vacation property, vehicles, etc.

Second, the high GDP growth can be attributed to healthy corporate earnings. These earnings, remember S&P 500 companies in 2018 saw a 23% increase in net profits, came about due to the Trump administration's corporate tax cuts that resulted in a jaw-dropping half a trillion dollars moved into US multinationals from their overseas tax havens. These companies then plowed around $1 trillion into their own coffers, through share buybacks, thus lowering their outstanding shares, goosing their earnings per share, and hiking their stock prices.

This artifical goosing of the economy helped the GDP number, and made Corporate America look great, but the shine didn't, and still doesn't, extend to employees, the 95% of Americans not in the stock market, and in most cases, the companies themselves. Stock price-centric management and boards invested little to nothing into growing their businesses, preferring instead to take the easy route, and just buy stock.

Curious as to what the official reason is for the 3.2% annual growth rate in the first quarter? Here is the answer, verbatim, from the Bureau of Economic Analysis:

The increase in real GDP in the first quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, exports, state and local government spending, and nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, decreased (table 2). These contributions were partly offset by a decrease in residential investment.

Tough to decipher what that means in plain English, but it pretty much jibes with what we’re saying. We haven’t mentioned government spending, which is 17% of GDP. We know that federal, state and local governments spent $3.18 trillion in 2018, of which Washington spent $1.23 trillion. More than 60% of that went to the military. According to The Balance, although state and local government contributions rose a bit since 2017, other sectors of the economy grew faster, so we can eliminate it from our variables as to what is causing US GDP to rise.

When Trump runs for re-election in 2020, he's going to claim the strength of the economy is all his doing. From everything we've read, he's not wrong, but it's more nuanced than he will make it out to be. As to whether the average American is feeling the love, we are guessing, probably not.

His opponents will find plenty of other ammunition to shoot at The Donald, but in most elections, success comes to those who connect with voters and their pocketbooks. Or to borrow a line from James Carville, Bill Clinton's strategist, “it's the economy, stupid.”

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.