Earth vs. The Human Amoeba

Politics / Environmental Issues May 06, 2019 - 09:37 AM GMTBy: Raul_I_Meijer

A few days ago, I received a video of an April 22 (Earth Day) lecture by my longtime friend Nate Hagens. Nate and I both owe a lot concerning our view and understanding of the world to Jay Hanson, who tragically died about a month ago on a diving trip in Indonesia. Many people have written and thought about issues of energy, or economics, or ecology; Jay brought it all together and, crucially, added the human brain and genetic properties to the mix.

A few days ago, I received a video of an April 22 (Earth Day) lecture by my longtime friend Nate Hagens. Nate and I both owe a lot concerning our view and understanding of the world to Jay Hanson, who tragically died about a month ago on a diving trip in Indonesia. Many people have written and thought about issues of energy, or economics, or ecology; Jay brought it all together and, crucially, added the human brain and genetic properties to the mix.

Teaching at the University of Minnesota, Nate has greatly expanded on this big picture, and produces -among other things- a lot of video material for his students. Lucky them: a view with so much breadth and depth at the same time is exceedingly rare. What most people don’t get is that you can say: we can do so-and-so, but it’s mostly just in theory. In practice, our brains make us react much different from the theory. Because it’s not our “rational brain” that drives us, it’s our amoeba brain.

We have to work very hard, and be very self-critical, to escape the ‘trap’, that, as Nate formulates it, dictates that:

Thermodynamics, expressed through genetics, creates beings incapable of not maximizing energy consumption.

We can even wonder if we can escape it at all. Nate’s position on this is more positive than mine. So I guess if you follow the theoreticals, you’ll be more inclined to listen to him than to me. Because there’s more dopamine to be gotten there. And denial is our main engine.

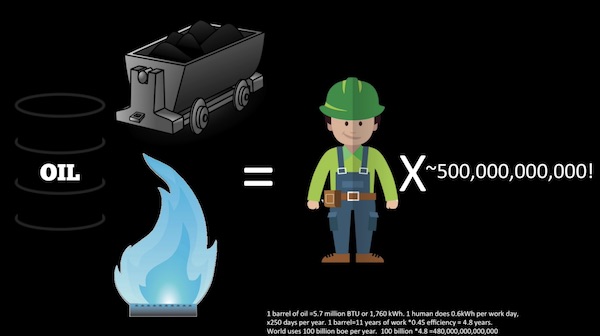

Two pics from the video of Nate’s lecture which you can find below give an idea of what is our problem, at least the energy part of it:

One man with a chainsaw (powered by fossil fuels) can do the work of 100 men.

Which means that with about 5 billion of us in the global work force, our present day consumption of fossil fuels provides us with the labor subsidy of the equivalent of some 500 billion people.

A lot more of Nate’s video material can be found here and here (5 hours).

You can also visit Nate’s new site, Institute for the Study of Energy and Our Future.

And here are a few of his quotes:

• Things that can’t continue usually stop too late.

• Each time history repeats itself, the price goes up.

• While it digs its own grave, all the mind can do is entertain fantasies and create excuses.

• Meaning comes from understanding why we can understand there is no meaning.

• Thermodynamics, expressed through genetics, creates beings incapable of not maximizing energy consumption.

• All 8 billion of us owe our existence to a six-inch layer of topsoil and the fact it rains; 6 billion of us also owe our existence to nitrogen fertilizer created from natural gas by Haber-Bosch factories.

Dr. Nathan John Hagens worked on Wall Street at Lehman Brothers and Salomon Brothers and closed his own hedge fund in 2003 to pursue interdisciplinary knowledge about the bigger picture of modern society. Nate was the lead editor of the online web portal theoildrum.com, and is currently President of the Bottleneck Foundation and on the Boards of the Post Carbon Institute, Institute for Energy and Our Future, and IIER. Nate teaches at the University of Minnesota.

Nate Hagens:

Earth Day Talk, Stockholm Wisconsin, April 22, 2019

This is a story about our culture, arriving at a period I refer to as ‘The Great Simplification’. This story explains why things in the environment and social sphere are getting worse not better, and why we won’t en masse do anything meaningful until we get emotional cues to do so. Obviously this is a bit of a buzzkill to hear about – especially on a nice spring day – but imo we have to understand the current game board and rules if we’re to make good ‘game moves’ as future events arrive. The more people who are aware of – and start to engage on – the choreography of these issues in their communities and in their own lives, the higher the chances of a networked, creative response will be. My hope with these and other videos is to change the initial conditions of these future events in a positive way. Because we have a lot to lose -and also gain.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2019 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.