US $2 Trillion Infrastructure Plan Will Require Mega Metals

Commodities / Metals & Mining May 05, 2019 - 03:21 AM GMTBy: Richard_Mills

The White House and Congress finally agreed to put their significant differences aside and work together on something constructive, no pun intended.

The White House and Congress finally agreed to put their significant differences aside and work together on something constructive, no pun intended.

On Wednesday it was announced that President Trump and Democratic congressional leaders plan to spend $2 trillion on US roads, bridges, power grids, water and broadband infrastructure - bricks and mortar priorities that are sorely underfunded in both the United States and Canada.

For more on this, read our The global infrastructure deficit: the road not yet taken

“We just had a very productive meeting with the president of the United States,” House of Representatives Speaker Nancy Polosi said during a press scrum, adding: “We did come to one agreement: That the agreement would be big and bold.”

The Democrats’ House leader Chuck Schumer was equally optimistic, per Reuters:

“We agreed on a number, which was very, very good - $2 trillion for infrastructure. Originally we had started with a lower - even the president was eager to push it up to $2 trillion,” Schumer said.

Trump campaigned on a pledge for fix America’s crumbling towns, cities, freeways, ports etc., but a $1.5 trillion White House infrastructure proposal last year didn’t go anywhere. The plan called for $200 billion in federal funds that would require a 4-1 match from state and local governments.

The proposed legislation reportedly faced hurdles in Congress because it didn’t offer enough federal funding for Democrats, nor did it address how the program would be paid for. A later $1 trillion proposal by House Democrats also failed to get any traction.

The fact that the Dems and the GOP have shown bipartisanship in a government that up to now has been as divisive as they come, is good news. We’ll leave the thorny subject of whether the legislation actually passes, to the political gurus. Let’s presume it does. What would it mean for mined metals? This article takes a stab at that question.

$2T shortfall

Spending on infrastructure, also known as “blacktop politics”, is a common way for politicians to earn votes in an election cycle, but for the United States the issue transcends politics because the need is so dire.

According to the American Society of Civil Engineers (ASCE), the US needs to spend $4.6 trillion between 2016 and 2024 in order to upgrade all its infrastructure to an acceptable standard. But only $2.6T has been earmarked, leaving a funding gap of $2 trillion. US lawmakers must have been reading the 2017 Infrastructure Report Card, put out by the ASCE every four years, with its $2T shortfall figure.

We see and hear about the implications of infrastructure neglect almost every day in the news.

Infrastructure failures

Likely the most impactful, in terms of the potential for death and destruction, are blackouts or brownouts that happen when electrical grids fail. In the United States, the grids are particularly vulnerable to hurricanes, floods and scorching-hot weather. They must be sturdy enough to withstand natural disasters that are becoming all too frequent due to climate change.

But the US energy system, comprising 640,000 miles of high-voltage transmission lines split into three grids by region, is at full capacity. Most of it was built in the 1950s and 60s and has a 50-year life expectancy.

Half of the nine worst power outages in US history were storm-related. In 2012 a line of fast-moving winds and thunderstorms called a “derecho” moved across the US Midwest, causing 4 million people across 11 states to lose power; some were in the dark for 10 days. This was just a warmup though to Sandy, a massive hurricane that impacted 24 states the same year. The storm drenched New York, flooding streets and closing subway lines, and cutting power to some New Yorkers for up to two weeks. The damage to New York City was $18 billion, more than the damage tally for all the other states combined.

Affecting less people but more dramatic, are bridge failures. There are few accidents - except maybe a plane crash or a passenger train derailment - that strikes as much fear into the traveling public, as a major bridge collapsing as you drive over it. In 2007 it happened in Minneapolis. Investigators said support plates that were half as thick as they should be caused the I-35 W bridge to fall down, killing 13 people.

Then there’s the annoying. Fitting into this category are overcrowded airports, subways, buses, and schools. All are problems that could be alleviated by building more infrastructure. Nobody has likely died from a watermain break but these incidents always draw attention to how old these pipes are.

On July 29, 2014, a major watermain in Los Angeles sprung a leak, causing 20 million gallons to spill onto the UCLA campus. The flood waterlogged and stranded hundreds of vehicles. It was discovered that the problem was at the juncture of a 93-year-old and 53-year-old water pipe under Sunset Boulevard.

Infrastructure metals & uses

Infrastructure is the physical systems – the roads, power transmission lines and towers, airports, dams, buses, subways, railways, ports, bridges, power plants, water delivery systems, hospitals, sewage treatment, etc. – that are the building blocks, the Lego pieces, which fuel a country’s, city’s or community’s economic, social and financial development.

Economic growth necessitates building more infrastructure to meet increasing demands on power, heat, water, roads and the like. As populations grow, they need more houses, hospitals, subway lines, roads, recreational facilities, sports stadiums.

There is an undeniable connection between a country’s competitiveness and its infrastructure, yet both Canada and the US are facing significant infrastructure deficits, meaning the money that is being allocated for upgrades to water lines, sewers, bridges, roads, dams, power plants, public buildings, etc., isn’t enough to cover maintenance let alone replacement costs.

The amount of pipe rehabilitation, the number of dams that need to be upgraded, new ports, airports, bridges, power plants etc., will require billions of tonnes of raw materials. We’re talking iron ore, steel, zinc, manganese, vanadium and copper, just to name a few key metals.

Let’s take a closer look at some key infrastructure metals, and their uses in infrastructure.

Aside from iron ore, manganese is the most essential mineral in the production of steel. You can’t produce steel without adding 10 to 20 pounds of manganese per tonne of iron ore, making manganese the fourth most traded metal commodity.

Canada and the United States have numerous and vast iron ore deposits, yet neither country produces manganese.

Steel

Building new North American infrastructure would obviously take a lot of steel. It’s hard to say how much, but consider these facts: The Hoover Dam on the Arizona-Nevada state line used 45 million pound of reinforced steel, 88 million pounds of plate steel and outlet pipes, 6.7 million pounds of pipe and fittings, and 4.4 million yards of concrete.

According to the American Society of Civil Engineers, by 2025 70% of US dams will be over 50 years old and past their life expectancies. The cost to rehabilitate them? $64 billion. It would cost American taxpayers one-third of that just to repair the most hazardous dams.

Bridges are in equally bad shape. The United States has 614,387 bridges. Nearly four in 10 are over 50 years of age. On average 188 million trips are made across a structurally deficient bridge every day! The engineering society (ASCE) tells us that the backlog of bridge rehabilitation is valued at $123 billion.

The most common raw materials found in new modern bridges are steel, concrete, stone and asphalt. Steel is often used in the bridge superstructure for expansion joints, beams, bearings, floor beams, girders, reinforcing bars in concrete, traffic barriers and trusses. It is used in the substructure for the reinforcing bars in concrete, armoring for expansion joints, anchor bolts, etc. It is also used for piles to support the abutments and piers.

To get an idea how much steel is required to fix America’s broken-down bridges, consider the raw materials that went into just one new bridge, the $24-million Sundial Bridge in California, completed in 2004:

In addition to being a functional work of art, the Sundial Bridge is a technical marvel as well. The cable-stayed structure has an inclined, 217 foot pylon constructed of 580 tons of steel. The deck is made up of 200 tons of glass and granite and is supported by more than 4,300 feet of cable. The structure is stabilized by a steel truss, and rests on a foundation of more than 115 tons of steel and 1,900 cubic yards of concrete.

The famous Golden Gate Bridge contains about 88,000 tons of steel, and 80,000 miles of wire inside each of the two steel cables. That’s enough wire to go around the world three times.

Zinc is mostly used in steel fabrication to prevent rusting; it is an essential component of galvanized steel bridges.

Rare earths

Rare earths are used in a variety of industrial applications. Updating Internet speeds to 5G using fibre-optics requires erbium for the fiber. Computers that will go into new schools and public buildings contain europium. REEs are used in metallurgy as an alloying agent to desulfurize steels, as a nodularising agent in ductile iron, and as alloying agents to improve the properties of magnesium, aluminium and titanium alloys.

Copper

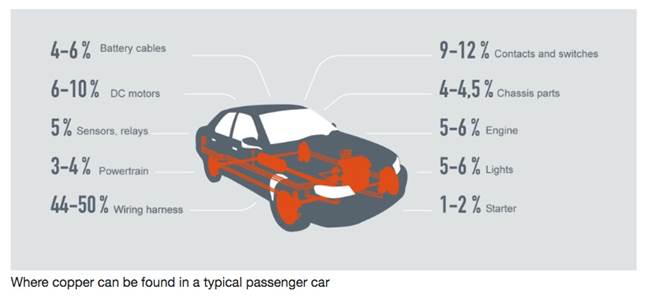

Copper is used for electrical applications because it is an excellent conductor of electricity. That, combined with its corrosion resistance, ductility, malleability, and ability to work in a range of electrical networks, makes it ideal for wiring. Among electrical devices that use copper are computers, televisions, circuit boards, semiconductors, microwaves and fire prevention sprinkler systems.

In telecommunications, copper is used in wiring for local area networks (LAN), modems and routers. The construction industry would not exist without copper - it is used in both wiring and plumbing. The red metal is also used for potable water and heating systems due to its ability to resist the growth of water-borne organisms, as well as its resistance to heat corrosion.

Consider the amount of copper needed to upgrade rail networks. The ASCE divides the rail infrastructure deficit into freight rail and passenger rail.

The Federal Railroad Administration estimates that, of the $6.9 billion needed to maintain, modernize and expand freight rail capacity, 2017-22, railroads only have $1.6 billion. Scary when you consider how the dearth of pipeline capacity in Canada is forcing producers to ship their product by rail.

In March 2018 the crude-by-rail exports to the United States hit a three-year high of 170,000 barrels a day. That’s not too impressive until you consider the accidents that have occurred shipping crude oil by rail. How about the Lac Megantic trail derailment in Quebec that killed 24 people and spilled 1.5 million gallons of crude? Or the Mount Carbon trail derailment in 2015, where 19 tank cars of crude oil went off the tracks in West Virginia? The large oil spill caught fire, resulting in several large, violent fireball eruptions that destroyed one home and forced the evacuation of hundreds of families. Each car was carrying 30,000 gallons of crude oil.

For passenger rail, the repair backlog is $28 billion.

How much metal will be required to upgrade US freight and passenger rail? Again we can only estimate but consider the amount of copper it takes to build a high-speed train network: 10 tonnes per kilometer of track. Powerful electric locomotives contain over eight tonnes of copper, according to the Copper Alliance.

Public transit is lacking in the US compared to Canada and Europe. New subway and light-rail systems are badly needed to get motorists out of their cars. Buses will also be in high demand.

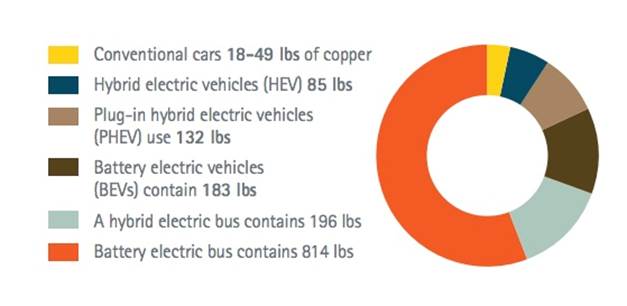

Likely, the buses of the future will be electric. EVs contain about four times as much copper as regular vehicles. A hybrid electric bus has 196 pounds, and 814 pounds of copper go into a hybrid-electric bus, mostly the battery. The Copper Alliance states that the largest EV maker, China’s BYD, used an estimated 26 million pounds of copper in 2016.

Military infrastructure

So far we have only talked about civilian infrastructure needs; there’s also the needs of the US Military. The $2 trillion infrastructure deficit doesn’t include money that needs to be spent on military barracks, storage buildings, roads, lighting, etc.

Considering we are in the beginning stages of a Cold War between the US, Russia and China, it’s the wrong time to be under-funding the military. And another reason why the United States government needs to take a hard look at the metals it lacks. The US Military is number one despite having virtually no rare earths of its own (other than one light rare earths mine in California) that go into a plethora of defense applications, no production of manganese necessary for steel, no domestic vanadium or titanium used in fighter aircraft, and 100%-reliant on imports for it’s metallurgical-grade bauxite used for aluminum.

President Trump just pilfered $3.6 billion from the Pentagon’s funding and put it towards his border wall, despite the fact that the US Air Force is in desperate need of funding for bases hammered by recent bad weather, and just general deterioration.

The Air Force needs $5 billion to rebuild bases in Florida and Nebraska. Hurricane Michael destroyed most of the Tyndall base when it slammed into the Florida Panhandle in October, while the base in Offutt was inundated by an overflowing Missouri River that damaged nearly 80 buildings.

An article by Defense One uncovers a startling backlog of deferred maintenance of military infrastructure that extends to 2047! This is due to chronic underfunding since 2012. It’s hard to believe the Department of Defense has a problem funding anything; its nearly $1 trillion allowance is the largest item in the federal budget behind Social Security. The DoD’s base budget for 2019-20 is $576 billion.

Yet according to Defense One, combined spending on military construction and family housing is nearly half what it was in 2012, $14.6 billion, versus an annual average of $8.2 billion from 2015 to 2018.

The Pentagon rates 23% of its infrastructure is in poor condition and another 9% is failing. Some of it is in such rough shape, it’s not worth saving.

Conclusion

The $2 trillion that the White House is planning to spend on infrastructure has two aspects to it. One is finding the money. There’s plenty of money in the budget, but most of it goes to Social Security and defense. The close to a trillion dollars a year the American Society of Civil Engineers says it needs for the next five years is there, it just isn’t allocated. To lawmakers there must be other priorities.

The second problem relates to how we source the materials needed for rebuilding American infrastructure. The amount of pipe rehabilitation, the number of dams that need to be upgraded, new ports, airports, bridges, power plants etc., will require billions of tonnes of raw materials. We’re talking iron ore, steel, zinc, manganese, vanadium and copper, just to name a few key metals.

Some of these metals are unavailable in the States or Canada. North America has some deposits, but no mines. So we import them.

We think we can just get the metals needed for these huge infrastructure build-outs from places like China, Russia, South Africa, the DRC and Gabon, but these countries aren’t reliable and in the case of the first two, they have shown they are not friendly to the West.

Most people don’t know it, but Canada and the US are dependent on foreign countries for a number of critical metals. Without a reliable supply chain, a country must depend on outsiders. This gives foreign suppliers incredible leverage over North Americans. There is always the possibility of slowed flows or bans on strategic materials, due to politics or trade disputes – a perfect example is Saudi Arabia’s threat to slow or stop oil production if sanctioned over the Khoshoggi affair, another current example is the ongoing trade dispute with China.

The US is dependent on South Africa, the politically unstable Democratic Republic of Congo (DRC) and an increasingly unreliable and aggressive China for over half of its supply of what it considers strategic or critical minerals.

Rare earths, manganese and vanadium are three examples of critical metals needed for the massive infrastructure build-out the US is talking about, in that $2 trillion bill it’s talking about passing. America doesn’t mine any of them. (we can’t really count the Mountain Pass rare earths mine in California because the concentrates are shipped to China for refining into oxides)

The majority of the metals needed, as we’ve discussed, are base metals like iron ore, zinc and copper. The United States is not a major producer of any of these metals. In fact, there is no way the US will be able to correct its infrastructure deficit through domestic mining; a large percentage will have to be imported.

As the infrastructure roll-out begins (if the infrastructure bill is passed... ) we should also remind ourselves that, while improving public infrastructure is a good thing in terms of safety and productivity, it is yet another sign of resource gluttony.

As we wrote about in We are the lemmings, every year we are depleting our resources faster and faster.

For example, China’s Belt and Road Initiative (BRI) is expected to push demand for copper to 6.5 million tonnes by 2027, an increase of 22% compared to 2017, according to the International Copper Association. Imagine how much steel, iron ore, concrete, etc., Belt and Road is going to consume? It boggles the mind.

In the absence of change, we can only observe, and bet on trends. As metal markets observers, we know that coming deficits in copper and zinc, to name two infrastructure metals, are about to meet a tsunami of demand, as Belt and Road and US/ Global infrastructure spends seriously ramp up. Where are they going to find the metal? Who knows, but we are sure it’s going to become dearer.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.