Crunch Time for Gold Bulls

Commodities / Gold & Silver Sep 26, 2008 - 10:27 AM GMTBy: Brian_Bloom

It's a lonely feeling being the only guy in the room on the other side of the table. But then, it's not about winning friends and influencing people. And it's not about being contrary for the sake of it. It's about ignoring all the emotional static in the room and focussing on the facts.

It's a lonely feeling being the only guy in the room on the other side of the table. But then, it's not about winning friends and influencing people. And it's not about being contrary for the sake of it. It's about ignoring all the emotional static in the room and focussing on the facts.

Can the gold price explode upwards? Of course it can. Anything can happen. There is no “science” to technical analysis. It's about a balance of probabilities. If I turn out to be wrong well, then I will shrug my shoulders and admit it. I don't participate in your profits and I therefore don't feel responsible for your losses. All I'm doing here is sharing my thoughts.

In my view, on a balance of probabilities, the gold charts still do not look like they have explosive upside potential.

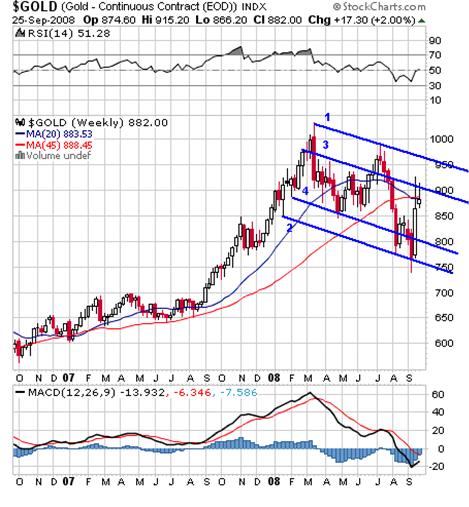

For example, the weekly chart below (courtesy stockcharts.com ) is showing some resistance to further upside at both the 20 week MA level and the 45 week MA level

Importantly, the price has been moving within the confines of a downward pointing channel, the outside boundaries of which are determined by lines 1 and 2; and the intermediary boundaries seem to be bounded by parallel lines 3 and 4. Importantly, the 20 week Moving Average is sitting below the 45 week MA.

To become bullish, the gold price will have to close the week above $900 an ounce. This will put it above the 20 week MA, the 45 week MA and the resistance of line 3. This will also cause the MACD histograms to close above the zero line. Thereafter, if the gold price closes above $960, then the preferred angle of decline (thanks to Daan Joubert) will have been negated and the gold price may be said to be positioning to search for a new preferred angle of incline .

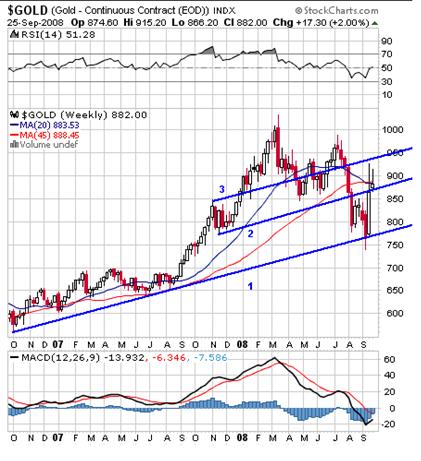

Okay, let's see what that preferred angle of incline might be:

The obvious line to draw in is line 1 below

Lines 2 and 3 are merely parallel lines drawn in to join as many points as possible. What they show is very interesting.

The price is currently above line 2 –which now represents support; but it is below the resistance of line 3 which sits at $940.

In all honesty, there is room to argue that the market “may” be sending a subtle clue that it is positioning to re-enter its old angle of incline, but the resistance level is 940 - $960 an ounce. Line 3 in the above chart, and line 1 in the first chart show that this resistance level is “key”.

Arguably, whether the gold price rises above the $950 level will be a function of whether or not gold is going to be perceived as anything other than a commodity.

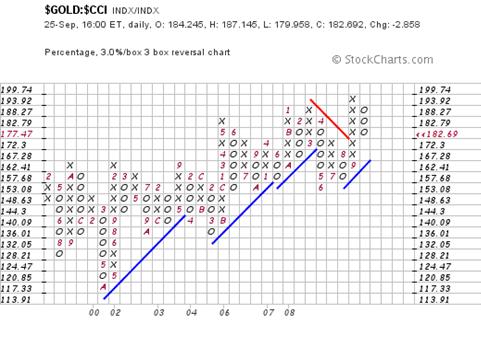

So lets look at the Relative Strength Chart of Gold divided by the $CCI. This time I have chosen a 3% X 3 box reversal Point and Figure Chart

Again, to be honest, the chart gave a buy signal when it rose above the 188.27 level. But the fact is that the buy signal has aborted and 193.92 now represents to new level beyond which the ratio needs to rise before we can say anything definitively.

Yes, we know that it's impossible to get our hands on gold coins. Yes, we understand that Indians are buyers whenever the gold price pulls back. Yes, it's clear that the Masters of the Universe are on their knees. But these are three of who knows how many issues are out there. Who knows how many people have bought gold on leverage? Who knows how many “investors” are sitting, biting their nails, just hoping and praying that the gold price will rise? These investors need to be taken out. There is no such thing as a free lunch and the majority of such investors typically lose money. That's the hard, cold cynical fact. But feel free to try to be amongst the very few who can beat the odds.

At the end of the day, the fundamentals and the technicals need to agree. If fundamentals are bullish and technicals are bearish, then it's safe to assume that the market knows something that we don't.

Are the gold charts bearish?

The answer is that they are reaching a point of decision, and the near term decision may not be as obvious as it seems.

Fact #1: The preferred angle of incline on the weekly chart is currently pointing down .

Fact #2: The PMO oscillator on the monthly chart below (courtesy Decisionpoint.com) has given a sell signal.

Fact #3: The current gold price is above its rising trend-line

Conclusion

The angle of incline at the $800 level is still prevailing over the angle of decline which is manifesting on the first chart above.

However. on a balance of probabilities, because of the sell signal on the PMO of the monthly chart, and because of the resistance to further upside at the $950 level, and because the market is clearly still regarding gold as a commodity (regardless of any “dogmatic opinions” to the contrary), the upside potential of the gold price appears limited in the short to medium term.

By contrast, because most of the bad news is now out, the only reasonable “fact” that will drive the gold price to buck the technical trends, is if some financial catastrophe manifested that was not expected. The market seems to be expecting the world's financial infrastructure to survive the next few weeks.

On balance, the gold price looks more likely to “sigh” back over the short to medium term. Be thankful.

By Brian Bloom

Beyond Neanderthal is a novel with a light hearted and entertaining fictional storyline; and with carefully researched, fact based themes. In Chapter 1 (written over a year ago) the current financial turmoil is anticipated. The rest of the 430 page novel focuses on the probable causes of this turmoil and what we might do to dig ourselves out of the quagmire we now find ourselves in. The core issue is “energy”, and the story leads the reader step-by-step on one possible path which might point a way forward. Gold plays a pivotal role in our future – not as a currency, but as a commodity with unique physical characteristics that can be harnessed to humanity's benefit. Until the current market collapse, there would have been many who questioned the validity of the arguments in Beyond Neanderthal. Now the evidence is too stark to ignore. This is a book that needs to be read by large numbers of people to make a difference. It can be ordered over the internet via www.beyondneanderthal.com

Copyright © 2008 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.